by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins by analyzing the market sell-off on Thursday, which was driven by uncertainty surrounding US monetary policy. We then pivot to the political arena and examine the White House’s coordinated push to mollify anxious voters. On the global stage, we detail the US’s hawkish military stance in the Western Hemisphere, break down the impact of the recent Chilean election, and explore the surprise rise in UK bonds after a major reversal in tax policy. Finally, we include an essential roundup of key international and domestic data releases.

Fed Rate Cut Doubts: A sharp market sell-off ensued on Thursday as Federal Reserve officials cast significant doubt on the timeline for interest rate cuts. The dovish outlook was challenged by several Fed presidents, who voiced a resolute reluctance to ease monetary policy, warning that such a move could compromise the bank’s price stability mandate. This repricing of expectations was immediately reflected in interest rate futures, with the CME FedWatch Tool indicating that the implied probability of a December cut nosedived from 63% to 50%.

- The market sell-off was broad-based across asset classes as investors aggressively deleveraged their portfolios and liquidated overweighted positions. Technology stocks bore the brunt of the decline, with the NASDAQ Composite dropping 2.29%. Crucially, traditional safe-haven assets, such as gold and the US 10-year Treasury bond, also saw simultaneous selling pressure. This counterintuitive move signals that investors were prioritizing liquidity and profit-taking over a classic “flight-to-safety” strategy.

- The unwinding of trades vividly reflects the market’s overconfidence in an imminent rate cut. This optimism was largely rooted in evidence of a cooling labor market, particularly the high-frequency data from the ADP weekly tracker. This tracker showed that in the four weeks ending October 25, private employers were, on average, shedding 11,250 jobs per week, suggesting a notable deceleration in employment growth.

- The Federal Reserve’s renewed commitment to price stability is also tempering economic growth outlooks. A prolonged period of high interest rates would keep borrowing costs elevated, potentially straining household finances and raising the cost of corporate investments. This is particularly relevant for AI expansion, as many firms funding these initiatives have done so through increased debt.

- The Federal Reserve’s recent rhetoric signals a clear prioritization of price stability over maximum employment, dramatically dimming the prospects for a December rate cut. The central bank is now positioning for a pause in its easing cycle, potentially as soon as next month. Nonetheless, any definitive signal that the Fed will resume aggressive easing would serve as a powerful catalyst for a major risk-asset rally.

Affordability Push: The White House is urgently evaluating new proposals to tackle affordability, recognizing this issue as a crucial hurdle ahead of the midterm elections. This intense focus is driven by recent off-cycle elections, which served as a clear bellwether of voter frustration. Analysis of those contests showed a significant portion of the electorate is struggling with stubbornly high inflation and stagnant job growth. As a result, the administration is now compelled to prioritize visible economic relief measures.

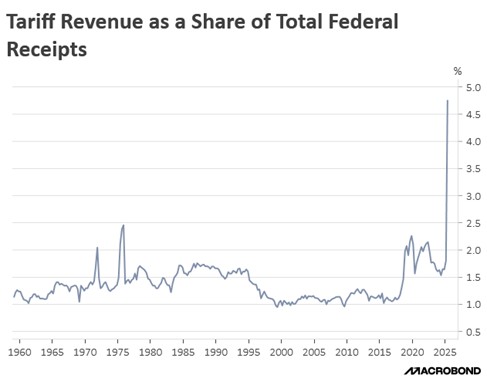

- To combat food inflation, which has accelerated in recent months, White House officials are actively engaging with their South American trading partners to negotiate tariff reductions and boost food imports. This initiative is specifically expected to ease price pressures on key commodities such as beef, beans, and fruits, directly supporting the administration’s goal of reducing overall consumer grocery costs.

- The White House is considering several measures to improve housing affordability, including 50-year mortgages and “portable mortgages.” The latter would allow homeowners to transfer their existing loan terms to a new property. Although details are not yet finalized, the initiative signals a proactive effort to provide household relief and is expected to offer some support for the broader economy.

- This flurry of activity signals a strategic pivot toward populist economic measures to bolster public support. Looking further ahead to the 2026 election cycle, the administration is likely to continue this approach, with a new wave of growth-oriented policies already taking shape. The prospect of direct stimulus checks remains a credible tool, and any significant fiscal injection of this kind could serve as a powerful catalyst, igniting a fresh rally in equity markets.

New Monroe Doctrine? Defense Secretary Pete Hegseth has announced the launch of Operation “Southern Spear,” a new initiative to counter alleged drug traffickers in the Caribbean Sea and Pacific Ocean. The operation appears to be part of a broader administration effort to project power in adjacent waterways. In a social media post, Hegseth asserted that “the Western Hemisphere is America’s neighborhood,” a statement that underscores the United States’ ambition to exert stronger influence and secure its interests throughout South America.

Chilean Elections: The South American country will hold a pivotal election dominated by three candidates from political extremes. The frontrunner is Communist candidate Jeannette Jara, who is trailed by far-right leader José Antonio Kast and Libertarian candidate Johannes Kaiser. While Jara is favored to secure the largest share of votes in the first round, she is projected to fall short of an outright majority and is widely expected to lose to the unified right-wing candidate in the subsequent runoff election.

Nvidia Surrounded? While the White House has consistently urged chipmakers to reduce their exposure to China, Microsoft and Amazon have now endorsed this position. The tech giants are prepared to back legislation that would restrict Nvidia’s ability to sell advanced semiconductors to China while ensuring that they receive priority access. This move exemplifies a broader shift in US policy away from traditional laissez-faire principles toward more centralized economic planning, justified on national security grounds.

UK Bonds: A sharp sell-off in UK government bonds occurred after the government abruptly abandoned plans for income tax hikes. Although the decision was officially attributed to improved growth forecasts from the budget watchdog, investors viewed the policy reversal as a signal that the administration was prioritizing political expediency over fiscal responsibility. This erosion of confidence is contributing to negative global sentiment on sovereign debt in developed nations that continue to face challenges in stabilizing their finances post-pandemic.