Daily Comment (January 26, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s Comment begins with a discussion about whether central banks will continue to raise rates. Next, we explain why investors have varying opinions about the state of the global economy. We end the report with our thoughts about rising friction within the U.S.-led geopolitical bloc.

Are They Done? Moderating inflation data and fears of a recession have led to calls for central banks to stop tightening; however, policymakers have pushed back.

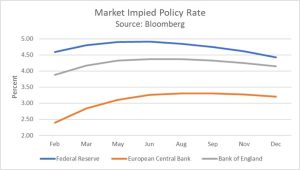

- Most of the G-7 central banks have resisted pressure from markets to change tack and stop hiking. After a report stated that policymakers were considering slowing hikes after their March meeting, European Central Bank officials decided instead to double down on the need to raise interest rates by 50 bps increments. Governing Council members Gediminas Šimkus and Joachim Nagel argued that the ECB should continue to raise rates in half-point increments throughout the year in order to contain inflation. Meanwhile, Fed policymakers, in the days leading up to the central banks’ one-week silence period, have urged markets to reconsider bets that the Fed could stop hiking as soon as June.

- Global credit conditions are beginning to ease despite the rhetoric from central bank officials. The spread between the 10-year Italian and German bonds, a gauge for financial distress, has narrowed by almost 60 bps from its 2022 peak in October. At the same time, the average 30-year U.S. fixed-mortgage rate has fallen almost 100 bps within a similar period. The relaxation of borrowing costs partially reflects investor expectations that the lending environment may improve in the future.

- The Bank of Canada’s decision to pause rate hikes after Wednesday’s 25 bps increase adds to speculation that central banks could be almost done tightening. It was the first of the G-7 countries to announce at least a temporary reprieve from its hiking cycle. This may force the Federal Reserve and the ECB, who are meeting on back-to-back days, to give more details about their policy path going forward. Equities could take a hit if policymakers signal that they are prepared to lift rates during a downturn. However, anything short of that may be favorable toward shorter-duration equities.

The Recession Debate: Warmer-than-expected weather, China’s reopening, and faster-than-expected U.S. GDP growth have made investors optimistic that a recession may be averted; however, there is still room for cautiousness.

- The improved economic outlook has helped boost investor appetite for equities, particularly in Europe. So far this year, MSCI Europe ex-U.K. UCITS has outpaced MSCI USA UCITS as the indexes have risen 8.23% and 2.54%, respectively, within that period. Positive economic data and a weaker dollar have driven this preference for European stocks. Earlier this week, the preliminary Purchasing Manager Index (PMI) and Euro Area Consumer Confidence report figures showed that economic activity was gaining steam in Europe. Meanwhile, December pending home sales showed the first monthly purchase rise in 14 months, a rare win for U.S. real estate that has been hampered as of late.

- Despite the glimpses of sunshine, there still remains much gloom. The U.K. has had a rocky start to the year as rising energy costs in December hurt the country’s manufacturing sector and households, and forced the government to take out more debt to fund energy subsidies. The U.S. has also faced some bad news. Retail sales were weak in December, while the industrial sector may already be in contraction. The deteriorating economic conditions within the two countries partially explain why the GBP is expected to underperform the EUR in 2023, and the USD has depreciated against many of its trade partners so far this year.

- In short, many unknowns remain regarding where equities will peak and bottom this year. Those that are pessimistic about growth in the U.S. and abroad have forecasted a possible low in the S&P 500 of around 3300, while optimists foresee the index rising to 4500. The wide range in forecasts shows the vast amount of uncertainty within the market. As a result of these jitters, many investors have piled into global money market funds, which are now having their best four-week run since May 2020.

- The winner of these three groups (optimist, pessimist, and the jitters) will depend on the scale of the downturn and the Fed’s response. If the recession is mild and the Fed moderates its policy, participants on the sidelines could miss out on a decent opportunity as many stocks have discounted the possibility of a recession.

Bloc Battle: Rivalries are brewing between and within blocs as governments prepare for a less globalized world.

- The United States, European Union, and the United Kingdom plan to offer subsidies to support semiconductor production. The push to develop semiconductors locally is related to concerns that the bloc may be cut off from vital chips if China invades Taiwan. The increase in state investment should be a boon for chip developers looking to set up shop in the West. However, the cost of relocation and the increase in labor costs may lead to more expensive chips.

- Despite their coordination over semiconductors, there seems to be tensions brewing between the U.S. and EU over clean energy subsidies. European companies are being pressured to move operations to the U.S. to take advantage of the tax incentives granted in the Inflation Reduction Act. Although there seems to be reluctance among some members of the EU to take up similar initiatives, it does appear that the European Commission is preparing for a response. The EU is considering loosening stimulus rules to help facilitate more lending to member countries. The action could help support European firms but will likely face resistance from fiscally prudent countries.

- That said, the group maintained a united military and trade front in its stance against the China-Russia bloc. On Tuesday, Germany and the U.S. agreed to send tanks to help Ukraine fight the Russians. Dutch officials are traveling to Washington to discuss export controls on China after ASML (ASML, $681.53) urged lawmakers for “sensible” restrictions. Additionally, Politico reported that the EU is preparing to take on China in the Middle East and Africa by offering an alternative to the Belt and Road Initiative. Even with their differences, Brussels and Washington will likely have similar trade and foreign policies going forward. As a result, the two sides may be more prone to work out their issues.

- On Wednesday, it was revealed that Washington could include European firms in the subsidies offered in the Inflation Reduction Act in exchange for access to the region’s critical minerals and raw materials. Earlier this month, the largest European deposit of rare earth elements was discovered in Sweden.