Author: Rebekah Stovall

Bi-Weekly Geopolitical Podcast – #33 “China’s Collapsing Population” (Posted 7/24/23)

Keller Quarterly (July 2023)

Letter to Investors | PDF

At least once a decade, the stock market vibrates with excitement over a new technology and, in this revelry, the stocks of any company close to that technology separate themselves from the rest of the market as a rocket separates itself from the ground. That remarkable upward surge in stock prices provides validation to speculators that they’re doing the right thing in paying exorbitant prices for these stocks. No analysis of business models, profit margins, capital structures, dividends, or (least of all) valuations are required. All that’s needed to justify the investment is to cite the name of the technology: “It’s artificial intelligence!” No other explanation is needed. Other speculators nod knowingly. “It’s a sure thing!”

Prior speculations were provided with similarly simple justifications. “It’s crypto-currency!” “It’s electric vehicles!” “It’s the internet!” “It’s mobile phones!” “It’s personal computers!” “It’s semiconductors!” “It’s plastics!” “It’s television!” “It’s radio!” “It’s the airplane!” “It’s the automobile!”

The ironic thing is that most, if not all, of these new speculation-sparking technologies really are transformational. They change the economy and society. What’s rarely remembered years later is how much capital was incinerated along the way as investors chased one “sure thing” after another. In 1908, there were 253 automobile manufacturers in the United States; by 1929, there were 44. Even among those 44 companies, General Motors, Ford, and Chrysler were making 80% of all cars in that year. Fifty years later, they were the only three left. Yes, some of the 250 other manufacturers were acquired, but the majority simply went out of business, leaving investors with nothing to show for their optimism.

Stock market analysts as old as I am can name dozens of defunct companies in all these transformational industries. You can probably think of a few crypto and EV companies that have already “bit the dust.” It’s hard enough to forecast which technologies are going to succeed financially; it’s much harder to figure out which companies in these lanes are going to both survive and prosper.

All too many people today believe that this is investing. To us, it is simply speculation: a level of risk that we deem unwise. I’ve often likened this manner of investing to wildcat drilling, that is, drilling lots of speculative holes in the ground, hoping that at least one proves to be a gusher and delivers enough of a return to more than compensate for all the dry holes. While that makes sense to some, we’ve never gone that route. If that gusher never comes in, you’re left with lots of lost money.

What makes much more sense to us is to invest in companies that are successful today, whose prospects for staying successful seem bright based on current developments, and whose management teams have proven to be effective in adapting to changing conditions. In other words, we want to invest in what is, not what if.

T.S. Eliot voiced similar thoughts (with infinitely greater eloquence):

What might have been and what has been

Point to one end, which is always present.

(Burnt Norton, I, 9-10)

With investing, as with life, we can get lost if we live in the past or in the future. We live in neither; we live in the present, and thus we can only invest in the present. But isn’t investing about the future? Future returns, future cash flows, etc.? Yes, but we can’t go to the future and see what’s there. We must invest in the present, using the best available information and judgment we can bring to the decision. When the present changes, we can adjust our decisions. The problem with the future is that you can’t know if or when it will change.

Loeb Strauss emigrated from Bavaria to the U.S. in 1848 and joined his older brothers’ wholesale dry goods business in New York. A year later, gold was discovered in California. Unlike other 20- year-olds, Loeb wasn’t interested in chasing the prospect of maybe finding gold; he went to San Francisco to sell wholesale dry goods. He imported clothing, umbrellas, bolts of fabric, and other such stuff from his brothers in New York and sold them to local retailers. When one of his customers asked him to help patent a method for making pants out of Strauss’ denim by putting rivets at the points of stress, Loeb (now known by his nickname Levi) quickly agreed. The blue jean was born. Not many of the 300,000 people who went to California to find gold made a serious amount of money. Not only was Levi much more successful than the dream-followers, but his business also survives to this day.

We like the example of Levi Strauss, who invested in the present rather than speculating on the future.

We appreciate your confidence in us.

Gratefully,

Mark A. Keller, CFA

CEO and Chief Investment Officer

Asset Allocation Bi-Weekly – #102 “Are Higher Interest Rates Bearish for Risk Assets?” (Posted 7/17/23)

Daily Comment (July 11, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with news that Turkey has agreed to support Sweden’s accession to NATO, creating an even more formidable military bulwark in response to Russia’s invasion of Ukraine. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including today’s voting on a controversial environmental law in Europe and new statements about interest rates by several policymakers at the Federal Reserve.

