by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a note on Congress’s passing of the last funding bills for the federal government on Friday and the resulting political clashes in the Republican Party. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including an aggressive new European Union antitrust probe into several top US technology firms and new data showing strong investor interest in US corporate bond funds.

US Politics: On Saturday, the Senate passed the last of the bills funding the federal government through the end of the fiscal year on September 30, sending the bills to President Biden to sign into law to avoid a partial shutdown of the government. Despite that victory, passage of the bills in the House on Friday with almost unanimous support from the Democrats and a minority of the Republicans has left the chamber in disarray. As a result, the Republican majority in the chamber has narrowed to the point where the Democrats could take control.

- Far-right, hardline Republicans in the House are enraged that Speaker Johnson allowed a vote on the spending plan that was a compromise agreed to by President Biden and House leaders last spring. Republican Rep. Marjorie Taylor Greene of Georgia filed a motion to vacate the leadership, serving notice that Johnson could be ousted.

- Perhaps more important, Republican Rep. Mike Gallagher of Wisconsin announced he will leave Congress early in mid-April. That will leave the Republicans in the House with a majority of just one, meaning they could easily fail to push the Republican agenda in the chamber and could lose their majority if just one more Republican member leaves Congress early.

- To the extent that voters see the Republicans in the House as dysfunctional, the drama is a reminder that former President Trump does not necessarily have a lock on the November election, despite current polling showing that he has a slight advantage in public support. It remains too early to tell whom the next president will be.

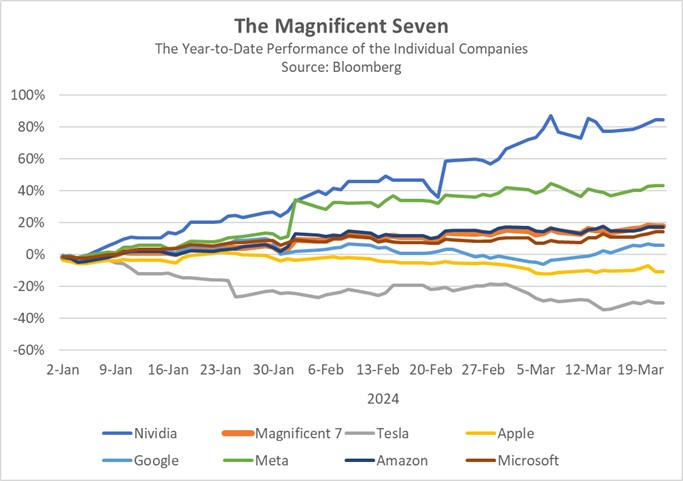

European Union-United States: The European Commission today announced it is launching official antitrust investigations into US technology giants Apple, Meta, and Google owner Alphabet. The probes are based on the EU’s new Digital Markets Act, which aims to limit the market power of big, on-line “gatekeeper” platforms. They will focus on whether the firms favor their own apps and how they use personal data for marketing. The probes will raise regulatory risks for a range of technology companies operating in the big European market.

Japan-United States: The Financial Times said yesterday that the US and Japanese governments are preparing to make the biggest upgrade to their security relationship since their mutual defense treaty was signed in 1960. The moves, which are aimed at more effectively fighting China in case of a conflict, will focus on giving US commanders in Japan greater operational authority to improve US-Japanese joint operations.

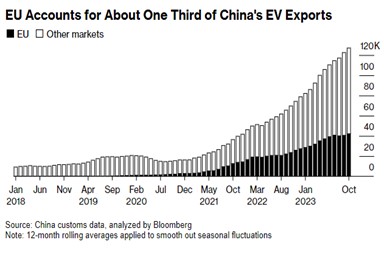

China-United States: In yet another sign of economic decoupling brought on by US-China tensions, Beijing has issued new procurement guidelines that will phase out the use of foreign technology in government computers and servers. For example, the new rules will outlaw computer chips from Intel and AMD, as well as operating and database software from Microsoft. Instead, the government will seek to buy more Chinese-made technology, further limiting Chinese market opportunities for Western companies.

China: In his keynote address to the China Development Forum yesterday, Premier Li Qiang tried to assure top foreign business leaders that the government is focused on removing obstacles to foreign investment in China. Li specifically mentioned key issues such as fair market access, public contracts, and cross-border data flows. Nevertheless, we suspect that the range of entrenched structural headwinds in China will continue to weigh on foreign investment in the coming years.

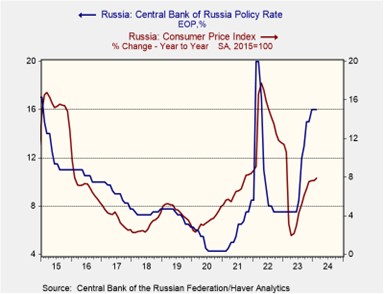

Russia: The death toll from Friday evening’s attack by Islamic State on a crowded concert near Moscow has now surpassed 130. Russia officials say they have arrested 11 people involved in the attack, including the attackers themselves. Importantly, Russian officials continue to push a narrative that the Ukrainian government was involved, potentially with the intention to use the attacks to justify stepped-up aggression against Ukraine.

- Despite a laudable US effort to warn the Russians about the attacks ahead of time, we have seen little or no indication that the Kremlin respected the warnings or appreciated the US effort to avert civilian casualties.

