Daily Comment (December 15, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Risk assets surge as bullish winds sweep the market, while the Las Vegas Raiders dismantled their AFC West rivals in a dominant win. In today’s Comment, we unpack the dollar’s accelerating decline, dissect the shift away from mega-cap stocks, and delve into the unexpected delays in Ukraine funding. As always, our comprehensive report encompasses the latest domestic and international data releases.

The Greenback’s Nosedive: The U.S. dollar dropped against major currencies today, likely triggered by divergent policy rate signals from the Federal Reserve and its G-7 counterparts.

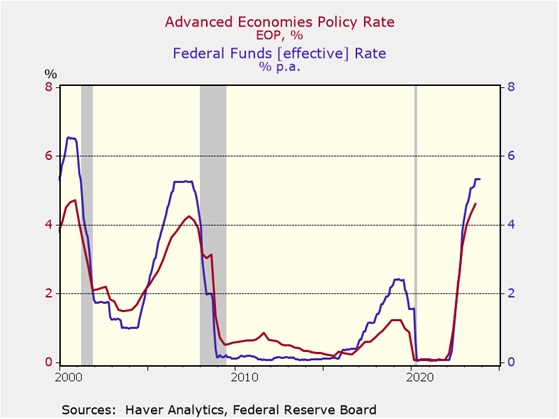

- Amidst a chorus of restraint from other major central banks, the Federal Reserve stood as a lone dove, hinting at a potential policy easing in the near future. This contrasted with commitments from the European Central Bank and Bank of England to hold policy rates steady until price stability is restored. Even the Bank of Japan, long known for its ultra-accommodative stance, suggested a possible shift from quantitative easing and negative interest rates earlier this month. Following the divergent signals from U.S. policymakers and its developed counterparts, the Bloomberg Dollar Index has plunged 3% since Wednesday, reflecting investor expectations of a narrowing interest rate spread between countries. This shift has also triggered a rebound in oil prices, previously weighed down by oversupply concerns.

- Investors were shocked as the ECB and Bank of England unexpectedly split from the Federal Reserve. However, historical data reveals that this is not unprecedented. In past tightening cycles, the Fed has often led the charge, taking a more hawkish stance than its counterparts, followed by a more dovish pivot during periods of monetary easing. These swings likely stem from concerns about the impact that U.S. monetary policy has on other countries. High U.S. rates can lead to inflation abroad by pushing up import costs for dollar-denominated goods, while low U.S. rates can hurt the competitiveness of foreign exports, which could weaken growth. As a result, rate-setters abroad typically seek a happy medium.

- Monetary policy as mapped out by the central banks is based on a rosy outlook for next year. European policymakers’ confidence in avoiding rate cuts hinges on the region sidestepping a recession, while the Fed’s conditional optimism rests on inflationary pressures holding steady. A misstep by either could send investors scrambling to adjust their risk appetite and portfolio allocations. While the latest decisions from the central banks offer temporary clarity, investors should remain cautious and prepare for potential adjustments. Should central banks hold firm, the dollar’s downward trajectory is likely to continue, potentially providing a boost to foreign stocks.

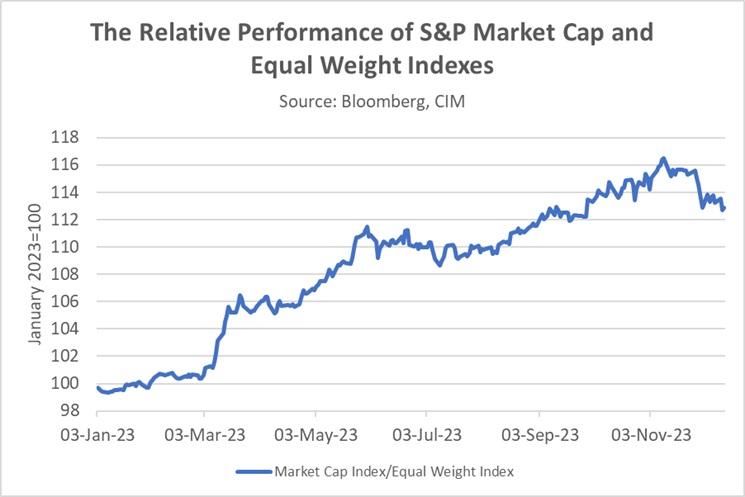

The Great Rebalancing: While the index approaches record territory, the current surge is a broad-based rally, fueled by a wider range of actors beyond the usual market darlings.