North Atlantic Treaty Organization: Just ahead of today’s big NATO summit, the Turkish government yesterday unexpectedly released its veto on Sweden’s accession to the alliance. According to NATO Secretary-General Stoltenberg, Turkish President Erdoğan agreed to forward Sweden’s accession to the Turkish parliament “as soon as possible” after achieving several concessions from Sweden and NATO. Those concessions apparently included steps aimed at aiding Turkey’s fight against Kurdish terrorists and the U.S. unlocking the sale of advanced F-16 fighter jets to Turkey. The Hungarian government has also recently said it would lift its veto of Sweden’s accession.

- The Turkish move helps ensure that the NATO summit will project heightened unity and new strength in response to Russia’s aggression against Ukraine.

- Over the longer term, this year’s accession of both Sweden and Finland to NATO will give the alliance increased overall military strength, better insight into Russian activities in northwestern Europe, and the potential to strangle civilian and military shipping in the Baltic Sea in the event of war with Russia.

China-Taiwan: In a new sign that Taipei is getting more serious about defending against possible Chinese aggression, the government is holding its biggest civil defense drill in decades today. This year’s version of the Wan’an air raid drill will take place in districts across the country and include practice evacuations of civilians to bomb shelters.

China: The China Passenger Car Association yesterday said domestic Chinese brands made up 54% of the country’s wholesale shipments in the first half of 2023, up from 48% in the same period one year earlier. That marked the second consecutive half in which domestic automakers sold more vehicles than foreign makers did.

- As we have been discussing recently, the surge in domestic brands comes mostly from their sudden improvement in electric vehicles.

- That has sapped the profitability of foreign brands operating in China and serves as a harbinger of the competitive threat that Chinese electric vehicles are likely to pose as they begin to be sold in the rich, highly advanced countries of the world.

European Union: The European Parliament today and tomorrow will be voting on a divisive nature-restoration law that would require setting aside land to encourage the return of healthy ecosystems. The law, proposed by the European Commission under the leadership of Ursula von der Leyen, has been criticized for potentially undermining farmers’ livelihoods, preventing wind farms from being built, and putting EU food security at risk.

- Ahead of EU parliamentary elections in June 2024, von der Leyen’s own center-right European People’s Party has come out against the legislation. EPP leaders appear to be concerned that the law would play into the hands of far-right politicians, who are already gaining influence through Europe.

- In an interview with the Financial Times, European Parliament President Metsola, who is also a member of the EPP, has warned that parliament members should refrain from crossing an “invisible line” between ambitious green policies and citizens’ support for the changes imposed on their lives.

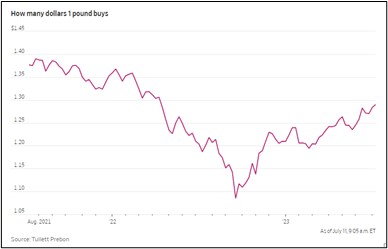

United Kingdom: Average weekly earnings in March through May were up 7.3% from the same period one year earlier, significantly more than anticipated and matching the record gain in the three months to April. The strong wage growth has prompted even stronger expectations that the Bank of England will keep hiking interest rates, which in turn has given a further boost to the pound (GBP). So far this morning, sterling is trading up 0.3% to a 15-month high of about $1.2895.

U.S. Monetary Policy: At events yesterday, San Francisco FRB President Daly and Cleveland FRB President Mester both signaled interest rates should go at least a bit higher, with Mester saying a “somewhat tighter” policy stance would help strike the right balance between tightening too much and tightening too little in the face of price inflation. The statements are consistent with the rising market expectation that the Fed will raise its benchmark short-term interest rate one or two more times, although perhaps with another pause interspersed.

- Separately, New York FRB President Williams reiterated in a Financial Times interview that he sees a need for a few more rate hikes. In his view, the labor market remains tight enough to drive up wages and inflation, even though he sees signs that labor demand is gradually cooling.

