Daily Comment (January 30, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with confirmation that the U.S. has secured the cooperation of Japan and the Netherlands in clamping down on key semiconductor technology transfers to China. The move is designed to suppress China’s military technology development, but it will also feed the continued escalation of tensions between the West and China. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including new, lower forecasts of future fossil fuel use and a preview of the Federal Reserve’s upcoming policy meeting this week.

United States-Japan-Netherlands-China: As we flagged in our Comment earlier this month, the Biden administration reached a deal with Japan and the Netherlands on Friday under which they will restrict the exporting of certain advanced semiconductor manufacturing equipment to China. The Japanese and Dutch restrictions will complement the aggressive new rules unveiled by the U.S. in October, which prohibit sending China certain advanced U.S. computer chips, chipmaking equipment, chip components and inputs, and even personal services related to those items.

- The new U.S. restrictions aim to suppress China’s ability to produce advanced military technology, including not only advanced computer chips but also artificial intelligence, supercomputing, and other technologies for modern warfare.

- With allies like Japan and the Netherlands signing up to enforce the restrictions as well, the new U.S. rules are likely to seriously impede China’s overall information technology development. On top of that, House Foreign Affairs Committee Chairman McFaul revealed last week that the Biden administration is planning to issue an executive order that would dramatically widen its clampdown on U.S. capital flows into China’s technology industry. That order would prohibit U.S. investments in whole sectors, such as artificial intelligence, quantum computing, and cybersecurity.

- In theory, China could still catch up to Western technology standards in the future, but the U.S.-led restrictions are likely to seriously slow the process and crimp U.S. investment opportunities in the country.

- Of course, the U.S. clampdown on technology and capital flows will also anger Beijing and will almost certainly prompt retaliatory measures and increase friction between the two countries.

United States-China: As U.S.-China tensions continue to escalate, U.S. Air Force General Mike Minihan, chief of the Air Mobility Command, reportedly ordered his officers last Friday to achieve “maximum combat readiness” this year, in preparation for a U.S.-China conflict that he believes will happen by 2025. Minihan’s timeline for war is even earlier than the 2027 date predicted two years ago by Adm. Phil Davidson, then chief of the U.S. Indo-Pacific Command.

- A U.S.-China conflict is still not necessarily inevitable. Nevertheless, it appears that U.S. national security officials are becoming increasingly concerned about tensions boiling over in the near term.

- We continue to believe that increasing tensions with China and Russia’s aggression in Ukraine will spur more military spending and defense investment throughout the U.S.-led geopolitical bloc in the coming years. However, those increases are coming slowly, largely reflecting bureaucratic delays, resistance by both business elites and populists alike, and the lack of a modern-day Winston Churchill raising the alarm about China’s growing power and military aggressiveness.

- The West’s defense industry should probably be moving closer to a war footing right now, which should include dramatically boosting its capacity and production. Although we have emphasized that global economic fracturing and shortened supply chains will prompt “re-industrialization” in the West, increased defense manufacturing could also be an important part of the story. However, the West’s defense industry currently remains on a peacetime footing.

- If U.S.-China tensions suddenly worsen, it could require a rapid expansion in the West’s defense industry. That kind of expansion could be chaotic, but it could also lead to great wealth creation for those in a position to benefit from defense contracts.

Russia-Ukraine War: Russian forces, bolstered by recent conscripts, have reportedly changed their tactics and are now making progress in their efforts to surround the embattled city of Bakhmut in eastern Ukraine. The new Russian progress comes as Western officials begin to worry that the Russians will have the advantage the longer the war of attrition lasts, due to their superior numbers of troops and equipment. That calculus could well spur the West to speed its deliveries of advanced equipment to the Ukrainians, perhaps even to include jet fighters.

Israel-Iran: Over the weekend, the Israeli military launched a drone strike on a military facility deep in Iran, in the city of Isfahan. The strike, the first under Prime Minister Netanyahu’s new far-right government, came just days after the U.S. and Israel held their biggest-ever joint military exercise. It also comes amid an escalating cycle of violence between Palestinians and Israeli security forces in Jerusalem and in the West Bank.

