by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

The newest Confluence of Ideas podcast episode, “The Dollar and the Eurobond,” is available today! This episode looks at the decision by the EU to create a mutualized bond, a debt instrument backed by the full faith and credit of all the member states of the EU, and how this could affect the dollar’s reserve currency role and create a competing instrument for the U.S. Treasury. Although the dollar remains the global reserve currency, there is widespread dissatisfaction with the role. On the domestic front, the dollar’s role has been positive for financial services and retailers, but it has been a persistent negative factor for import-competing industries and their workers. Foreign nations are increasingly uncomfortable with the U.S. weaponization of the dollar through financial sanctions. If debt mutualization continues to expand, the euro will become an attractive reserve currency to foreign reserve managers.

The strength in U.S. risk assets so far today stems in large part from signs that the U.S.-China trade deal signed in January is still on track, despite all the other friction points in the bilateral relationship. Oil and gas prices are up as Tropical Storm Laura heads toward the Gulf Coast. For once, there is little new info on the coronavirus pandemic. We review all the key news below.

United States-China: After a videoconference between U.S. Trade Representative Lighthizer, Treasury Secretary Mnuchin, and Chinese Vice Premier Liu He to review the U.S.-China trade deal signed in January, the Trade Representative’s office released a short statement saying, “Both sides see progress and are committed to taking the steps necessary to ensure the success of the agreement.” China’s official Xinhua News Agency published a statement saying, “Both sides agreed to create conditions and atmosphere to continue to promote the implementation” of the trade pact. The statements provide reassurance that the agreement remains in place regardless of China’s apparent shortfall to date in meeting its commitment to import more U.S. products. The statements therefore suggest trade tensions between the countries could remain calm in the near term. That’s clearly a positive for risk assets for now. However, it’s important to remember that there are plenty of other friction points between the U.S. and China, such as China’s geopolitical aggressiveness, technology theft, and spying, to name a few. All the U.S.-China friction points could heat up again if they become a point of contention in the runup to the U.S. elections in November.

United States: The Republican Party launched its mostly online convention yesterday, with President Trump being nominated unanimously as its candidate for president. The convention programming included a noticeably higher share of live speeches than the Democratic one last week, though there isn’t yet much of a sense which party was more successful in engaging the national audience. We also noted that in discussing his administration’s response to the coronavirus pandemic, President Trump reverted to calling it the “China virus.” That signals China bashing could indeed be a significant part of Trump’s campaign leading up to November.

Speaking of elections, National Security Agency Director and head of U.S. Cyber Command Paul Nakasone, along with senior Cyber Command adviser Michael Sulmeyer, have published an article in Foreign Affairs stating that the U.S. “disrupted a concerted effort to undermine the midterm elections” in 2018 and is using those lessons to protect November’s elections. The article claims experts at the NSA and Cyber Command have “formed the Russia Small Group (RSG), a task force created to ensure that democratic processes were executed unfettered by Russian activity.”

China-India: In response to the China-India border dispute in the Himalaya Mountains, the Indian government has quietly started to phase out equipment from Huawei (002502.SZ, 3.04) and other Chinese companies from its telecom networks. New Delhi has issued no formal written ban on Chinese equipment, nor has Prime Minister Modi’s government made any such public pronouncements. However, industry executives and government officials say key ministries have clearly indicated that local telecom service providers should avoid using Chinese equipment in future investments, including in 5G networks. The move suggests the U.S. is gradually bringing more countries to its side in its effort to roll back Chinese economic, technological, and spying activities around the globe.

Russia: German doctors treating Russian opposition activist Alexei Navalny said tests confirmed he was poisoned with a toxic nerve agent. It therefore looks like Navalny has joined a long list of Russian opposition figures who have mysteriously been poisoned and/or murdered. In response to the announcement, German Chancellor Merkel and her foreign minister, Heiko Maas, called on Russia to conduct an open and transparent investigation into the poisoning and to prosecute the culprit. However, the Russian government said it sees no need for a probe and accused the German doctors of rushing to judgment.

Belarus: At least two members of an opposition-led council formed to help the transfer of power to a new government following Belarus’s presidential vote were detained, raising fears that longtime authoritarian leader Alexander Lukashenko has no intention of ceding power.