- Williams also noted that he doesn’t currently have a recession in his forecast. Nevertheless, he admitted that he sees “pretty slow growth” in the coming quarters.

U.S. Bank Regulation: Michael Barr, the Fed’s vice chair for regulation, said in a speech yesterday that larger U.S. banks should further strengthen their capital cushions after the crisis among mid-sized lenders this spring. According to Barr, a recent Fed review of big banks’ capital requirements suggested they should be required to boost their capital/risk-weighted asset ratio by about 2%. The speech is being taken as a signal that Fed regulators will formally propose the change later this summer.

U.S. Labor Market: Amid a general shortage of workers, a number of companies have said in recent earnings reports that a shortage of accountants is hampering their efforts to address weaknesses in financial reporting and control. The lack of accountants reflects both a recent fall in the number of young people pursuing accounting degrees and a growing share of established accountants who are retiring.

Global Gold Market: A survey by Invesco (IVZ, $17.37) found that global central banks not only boosted their purchases of gold in 2022 and early 2023, but they also shifted toward buying the physical asset instead of derivatives and opted to hold their gold in their own country. As we’ve been arguing, the U.S.’s move to freeze Russia’s foreign reserves over its invasion of Ukraine last year has prompted many central banks to purchase more of the yellow metal for their own financial security. Along with our expectations of higher average price inflation in the future, strong central bank buying is a key reason why we think gold will produce good returns in the medium-to-long term.

Global Green-Tech Minerals Market: The International Energy Agency has issued a report saying global investment in green-technology mineral resources is starting to catch up with the growing demand for those materials. According to the IEA, worldwide investment in green-tech mineral facilities rose 30% to more than $40 billion in 2022, building on a 20% increase in 2021.

- Still, the report also cited some negative trends. For example, the rise in investment in 2022 was driven by China, which already dominates the production and refining of key green-tech materials.

- The report also noted that the supply of some of these minerals, such as lithium and cobalt, remains too concentrated.

Confluence of Ideas – #31 “The 2023 Mid-Year Geopolitical Outlook” (Posted 7/10/23)

Bi-Weekly Geopolitical Report – The 2023 Mid-Year Geopolitical Outlook: The Polycrisis (July 10, 2023)

Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

As is our custom, we update our geopolitical outlook for the remainder of the year as the first half comes to a close. This report is less a series of predictions as it is a list of potential geopolitical issues that we believe will dominate the international landscape for the rest of the year.

We have subtitled this report “The Polycrisis” to reflect the complicated and multifaceted geopolitical world that is rapidly evolving. The number of issues we cover here is much greater than our usual mid-year update, but we felt that all these matters were important enough to mention. They are listed in order of importance.

Issue #1: Russian Political Instability

Issue #2: Ukraine’s Military Prospects

Issue #3: China Navigating Great Power Relations

Issue #4: China’s Youth Unemployment

Issue #5: China’s Debt Problem

Issue #6: U.S. Superpower Status and Fracturing Domestic Consensus

Issue #7: Re-Industrialization

Issue #8: Climate Change and Great Power Competition

Issue #9: The Problem with Mexico

Issue #10: Artificial Intelligence

Issue #11: EU vs. Poland and Hungary

Issue #12: Middle East Realignment

Issue #13: Iranian Nuclear Breakout

Issue #14: Emerging Market Debt

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify | Google

The podcast episode for this particular edition is posted under the Confluence of Ideas series.

Daily Comment (July 10, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with multiple China-related reports highlighting the country’s growing frictions with the West and its sharply slowing economy. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the collapse of the Dutch government and a preview of U.S. bank earnings in the second quarter.

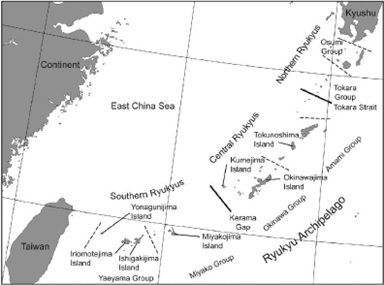

China-Japan: We’ve noted many times that geopolitical tensions between China and the U.S. bloc are in a clear escalatory spiral, and that China’s increased military aggressiveness is a big driver of that spiral. In an important recent example, the People’s Liberation Army naval force sailed its second-largest warship and a destroyer escort through the Osumi Strait, which lies just 40 miles south of Japan’s key island of Kyushu and north of the major U.S. military bases on Okinawa.

