by Asset Allocation Committee

Do fiscal deficits matter? This is one of the more polarizing topics in economics. The recent tax bill and budget agreement will increase the deficit, which has led to all sorts of worries and claims. Here are a few observations:

- Politically, deficits matter to the party out of power. Protesting against deficits are one of the few ways a party out of power can restrain the party in power. Thus, the party in power tends to ignore deficits because it doesn’t want to be restrained. In addition, there is always a fear that borrowing capacity could become constrained, so by the time the party out of power regains a majority, it will be stuck with implementing austerity. Each party believes there are some types of public expenditures that are good for their own sake and should be paid for even if the deficit increases. Although a generalization, Republicans tend to support defense spending and tax cuts; Democrats tend to support health care and social spending. Thus, what angers each side about the other side’s priorities is that they view their own priorities as sacred and the others’ as buying votes.

- The economic impact is complicated and dependent upon market and economic conditions. One of the most common mistakes people make in terms of the deficit is the error of composition. This is a classic logic error where one postulates that what is true on a small scale is also true on a large scale. Thus, it’s common for politicians[1] to note that a household can’t borrow money to unsustainable levels and neither can the government. However, there is a big difference between a government and a household. First, the former can use force to collect revenue to service debt (if you don’t pay your taxes, the government can use coercion), and second, the government prints the currency used to pay the debt. If households could use force to service their debt and print money, they would be like the government and thus could borrow much more.

- The major issue with deficits is spending priorities. The government of a developing nation should run deficits to build out infrastructure because the return on the investment will likely exceed the cost. In wartime, borrowing money to fund the war effort makes sense because the state will cease to exist if the nation loses the war. Education is arguably a good public investment, as is domestic security. One would expect strong debates about how much of these public[2] or quasi-public goods should be provided. The reality is that it’s difficult to estimate the value of public investment and spending, and arguments over these issues will be perpetual.

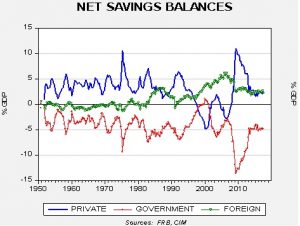

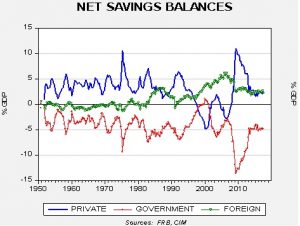

Do deficits matter? Yes, but not in the simple form that pundits suggest. When the government spends more money than it takes in from taxes, that saving has to be acquired from the other major sectors of the economy, the private sector (households and businesses) or the foreign sector (through the trade account).

Private saving balance = (business revenue less business investment) + (household saving less consumption)

Public saving balance = (taxes less government spending and transfers)

Foreign saving balance = inverse of the current account

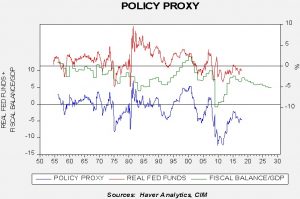

The above chart shows the three sectors of the saving balance; it’s a macroeconomic identity, meaning that it will always equal zero. Thus, when the government deficit expands, it must be funded by saving created by either the foreign sector or the private sector. When the government runs a surplus, it depletes private sector saving or reduces foreign inflows.

The impact on the economy depends on the return from government spending relative to the return from the private sector or the foreign sector. If public spending has a higher rate of return than investment in the private sector, then fiscal deficits are reasonable. However, this calculation is extraordinarily difficult. Think of the rate of return on the Strategic Petroleum Reserve; if the world experiences a major war in the Middle East and oil rises to $150 per barrel, the investment when oil was cheaper would almost certainly be positive. The same would be true for peacetime defense spending when war breaks out. However, outside of dire situations and under shorter time frames, private sector investment probably has a higher rate of return.

