by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with positive reports on the global gold market in 2022 and world economic growth in 2023. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including signs of better-than-expected economic growth in Europe and China, and news that the U.S. will officially end its COVID-19 emergency in May.

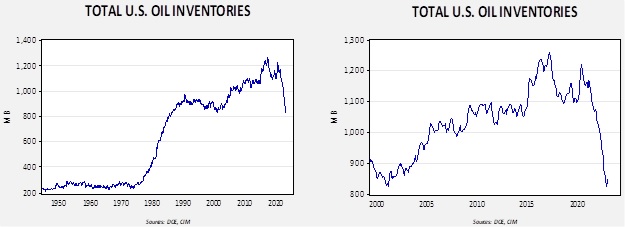

Global Gold Market: The World Gold Council reported that global gold demand increased 18% last year to 4,741 tons, marking the strongest demand for the yellow metal since 2011. According to the council, the increase was driven by a 55-year high in central bank purchases. We continue to believe that factors such as loose monetary and fiscal policies, fear of currency debasement, geopolitical tensions, and the U.S.’s willingness to freeze foreign countries’ dollar reserves will all continue to bolster the demand for gold going forward, pushing up gold prices.

Global Economic Growth: The International Monetary Fund said it now expects the global economy to grow 2.9% in 2023, an upgrade from its October forecast of 2.7%. Coupled with unexpectedly strong economic data from Europe and China (see below), the report has given a modest boost to global equity markets so far this morning.

- In its report, the IMF ascribed the update to its 2023 forecast to unexpectedly resilient demand, falling inflation, and China’s economic reopening after its Zero-COVID pandemic lockdowns.

- On a more downbeat note, however, the institution slightly downgraded its forecast for 2024 to 3.1%, far below the average growth rate of 3.8% in the two decades prior to the pandemic.

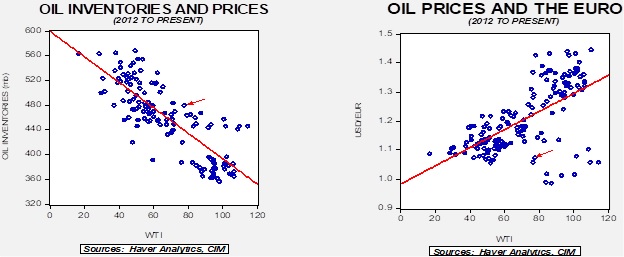

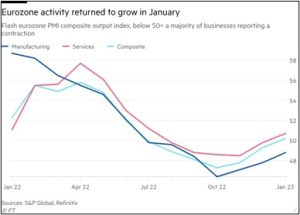

Eurozone: After stripping out price changes and seasonal factors, fourth-quarter gross domestic product increased 0.1% from the previous quarter, beating expectations for a fall of 0.1% even though Germany and Italy both posted contractions in the period. The expansion means that the overall Eurozone economy managed to grow in each quarter of 2022, bringing its full-year increase to 3.5%. It also means the bloc has been able to skirt the recession that was widely expected just a few months ago. Since the news could embolden the European Central Bank to keep hiking interest rates aggressively, even as the Fed slows its rate hikes, it should be positive for the EUR.

France: On a less positive note out of Europe today, France is facing its second major wave of strikes in two weeks as education, health, railway, and energy workers go out on strike to protest the Macron government’s proposed pension overhaul.

China: The country’s official Purchasing Managers Index (PMI) for manufacturing rebounded sharply to 50.1 in December from 47.0 in November, while the PMI for the nonmanufacturing sector jumped to 54.4 from 41.6. Like most major PMIs, China’s are designed so that readings over 50 indicate expanding activity. Even though the December manufacturing index was slightly below expectations, the figures suggest that the overall Chinese economy has snapped back to growth after the government abandoned its strict pandemic testing and lockdown policies late last year. The news is at least a short-term positive for global economic growth and stock prices.

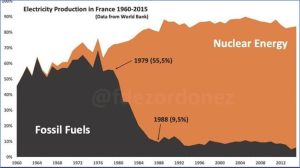

Russia-Ukraine War: Despite increasing pressures from the beleaguered Ukrainians and a coterie of Pentagon officials, yesterday President Biden appeared to rule out sending the F-16 fighter jets being requested. On the other hand, yesterday French President Macron signaled that he would be open to sending such support.