- The sailing was unusual because the PLA Navy doesn’t typically use the Osumi Strait to transit to the Western Pacific Ocean. Just as important, the vessel in question was the Guangxi, a Yushen-class, Type 075 amphibious assault ship, which can carry some 800 troops, 60 armored fighting vehicles, and 30 helicopters. Chinese state media trumpeted the transit as the first time a Yushen-class assault ship had “broken the island chain” south of Japan.

- Now that Japan is strengthening its alliances with the U.S., South Korea, and Taiwan, and now that it is rapidly building up its defenses on its southwestern islands, the sailing of the assault ship so close to Japan’s home islands was likely a subtle reminder that China is prepared to take a fight to Japanese territory if necessary.

- Just as concerning, the sailing came just weeks after President Xi gave a speech in which he described China’s historical relationship to the Ryukyu Islands in Okinawa prefecture in the same way he described China’s relationship with Japan’s Senkaku Islands, which China openly claims.

- In other words, it appears that Xi is issuing the following warning to Japan: If you boost your support for Taiwan, South Korea, and the U.S., we will boost our claims on your southwestern islands. To reiterate, this Chinese military aggression will likely feed the current spiral in tensions and further increase risks for investors, especially those investing in China. (And if there’s any doubt about that, one should consider how U.S. voters would react if Guangxi had sailed between Maui and the big island of Hawaii.)

China-India-Philippines: Concerns about China’s aggression also continue to drive countries into the evolving geopolitical and economic blocs. In the latest example, the Indian government for the first time has expressed its opposition to Beijing’s territorial claims against the Philippines. Our analysis still puts India in the “China-Leaning” bloc, but New Delhi continues to slowly align itself more closely with Washington. At the same time, Iran this month formally became a member of the China-led Shanghai Security Organization, which cements Tehran as a key member of the China-led bloc.

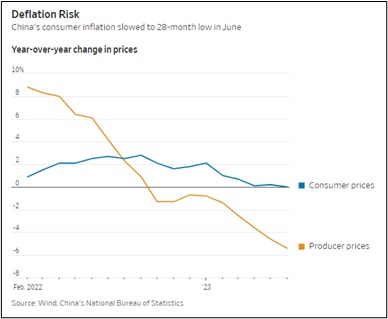

China: Within China, the June consumer price index was unchanged from the same month one year earlier, weakening further after the tepid gains of 0.2% in the year to May and 0.1% in the year to April. The almost nonexistent inflation reflects just how weak Chinese domestic demand has become as the economic recovery from President Xi’s “zero COVID” policy continues to falter. Separately, the June producer price index was down 5.4% year-over-year, reflecting weak demand both at home and abroad. The reports are weighing modestly on the value of global risk assets so far this morning.

Russia-Turkey-Ukraine: Some key “borderland” leaders continue trying to play the China bloc off the U.S. bloc. Over the weekend, President Erdogan allowed the release of Ukrainian prisoners of war being housed in Turkey, evidently reneging on an agreement with Russia, a key member of the China-led bloc. Under Erdogan, the Turkish government has alternatively supported both sides in Russia’s invasion of Ukraine. The release of the prisoners was likely aimed at mollifying the rest of the NATO alliance ahead of its summit this week.

Russia: The Kremlin spokesman today said that just days after Yevgeniy Prigozhin and his Wagner Group mercenaries staged their short-lived mutiny in late June, President Putin met for three hours with Prigozhin and his top subordinates. As more details are provided, we’re hopeful that we’ll get a better read on why Putin has gone so easy on Prigozhin and what it all means for Russian political stability.

Netherlands: The parties in Prime Minister Mark Rutte’s government decided to disband the coalition on Friday after failing to reach an agreement on migration policy. The collapse of the Dutch government means Rutte will now submit his resignation to the king, triggering a new general election in the autumn.

- The collapse also illustrates how migration policy continues to create internal divisions in many European governments. In this case, the key issue was how tight the rules should be for asylum seekers trying to enter the Netherlands.

- These divisions have made some European governments more unstable and have created openings for politicians on the far right of the political spectrum. This increasing instability has the potential to undermine the value of European assets.

