Daily Comment (January 24, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

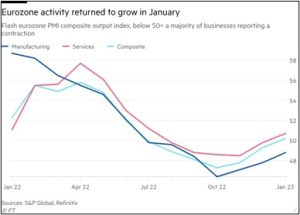

Our Comment today opens with some positive economic news out of Europe where the January flash composite PMI unexpectedly swung above the level of 50, indicating a return to growth. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a report that Japan and the Netherlands will join in the U.S. clampdown on sending advanced semiconductor technology to China, and new indications of a broader softening in the U.S. labor market.

Eurozone: S&P Global said its flash composite Purchasing Managers Index for the Eurozone rose to a seasonally adjusted 50.2, beating the expected reading of 49.8 and the final December reading of 49.3. The index has now risen for three consecutive months after it reached its most recent low in October.

- As with most major PMIs, this one is designed so that readings over 50 signify expanding activity. At its current level, the figure suggests that the Eurozone economy is already expanding again despite the war in Ukraine, energy shortages, and sky-high inflation.

- In turn, that has bolstered recent hopes that the European economy may have dodged the recession that was widely expected just a few months ago.

Russia-Ukraine War: As we flagged in our Comment yesterday, the Polish government has formally requested permission from Berlin to send its German-made Leopard 2 tanks to Ukraine. The move raises the pressure on Germany to finally relent and give its required permission. However, it’s too early to know if Chancellor Scholz will acquiesce, especially since the Russian government has now warned him that granting such permission would sour future German-Russian relations.

- As a reminder, Poland earlier this week vowed to send the tanks to help Ukraine even if Germany doesn’t approve. Once Poland sends its Leopards, it would probably clear the way for a range of other European countries to send their own Leopards to Ukraine.

- Scholz is concerned that if Ukraine ends up with a nearly entirely German-made tank force, his country will look like the major power backing Ukraine. He and some other officials in Germany are wary about drawing Russia’s ire because of Germany’s past economic links to Russia and Germany’s lack of any nuclear deterrence to defend itself.

- That’s why Scholz has said that Germany wouldn’t allow shipping the Leopards to Ukraine unless other countries send their advanced tanks, especially the U.S. Abrams tank.

- However, the turbine-powered Abrams may not be appropriate for the Ukrainians, given the long time needed to train on it, its immense fuel usage, and its need for extensive maintenance capabilities.

- Having dozens of Leopards would enhance Ukraine’s firepower and help it defend against a new Russian offensive expected in the coming months. The Leopards could also help Ukraine recapture more territory from the Russians. However, they wouldn’t necessarily guarantee a Ukrainian victory in the war.

NATO Expansion: In a new setback for Sweden and Finland as they work to join NATO, a far-right politician burned a copy of the Quran and denounced Muslims outside the Turkish Embassy in Stockholm over the weekend. The incident prompted Turkish President Erdoğan to again threaten to veto the Swedish and Finnish applications to join the military alliance. There is some speculation that Erdoğan is simply playing the strong nationalist card ahead of Turkey’s May elections. Even if that’s true, however, it would suggest Sweden and Finland can’t move forward in their applications to join NATO for at least several more months.

France: In its new six-year defense plan, the French government plans to spend some €400 billion (approximately $433.4 billion) to transform its military into a more responsive force that can quickly respond to contingencies around the globe, particularly around French territories in the Indo-Pacific region.

- The spending would represent a 35% increase over the previous six-year plan. The new spending will include a new aircraft carrier, big new investments in drones and undersea warfare equipment, and a massive increase in France’s intelligence and surveillance capabilities.

- The spending increase is consistent with our view that threats from revisionist, authoritarian powers like China and Russia have touched off what will likely be a multi-year boom in global defense spending, much of which will benefit U.S. defense firms.

Brazil: President Lula da Silva has replaced the country’s top army commander, Gen. Julio Cesar de Arruda, because of what Defense Minister Mucio called a “fracturing of trust” after the riots at Brazil’s capital on January 8 which aimed to prevent Lula from taking power despite his win in the October elections. Since those riots, Lula has accused many officials in the Brazilian military and security forces of conspiring to let the violence proceed unimpeded.

Japan: Yesterday, the Bank of Japan held its first bond auction under an expanded bank lending program designed to ease pressure on its yield-curve control policy. The successful auction and the broader program are expected to boost bank liquidity and improve the demand for Japanese government bonds, helping keep 10-Year JGB yields at the BOJ ceiling of 0.50%. However, it is not yet certain how long the BOJ will be able to maintain its yield-curve control in the future.

United States-Japan-Netherlands-China: The Japanese and Dutch governments are reportedly ready to join the U.S. in imposing stringent new restrictions on sending advanced semiconductor technologies to China. The Japanese and Dutch restrictions could be announced by the end of January.

- The U.S. restrictions, announced last October, aim to suppress China’s ability to develop advanced weapons that could threaten the U.S. and its allies.

- The rules essentially cut China off from acquiring advanced semiconductors, semiconductor manufacturing equipment, semiconductor manufacturing components and other inputs, and even semiconductor support services that are based on U.S. technology.

- The pending Japanese and Dutch restrictions appear to be focused more narrowly on exports of advanced semiconductor manufacturing equipment and inputs.

- In any case, having the U.S., Japan, and the Netherlands all restricting advanced semiconductor technology will likely knee-cap China’s effort to build its own advanced computer chip capabilities and impede its development of some military technologies.

- As the world continues to fracture into at least a U.S.-led geopolitical bloc and a rival China-led bloc, it’s important to remember that there will still probably be a lot of trade and travel between the two camps.

- However, the competing governments will likely be quite aggressive in limiting the transfer of critical, high-value goods and technologies, as we’ve already seen over the last few years. Importantly, that will likely crimp China’s technological development going forward.

U.S. Labor Market: On top of the layoffs in the information technology and real estate industries that we’ve been flagging, new reports today hint that labor demand may be starting to wane more broadly. First, industrial conglomerate 3M (MMM, $122.62) said that it is cutting some 2,500 manufacturing positions globally due to a softening in demand for its products that took hold late last year. Separately, economists have begun to note a consistent fall in temporary employment over the same period. Falling temp jobs often signal a broader decline in the labor market.

U.S. Energy Industry: After years of paltry investment in new oil and gas drilling, offshore drilling in the Gulf of Mexico and elsewhere around the world is quietly growing again. According to data provider Westwood Global Energy Group, about 90% of the 600 leasable offshore drilling rigs available worldwide were working or under contract to do so in December, versus just 63% five years ago. The increase in drilling suggests today’s high energy prices and growing energy demand have begun to produce a supply response, despite the prior hurdles like investor demand for capital discipline and social and regulatory preferences for green energy.

U.S. Cryptocurrency Industry: New reporting indicates that tougher scrutiny by the Securities and Exchange Commission has hindered a number of cryptocurrency companies from going public over the last year. As we had warned would happen, the regulatory crackdown appears to stem from the wave of bankruptcies and financial problems in the industry.