by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with thoughts on the Fed’s latest rate decision. We then explore why Nvidia’s investment in Intel may reflect a broader US tech policy. Additional topics include progress in easing US-China trade tensions, a new EU sanctions proposal against Russia, and further evidence of China’s advances in chipmaking. We conclude with a summary of recent global and domestic economic data.

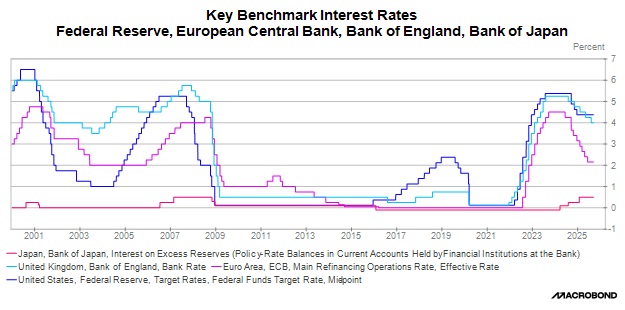

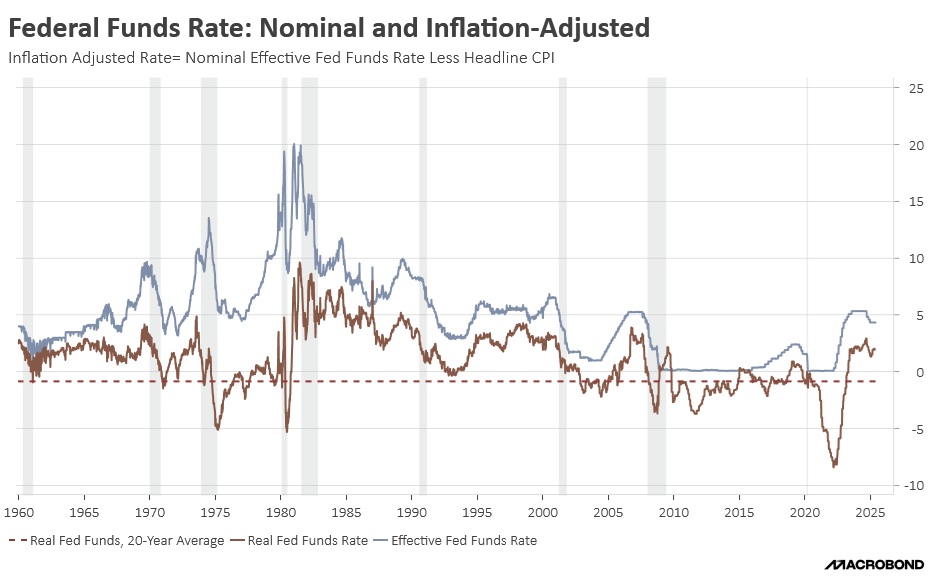

A Fed Divided: The Federal Reserve lowered its benchmark interest rate by 25 basis points, a move that was widely anticipated by markets. While the decision itself garnered broad consensus — with even the two previous dissenters siding with the majority — the future policy path remains uncertain. The sole dissenting vote came from the newest member, Stephen Miran. Furthermore, the updated “dots plot” signaled a more dovish shift, indicating expectations for an additional rate cut. Despite this, the overall trajectory of monetary policy appears far from settled.

- The Fed’s committee is in a near-perfect stalemate, with a deep divide underscoring the challenge of balancing short-term employment concerns against the long-term goal of controlling inflation. When you exclude the most dovish member’s forecast, likely from Governor Stephen Miran, the committee is split right down the middle: nine members favor, at most, one rate cut this year, while the other nine favor two.

- Fed communication failed to offer clear guidance on the future policy path. During his press conference, Fed Chair Powell framed the rate cut as a form of risk management. However, this dovish move was contradicted by the Summary of Economic Projections (SEP), which revealed that the Fed had grown more optimistic about economic growth and less confident that inflation would return to its 2% target.

- There’s growing concern over the Fed’s independence, stemming from Stephen Miran’s role as both a White House Economic Advisor and a newly appointed Fed governor. This conflict became evident in the latest “dots plot.” The projection attributed to Miran was 75 basis points below the next lowest dot, a stark outlier that suggests he’s deeply at odds with his colleagues. This wide gap likely indicates that other Fed officials are pushing back against potential White House influence.

