by Bill O’Grady and Thomas Wash

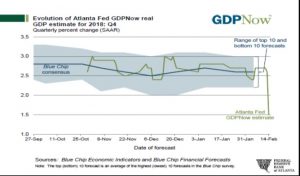

[Posted: 9:30 AM EDT] U.S. equity futures are steady this morning in quiet trading. There is some optimism, however, on the China/U.S. trade talks and on the Fed’s balance sheet. European and Japanese PMIs were disappointing, suggesting weaker global growth, and the Philly Fed was very weak (see below). Here is what we are watching this morning:

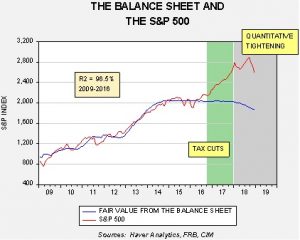

Fed minutes: Although the bulk of the market chatter seemed to be around the balance sheet, we view that discussion as mostly sterile—there isn’t much evidence to show that QE helped the real economy and there isn’t much to suggest that QT has impeded it either. Here are the two items we find interesting, shown by these quotes:

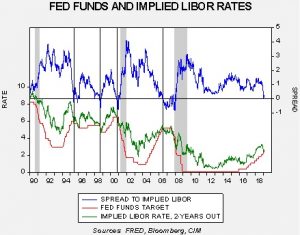

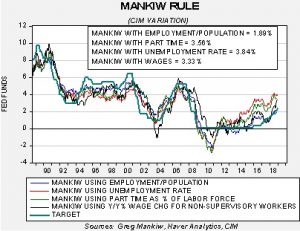

…several of the participants argued that rate increases might prove necessary only if inflation outcomes were higher than in their baseline outlook.

Several others indicated that if the economy evolved as they expected, they would view it as appropriate to raise the target range for the fed funds target later this year.

Chair Powell now has a committee divided over a basic issue. The first entry suggests that the FOMC should only pay attention to inflation and ignore the growth path. These members probably hold the position that the Phillips Curve is no longer relevant and the central bank should only focus on inflation. The members mentioned in the second entry likely still hold to a Phillips Curve model and thus stronger growth should trigger tighter policy even in the absence of rising inflation. That’s because the Phillips Curve, at its core, maintains that the loss of slack in the economy will eventually lead to higher prices. Although it makes intuitive sense, globalization and deregulation seem to have flattened supply curves to the point where even if the Phillips Curve relationship holds it isn’t very powerful.

We suspect Powell is in the former camp. If so, he will likely press to keep policy steady until actual evidence of inflation occurs. Usually, the chair has some sway with the committee and may be able to keep the number of dissents manageable, but divisions will be something to watch in the coming months. As long as growth is lackluster and inflation tame, the divisions probably won’t be evident. Still, they might develop at some point and then we may see a spate of dissents that could undermine Powell.

Venezuela: This weekend, the opposition is planning to move tons of donated aid on Saturday. Maduro has closed the borders. There could be violence.[1] If there is, we will be watching to see how the Trump administration reacts.

On the issue of Venezuelan debt, according to a report from the FT,[2] the opposition leader in Venezuela, Juan Guaido, has approached Lee Buchheit, a sovereign workout specialist who recently retired from a major law firm that specializes in this area. Buchheit proposed that the best way for Venezuela to work out of its debt situation is for the government to “ring fence” its petroleum-related assets in the U.S. Venezuelan debt lacks collective action clauses so a small group of creditors could seize Venezuelan assets in the U.S. and effectively prevent any significant restructuring. The U.S. and the U.N. did something similar with Iraqi debt after the fall of Saddam Hussein, with the UNSC issuing a directive forbidding all U.N. members from attaching or seizing any Iraqi assets. President Bush also issued an Executive Order doing the same thing in 2004, and did so every year of his presidency. President Obama followed Bush’s lead by extending the ban through 2014.

These orders were devastating for bondholders. Essentially, bondholders received about 10 cents on the dollar for the Hussein-era debt they held. Needless to say, Venezuelan creditors are cool to this plan, claiming that it will deny the new government access to capital. Although it will do so for a while, in our experience,[3] new lenders always appear even after default and workout. At first blush, if the U.S. were to implement such a plan, it would not get support in the UNSC because China and Russia can veto any proposals. However, if the president were to sign an Executive Order preventing creditors from attaching Venezuelan assets in the U.S. and use the threat of military force to prevent foreign creditors from being physically able to control collateral assets in Venezuela, then it could force China and Russia to accept sharply reduced settlements on their debt.

Trade talks: There is evidence of progress on the U.S./China front. This morning, there are reports that China will boost agricultural imports. The two sides are putting together an outline of commitments on various issues in a Memorandum of Understanding (MOU).[4] We suspect the outline and MOU will be out before the March 1 deadline, but we doubt this will be the culmination of talks. Instead, the MOU will be a roadmap to further negotiations that will likely stretch into next year. In the end, we doubt the substantial issues will ever be decided.[5] At the same time, both sides need an immediate deal[6] even if it falls short of a comprehensive agreement.

