by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment is split into three sections: 1) Why rising energy prices will complicate the Fed’s efforts to project future policy rates; 2) Why European policymakers may be finished with their hiking cycle; and 3) Why the green transition is leading governments to push for more domestic manufacturing.

Where Do They Stand? The disappointing consumer price index (CPI) report may lead to further divisions within the Federal Open Market Committee (FOMC).

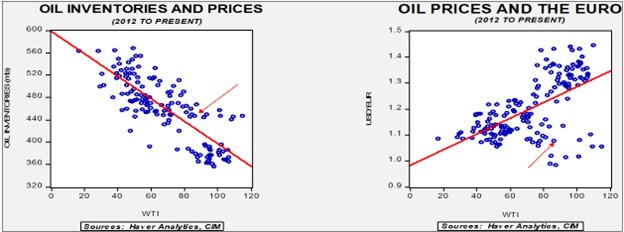

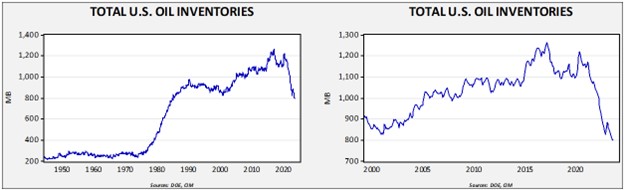

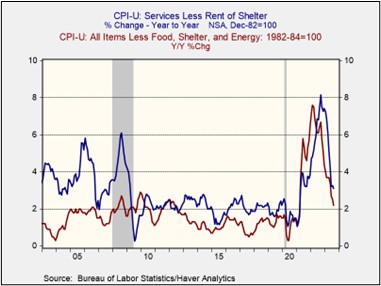

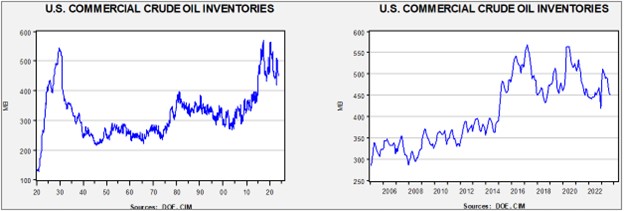

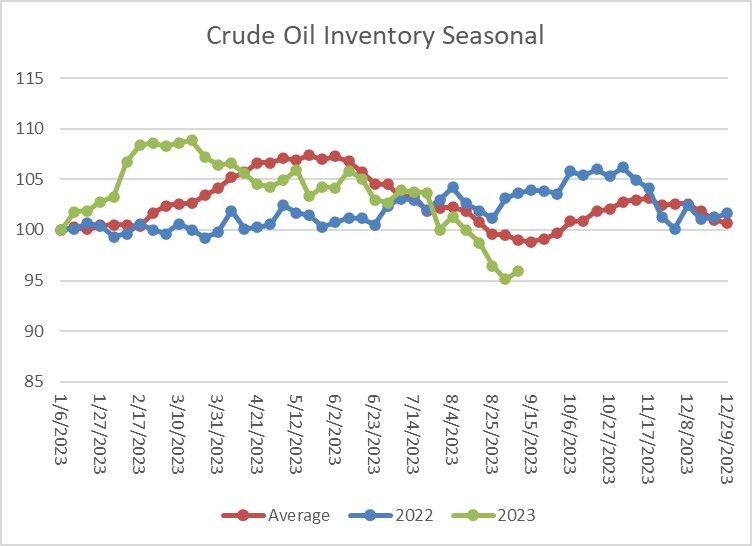

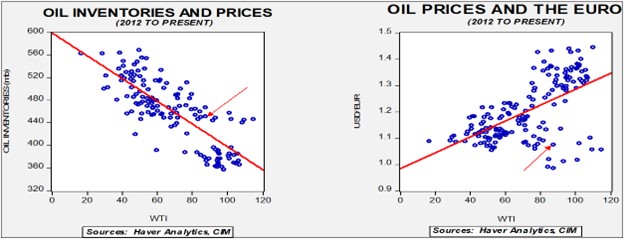

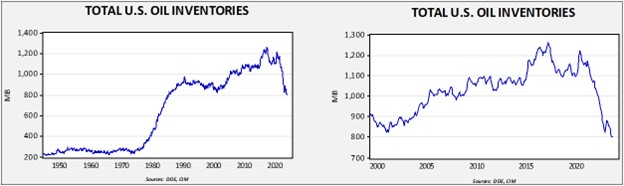

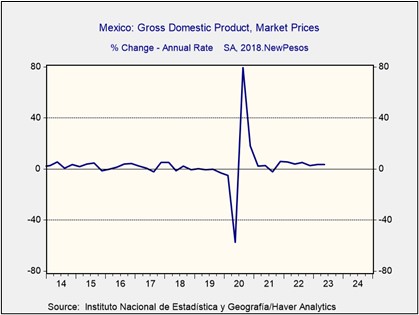

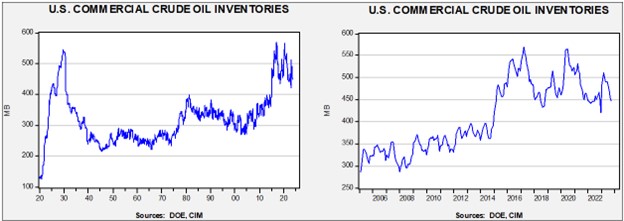

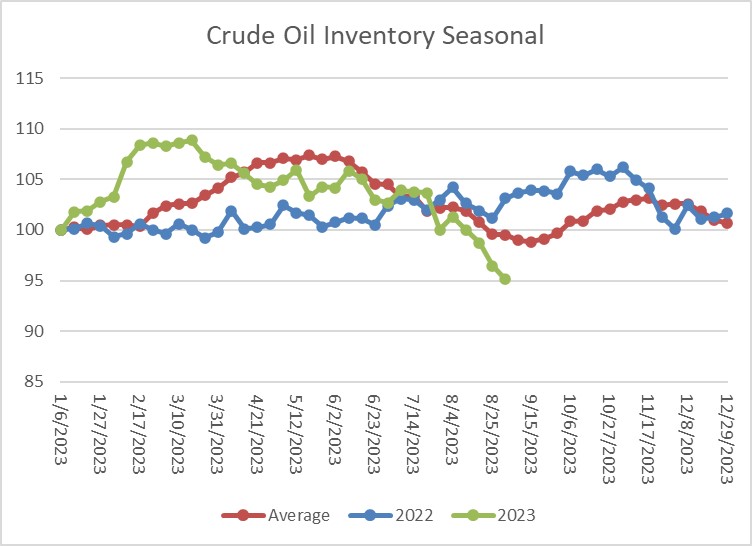

- Rising energy prices pushed headline CPI above expectations in August, leading investors to adjust their interest rate expectations. Consumer prices rose 3.7% from the previous year, above economists’ expectations of 3.5% and July’s reading of 3.3%. The rise was driven by a 5.6% surge in petrol prices from the previous month, which accounted for more than half of the month-over-month increase. Energy prices have picked up following efforts by Saudi Arabia and Russia to prop up oil prices through production cuts. The sudden reversal of inflationary pressures has led to investors’ pricing in a near 50% chance of another hike by the end of the year.

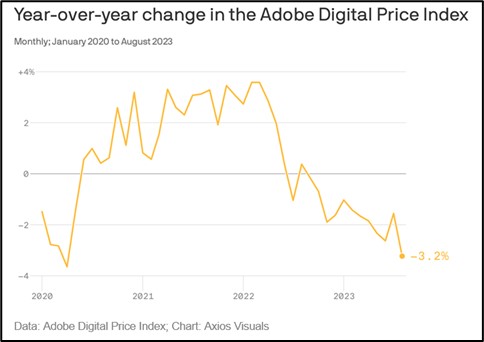

- Despite the recent surge in headline inflation, there are some encouraging signs that underlying inflation pressures may be easing. The year-over-year change in core CPI, which excludes food and energy, fell from 4.7% to 4.3% in August. Meanwhile, the frequently cited core services inflation, which excludes goods and shelter, also eased in August, declining from 3.3% in July to 3.1%. Additionally, supercore inflation, which excludes food, shelter, and energy, rose by 2.2% in the same period but was modestly above its 20-year historical average of 1.9%. Therefore, there is still a case for the Fed to stand pat, at least for now.

