by Bill O’Grady, Kaisa Stucke, and Thomas Wash

[Posted: 9:30 AM EST] One of the key themes we have been monitoring since Trump’s election has been the uneasy alliance between the populists and the GOP establishment. We personalized this interaction as Speaker Ryan versus Chief Strategist Bannon. The policies that would be supported from the Ryan camp are primarily personal and corporate tax reform, which would mostly be in the form of lower marginal rates. This group would also want to maintain globalization (including open immigration) and deregulation, with a focus on relaxing financial regulations and environmental rules. This group is cool to the call for infrastructure spending. The Ryan group is where the fiscal budget hawks reside. The latter group, represented by Bannon, are economic nationalists who want to curtail globalization by restricting immigration and reducing the trade deficit through trade barriers, if necessary. This group wants to see fiscal expansion via defense and infrastructure spending. They are less concerned about tax cuts but are also less worried about deficits.

Although equity markets retreated in the early hours after the election, that pullback was short-lived. After a surprisingly conciliatory acceptance speech, equities turned and have been rallying ever since. It appears to us that this rally is predicated on the idea that the Ryan cohort will generally prevail, meaning we would mostly see an establishment GOP program of tax cuts and deregulation.

The key unknown is which group will eventually prevail. It would make sense for Trump to swing between these two groups; in fact, if he completely favors one over the other, it may either lead to him being a one-term president or undermine his ability to work with Congress. In reality, we expect him to give “bones” to each side over the next four years. However, we do have to say that Bannon has won the last few days. The executive order to ban Muslim immigrants, refugees and, for a time, U.S. green card holders from a handful of Islamic nations comes purely out of the Bannon agenda. Although reports are somewhat conflicting, it does appear that this policy change caught much of the government by surprise. According to reports, Bannon and his inner circle were behind the executive order.

The other important decision was to appoint Bannon as a permanent member of the National Security Council while indicating that the director of National Intelligence and the chair of the Joint Chiefs of Staff will no longer be permanent members of the council. For background, this council was created by President Truman to offer the president advice and assistance with national security and foreign policy issues. The statutory attendees are the president, vice president, secretary of state, secretary of defense and secretary of energy. These members are required, by statute, to attend. Before President Trump’s recent decision, the chair of the Joint Chiefs of Staff and the director of National Intelligence were also required by statute to attend; that is no longer the case. The director of National Drug Control Policy is also a statutory member. All other members, now including the chair of the Joint Chiefs of Staff and the director of National Intelligence, are invited to meetings that pertain to their responsibilities.

We suspect that the chair of the Joint Chiefs of Staff and the director of National Intelligence will end up attending most meetings. Thus, the downgrade of their positions may be more form over substance. However, appointing Bannon as a permanent member elevates someone whose position has traditionally been more of a political advisor rather than security advisor. It’s a bit like putting Karl Rove on the council. It is a clear indication of Bannon’s influence on the administration.

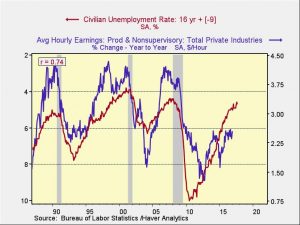

We are watching the impact on financial markets. If Bannon’s influence grows, we would expect Trump’s policies to lean more toward the populists and less toward the establishment. That would be bearish for long duration debt and likely also bearish for equities as we would look for multiples contraction over time. Simply put, populist policies are inflationary and negative for financial markets. The major “known/unknown” is how the FOMC will react. Central bank independence is granted by the political system and thus can be taken away by that same system. A Bannon-influenced Fed will have more in common with the Burns/Miller era than the Volcker/Greenspan era.

At the same time, it is important to remember that President Trump needs Congress to get major things accomplished. Thus, some sort of accommodation to the GOP establishment is probably necessary. We are closely watching the U.S. political situation as well. Trump may very well represent a major rejiggering of party affiliation. It seems hard to imagine that labor may find its home in the GOP while the Democrats become the party of business, but such shifts have occurred before. The Democratic Party was the party of Jim Crow before the 1964 Civil Rights Act and the GOP was the party of trade protection before WWII. Thus, we are paying close attention to party affiliation changes.