Asset Allocation Quarterly (First Quarter 2024)

by the Asset Allocation Committee | PDF

- The likelihood of a recession occurring during our forecast period has declined.

- Domestic economic growth should be robust over the forecast period, although momentum has slowed.

- Elevated geopolitical tensions and ambiguity related to the U.S. elections are likely to create volatility in the markets.

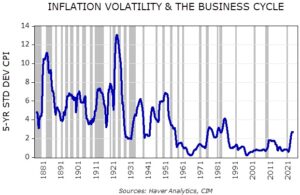

- Inflation volatility is likely to remain elevated as we anticipate inflation should moderate in the near-term but will reaccelerate to higher than pre-pandemic levels due to various structural influences.

- Monetary policy is expected to ease, but we believe market expectations may be too optimistic in terms of the timing and magnitude.

- We have shortened our duration modestly as we expect normalization of the yield curve.

- In domestic equities, we maintain our Value bias as well as quality factors.

- We maintained the exposure to gold and, where risk-appropriate, added silver as a hedge in volatile times.

ECONOMIC VIEWPOINTS

Markets are currently expecting that the FOMC will shift to easing and the economy will avoid a recession. We agree that the likelihood of a recession has declined and expect economic expansion for the majority of our three-year forecast time period. The Fed dots plot indicates 75 bps of easing in 2024 and futures-based market expectations call for even more aggressive easing. Although we concur that the next step is likely to be easing, market expectations may be too optimistic regarding the timing and magnitude, and this mismatch has the potential to create market volatility. We expect the Fed to hold policy steady later this year as we head into elections to avoid the impression of political favoritism.

Economic growth should remain healthy over the forecast period; however, we believe that volatility, in general, will remain high for both economic indicators and markets. For example, we anticipate that inflation should continue to moderate in the short term due to tighter monetary policy but will reaccelerate to higher than pre-pandemic levels in the medium term. Factors contributing to tighter supply chains include supply chain rearrangement with reshoring and friend-shoring of industrial capacity, elevated geopolitical tensions, and developed world demographics. For investors, the volatility of inflation is equally as important as the level. As this first chart indicates, the volatility of inflation during the post-Cold War era has been much lower than it was pre-1990. We also expect many other economic and market metrics to return to the more volatile paradigm similar to what existed during the Cold War.

The effects of fiscal spending are a supporting factor for continued economic growth. According to the Congressional Budget Office, fiscal outlays are expected to further increase over the next three years from the current 23.7% of GDP. The Inflation Reduction Act, the CHIPS and Science Act, and the Infrastructure & Jobs Act form an accommodative fiscal backdrop, supporting corporations as well as consumers.

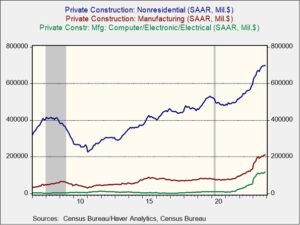

In the coming quarters, domestic industrial production should slowly increase as geopolitical tensions remain elevated and reshoring moves along its intended path. As this chart shows, industrial capacity construction has increased remarkably. Tight labor markets have hindered progress but growing technology/AI use should advance it. Given that capacity buildouts are extended over multiple years, there will be escalating demands on construction, labor, and materials in the short term, while increased revenue realization is likely to occur outside of our forecast period.

In addition to the U.S. elections, pivotal elections abound globally. This is especially significant amidst high geopolitical uncertainty. As the world continues to polarize into blocs, elections provide signposts along the way about the direction and speed of change. This introduces further volatility to the system, and for investors, it necessitates keeping a close eye on their portfolios. Markets tend to focus more on the uncertainty that elections introduce rather than a specific outcome. Moreover, markets discount election results rather quickly, so a quick resolution to the U.S. primaries would be beneficial.

STOCK MARKET OUTLOOK

We expect a good economic backdrop over the forecast period. While earnings growth has slowed somewhat, market consensus is calling for improving margins. The consumer is showing signs of a slowdown, with household debt service ratios rebounding to pre-pandemic highs. While saving levels have fallen, consumer confidence has remained solid and holiday shopping was strong (although we’ll quote Confluence CIO Mark Keller here: “Don’t extrapolate holiday shopping; no matter what, Santa always comes.”). On the other hand, domestic equity valuations might find support from the high levels of cash currently held on the sidelines.

