Asset Allocation Bi-Weekly – Reflections on Inflation (February 13, 2023)

by the Asset Allocation Committee | PDF

[Note: There will be no accompanying podcast with this report.]

Several advisors and their clients have been asking questions about inflation, which suggests there is a degree of uncertainty surrounding the issue. This uncertainty is understandable as inflation is a very complicated subject and, unfortunately, economic theory has oversimplified inflation to the point where it can seem mechanical. For example, an increase in the money supply and/or strong economic growth doesn’t always lead to inflation, but theory would suggest it should. On the other hand, sometimes these factors do lead to inflation. In the absence of a definitive working theory of inflation, confusion shouldn’t be a surprise.

We won’t offer a definitive theory of inflation in this short report, but we will make some observations that will hopefully shed some light on the situation. First, it’s important to have working definitions of topics. The Consumer Price Index (CPI) measures the cost of living, while inflation measures the rate of change in the cost of living.

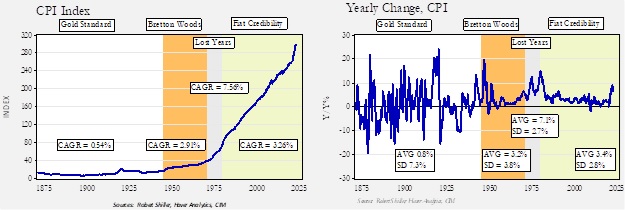

The chart on the left shows the CPI beginning in 1871, and the chart on the right depicts the yearly rate of change (inflation). On both charts, we have labeled four different monetary regimes. On the far left is the Gold Standard. It yielded cost of living stability, and over time, the level of the index barely budged. However, the chart on the right shows the rate of change in the index (inflation or deflation), indicating that price volatility was the main feature of the Gold Standard years. Because the money supply was mostly fixed, industrial expansion often led to deflation. During wars, or when new gold mines were discovered, the influx of new money or the increase in velocity (wars boost spending) led to spikes in inflation. Note the standard deviation in this period was a whopping 7.3%.

The second regime was Bretton Woods, which was a quasi-gold standard. The dollar was convertible to gold, and other currencies were fixed against the dollar. In theory, this system created an anchor, with the idea that the U.S. couldn’t abuse its reserve currency position because foreigners could demand gold for their dollars. In practice, the U.S. was only partially constrained by the restriction of gold convertibility. Capital controls were a key feature of this era.[1] But the advent of the Eurodollar market created a way to circumvent capital controls and accelerated the end of Bretton Woods. Still, in terms of price and inflation control, the system led to higher, but much less volatile, inflation.

The third regime, known as the Lost Years, emerged when President Nixon ended gold convertibility. Although the Eurodollar market was undermining the system, Nixon didn’t want to curtail fiscal spending or the Fed to trigger a recession going into the 1972 election. The decision unmoored the dollar and convinced foreigners that the U.S. would not inflict austerity in order to protect the value of the dollar. In other words, American policymakers would protect the domestic economy to the detriment of foreigners.[2] The greenback entered a deep bear market, and inflation roared. Interestingly enough, the standard deviation actually fell, suggesting that prices were rising at a steady clip.

The fourth era, which we call Fiat Credibility, is the current regime. Paul Volcker was a key figure in this regime. Although he is credited with bringing down inflation by forcing two recessions on the economy, perhaps his greatest contribution was that his policies signaled that the U.S. would implement austerity (at least monetary austerity) and would be willing to put the country into a deep downturn to curtail inflation. In other words, Volcker signaled that, to bring inflation under control, the U.S. would offer some degree of protection to foreign investors. The dollar soared, and combined with deregulation and globalization, inflation remained at bay.[3] Monetary policy had two pillars: a defined inflation target (usually 2%) and central bank independence, both seen as necessary to implement austerity.

This history shows that low inflation isn’t the same as cost-of-living stability. During the Gold Standard, the broad index of prices didn’t change much over time, although year-to-year the swings could be large. The Fiat Credibility era showed that steady price increases can be tolerated. But make no mistake about it—prices generally rise. When Chair Greenspan was asked to define price stability, he stated that it is an inflation level low enough to where the general price level isn’t taken into consideration when making investment or purchasing decisions. However, this isn’t cost-of-living stability; instead, it’s a pace of price increases deemed to be tolerable.

Ultimately, inflation becomes a problem when businesses and households think it’s a problem. When inflation begins to affect purchasing and investment decisions, the very act of protecting oneself from higher future inflation creates an adverse feedback loop of ever-increasing inflation. For example, a business estimating a project will build in an inflation estimate for materials, thereby increasing the cost to the buyer. Consumers, seeing higher prices, begin to protect themselves by hoarding goods. Accordingly, businesses may react similarly, causing rising inventories. Consumers will also tend to buy sooner rather than later, which can feed into demand and exacerbate inflationary pressures.

Central bankers believe that 2% inflation is tolerable, and thus, have established public targets for that rate. However, there isn’t anything to prove that 2% inflation has this unique characteristic. It’s just as possible that 3% might lead to the same outcome, or it’s also possible that any target rate might lead to the perception of price stability.

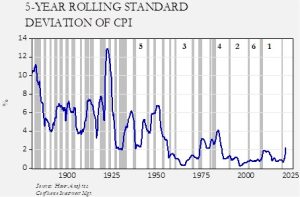

This chart shows the rolling five-year standard deviation of the yearly change in CPI. We have numbered business cycles by their length in rank order. In general, there is a tendency to see long expansions when price volatility is below 2%. This chart suggests that the pace of price increases may matter less than the dispersion. Note that in the Gold Standard years, recessions were common, but ultimately, what households and businesses want is the absence of recessions. It is quite possible that the 2% target isn’t “magic”; instead, inflation stability may be the more important goal.

Sadly, in a world that is resetting supply chains, inflation volatility is much more likely. This is because the end of the 1990-2020 period of hyper-globalization will likely lead to a steeper aggregate supply curve which means greater inflation volatility. If so, maintaining the 2% target may be excessively costly to the economy and, in fact, may lead to more frequent recessions and higher inflation variation.

[1] This feature also allowed governments to implement high marginal tax rates on high earning households. It was difficult to avoid taxes by shifting money abroad.

[2] Hence the famous quote, “The dollar is our currency, but it’s your problem.”

[3] That is, until recently.