by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

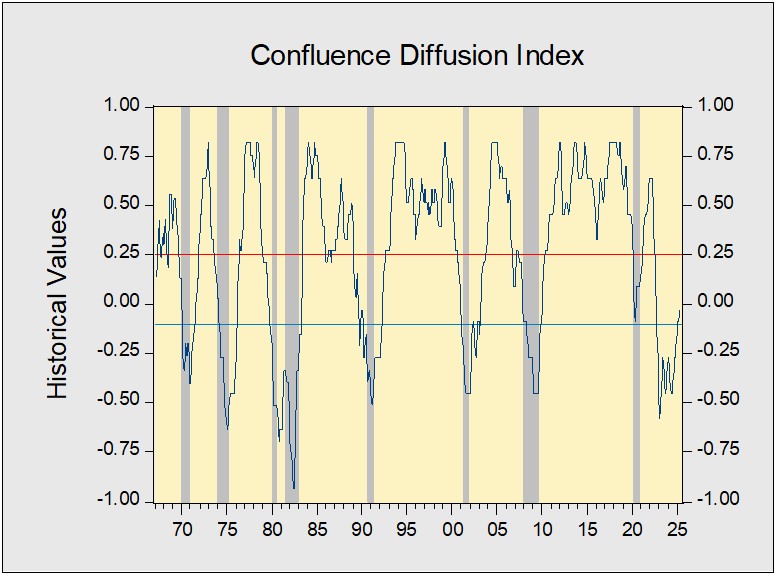

The US economy sustained its expansion in June, and our proprietary Confluence Diffusion Index stayed out of contraction territory for the fifth straight month. Most indicators showed improvement or only modest changes from the prior month. Financial markets reflected continued optimism from trade progress, lifting equity sentiment, while bond markets signaled lingering uncertainty over inflation and monetary policy. The real economy is showing resilience, with production levels improving (though still well below their peak) and both business and consumer sentiment on the rise. The labor market also looks stable as firms remain reluctant to cut jobs.

Financial Markets

Equity markets are adjusting to tariff-related headlines as confidence grows that the worst of the disruptions has passed. This optimism has driven a sustained rally, with tech stocks leading the gains. US government bonds have remained rangebound as a decline in the 10-year Treasury yield has pushed the financial spread (measured by the 10-year yield minus the effective fed funds rate) into contraction territory. However, this compression likely reflects shifting expectations around Fed policy rather than underlying economic stress as markets continue to assess the timing and magnitude of potential rate cuts this year.

Goods Production & Sentiment

The goods production and sentiment segments remain the weakest component of the business cycle report. In June, three of the four key diffusion indicators remained in contraction. While consumer sentiment showed an improved household inflation outlook, concerns have shifted toward labor market conditions. Business sentiment also edged higher, with supplier deliveries continuing to signal expansion. On a positive note, housing construction activity picked up modestly, led by multi-family projects. Meanwhile, a proxy for investment spending showed marginal improvement but stayed in contractionary territory.

Labor Market

The latest labor market data underscored the economy’s continued durability, with the unemployment rate unexpectedly dropping to 4.1% as more people secured jobs, though a deeper dive into the payroll numbers reveals a more nuanced picture. Nearly half of all new positions were created in state and local governments, highlighting the public sector’s outsized role in driving recent job growth. The steady decline in jobless claims suggests private employers are also retaining workers, signaling broader labor market strength.

Outlook & Risks

The economy is proving to be remarkably resilient, even with new tariffs in play. As trade deals are concluded, businesses and households should gain a clearer roadmap for navigating this evolving landscape. The new tax bill is a welcome shot of relief and is set to reduce recession risk. We’ll get an even better read on its full positive impact over time. Our focus stays squarely on earnings. As long as firms show flexibility and creativity in adjusting, we anticipate continued stability. But if companies shrink their margins, we could still see some economic volatility.

The Confluence Diffusion Index for July, which encompasses data for June, remained slightly above the recovery indicator. However, the report revealed that four of the 11 benchmarks remained in contraction territory from last month, and one additional indicator has now crossed into contraction for the month of June. Using June data, the diffusion index was unchanged at -0.0303, above the recovery signal of -0.1000.

- Stocks sustained the previous month’s momentum while bonds remain in holding.

- Sentiment and production showed signs of improvement.

- The labor market has softened but remains tight.

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is in recovery. The diffusion index currently provides about six months of lead time for a contraction and five months of lead time for recovery. Continue reading for an in-depth understanding of how the indicators are performing. At the end of the report, the Glossary of Charts describes each chart and its measures. In addition, a chart title listed in red indicates that the index is signaling recession.