Weekly Energy Update (January 26, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

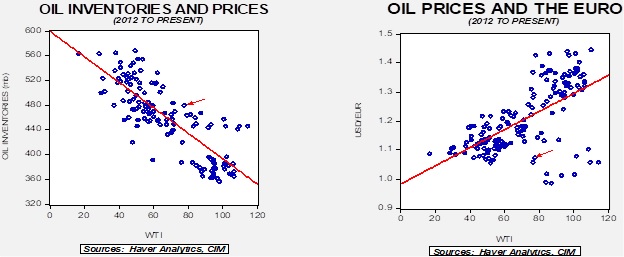

Crude oil prices appear to have based but so far have failed to break above resistance at around $80-$82 per barrel.

(Source: Barchart.com)

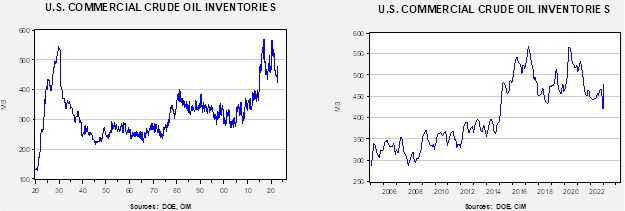

Crude oil inventories rose 0.5 mb compared to a 3.0 mb draw forecast. The SPR was unchanged.

In the details, U.S. crude oil production was unchanged at 12.2 mbpd. Exports rose 0.8 mbpd, while imports fell 1.0 mbpd. Refining activity rose 0.8% to 86.1% of capacity.

(Sources: DOE, CIM)

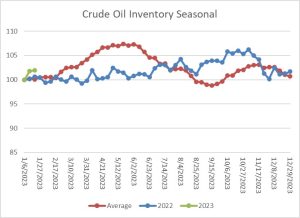

The above chart shows the seasonal pattern for crude oil inventories. Last week’s mostly steady injection is consistent with last year and seasonal patterns. We expect this year to mostly follow last year, meaning that the usual rise in inventories isn’t likely.

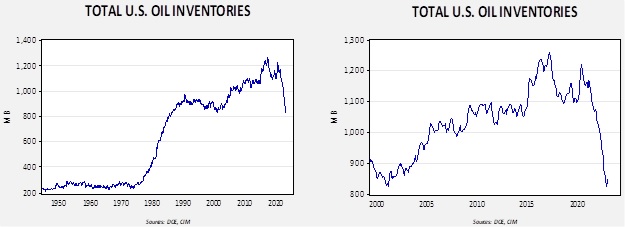

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. For the next few months, we expect the SPR level to remain steady, so changes in total stockpiles will be driven solely by commercial adjustments.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $107.07.

Market News:

- We are just over 11 months into Russia’s invasion of Ukraine. At this juncture, we don’t know what the outcome of the war will be. Ukraine has proven itself to be a formidable opponent and is clearly leveraging its “home field advantage.” At the same time, Russia is a larger nation and still has ample resources to throw at the conflict. But even with this uncertainty, it looks like global energy markets are unlikely to return their pre-war state.

- Europe now knows that Russia is an unreliable supplier of energy. Moscow would need to discount prices heavily to retake the European market share. After all, Russia used to supply 40% of EU natural gas, but now that number is down to 14.4%.

- Putin obviously wagered that the EU would not be willing to absorb the pain from the loss of Russian oil and natural gas. He might have been right, but in a fascinating twist of fate, a mild winter has allowed Europe to see a sharp drop in natural gas prices. Russia, for centuries, has relied on winter as its ultimate defense against invaders. Now, winter has, at best, postponed Russia’s leverage over Europe. As supply chains adjust, Moscow’s leverage may be permanently reduced.

- Russian oil has to go somewhere, and it has mostly flowed to India and China in a clear benefit to those nations. This has, however, reduced market share for Middle Eastern oil producers, and we wait to see their response.

- Even with these expanded markets, it is highly likely that Russia will lose market share on global markets and eventually be forced to shut-in production. Complicating matters further is that that the price cap is beginning to reduce Russia’s revenues. Washington’s goal with the price cap was this reduction in revenues, but it was also meant to keep oil supplies ample. Thus, it set a price high enough to keep Russia producing, but low enough to “hurt.” It’s quite possible that the price is set too low.

- On February 5, the EU will begin a price capping system on Russian oil products, along with an outright ban on Russian diesel. However, the actual setting of the caps hasn’t been resolved.

