by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] We bid welcome to June! Like the St. Louis Cardinals, we are more than happy to see May in the rearview mirror. However, like the other major league baseball team in the state, June may not be much better. POTUS is in the U.K. Trade wars are spreading. Here is what we are watching today:

The dizzying effect of trade wars: Washington is opening new battles on the trade front at a pace that is nearly impossible to digest. Here is what developed over the weekend:

- India: The Trump administration has removed India from the developing nations list. Being on this list gives a nation preferential treatment on trade. This action will increase the number of Indian imports now subject to tariffs. This decision does make sense; India is clearly a major economic power now and treating it like a small developing nation doesn’t reflect reality. At the same time, no one wants to have preferential treatment removed and India has intimated that it will retaliate in kind. In addition, the U.S. has been wooing India for some time to participate in America’s goal of containing China’s geopolitical ambitions. Boosting tariffs on India won’t support that goal.

- China retorts: China published a 23-page white paper explaining its position on the recent trade rupture with the U.S. Not surprisingly, Beijing blames Washington for the recent rise in trade tensions. China is also investigating FedEx (154.28, -3.70) for diverting shipments that were to be sent to China and instead ended up in Japan. China is implying the company is a “tool” of U.S. policy; if it decides that is the case then the company’s business in China could be affected. The U.S. does appear to be trying to ease tensions, considering sending “good cop” Mnuchin to meet with Chinese officials at the G-20. Meanwhile, the fallout from the tech and trade conflict continues as tech firms are starting to look at their supply chain risk and the conflict is prompting China and Russia to improve relations. China has also officially warned its students about getting their education in the U.S.

- Mexico: It seems President Trump was mostly on his own in the decision to apply tariffs on Mexico over the border situation. Automakers are scrambling to adjust their supply chains that will be disrupted if the tariffs are implemented. It does appear that the Mexican tariffs are likely to be implemented. First, it isn’t obvious what Mexico can do to address Washington’s concerns; the White House did not offer any specific actions it wants from Mexico. Second, because President Trump doesn’t seem to grasp that tariffs are, essentially, a consumption tax, he is under the impression that foreigners pay the tax. Like the mayor of a locality where the only shopping center exists, he seems to think that sales taxes are fully paid by outsiders. Accordingly, he apparently thinks the Mexican tariffs can be used to fund his border wall. Mexico’s president, AMLO, is trying to defuse the situation, sending a delegation to Washington.

- Australia: Although the Trump administration has indicated it won’t take action, apparently the White House considered attaching tariffs on Australia due to a surge of imports of Australian aluminum. This surge makes perfect economic sense; if some tariffs are applied to parts of the world, the parts that are not affected gain an advantage and thus their shipments will tend to increase. Given the mercurial nature of the Trump administration, we would not be surprised to see this threat reemerge later.

- Kevin Hassett: The head of the Council of Economic Advisors is leaving, likely due to his opposition to the administration’s tariff policy. Hassett was instrumental in supporting the corporate tax cuts but he is a free trader and we suspect he couldn’t continue to work with a government that was expanding tariffs. This position requires Senate approval so we would expect it to remain vacant as the Senate probably won’t approve a tariff supporter (the Senate is quietly opposing Trump’s trade policy), and we doubt Trump will bother to have a voice near him that opposes his position on tariffs.

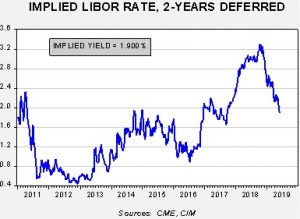

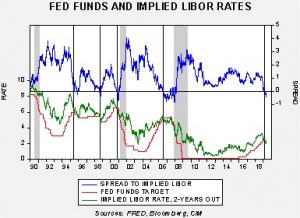

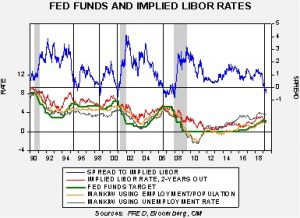

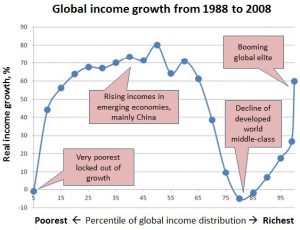

One of the more difficult issues to resolve with the administration’s trade policy is that it works in cross-purposes. The White House wants to pass USMCA but then applies tariffs on Mexico over a different issue; if there is no movement, we can’t see how Mexico will support the new treaty. The U.S. needs India as a foil to China but hurts its economy with new tariffs. We expect the administration will start to face more significant retaliation in the coming months that will affect the economy, both domestic and global, in ways that will be hard to predict. We are already seeing weaker PMI data due, in part, to trade tensions. One trend that is likely to emerge is the creation of trade blocs, where local trade will be dominated by regional hegemons with little trade activity between blocs due to impediments. This would mean a world of higher inflation and lower profitability, but it will likely also be more equal and there will be less “creative destruction.” In the meantime, the tariff actions have roiled financial markets; we are actually seeing the yield curve steepen this morning because rates at the short end are falling rapidly in anticipation that the Fed will need to cut rates soon.

Talking to Iran? The Trump administration appears to be “ready to talk” to Iran. In some respects, it’s hard to see why Iran would want to negotiate with the U.S. because whatever deal is struck may not survive the next U.S. administration. At the same time, the Iranian economy is in shambles and if Trump offers an acceptable deal Tehran might just take it. However, we suspect the U.S. wants a permanent end to uranium enrichment, something we doubt Iran would accept. But, if the economic “carrot” is large enough, it might just work. A deal with Iran would be profoundly bearish for crude oil.

Oil higher: After getting slammed the past few sessions, oil prices are up today on reports that both Saudi and Russian oil production declined in May. It appears the former made cuts to lift prices, while the latter was adversely affected by an industrial accident that tainted a large shipment of Russian oil.

European political turmoil: The head of the SDP in Germany has resigned due to her party’s poor showing in the latest European elections. The current German government is a grand coalition of the SDP/CDU-CSU; if the SDP exits the coalition, the government will fall and result in new elections with an uncertain outcome. Many SDP members believe that membership in the government is destroying their party and want to shift toward the opposition. However, the fear is that if the government falls then the centrist bloc may fail altogether. A reflection of this fear is shown in Denmark, which goes to the polls on Wednesday. The center-left Social Democrats are expected to do well by taking an anti-immigration stance. A truism of politics has been that one can have a large social welfare state or open borders, but not both. If a nation has both, resentment tends to build because taxpayers feel they are supporting foreigners. The Danish Social Democrats have decided they want a broad social safety net and are willing to take a hardline position against immigration.

Tech and regulation: Both Google (GOOGL, 1063.70, -42.80) and Amazon (AMZN, 1765.27, -9.80) are facing increased anti-trust scrutiny. To some extent, regulation is the greatest threat to both companies’ business models.

Not dead yet:Rumors that Kim Yong Chol had been demoted or executed over the failure of the Hanoi summit with the U.S. are apparently untrue.