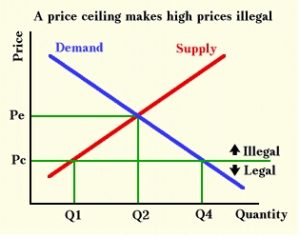

On the EU front, it appears the Trump administration is turning up the pressure, threatening auto tariffs.[7] Getting a deal with Europe will be difficult; the Europeans want to avoid auto restrictions, which would deeply hurt German automakers,[8] and the U.S. wants open trade on agriculture, which would disrupt the EU’s carefully negotiated Common Agricultural Policy. At the same time, U.S. auto nameplates are protected by a 25% tariff on light trucks[9] that would go away under conditions of free trade.

Financial markets have mostly discounted a trade deal with China, but a resumption of trade hostilities with the EU isn’t currently in prices. Thus, if this conflict heats up, it could put pressure on the current equity rally.

Brexit: Although there is nothing concrete, we may be seeing some movement on both sides of the Channel.[10] The EU appears sensitive to U.K. concerns about the Irish backstop being temporary in name but eternal in practice. It appears the goal is to show enough movement for Brexit supporters to go along with May’s original agreement but without so much change to force the EU to hold another vote. Meanwhile, the splinter group has added another member, a Labour Party defector.[11]

Trouble down under: China is putting pressure on both New Zealand and Australia over the Huawei (002502, Shenzhen, CNY, 4.01) issue and other concerns. China’s Dalian port has banned Australian coal imports,[12] and China has also threatened New Zealand.[13] China is a key customer for both countries and it appears Beijing is using that position to influence policy in both nations. Australia has been a favored destination for Chinese capital flight and the Xi government would probably like to press Canberra to extradite Chinese citizens trying to flee the clutches of the Communist Party of China. It is important to note that Australia and New Zealand are members of the “five eyes” network, an alliance of English-speaking nations (U.S., U.K., Australia, New Zealand and Canada) that share intelligence. The U.S. is particularly worried that any of these nations using Huawei equipment could be subject to hacking by the Chinese government, allowing it to gain access to the shared intelligence of the five eyes group.

The Mueller investigation: For the most part, we have not commented on the investigation because financial markets have mostly ignored it. That doesn’t mean we haven’t been monitoring developments, but we didn’t believe it made sense to weigh in on a controversial topic that wasn’t affecting “our lane.” However, there are reports that the investigation may be wrapping up soon[14] and a report could be issued to the DOJ in a few weeks. We won’t speculate on what it may contain but it could have information that might affect market sentiment. If so, we will address this issue once it becomes a market factor.

View the complete PDF

[1] https://www.axios.com/newsletters/axios-am-bc3c4888-ea2b-4248-9e96-63848bdf9912.html?chunk=6#story6 and https://www.ft.com/content/8149fad0-34c2-11e9-bd3a-8b2a211d90d5

[2] https://ftalphaville.ft.com/2019/02/19/1550575804000/A–nuclear-option–to-resolve-Venezuela-s-debt-woes/

[3] Bill was a country risk analyst at a bank that did international lending and was involved in the Brady bonds and debt/equity swaps in the late 1980s. Most of the affected nations were able to access the credit markets within five years or less.

[4] https://finance.yahoo.com/news/exclusive-u-china-sketch-outlines-024419838.html

[5] https://www.ft.com/content/79d8e466-342f-11e9-bd3a-8b2a211d90d5?emailId=5c6e34726220f700040cf3c1&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[6] https://www.wsj.com/articles/warriors-on-trade-trump-and-xi-face-a-similar-challenge-at-home-11550709127

[7] https://www.wsj.com/articles/trump-continues-to-weigh-eu-auto-tariffs-11550693479

[8] https://www.ft.com/content/9aea1f38-352b-11e9-bd3a-8b2a211d90d5?emailId=5c6e34726220f700040cf3c1&segmentId=22011ee7-896a-8c4c-22a0-7603348b7f22

[9] https://en.wikipedia.org/wiki/Chicken_tax

[10] https://www.ft.com/content/5c0c3c70-3548-11e9-bb0c-42459962a812

[11] https://www.ft.com/content/c71397c0-352f-11e9-bd3a-8b2a211d90d5

[12] https://www.reuters.com/article/us-china-australia-coal-exclusive/exclusive-chinas-dalian-port-bans-australian-coal-imports-sets-2019-quota-source-idUSKCN1QA0F1

[13] https://www.nytimes.com/2019/02/14/world/asia/new-zealand-china-huawei-tensions.html

[14] https://www.washingtonpost.com/world/national-security/justice-department-preparing-for-mueller-report-in-coming-days/2019/02/20/c472691c-354b-11e9-af5b-b51b7ff322e9_story.html?utm_term=.c53d26a2710a