- Poor communication from the Federal Reserve and concerns about central bank independence fueled significant market volatility on Thursday. This was evident in the dollar’s whipsaw action — initially dropping before rising — and in the S&P 500, which spiked following the announcement only to finish lower on the day. The reaction suggests deep market skepticism about the central bank’s ability to sustain its monetary easing cycle, given the current composition of the committee.

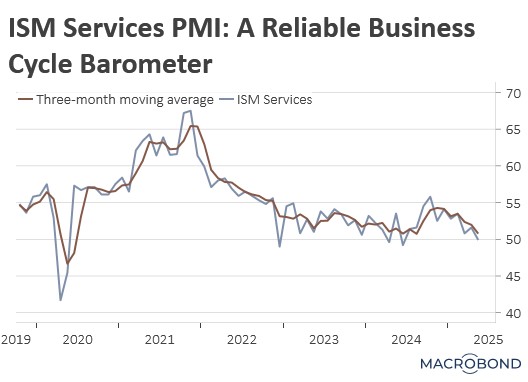

- The latest dots plot indicates that the FOMC is projecting additional rate cuts of 25 basis points over the last two meetings. The pace of this easing, however, will be highly dependent on incoming data. We believe a sustained cooling of the labor market is a prerequisite for more aggressive rate cuts. Conversely, if inflation remains stubbornly high, the Fed may be forced to postpone any rate cuts. While we do not see it as the most likely outcome, persistent inflationary pressure could even prompt discussions of a potential rate hike.

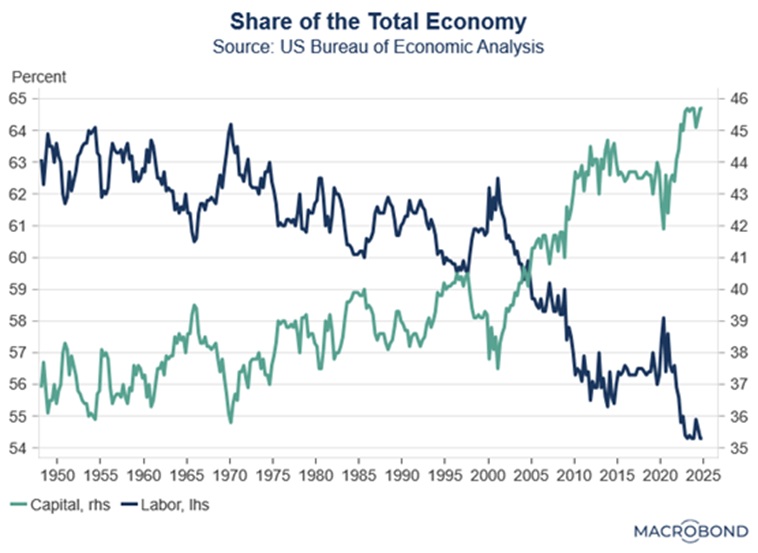

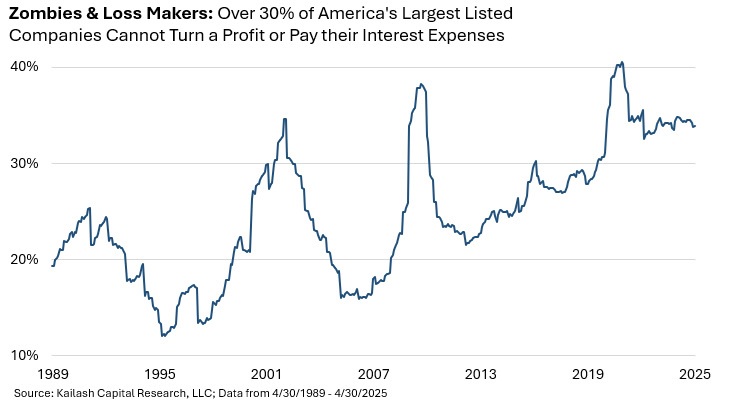

AI Race: Nvidia has announced plans to invest $5 billion in Intel as the two companies look to co-develop chips for PCs and data centers. The deal would allow Nvidia to purchase Intel shares at a steep discount, giving it a stake in its longtime rival. The move follows major US government funding and investment from SoftBank, highlighting the growing alignment among American tech firms to strengthen domestic capabilities and ensure the US remains competitive in the global AI race.