- Although the U.S. still imports crude oil and products, the net figure is increasingly positive, meaning that the U.S. is a net exporter of oil and products. As exports increase in importance, the goals of domestic energy security will clash with the oil industry’s revenue and profitability.

- OPEC+ is expected to keep production targets unchanged when it meets next Tuesday. The cartel is taking a “wait and see” approach to the crosscurrents of China’s reopening and a looming global slowdown.

- There are increasing reports that drilling activity is beginning to increase as high prices may finally be triggering a supply response. The DOE is forecasting that U.S. production will average 12.4 mbpd this year and 12.8 mbpd next year.

- Freeport LNG has announced its plant repairs are complete and the company is preparing to restart operations. Last year, the plant suffered a major accident which reduced operations for several months. The return of this liquification plant is a bullish factor for U.S. natural gas prices.

- China’s electricity officials warn that economic recovery in the post-COVID era will boost electricity needs. This will lift demand for coal and LNG.

- China oil trading firm Unipec, the trading arm of Sinopec (6000028, CNY, 4.54), is reported to be aggressively buying crude oil. It isn’t clear if it is buying the crude for China or merely reselling it. In 2022, China’s oil imports declined from the previous year, but with COVID restrictions being lifted, we may be seeing Chinese firms prepare for higher consumption. Imports from Malaysia have recently hit a new record.

- Japan’s oil imports have increased for the first time in a decade.

- China has a large, but mostly inefficient, refining industry. Unlike most areas of the world, it is increasing its refining capacity, which could mean China will become a critical source of refined products. Meanwhile, U.S. refining margins are rising, in part due to the continued slow recovery from the late December cold snap.

Geopolitical News:

- Pakistan and Russia, Cold War enemies, are looking at an agreement where Russia would supply Pakistan with oil. Pakistan has suffered from being outbid by Europe for oil and LNG. Russia would not only supply oil to the country but has also hinted that it would take payment in a “friendly” currency, likely CNY. As U.S./Pakistan relations have cooled, the country has suffered a dollar shortage. However, Pakistan appears to want Russian oil under the price cap regime, which may not appeal to Moscow. This deal highlights the emerging blocs that we have been discussing over the past year.

- The U.S. has added additional sanctions on elements of the Islamic Revolutionary Guard Corps for the body’s suppression of recent protests. The U.S. is also increasing pressure on China to end its purchases of Iranian oil. We doubt China will comply, but the pressure might cap the amount of oil China purchases from Iran.

Alternative Energy/Policy News:

- There are reports that wind turbines are falling over as structural problems are emerging.

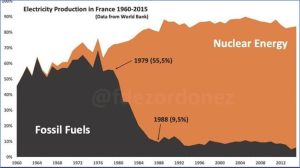

- This chart shows the impact of France’s nuclear power on fossil fuel consumption. It shows that, at least for electricity, nuclear power can displace fossil fuels.

- The U.S. is extending the life of its aging nuclear power plants.

- Recently, there was a reported breakthrough in fusion energy. Although we think the new information is interesting, it will be a long time before such power could be commercialized. However, the U.S. is offering subsidies for firms working on this potential power source, and European companies are considering moving to the U.S. to capture this support.

- Although the U.S. and other nations are taking steps to build a domestic auto battery industry, in reality, China is expected to maintain its dominant position.

- Another metal that has been overlooked in battery production is graphite. It comes from two sources—man made and mined. The former is produced from oil, mostly in China (again!), while mined sources have mostly been underdeveloped. There is growing interest in the mined sources, which are in short supply.

- Lithium miners remain optimistic about demand and future earnings.

- In response to the Inflation Reduction Act’s (IRA) green energy subsidy measures, EU industries are asking for similar subsidies. This is partly in response to U.S. governors wooing European green energy firms to build factories in the U.S. to take advantage of the subsidies in the act.

- An interesting political sidelight to the IRA is that much of the green industry subsidies are benefiting Republican-controlled states. It’s simply a matter of geography as ample wind and solar resources are found across the southern tier, which are mostly GOP states. Although the GOP coalition includes extractive industries, the green subsidies may stay in place even with a change in government in the White House since the affected states won’t want to lose the support.

- The IRA also has generous subsidies for EV buyers, but they are limited to domestically produced cars and batteries. There has been growing pressure on Washington to ease these restrictions, but Manchin (D-WV) is opposing such changes and is pushing to delay the implementation of the subsidies.