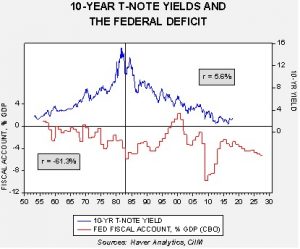

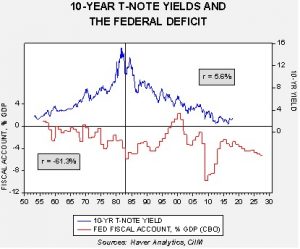

Our concern is the market impact. The classic fear is that deficits trigger inflation and higher interest rates. The theory is that if the government runs a deficit, the private sector will offset it, which will require a drop in consumption and crowd out private investment. The drop in consumption is usually facilitated by higher prices and the contraction of investment would usually constrain output and lift inflation as well. The data actually shows that higher deficits did seem to boost interest rates from the late 1950s into the early 1980s; however, the relationship became uncorrelated thereafter.

Since 1983, long-duration Treasury rates have steadily declined despite the trend in the deficit. In comparison to the first graph, what changed in 1983 was the expanding current account deficit, which brought in another source of saving to fund the fiscal deficit.

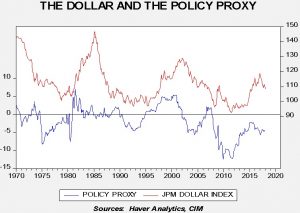

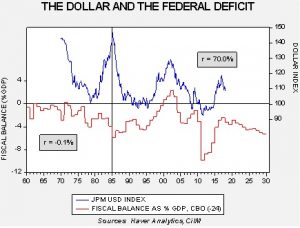

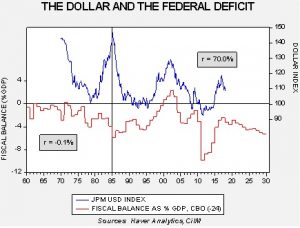

One area that will likely be affected is the dollar. The dollar was mostly uncorrelated with the fiscal balance until the peak of the “Volcker dollar” in 1985. However, since then, with a two-year lag, the fiscal account correlates directly with the dollar at a level of 70%. A fiscal surplus tends to be dollar bullish, while a widening deficit is dollar bearish.

We believe this occurs because of the dollar’s reserve status. There is a constant demand for dollars on world markets to facilitate trade. A wider fiscal deficit makes more dollars available for world markets; rising supply tends to weaken the dollar’s price, the exchange rate. On the other hand, a fiscal surplus (or narrower deficit) means the supply of dollars is less, boosting the exchange rate.

Although it is possible that a weaker dollar could lift prices, the evidence is scant; foreign countries use exports for growth and to lower unemployment in their nations. As a result, they tend to accept margin compression rather than give up market share through higher prices. Accordingly, we think the preponderance of the evidence suggests the expanding fiscal deficit will be dollar bearish and supportive for foreign assets.

View the PDF

[1] Usually the party out of power, but not always. There are a few political figures that are consistently opposed to deficits and government debt regardless of whether or not their party is in control of Congress.

[2] In public finance, a public good is a good that cannot be easily excluded and is non-rivalrous, meaning that it is either provided to all or none. Fire protection cannot be easily segregated, for example. In theory, one could argue that the fire department should only put out fires from households that pay their “fire bill.” In reality, it is probably impossible to allow one house to burn down and not adversely affect neighboring homes who did pay their fees. Police services, libraries, etc. are examples of pure public goods. If the government or a non-profit entity doesn’t provide the good, no private sector firm will provide it because it cannot ensure it will get paid (getting back to the government’s ability to use coercion to collect taxes). Quasi-public goods are goods that can be provided by the private sector but is sometimes provided in less quantities than considered optimal. If households don’t earn enough to provide for the wellbeing of a family, a quasi-public good would be public assistance. The private sector does provide food and shelter but it may not produce enough to be a feasible option for a low income household.