- We believe the continued collaboration between US tech firms and the government to expand AI capacity reflects a broader strategy: shifting from offering access to America’s vast consumer market to granting access to its technological ecosystem — a transition we call moving from free trade to free tech.

- This sentiment was reinforced by White House AI adviser Sriram Krishnan, who noted that the US is using global market share as a benchmark for success. His remarks suggest not only a massive expansion of domestic AI infrastructure, but also an effort to extend US technology abroad, positioning it as the global gold standard.

- We believe US tech companies collaborating to expand their global footprint could be a key driver of equity market returns in the coming years. However, failure to secure leadership in AI may trigger a significant pullback. As a result, while we remain optimistic on the tech sector, we also see merit in maintaining exposure to value stocks to help balance portfolios.

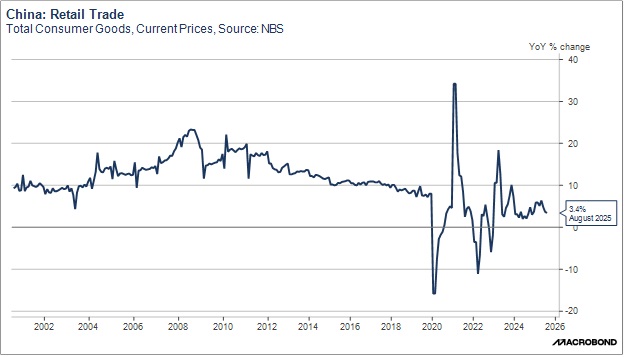

US-China Trade Talks: China has dropped its antitrust probe into Google’s Android mobile platform, a move seen as a concession to the US as the two nations prepare for trade talks. The investigation was launched in February, the same day the White House imposed new tariffs on Chinese goods. This decision signals Beijing has learned that fostering a friendlier environment for US tech companies can lead to more favorable trade terms. It is a prime example of the growing linkage between global technology policy and trade diplomacy.

AI’s Competition: Earlier this month, two leading American AI models performed at a top-tier level against human competitors at the International Collegiate Programming Contest (ICPC) World Finals, often called the “coding Olympics.” OpenAI claimed its model would have secured first place, while DeepMind’s would have taken second. This breakthrough will likely accelerate the adoption of AI as an assistant or complement to computer programmers.

EU Sanctions: The EU is drafting a new Russia sanctions package for its members, targeting crypto, banking, and energy transactions to pressure an end to the war in Ukraine. This move comes after the US pushed the EU to enact 100% tariffs on India and China for backing Russia. Although the EU has not expressed openness to the tariff idea, it has pursued other restrictions against the Russian allies. Ultimately, while coordinated Western pressure could advance peace talks, it may also encourage Moscow to challenge NATO’s unity.

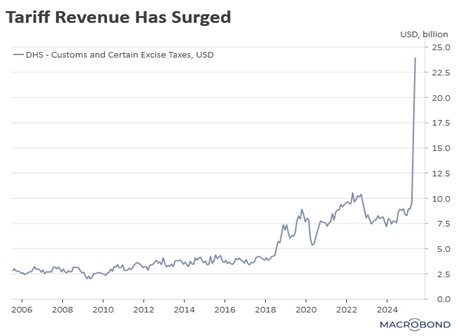

Farmer Bailout: The White House has announced a new plan to use revenue from tariffs to provide support to US farmers. This comes as the agricultural sector has seen a downturn in sales as a result of trade restrictions. The use of tariff funds for this purpose will likely lead to two key debates: first, the broader economic impact of these tariffs, and second, their long-term viability as a consistent source of government revenue to address fiscal needs, such as debt reduction.

The Chinese Nvidia? In a significant step toward technological self-reliance, Huawei Technologies has launched a new suite of semiconductors, including memory chips and AI accelerators. This announcement comes just one day after China prohibited its domestic companies from buying chips from Nvidia, highlighting a strategic push to control its supply chain. These events mark a major escalation in the US-China tech rivalry as both nations vie for dominance in the critical global semiconductor market.