by Asset Allocation Committee

As promised, this week we will discuss how President Clinton’s policies would likely affect the financial markets. It should be noted that, unlike Mr. Trump, Sen. Clinton has published most of her policy positions. However, there have been apparent shifts in her policy positions as Clinton adjusts her campaign to react to changes in the election environment.

Sen. Clinton’s campaign is similar to that of a succeeding vice president: In 2008, when Clinton ran against Barack Obama, she framed him as an ephemeral dreamer who lacked the necessary experience to accomplish much. Early in her 2016 campaign, she appeared to be distancing herself from the president. For example, President Obama has characterized his foreign policy as “don’t do stupid s*@t.” Clinton suggested that this sentiment wasn’t a working foreign policy stance for the world’s superpower. Her comment raised expectations that she would triangulate a position different from Obama and her GOP opponent.

However, as it became apparent that she faced a legitimate primary threat from Sen. Sanders, Clinton, in an effort to secure the African American voter block, has completely embraced President Obama and has framed Sanders’s calls for new policies as a repudiation of Obama’s legacy. This position has been very effective in securing African American votes and has also given her an edge in closed primaries, taking advantage of Obama’s popularity with most Democrats. However, in open primaries, which allow independents to vote, and in areas with white voters, Sen. Clinton has underperformed Sen. Sanders. While tying her fate to President Obama’s legacy has been mostly effective in winning the nomination,[1] Clinton’s positioning as essentially the third term of the Obama administration is a risky general election strategy as she will face the debate line, “if you liked the last eight years, you should vote for Hillary.”[2]

What can we expect from a Clinton administration?

Foreign Policy: This is one of the few areas where we would expect a Clinton government to differ significantly from the outgoing administration. Clinton is much more hawkish than Obama and her positions are in direct opposition to the apparent populist mood of the nation. During her time as secretary of state, she often favored a more hawkish foreign policy than the president, pushing for greater military involvement in the world. Although she isn’t a neoconservative, she is about as close to one as this group can hope for among the remaining candidates. In terms of Meade’s archetypes, she is Wilsonian. Thus, we would not be surprised to see neoconservatives, who usually vote Republican, drift toward Sen. Clinton.

Domestic Policy: As noted above, she is proposing nothing more than maintaining and defending the Obama policy legacy. That policy means preserving Obamacare, holding tax rates at current levels or perhaps raising them modestly on the very wealthy, and expanding on the regulatory legacy started by President Obama.