We remain overweight Value across all market capitalizations. In our view, equities categorized as Value have more sustainable earnings growth, their fundamental valuation multiples are historically attractive, and they have a lower exposure to sectors that we view as overpriced. Although Growth has recently outperformed, we anticipate we are in the early stages of a value outperformance cycle. Within large caps, we maintain an overweight position in Energy and exited the Metals & Mining and Industrials sectors. In addition to military hardware exposure via the Aerospace & Defense factor, we also added a position in Cybersecurity as we believe global conflicts will be increasingly cyber-related. The military has a long history of working with private enterprises to innovate in the tech-heavy segments of national security. Our perspective holds that the valuations of small and mid-cap stocks continue to present an attractive proposition, coupled with robust fundamental earnings power. Historically, mid-cap stocks maintain considerable valuation discounts compared to their large cap counterparts. To mitigate potential risks amid economic volatility, we uphold our commitment to the quality factor within our mid-cap and small cap exposures, which involves screening for indicators such as profitability, leverage, and cash flows.

The Uranium Miners ETF that we introduced last quarter was constructive for our portfolios as our thesis of increased nuclear energy use started to materialize. Although the underlying uranium spot price increased significantly, we believe the uranium miners will benefit further. The evolving landscape of baseload energy production, influenced by dynamic policies, has opened a window of opportunity for nuclear energy. Ambitious green energy policies are driving substantial goals for reducing fossil fuel usage, yet the current green energy technologies face challenges in generating energy at the required scale and consistency. Given the constrained supply of uranium over the past decade, we perceive the supply/demand imbalance as a robust opportunity for exposure in this sector.

Low valuations in international developed equities are attractive for the more risk-accepting portfolios. The combination of deglobalization and increased geopolitical risks has widened the volatility range of the asset class. We maintain a country-specific exposure to Japan as shareholder-friendly reforms continue to take effect and as capital flows continue moving into Japan, which could potentially lead to a multiple expansion.

BOND MARKET OUTLOOK

Although the steeply inverted yield curve has attracted outsized interest on the short end, as indicated by the $8.8 trillion in money market funds and CDs as of year-end, it will likely prove fleeting as the Fed begins its pattern of easing. Similarly, our expectations of heightened inflation volatility for the foreseeable future combined with the rally in long-dated Treasuries over the past quarter dampen our return expectations for the long end of the curve. Contrasted with our positive view of long Treasuries last quarter, the rally occurred in a much tighter time frame than we anticipated which encouraged us to unwind this position. The belly of the curve, particularly around five years of maturity, holds the greatest allure in terms of rate stability and limitation of both market risk and opportunity cost. Within this segment, we find mortgage-backed securities (MBS) to hold merit within our thesis of an intermediate-term bond focus. With the bulk of conventional mortgages carrying rates well below refi rates, extension risk is currently dampened. Spreads on MBS remain attractive despite their narrowing since October. Conversely, corporate spreads have narrowed to historically tight levels of roughly +100 bps, encouraging a relative underweight to corporates versus the market benchmark.

Speculative grade bonds are also trading at low spreads to Treasuries; however, the concerns we have are confined to the lower-rated segments below BB. The acceptance by investors to rate adjustments on leveraged loans underscores our concern that the risk appetite has become tilted toward lower rated bonds. While this has positive implications for the refinancing wave that is poised to affect companies rated B and below over the next two years, the increased risk tolerance on the part of investors gives us pause. Consequently, the speculative grade bond exposures remain exclusively in the BB-rated segment.

OTHER MARKETS

Among commodities, elevated risks in the Middle East have implications for the price of oil, but the potential economic slowdown is dampening demand; thus, we have exited oil and its derivatives near-term. In contrast, we retain the position in gold as a hedge against elevated geopolitical risks and as international central banks are buying reserves of the metal. Gold is augmented by exposure to silver in the more risk-tolerant strategies given its low price relative to gold by historical measures. Real estate remains absent in all strategies as demand remains in flux and REITs still face a difficult financing environment.