- Israel has been reluctant to directly help Ukraine defend itself against Russia’s invasion, given the Israel needs Russia’s acquiescence to attack its foes in Syria.

- However, the attack on an Iranian military supply depot may have been meant as much to degrade Iran’s ability to support Russia in its invasion as to damage Iran’s own defense capabilities.

European Union: Figures today showed that Germany’s gross domestic product unexpectedly declined 0.2% in the fourth quarter of 2022, largely reflecting reduced household consumption because of high energy prices. The contraction in the EU’s largest economy means the bloc’s overall GDP could also show a small contraction in the fourth quarter when the report is released tomorrow. If that’s the case, the EU’s GDP would have fallen for two straight quarters and would, therefore, have met the standard definition of a recession, although the downturn would still have been much less severe than was widely feared last year.

United Kingdom: Yesterday, Prime Minister Sunak sacked Cabinet Office Secretary and Conservative Party Chairman Nadhim Zahawi over a simmering scandal revolving around his late tax payments. That means Sunak has now lost two Cabinet ministers in the last three months, even as a third is under investigation and is likely to resign soon. The scandals have greatly wounded Sunak politically, even as he struggles to deal with Britain’s high inflation, economic slowdown, massive strikes, and worsening public finances.

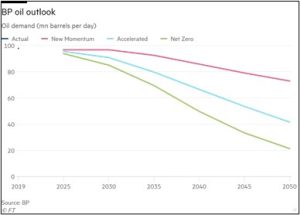

Global Energy Market: In its annual energy outlook publication, BP, plc (BP, $36.32) has reduced its forecasts of global fossil fuel demand to reflect how countries around the world are accelerating their transition to renewable energy in response to Russia’s invasion of Ukraine.

- In its forecast for 2035, for example, BP now expects global oil demand to fall to just 93 million barrels per day, about 5% lower than what was forecast last year.

- Despite the expected decline in demand, we continue to believe that oil, gas, and many other key commodities will be richly priced in the coming years, largely reflecting factors like the U.S.-China geopolitical tensions, potential supply shortfalls, and a weaker dollar.

U.S. Banking Industry: Regional banks and lenders with big credit-card businesses say they are tightening credit standards ahead of an expected recession. Some lenders also say they are boosting their financial reserves to prepare for a continued increase in delinquencies. Although consumer delinquencies remain historically low, they have begun rising in recent months.

U.S. Fiscal Policy: President Biden and House Speaker McCarthy are due to meet on Wednesday to discuss a range of issues and, most importantly, begin negotiating on a deal to raise the federal debt ceiling. Plans for the meeting may ease concerns about a bitter political fight that could lead to a U.S. default, but a lack of results could rekindle concerns and undermine the financial markets later in the week.

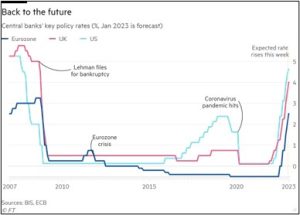

U.S. Monetary Policy: Fed officials will begin their latest two-day monetary policy meeting tomorrow, with the decision due to be announced on Wednesday at 2:00 PM ET. The officials are widely expected to slow their rate hikes at the meeting to just 25 basis points, bringing the benchmark fed funds rate to a range of 4.50% to 4.75%, but they are also expected to signal that they won’t be finished tightening policy until they make more progress in bringing down inflation.

- We continue to believe that the persistent rate hikes will help push the U.S. economy into recession in the very near future. That means U.S. stock prices may well turn downward again, despite their rally in recent weeks.

- Meanwhile, the European Central Bank and the Bank of England will also hold policy meetings this week, but they are expected to keep hiking their benchmark interest rates by an aggressive 50 basis points. The narrowing differential between the U.S. and European benchmark rates will probably put continued downward pressure on the dollar.