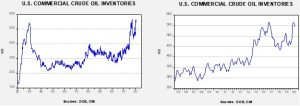

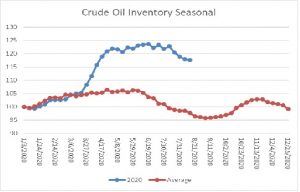

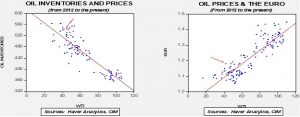

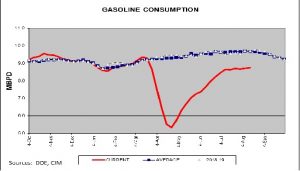

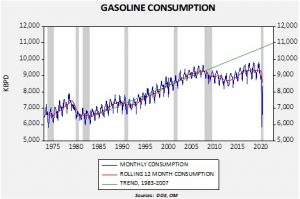

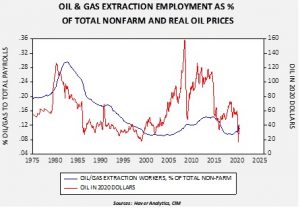

Hurricane news: The National Hurricane Center has issued a hurricane watch stretching from an area in Texas near Houston to western Louisiana as the two states prepared for Tropical Storm Laura to strengthen to a hurricane before making landfall later this week. The storm is expected to arrive Wednesday or Thursday, on the heels of Tropical Storm Marco, which brought high winds and rainfall to eastern Louisiana beginning late Monday. Oil and gasoline futures have jumped in response, based on concerns that the storms could force temporary production shutdowns.

Indexes: S&P Dow Jones Indices announced it will launch its latest major restructuring of the Dow Jones Industrial Average starting next Monday. The restructuring will involve eliminating ExxonMobil (XOM, 42.22), Pfizer (PFE, 38.84), and Raytheon (RTX, 61.88) from the DJIA, and replacing them with Salesforce.com (CRM, 208.46), Amgen (AMGN, 235.57), and Honeywell International (HON, 159.37). Even though the changes won’t take place until next week, the prospect of increased buying by index-tracking funds is likely to boost the new additions today and possibly through the end of the week.

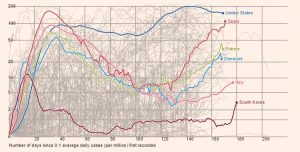

COVID-19: Official data show confirmed cases have risen to 23,679,320 worldwide, with 813,820 deaths and 15,359,999 recoveries. In the United States, confirmed cases rose to 5,741,189, with 177,284 deaths and 2,020,774 recoveries. Here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Newly confirmed U.S. infections rose slightly to 38,045 yesterday, but the figure continues to trend downward fairly steeply. Looking forward, new cases could be held down artificially in the coming days because of testing disruptions associated with Tropical Storm Marco and Hurricane Laura along the Gulf Coast. If those storms push many people into emergency shelters for any significant time, they could constitute as “super-spreader events” that might push up infection rates in the coming weeks.

- Japan will relax a controversial coronavirus rule allowing Japanese citizens to enter the country subject to a COVID-19 test and quarantine but bans foreign residents who left the country after April 2. The government fears the discriminatory stance against foreigners will undermine business competitiveness and damage Tokyo’s reputation as a financial center.

- For the first time, researchers have documented a case of COVID-19 reinfection. This offers evidence that patients who have recovered from the disease could be infected a second time months after the initial episode. If confirmed, the finding would bolster the theory that immunity from being infected with the virus or being vaccinated could last only a few months, similar to coronaviruses that cause the common cold. That would imply that when a viable vaccine is available, regular shots might be needed to maintain immunity.

Economic Impact

- Economists are now projecting Chinese GDP could exceed U.S. GDP in nominal dollar terms as early as 2028, reflecting China’s quick victory over the coronavirus early in the year and the longer, deeper lockdowns and complications in the U.S.

- Doctors and researchers are warning that the fallout from people who develop long-term health effects from the coronavirus could ripple through the U.S. economy, placing a burden on public safety-net programs such as Medicaid, while leaving many patients with significant medical debt.