by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Financial markets are very quiet again this morning in front of the employment data on Friday. Here is what we are watching this morning:

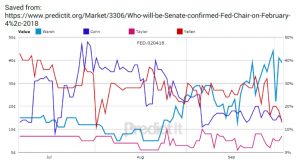

Fed chair decision: President Trump has distilled a short list for replacing (or, perhaps, reappointing) the position of Fed chair. Below is what the prediction markets are signaling.

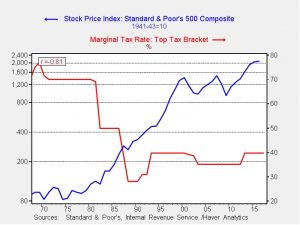

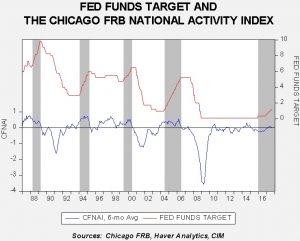

Bettors are putting their money on Warsh. He does meet many of the assumed criteria of the president. He is a Republican with private sector experience. He is young and well connected, coming from the elite establishment, and has been a Fed governor. He is not an economist. It is the latter point that gives most analysts and Fed watchers pause. He hasn’t written much, but what he has published has been skewered.[1] In his defense, Chair Bernanke did speak well of Warsh but mostly in his work as a liaison between various parties during the Great Financial Crisis. At the same time, Warsh might be the most compliant Fed chair Trump could appoint. Most of the other candidates would likely support Fed independence, but it is possible Warsh would be more inclined to please the White House. In watching the debate over who should be Fed chair and how that person would react in terms of policy, there have been persistent comments made that the combination of a new Fed chair and fiscal stimulation in the form of tax cuts could lead to a 1980s dollar bull market. That outcome is possible. However, there is another possibility that is almost never discussed, probably because most commentators were not even zygotes when that other outcome occurred, which is the combination of fiscal expansion and loose monetary policy, personified by Fed Chairs Arthur Burns and G. William Miller, that led to a significant dollar bear market. If Warsh is willing to be the most pliable chair, he could get Trump’s nod. If Warsh doesn’t win, we are leaning toward Jerome Powell, a current governor. He is a Republican but we would characterize him as a moderate on policy, sort of another Yellen.

The Iran deal: There are numerous reports this morning that Trump may not certify Iran’s compliance to the nuclear deal. We do note that Gen. Mattis, his SOD, has indicated he believes Iran is complying. Part of the problem is that there has always been a lack of consensus about what the Iran deal means. On the surface, it is a limited pact that probably prevents Iran from developing a nuclear weapon—nothing more, or less. However, during the process of negotiating the deal, the Obama administration seemed to believe that it might be the first step in normalizing relations with Iran. This is hugely important.

Before the end of WWII, when President Roosevelt met with King Ibn Saud on the Bitter Lake aboard the U.S.S. Quincy, the U.S. established itself as the enforcer of stability in the Middle East. The U.S. has significant military assets in the region and has acted as “offshore rebalancer” to intervene in various conflicts to prevent any regional power from becoming dominant. This position ensured a free flow of oil from the region and denied the Soviets a warm water port. However, with the end of the Cold War and the onset of shale production, the U.S. has been reconsidering the balancer role. The whole concept of “pivoting” to the Far East required the U.S. to pivot away from the Middle East. Thus, if the U.S. isn’t going to maintain that role, who should get it? The Obama administration seemed comfortable with giving that to Iran. Such a decision sent shock waves through the neo-conservative wing of the GOP who are focused on the security of Israel. And so, the election of Trump has led to a Sunni recovery in the region. At the same time, the Trump administration has essentially viewed the Iran nuclear deal with a broader mandate—that it should be designed to contain Iran and reduce its regional influence. Thus, rejecting the nuclear deal isn’t just about the strict reading of the treaty; it’s a reversal of unstated Obama-era policies to abandon the region to the tender mercies of the Persians. So, strictly speaking, Mattis is right…Iran is meeting its obligations. But to say that ignores the broader context, which is who will keep the Middle East stable?

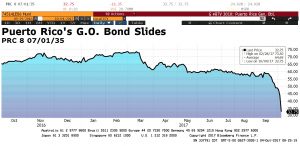

Debt forgiveness for Puerto Rico? President Trump suggested that Puerto Rico’s debt could be written off. Although we do expect a restructuring, the comments did surprise and Budget Director Mulvaney is trying to walk them back. We note that it seemed to have an impact on the island’s debt prices. As the chart below shows, this representative GO bond has seen its prices fall by almost half since mid-September.

[1] http://economistsview.typepad.com/timduy/2017/01/was-kevin-warsh-really-a-fed-governor.html