Daily Comment (January 27, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s Comment begins with our thoughts on the latest Gross Domestic Product data and what it may say about the economy. Next, we explain why the global bond rally has not eased concerns over government debt management. The report ends with our views on the latest earnings figures from various companies.

A Second Look: The market responded positively to the preliminary GDP data; however, a deeper dive shows signs of potential trouble.

- The economy expanded at a faster-than-expected pace in the fourth quarter. According to the Bureau of Economic Analysis, GDP rose at an annual pace of 2.9% in the final three months of 2022. The reading was well above expectations of 2.6%. The strong report boosted investor confidence that the country may avoid a downturn. As a result, investors showed an increased appetite for risk, leading to a 1.1% high in the S&P 500 and a 2.0% peak in the NASDAQ. That said, the excitement may be temporary as the overall GDP number overshadowed problems within the underlying data.

- Much of the GDP growth in the fourth quarter came from volatile elements of the report. Inventories accounted for nearly half of the rise in economic output, while a sharp decline in imports also boosted economic activity. Excluding trade, government spending, and inventory data, the economy only grew at a paltry 0.25% in the final quarter of 2022. The figure, referred to as final sales to private domestic consumers, shows that the country may be experiencing a slowdown. Thus, the market may have interpreted the headline figure as evidence that the Fed may achieve a soft landing, but a deep dive into the report shows that the economy is holding on by a mere thread.

- This may be a make-or-break moment for the Fed. It had signaled for several weeks that it was committed to raising its benchmark interest rate to 5.0% and above to help bring down inflation. However, this talk was under the belief that a tight labor market reflected a strong U.S. economy. Although policymakers have consistently pointed to the tight labor market as evidence that it has room to tighten, the GDP figures show that the economy may be on the verge of recession. Therefore, Powell may be forced to explain whether the Fed will raise rates into a downturn like officials have suggested or listen to markets and implement a pause.

- Further proof of the wonkiness in the data is that construction activity, as by housing starts, shows that homebuilders continue to hire workers at a steady pace despite taking on fewer projects.

Debt Problems: Governments have struggled to manage their debts even as the demand for global bonds have surged.

- The debt-ceiling fight could push the Fed to end its quantitative tightening earlier than expected. The U.S. Treasury is expected to limit the number of treasury bill issuances in the second quarter since the government reached its statutory debt limit earlier this month. The lack of bond offerings will likely cause problems within the financial system as financial institutions, such as money market funds and pension plans, must hold ultra-safe assets on their balance sheets. A lack of available debt could lead to bidding up for collateral within the repo market. The lack of quality capital may force these funds to withhold assets in the short-term lending facility; thus, causing the Fed to prematurely end the shrinking of its bond portfolio in order to prevent a potential crisis .

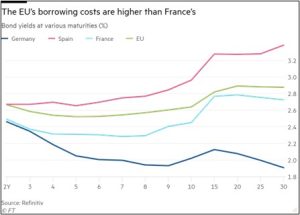

- Although European debt sales surged in January, the European Union is having trouble finding takers for its bonds as it considers expanding the bloc’s lending capacity. Interest rates on joint EU bonds are higher than those of many of its members, such as France and Germany. The lack of demand has less to do with the creditworthiness of the region and more to do with its lack of liquidity. Investors view resistance to the bond’s creation as a sign that these bonds can’t be relied upon as safe-haven assets in the future. Therefore, the EU may be limited in its ability to raise the funds needed to compete with the subsidies offered in the U.S. Inflation Reduction Act.

- The Bank of Japan is facing increased pressures to abandon its yield-curve control program to help improve financial conditions within Japan. On Thursday, the International Monetary Fund advised the BOJ to be more flexible in setting long-term yields and communicate clearly if it aims to tighten policy to control rising inflation. The successor to BOJ Governor Kuroda Haruhiko is expected to phase out yield-curve control after he takes over in April. Speculation over when the central bank will abandon its policy has forced the BOJ to take action to keep interest rates in check.

- This shift is expected to raise the country’s heavy debt burden, which is the highest amongst advanced economies. A 100 bps increase in the 10-year yield could raise the Japanese government debt-to-GDP ratio by 3% by 2025, according to the Fitch Ratings Agency.

Earnings Slowdown: The GDP shows that consumption helped save the economy from contracting in December, but more firms are expressing doubts about whether this will last.

- Major firms are forecasting a steep slowdown in sales for the coming year. Microsoft (MSFT, $248.00 ) and Intel (INTC, $30.09) both reported weak PC sales in their latest earnings reports. Meanwhile, Tesla (TSLA, $160.70) slashed the prices of its vehicles to maintain its market share. The deteriorating earnings outlook suggests that the firms may start to feel margin pressure as the economy begins to slow, and thus, it is possible that the market may not have reached its bottom yet.

- As input prices continue to rise, firms will likely have little room to maneuver to ensure profitability. Higher costs mean that firms depend on consumers to spend more to remain in the black. This feat may be harder to achieve, given the possibility of a looming recession. The negative earnings news on Thursday reversed some of the equity gains from the GDP report and is contributing to weakness in premarket trading. The S&P 500 rose above 1% yesterday but closed only 0.5% up from the previous trading day.

- The Chinese reopening and strong labor market data have boosted investor confidence that sales will be strong, even during a U.S. recession. However, that sentiment may be more sector dependent. For example, firms that offer more expensive and discretionary products could see a mild tapering of sales as consumption begins to cool. Though, this trend may not be consistent for all industries. Walmart’s (WMT, $142.21) decision to increase pay to all employees and Chipotle’s (CMG, $1,606.29) move to hire an additional 15,000 workers is evidence that not all firms are feeling a profit crunch.