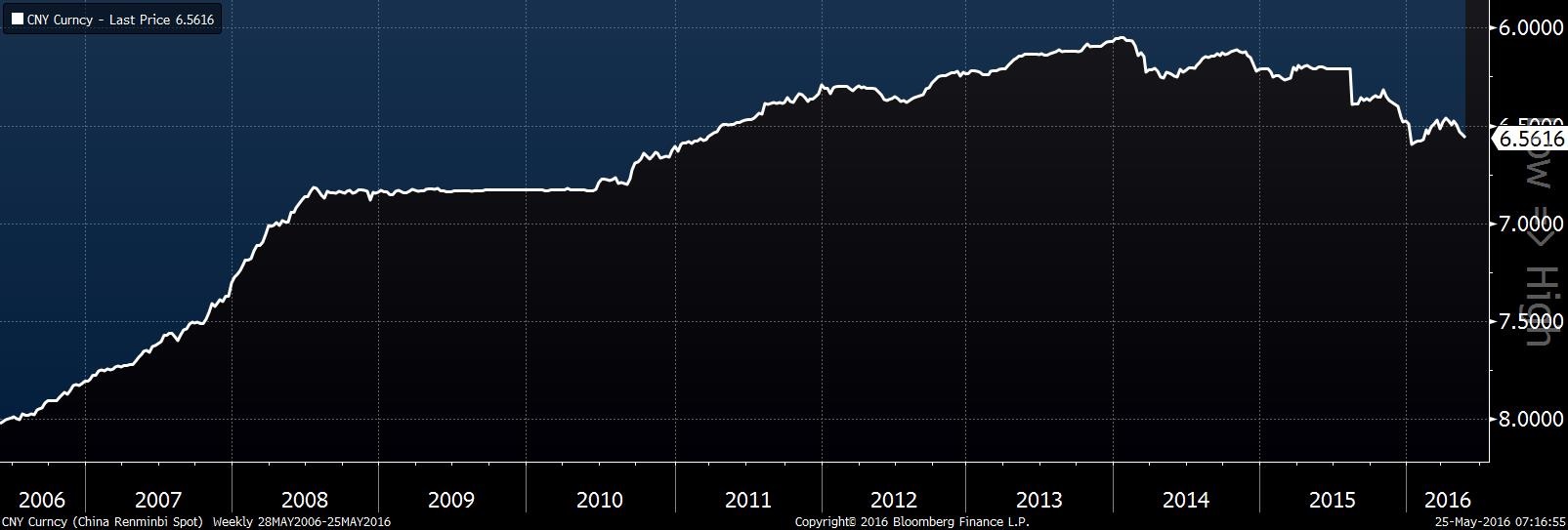

Trade Policy: On trade, Clinton has generally supported free trade agreements. She was originally in favor of the Trans-Pacific Partnership (TPP) before she turned against it. We seriously doubt she actually opposes either this agreement or the Transatlantic Trade and Investment Partnership (TTIP), but given the rising unpopularity of such agreements and the fact that both Sen. Sanders and Mr. Trump have made opposition to trade a major plank of their platforms, Clinton has been forced to tack left on this issue. We think there is a chance that President Obama will try to get the TPP passed before he leaves office; in fact, he may accomplish this during the “lame duck” session after the November elections. Although a President-elect Clinton would officially oppose this tactic, in reality, we suspect she would privately support it.

Immigration: The Democratic Party and, by extension, Sen. Clinton have generally supported easing restrictions on immigration and want to create a “path to citizenship” for illegal aliens living in the U.S. This position will alienate her with white, working-class voters, perhaps putting swing states like Ohio and Pennsylvania in play, but could help Clinton wrest Arizona and Georgia from GOP hands.

Defense: We would expect Clinton to have a better relationship with the military than President Obama. In fact, it would not be a surprise if she asked Ash Carter, the current secretary of defense, to stay on in her administration. Given her foreign policy stance, the military would likely be utilized more often in her government.

Fiscal Policy: Clinton would likely run an orthodox fiscal policy with a modest tilt toward raising taxes.

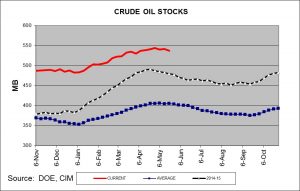

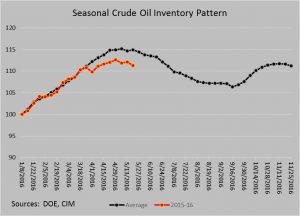

Environmental Policy: Her policies will likely follow in the trends established by President Obama. We would not expect anything as radical as Sen. Sanders’s bid to end fracking. At the same time, her policies won’t revive coal and we would expect a steadily tightening regulatory environment for oil and gas producers.

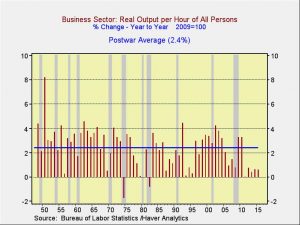

The market impact from a Clinton presidency would be negligible. Not only is she a solid member of the political establishment, but because she is running a campaign similar to a succeeding vice president, she will have virtually no political capital to bring “change” after gaining office. Thus, the slow growth, low inflation economic environment would likely continue. If markets fear a Trump presidency is likely and financial markets weaken into the election due to these fears, then a strong relief rally may ensue from a Clinton presidency, which is about the most notable market impact that would occur.

In our asset allocation views, we have consistently held that inflation would remain low; we have tended to favor longer duration in fixed income and generally supported equities. A Clinton presidency would maintain the status quo. We would continue to closely monitor the evolution of populism in the U.S., which threatens the current low inflation environment, but we would not expect Clinton to support a populist agenda. Bottom line: a Clinton presidency is a status quo outcome.

_______________________

[1] Although one could argue that she has barely been able to beat an elderly socialist.

[2] It should be noted that Gov. Reagan used a similar line against President Carter in a debate; some historians have argued that this phrase turned the election for Reagan.