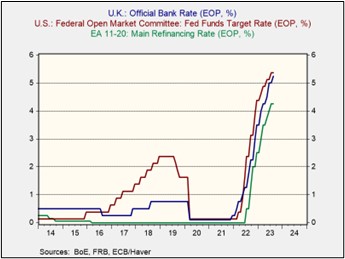

- The latest CPI report is unlikely to have a significant impact on the FOMC’s decision of whether to keep interest rates unchanged during its next meeting on September 19-20. Although policymakers have not commented on how they would vote in the meeting, members have expressed concern regarding the level of tightness in the labor market. The committee is 25 bps shy of meeting its fed funds target outline in the latest dot plots. As a result, we will be paying close attention to the latest FOMC projection materials and Fed speeches for evidence of the committee’s thinking on future rate hikes.

Policy Pushback: Economic woes are prompting policymakers to reconsider rate hikes amid slowing output and lawmaker complaints.

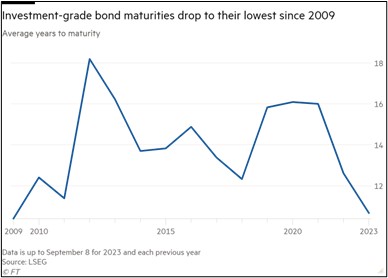

- The European Central Bank (ECB) raised its benchmark policy rates by 25 bps on Thursday. The increase comes amidst signs that inflation is starting to return to normal but still remains well above the central bank’s 2% mandate. Despite the decision to tighten monetary policy, markets believe that the central bank is likely finished hiking rates. During the press conference, ECB president Christine Lagarde suggested that rates are currently in sufficiently restrictive territory but stopped short of ruling out an additional hike. As a result, the euro (EUR) fell against the USD and Japanese yen (JPY).

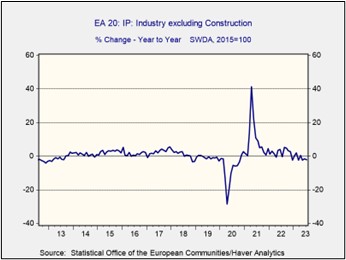

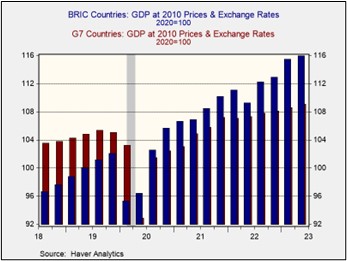

- Unlike the United States, the eurozone economy is more fragile, partly due to its greater reliance on exports, which are being hurt by China’s economic slowdown. European Central Bank officials downgraded their growth expectations for the next three years and hinted at the possibility of recession. At the same time, high interest rates have hurt manufacturing activity throughout the bloc, with industrial production falling 2.2% from the prior year in August. These troubles are not likely to go away anytime soon as the ECB projects that rates will likely stay above 3% in 2024, making it harder for them to justify rate cuts.

- Meanwhile, European governments have begun to express their frustration with the ECB’s tight monetary policy. Italian Prime Minister Giorgia Meloni has doubled down on a windfall tax on Italian banks (against the wishes of the ECB Governing Council) in a bid to prevent the banks from profiting at the expense of households due to monetary policy. A similar measure passed in Spain is currently being challenged in court. As the effects of the rate hikes start to work their way through the economy, policymakers will likely face political pressure to cut rates, thus leading to more downward pressure on the EUR.

Return of the Industrial State? Governments are becoming more assertive in protecting domestic industries as the world begins to fracture into blocs.

