Letter to Investors | PDF

Judging by the questions we’ve received in the last couple of months, the stock and bond markets have confused many. This is OK. Trying to explain why the markets have recently done something is an impossible task. In a former life I was regularly asked by business reporters why the stock market had done “thus-and-such” on a given day. I was sympathetic to their plight: they had to write something for their newspaper’s morning edition, even if there really wasn’t a good explanation for the market’s movement. The problem is that, often, the market doesn’t move on a real change in conditions, but on what market participants think the next round of changes might be. And that thinking may be wrong.

Investors often believe that when they delve into the stock market they are participating in a sort of beauty contest, by which they are judging which contestant (stock) is the most beautiful. But they are really participating in a derivative of a beauty contest: they are making a judgment about which contestant others will believe is most beautiful. And others may be wrong! This phenomenon is what led Warren Buffett to once say: “In the short run the stock market is a voting machine, but in the long run it is a weighing machine.” How true! In the short run, the investment market is a sort of popularity contest, but in the long run a truly good investment will stand out from all the rest.

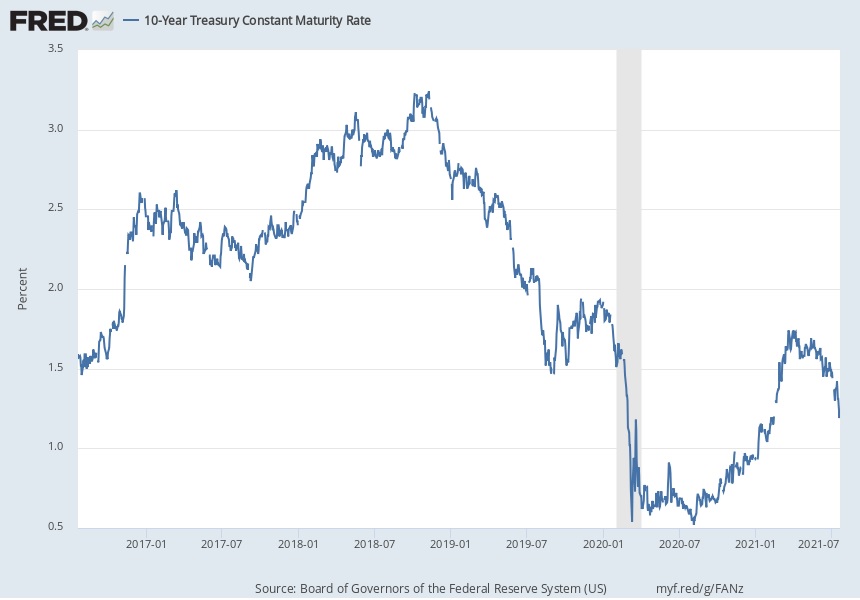

Last month, the stock and bond markets reversed course because of changes the members of the Federal Open Market Committee (FOMC) made in their forecasts of interest rates, as displayed quarterly in their so-called “dots chart.” Many investors thought these forecasts meant that the Fed would begin raising interest rates in late 2022, about a year earlier than expected. These investors immediately jumped to the conclusion that the Fed would tighten too soon, sending the economy into a premature recession, leading these investors to sell stocks and buy Treasury bonds. All this occurred without the Fed actually raising rates, or even setting a date to raise rates. It was all due to guesswork by investors as to what may happen a year-plus down the road, guesswork that may change. (Indeed, it seems to have already changed.)

This behavior is nothing new, in fact, we have observed it in markets for centuries. The near impossibility of correctly guessing what the “crowd” will do next is why trading strategies rarely work. We’ve always thought it better to get on the “weighing machine” side of the market, that is, to focus on investments that have the sort of positive characteristics that are recognized over the long term.

In the near term, our decision-making is guided by our conviction that the U.S. and developed world economies are in recovery mode from last year’s pandemic-induced recession. This is a good place for investors to be: companies are seeing a return to business that helps their earnings, dividends, and credit ratings, which is good for both their stocks and bonds. While there are many other things affecting the markets, all these are of lesser importance, in our opinion, than this key trend.

The factor most likely to imperil this economic and market trend is, in my opinion, a resurgence of the pandemic to levels we saw a year ago. We watch pandemic developments closely, as readers of our Daily Comment are aware. While the delta variant of COVID is surging worldwide, it appears to be less lethal than the original version. With almost half the population vaccinated in most developed economies and with the mRNA vaccines proving to be very effective against this variant, we believe it is unlikely that economic progress will reverse. Not only that, but the medical community has learned so much about how to treat those infected that we don’t expect this variant to be anywhere near the disruptive force the original version was. Thus, even regarding COVID, we believe the long-term weighing machine of the markets should work in investors’ favor.

We appreciate your confidence in us.

Gratefully,

Mark A. Keller, CFA

CEO and Chief Investment Officer

View PDF