- Given that the allies supporting Ukraine have continually expanded the list of weapons they’re willing to provide, it is possible that they will eventually send Kyiv some type of fourth-generation fighters, at least the European-made Tornado or Gripen.

- However, a key question is whether such weapons will be sent, in sufficient quantities, in time for the Ukrainians to counter an expected new Russian offensive in the spring.

Russia-Iran: Russia and Iran have reportedly launched a system to provide standardized, secure banking messages between Russian and Iranian financial institutions. The system is designed to help Russia and Iran get around Western sanctions barring them from the global SWIFT communications system.

- The effort to establish a rival system illustrates how countries in the evolving China-led geopolitical bloc are working to develop their own, independent financial relationships.

- Over time, we expect Beijing to focus on developing and controlling a bloc-wide financial system marked by its own bank messaging system, its own idiosyncratic financial rules, and probably some type of digital, commodity-backed CNY as the bloc’s reserve currency.

India: Energy and infrastructure conglomerate Adani Enterprises (ADANIENT.NS, INR, 2,892.85) continues to face a massive sell-off and a falling stock price on the Indian market after a recent short-seller’s report accused the company of cooking its books. Although Adani shares are not available to investors in the U.S., it’s important to remember that international investors have been known to sell a country’s wider stock market on the news that one of its bigger companies is facing issues.

Brazil: Former President Bolsonaro has applied for a six-month tourist visa to remain in the U.S. while the new government in Brasilia investigates him for corruption and any role he might have played in this month’s rioting in the country’s capital.

U.S. COVID Policy: President Biden reportedly plans to call for an end to the national emergency and public-health emergency declarations for COVID-19 on May 11. Ending the emergency declarations would allow for the termination of certain pandemic measures, such as the suspension of eligibility renewal requirements for people on Medicaid. That could mean that millions of beneficiaries lose coverage just as the economy is falling into recession.

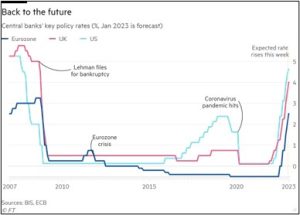

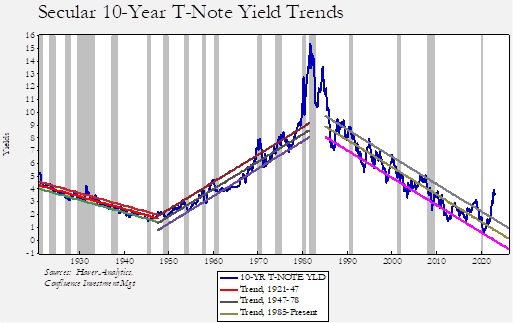

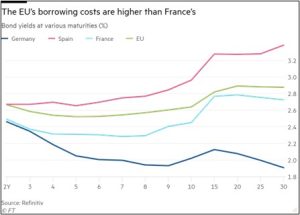

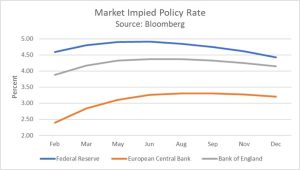

U.S. Monetary Policy: Fed officials begin their latest two-day monetary policy meeting today, with their decision due to be released tomorrow at 2:00 PM ET. The officials are widely expected to slow their rate hikes at the meeting to just 25 basis points, bringing the benchmark fed funds rate to a range of 4.50% to 4.75%. However, they are also expected to signal that they won’t be finished tightening policy until they make more progress in bringing down inflation.

- We continue to believe that the continued rate hikes will help push the U.S. economy into recession in the very near future. That suggests U.S. stock prices could well turn downward again, despite their rally in recent weeks.

- Meanwhile, the European Central Bank and the Bank of England will also hold policy meetings this week, but they are expected to keep hiking their benchmark interest rates by an aggressive 50 basis points. The narrowing differential between the U.S. and European benchmark rates will probably put continued downward pressure on the dollar.