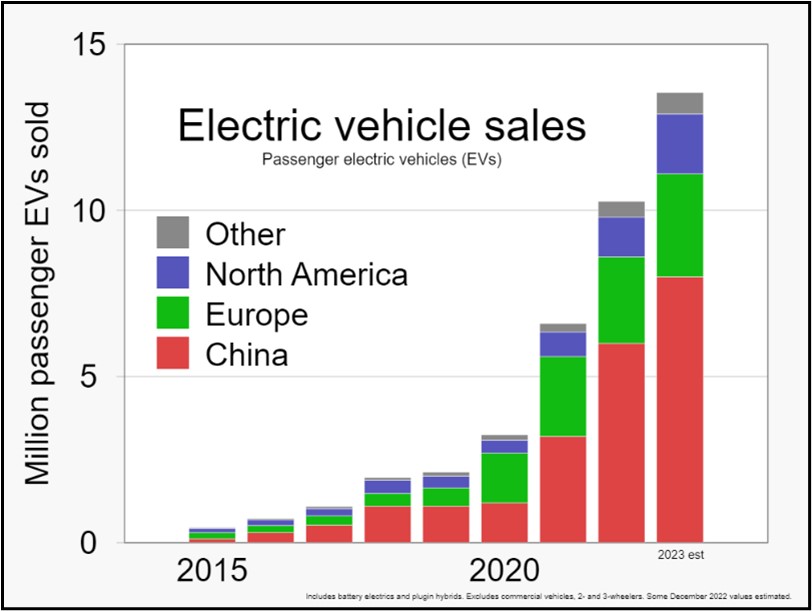

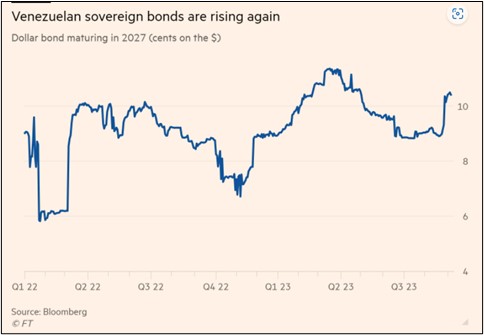

- The G-7 are increasingly becoming more protectionist as they look to prevent China from dominating the electric vehicle market. On Wednesday, European Commission President Ursula von der Leyen announced that the EU will launch an investigation into allegations of the Chinese dumping of electric vehicles. The probe paves the way for tariffs on foreign manufacturers that are in breach of trade rules. In the U.S., where there is already a 27.5% levy on Chinese made cars, regulators are considering a possible crackdown on EV battery imports from China, as lawmakers are trying to deter American carmakers from relying on China for the critical components of their vehicles.

- The pressure to reduce reliance on Chinese green technology is being driven by governments’ desire to avoid a repeat of the solar panel industry in the 2010s. During this period, Chinese companies backed by state aid undercut domestic producers, forcing many solar companies in the U.S. and Europe into insolvency. Given China’s dominance in EV batteries, automakers may be at risk of a similar outcome. China controls 76% of global battery cell production capacity and accounts for two-thirds of the world’s registered electric vehicles. Concerns over American supply chain exposure to China have led lawmakers to pressure Ford Motor Company (F, $12.64) to abandon its use of Chinese technology for its batteries.

(Source: Wikimedia Commons)

(Source: Wikimedia Commons)

- Governments in advanced economies are likely to play a more active role in the economy than investors are used to, reflecting a long-term trend of supporting domestic firms to compete with foreign competitors. This is already evident in the Inflation Reduction Act, which uses tax subsidies to build domestic manufacturing in the U.S., and in similar incentives offered by the EU. While this shift may help businesses subsidize their research efforts, it could also lead to higher inflation and borrowing costs due to inefficiencies associated with firms being unable to use outside suppliers.

(Source: Barchart.com)

(Source: Barchart.com)

(Sources: DOE, CIM)

(Sources: DOE, CIM)

(Source: Barchart.com)

(Source: Barchart.com)

(Sources: DOE, CIM)

(Sources: DOE, CIM)