- The fact that the attackers were able to carry out their plans despite the US warning to Russia suggests the Russian security services did not take the US warnings seriously and/or were incompetent in trying to stop the attacks.

Brazil: New reporting shows left-wing populist President Lula da Silva is stepping up his interference in major companies. For example, Lula reportedly forced partially state-owned oil giant Petrobras to backtrack on a plan to issue extraordinary dividends earlier this month. The move helped push the company’s stock price by some 10% in a single day. The moves are reviving concern that state intervention will eventually undermine Brazilian economic growth and prompt investors to flee the market.

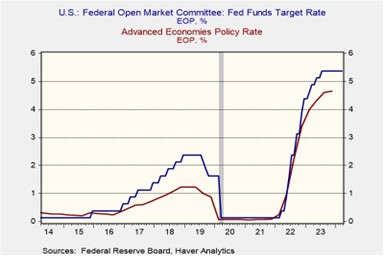

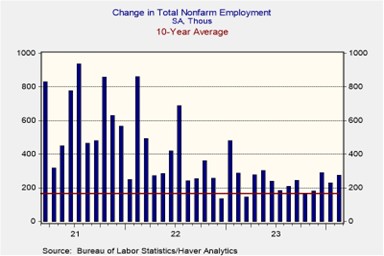

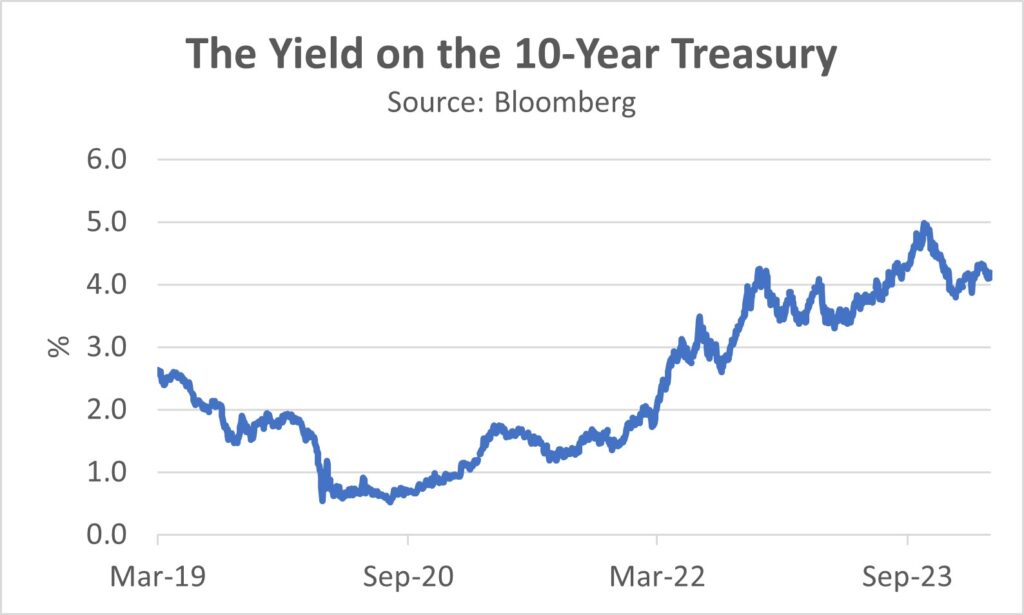

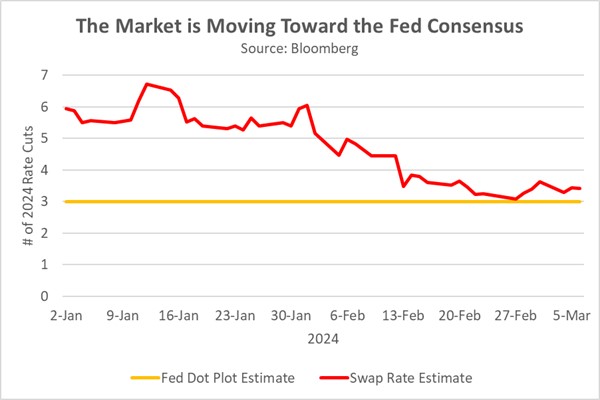

US Bond Market: New data from fund tracker EPFR shows investors have channeled about $22.8 billion into exchange-traded funds focused on corporate bonds so far this year, marking the first positive year-to-date inflows since 2019. The inflows appear to reflect investors hoping to lock in high yields ahead of the Federal Reserve’s expected interest-rate cuts later this year.

US Media Industry: Axios today carries an interesting article showing that the common news sources of the past have splintered into at least a dozen new information “bubbles” favored by different types of people. For example, the report describes the “Instagrammers” bubble as consisting mostly of young to middle-aged women in college and the professional class. In contrast, it describes the “Right-wing grandpas” bubble as mostly male older people who still watch Fox News, especially in prime time.

- It can be fun to read the article and ask yourself which bubble you fit into, or which bubble your family members or co-workers favor.

- On the other hand, the article illustrates the cleavages and mutually exclusive information sources that are driving political discussions these days. As people sink into their own bubble and keep themselves insulated from alternative viewpoints, the concern is that the new media landscape increases polarization and makes the country harder to govern.