Asset Allocation Weekly (August 14, 2020)

by Asset Allocation Committee | PDF

Precious metals prices have risen recently, making new highs.

This is a monthly chart for the nearest gold futures contract. As the chart shows, we have recently moved above the 2011 highs. In this report, we will discuss two areas that have supported this rise—the prevalence of negative real interest rates and a potential short squeeze on the futures market.

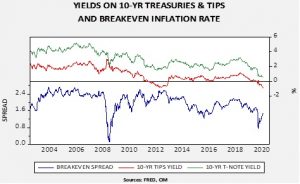

The Treasury Inflation Protected Securities (TIPS) are designed to provide protection against rising inflation. The security has a component where its value rises when inflation increases. It is possible to compare the Treasury yield relative to the TIPS yield to determine the “break-even” inflation rate; in other words, this is the market’s expectation of future inflation.

Note that the 10-year TIPS yield is now negative and the nominal yield on the 10-year T-note is mostly steady. To some extent, this suggests the market believes the Fed is already engaging in yield curve control. The combination of a falling real yield and a steady nominal yield means inflation expectations are rising.

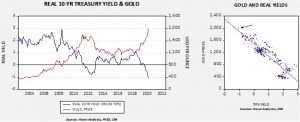

These charts show there is a close relationship between the real 10-year yield and gold prices. In fact, they correlate at the -88.9% level.

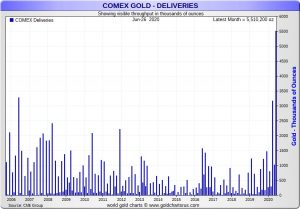

The second factor is a potential short squeeze in gold.

Recently, we have seen a rapid rise in gold delivery at the COMEX. Perhaps the most sophisticated process of buying gold is to buy a futures contract and take delivery. The buyer accepts a warehouse receipt at the COMEX exchange and pays a modest monthly fee for storage. The holder of the warehouse receipt can then short the futures and deliver the warehouse receipt back into the market when they decide to sell their holdings. This process solves a persistent problem for precious metals buyers—the transaction spread is narrow and the prices are fully transparent. The drawback for most investors is the 100 oz contract at the COMEX, which is a commitment beyond that of the small investor. Swap dealers who make markets between physical gold and the futures markets are not accustomed to this level of delivery and may have been caught short; if so, they will need to buy gold to deliver gold on their short positions. That may account for the recent strength we have seen in the market.