Daily Comment (December 12, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a disagreement at the big COP28 climate change conference over whether to call for an eventual phase-out of fossil fuels. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including an Israeli threat to widen its conflict with Hamas to include attacks on Hezbollah militants in Lebanon and new evidence of weaker white-collar labor demand in the U.S.

COP28 Climate Change Conference: At the ongoing United Nations climate change conference in Dubai, officials have released a controversial draft communique that drops any reference to phasing out the use of fossil fuels such as oil, natural gas, and coal. The draft statement has sparked outrage aimed at Saudi Arabia, host-nation UAE, and other major oil-producing countries, which are accused of using their influence to water down the document.

- Although several European and other countries are still working to amend the draft with required cuts in the use of fossil fuels, the document as currently written illustrates what we see as rising political pushback against onerous climate-change rules.

- Even if the communique is toughened before it is ultimately adopted by the conference, global fossil fuel companies don’t seem at risk of being pushed out of business anytime soon. Indeed, since capital discipline and environmental restrictions to date have held down investment in new exploration and development in recent years, future supply is likely to fall short of demand, pushing up prices and profits.

Israel-Hamas Conflict: As Iran-backed Hezbollah militants in southern Lebanon continue to fire rockets into Israel in response to Tel Aviv’s offensive against Hamas in the Gaza Strip, the head of Israel’s National Security Council has warned that Israel might also be forced to launch ground attacks against Hezbollah. Despite some signs that Hamas military forces in Gaza may be starting to disintegrate, an Israeli infantry offensive into Lebanon is just one way that the conflict could still spread.

Russia: Top opposition leader and anticorruption activist Alexey Navalny, who was jailed by the Kremlin and has been kept in a penal colony, has apparently been moved by the authorities to an unknown location. According to his spokeswoman and U.S. officials, he fell out of contact about a week ago after complaining of health problems, and Russian officials claim they don’t know where he is.

- The news comes just days after President Putin said he would run for another term in the March 2024 election.

- Putin probably still judges that it would be too politically risky for Navalny to be killed outright, as so many other Putin critics have been. At the very least, however, Putin would probably like to keep Navalny from making any public statements until after the election is concluded.

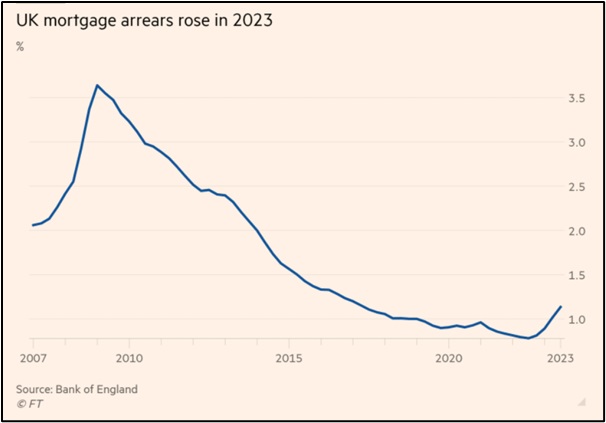

United Kingdom: The share of residential mortgages in arrears rose to a six-year high of 1.14% in the third quarter versus 1.02% in the second quarter. The rise appears to reflect both the impact of punishing inflation in the U.K. over the last couple of years and the impact of aggressive interest rate hikes by the Bank of England.

- The rise in mortgage delinquencies illustrates how homeowners in the U.K. and Europe have less access to U.S.-style fixed rate mortgages and are therefore more exposed to their central banks’ rate-hiking campaigns.

- The fact that their homeowners are relatively less insulated from rate hikes compared to U.S. homeowners is probably a key reason why the U.K. and EU economies are currently growing so poorly and are at greater risk of recession or are already in recession.

China: The November consumer price index was down 0.5% from the same month one year earlier, worse than expectations that the CPI would decline 0.2% as it did in the year to October. The November producer price index was down an even sharper 3.0%. The figures are further evidence that the Chinese economy is continuing to losing steam in the face of problems such as weak consumer demand, high debt, poor demographics, disincentives from government policies, and de-coupling by foreign countries—all of which bode poorly for the global economy.

India: With parliamentary elections expected in spring 2024, officials in recent days have banned onion exports, restricted the use of sugar for ethanol production, and cut the size of wheat stocks that traders and retailers are allowed to hold. The moves are apparently aimed at ensuring robust domestic supplies and low prices to keep voters happy with Prime Minister Modi. However, the moves have also roiled some international commodity markets, such as the market for sugar.

U.S. Monetary Policy: The Federal Reserve opens its latest policy meeting today, with its decision due on Wednesday at 2:00 pm ET. The policymakers are widely expected to keep their benchmark fed funds interest rate at today’s range of 5.25% to 5.50%. The question is what they’ll say about future policy moves. While many investors are hoping for a signal of near-term rate cuts, we think officials remain focused on rebuilding their inflation-fighting credentials and are more likely to repeat their “higher for longer” mantra.

U.S. Economic Growth: Accounting and consulting giant Ernst & Young is reportedly laying off dozens of highly paid partners across all its businesses in response to a failed merger earlier in the year and weakening demand from companies as U.S. economic growth slows. The job cuts follow a previous big round in April and are seen as larger than the usual annual cull of relatively underperforming professionals. The layoffs provide further evidence of moderating economic activity in the U.S., which puts the economy at greater risk of recession in 2024.