by Asset Allocation Committee

Since the recovery began, we have consistently favored duration in fixed income. Our position has been that growth would remain sluggish in the developed world and global overcapacity would keep inflation contained. The consensus of strategists and economists didn’t support our position.

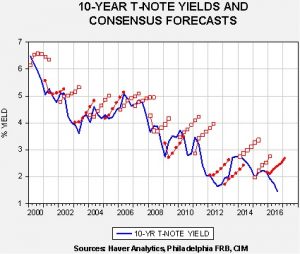

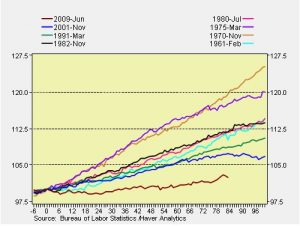

This chart shows the path of the 10-year T-note yield along with the forecast at the beginning of each year from the Philadelphia FRB Professional Forecasters Survey. The open boxes indicate when the forecasts were incorrect; the solid circles indicate correct forecasts. We are on the 17th forecast; so far, 10 have been wrong and, barring a strong jump in yields similar to 2012, the forecasters will be incorrect this year as well.

In general, the persistently incorrect forecasts are likely due to the consensus opinion that the economy, inflation and markets will normalize over some time frame. Instead, since the turn of the century, inflation has steadily declined and, in the aftermath of the financial crisis, economic growth has been persistently low. Accordingly, financial markets and global economies have been operating in a “new normal” rather than a return to the 1990s normal.

Although our position on fixed income has been correct, we are watchful for conditions that would reverse this long-term downtrend in yields. Inflation trends often have a political element. One of the key tradeoffs society makes is between equality and efficiency.[1] When society is leaning toward the latter, bonds will tend to do well because inflation will be controlled. If equality is demanded, the risk levels of bonds rise. Thus, we are carefully watching Brexit, Bernie Sanders and Donald Trump. These are all manifestations of a potential trend toward equality that would likely be expressed by re-regulation and deglobalization of the economy. If these trends, and others, gain traction, the potential for rising inflation and interest rates would increase. For now, we continue to favor long duration assets. Given the high level of binary risks looming (the process of the U.K. leaving the EU, November U.S. elections, the Italian referendum on government reform and its banking problems), long duration Treasuries offer some protection against bearish events, as the Brexit situation showed. But, we are closely monitoring economic and political conditions for a change in the secular trend in bonds.

_________________________

[1] For a discussion on efficiency and equality cycles, see our recent WGR: Post-Brexit (7/11/16).