- Tech’s year-long dominance is ceding ground to broader market focus, with non-tech sectors like Real Estate and Financials surging past Tech and more than doubling Communications’ growth since November. This rotation suggests a potential turning point in the market as investors prepare for the Federal Reserve to start its easing cycle in 2024. The latest CME FedWatch Tool shows that investors are becoming increasingly confident that the Fed will start to cut rates in the first quarter. Meanwhile, fragility within the repo market has led investors to question how long the central bank will be able to maintain its quantitative tightening program.

- The recent rotation in investor preferences is evident in the performance gap between the S&P 500 and its equal-weight counterpart. After dominating 2023, it has lagged its equal-weight counterpart by 2% over the last two months. This shift, fueled by the equal-weight index’s ability to level the playing field, exposes the true pulse of investor sentiment toward large caps. The potential for lower rates next year could fuel further rotation out of AI stocks as investors seek to capitalize on the upside potential of overlooked sectors with robust growth prospects and attractive valuations.

- After AI exuberance drove risk-taking in 2023, loosening financial conditions are poised to take center stage in the market narrative next year. During easing cycles, investors typically like to go bargain hunting as they look to cash in on companies that have been ignored. As investors rotate away from seemingly overstretched tech giants, smaller and mid-size companies with their more attractive valuations are poised to finally bask in the spotlight, particularly if economic conditions remain favorable, such as downward pressure on long-term interest rates and the abatement of producer price pressures.

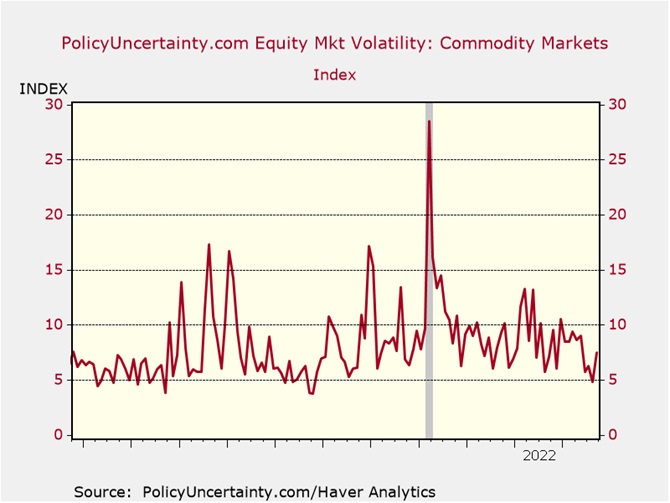

Bait and Switch: As Ukraine scrambles to secure vital weapons and equipment, Kyiv battles a storm of mixed messages from the West, stoking fears of its long-term ability to sustain its war effort against Russia.

- The European Union failed to come to an agreement on €50 billion in financial aid to help Ukraine fend off Russia. Talks collapsed following the decision from Hungarian Prime Minister (and Putin ally) Victor Orban to veto the proposal. Orban’s vote dealt a blow to Ukraine’s immediate financial lifeline and forced the EU to scramble for alternative solutions, raising questions about the bloc’s unity in supporting its embattled ally. While offering membership talks is a positive step forward, the EU must find a way to bridge the immediate financial gap and ensure Ukraine has the resources to defend itself from a potential Russian offensive.

- The EU’s failure to agree on a €50 billion military aid package for Ukraine coincides with the U.S. Congress’s struggle to pass a similar funding bill. The Senate has failed several times to pass military aid to help Ukraine and Israel as holdouts push for more border security funding. As of Friday, reports suggest the latest funding bill may have enough support to make it through the Senate; however, this is far from a done deal. Although the White House has warned that it was running out of money, President Biden released another round of funding for Ukraine on Tuesday.

- The emotional pull of the Ukraine-Russia conflict is undeniable, but investors must remember that the market remains indifferent to human tragedy. While a swift end to the conflict would ease supply chain pressures and stabilize commodity markets, a prolonged war significantly raises the risk of escalation, which would send shockwaves throughout the global economy and jeopardize investor confidence. Therefore, in market terms, the debate over funding would be better focused on its potential to incentivize a negotiated settlement, not based solely on achieving a decisive military victory. While Ukraine’s resilience is admirable, further military aid alone seems unlikely to force a Russian withdrawal. As a result, the West may be forced to rethink its support, particularly as domestic backing for the conflict wanes and the costs escalate over the next few months.