Israel: Prime Minister Netanyahu and his far-right government have again launched a judicial reform effort aimed at weakening the power of the supreme court. The new proposal is somewhat watered down from the one the government put on ice in March after mass protests, but it is nevertheless generating calls for new protests and strikes.

Brazil: The lower house of Congress has approved an important tax reform that could greatly improve the country’s investment environment, cut compliance costs for businesses, and boost economic growth. If approved by the Senate, the reform would replace today’s large number of different levies with just two value-added taxes, one federal and the other local. After a transition period from 2026 to 2032, the total VAT rate is expected to be about 25%. The reform is likely to be positive for Brazilian assets going forward.

U.S. Pension Industry: Stephen Meier, chief of the New York City Retirement System, said the increase in bond yields over the last two years has been healthy and will allow him to shift the allocation of his $250 billion portfolio away from equities and toward fixed income, high-yield bonds, and private assets such as private credit and infrastructure. The report didn’t indicate the maturity structure of Meier’s planned fixed income allocation, but we continue to believe that longer-maturity obligations may be valued too richly and stand at risk of more price declines.

U.S. Banking Industry: As they kick off earnings season this week, the nation’s largest banks are expected to report their biggest jump in loan losses and reserves against them since the depths of the coronavirus pandemic. The six biggest banks are expected to show that they benefited to some extent from higher interest rates in the second quarter, but they are also expected to say they had to write off a collective $5 billion in bad loans as borrowers struggled with higher rates and slowing economic growth. They are expected to announce new loan loss reserves of $7.6 billion. Both those figures would be about twice as high as in the second quarter of 2022.

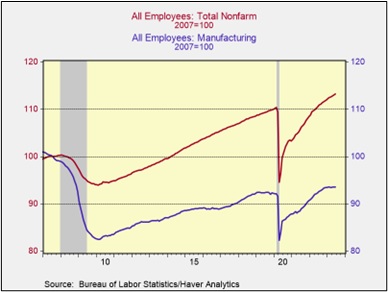

U.S. Labor Market: As usual, our Comment on Friday provided a quick overview of the monthly employment report shortly after it came out. Today, we want to mention one deeper aspect of the report related to our recent argument that the U.S. economy appears to be on the verge of a massive re-industrialization as companies bring production back home from Asia or elsewhere.

- The data show U.S. manufacturing payrolls in June were at their highest level since 2008.

- Nevertheless, factory employment has hit a plateau in recent months.

- We still believe re-industrialization will boost manufacturing jobs in the coming years. Nevertheless, the recent plateau in those jobs is consistent with our view that re-industrialization is just beginning and that the impending recession will hold down factory payrolls in the short term before the full impact of re-industrialization becomes clear in the future.

U.S. Postal Rates: For the six people or so who still use snail mail, the U.S. Postal Service yesterday hiked the cost of a first-class stamp to $0.66, up 4.8% from the previous cost of $0.63. It was the second price hike this year and the third in the last 12 months. With the latest price hike, the cost of a stamp is now up 13.8% since 2021. Inflation, indeed!

Daily Comment (July 7, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment begins with the latest development from Treasury Secretary Yellen’s trip to Beijing. Next, we discuss the heightened risk of unrest in Russia. Lastly, we examine why tech companies are looking to take greater control of access to consumer data.

Back to China: While the Biden administration may be willing to make some concessions in order to improve relations with China, it is unlikely to abandon its attempt to pivot away from the world’s second largest economy.

- U.S. Treasury Secretary Janet Yellen called out China for its mistreatment of U.S. firms over the last few months. On her first day in the country, she criticized recent crackdowns on U.S. firms headquartered in China as well as Beijing’s decision to restrict exports of critical minerals needed to make semiconductors. Beijing’s harshness is seen as retaliation for U.S. attempts to limit China’s ability to grow its own semiconductor industry. Although Yellen mentioned that the U.S. is not looking for a winner-take-all approach, it is unlikely that the feud will end in the near future.

