by Thomas Wash | PDF

The surge of gold past the $4,000-per-ounce level in October marks a definitive pivot in market behavior. Unlike past rallies driven by stock market fear, the current move is distinctly characterized by a structural rotation away from sovereign debt and toward tangible assets. This is not a simple risk-off move. Instead, investors are executing a sophisticated dual strategy of maintaining a critical allocation to equity momentum while actively using gold as the premier defense against systemic threats, specifically fiat currency debasement and sovereign debt risk.

This strategic pivot is rooted in three primary policy-driven anxieties: massive sovereign debt issuance, persistent inflationary pressures, and the weaponization of the US dollar. The extraordinary fiscal stimulus unleashed during the pandemic, while cushioning the immediate economic shock, led to an unprecedented accumulation of public debt and entrenched higher inflation. Together, these developments have eroded confidence in fiscal governance, as is evidenced by rising government borrowing costs and mounting concerns over long-term debt sustainability.

Confidence deteriorated further after Russia’s invasion of Ukraine. The coordinated Western move to weaponize the dollar as a financial sanction tool undermined its perceived neutrality as the global reserve asset. The episode crystallized a new risk that access to the dollar system could be constrained by geopolitics. In response, many central banks — particularly in emerging markets — have accelerated gold accumulation as a reserve diversification strategy, signaling a gradual but consequential retreat from pure fiat dependency.

Yet the flight to safety has not been uniform. Equities, especially high-quality large cap stocks, have also benefited from safe-haven inflows. Investors are directing capital into US technology giants for their robust earnings power and balance sheets, and into European pharmaceutical and defense firms for their resilience and defensive characteristics. This reflects a redefinition of safety as select equities are viewed not merely as growth vehicles but as durable stores of value capable of navigating structural volatility.

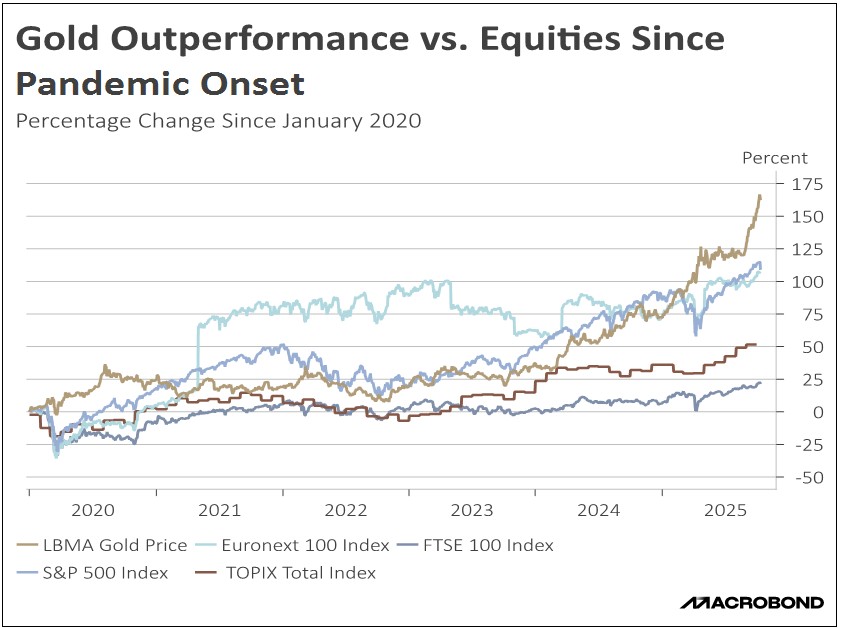

The relative performance of equities versus gold reveals this nuanced dynamic. When measured in gold terms, European equities briefly outperformed in 2021, a trend reversed by the war in Ukraine. US equities have since maintained steadier ground buoyed by comparatively stronger growth, though their relative strength has softened amid tariff-related tensions. Since 2020, US and European equities have traded largely in line in gold terms, suggesting that gold’s continued dominance will hinge on currency dynamics. A bullish dollar would likely favor US equities, while a bearish dollar could tilt the advantage toward Europe.

Gold’s historic rally thus signals more than inflation hedging — it also represents a crisis of confidence in the traditional financial order. Yet, the simultaneous preference for resilient equities underscores an important nuance: investors are not abandoning growth but recalibrating their definition of safety. Gold and select large cap stocks now operate as complementary safe havens, with the former guarding against systemic and currency risks, while the latter preserves value through corporate strength and adaptability.

Ultimately, the long-term interplay between these two pillars will serve as a barometer of market confidence. Gold will remain the preferred store of value as long as fiscal fragility and geopolitical instability persist. Conversely, a sustained stabilization of the US dollar coupled with credible fiscal consolidation could reignite a stronger rotation toward equities. Until that shift materializes, gold’s record valuation reflects a market structurally repositioned for a more volatile and less predictable financial era.