- China continues to flex its military muscles in an attempt to show that it is now capable of taking on the U.S. in a direct conflict. Last month, a Beijing think tank released a paper claiming that China’s military is capable of sinking the U.S. Navy’s most advanced aircraft carrier strike group. This claim has largely been dismissed as propaganda, designed to convince Taiwan that China is capable of taking over the region whenever it sees fit. Furthermore, it is still highly doubtful that China is preparing to take over Taiwan anytime soon. Nevertheless, the recent military exercises and propaganda efforts do show that annexing Taiwan remains part of China’s long-term agenda.

- The ongoing meetings between the U.S. and China are unlikely to deter the Biden administration from promoting reshoring efforts. The White House believes that it is in the country’s best interest to “de-risk” from China due to national security concerns. This broader shift will likely lead to a new industrial push in the U.S. On the one hand, reindustrialization can help reduce U.S. reliance on China and other countries for critical goods and services. This shift could improve national security and make the U.S. economy more resilient to disruptions in the global supply chain. On the other hand, reshoring could lead to higher prices for consumers and businesses.

Something Brewing: There are mounting concerns of an imminent armed rebellion in Russia as the Wagner Group does not seem inclined to follow Moscow’s orders to disband.

- Yevgeny Prigozhin, the leader of the Wagner Group, is back in Russia despite agreeing to a peace deal in which he would relocate to Belarus. This report comes from Belarusian President Alexander Lukashenko, who was a key figure in brokering the deal following last month’s failed mutiny. Prigozhin’s presence in Russia is likely to call into question Vladimir Putin’s authority. Although Prigozhin’s whereabouts are unknown, state-run television has shown that his offices and home were raided on Thursday. Despite Putin’s best efforts, the Wagner Group is still a force to be reckoned with and thus the possibility of a civil war cannot be ruled out.

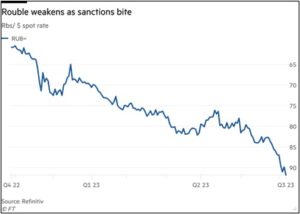

- The controversy may incentivize efforts from the White House to create a potential off-ramp for Russian government officials looking to escape a possible takeover attempt. Last week, CIA officials argued that disarray in Russia has created a massive recruitment opportunity. Additionally, there have been reports that former U.S. officials held informal talks with officials in the Kremlin in April regarding a peace deal, suggesting there is backchannel communication between the two sides. The Russian ruble has declined 12% against the U.S. dollar since Ukraine’s counteroffensive began on June 4, and it is now hovering near a 15-month low. At the same time, Ukrainian dollar bonds have rallied to pre-war levels, further supporting the case that the tide has turned against the Kremlin.

- Putin is running out of time and options. He vastly underestimated the West’s support for Ukraine as well as his own military’s ability to secure a quick victory. More than a year after the conflict began, he is now facing his most serious threat to hold onto power since taking office 23 years ago. The next few weeks will likely be crucial in determining whether he will be able to maintain control of the country. If Putin is removed from office, it is not clear who would replace him. As a result, there is the risk of a power vacuum or even a civil war. This could lead to a sudden spike in commodity prices and a rush to safe haven assets.

Tech Wars: Competition between social media companies is heating up as the major players battle for social media supremacy.

- The rivalry between tech billionaires Elon Musk and Mark Zuckerberg escalated this week as Instagram released its new Threads app in an attempt to provide users with an alternative to Twitter. The app added 30 million new users since Thursday, which still pales in comparison to Twitter’s 300 million subscribers. Musk’s social media company has come under much scrutiny after establishing rules that limit users’ access to the website. Threads, on the other hand, appears to offer similar features with none of the same restrictions. The launch of Threads shows how tech firms that alter their services too quickly may open themselves up to unwelcome competition.

- That said, Musk’s decision to limit access to Twitter’s website may be a way to prepare for a world built around artificial intelligence (AI). Tech companies have been able to use a method known as “scraping” to grab data needed to improve machine-learning algorithms. Scraping can be a valuable tool for AI research as it allows programmers to gather information about Twitter users free of charge. Hence, by protecting the data, Musk is ensuring that he keeps a valuable revenue stream open for future use.

- We are now entering the era of Big Data. This new period will be defined by companies buying and selling information as if it were a commodity. This changing dynamic will be particularly important as companies start to integrate AI into their business processes. Social media companies will likely try to compete in the space to ensure they can offer premium data for these models. Additionally, control over the access of data may be critical for companies looking to profit from the AI craze.