Asset Allocation Bi-Weekly – Part-Time Troubles (July 31, 2023)

by the Asset Allocation Committee | PDF

The job market has greatly surpassed the expectations of leading experts so far this year. Back in December, a Bloomberg survey found that economists predicted that monetary policy tightening by the Federal Reserve would push the country into a recession in the first half of 2023. They estimated that payrolls would decline in the second and third quarters and the unemployment rate would rise to 4.9% by 2024. However, these predictions have proven to be decidedly premature. Against all odds, the economy has added 1.29 million jobs in the first six months of the year, well above its historical average. Meanwhile, the unemployment rate currently stands at 3.6%, nearly a 50-year low. While these labor market indicators inspire optimism, we suspect that the economic situation may be a bit more complex.

Last month, the rate of underemployed individuals experienced a significant acceleration and reached its fastest pace since the onset of the pandemic. Part-time employment for economic reasons rose 15.4% from the prior year, raising concerns about the true state of the labor market. The only other time the underemployment rate has risen at this speed without an economic downturn was in 1967, when swaths of workers went on strike. Comparatively, part-time work for noneconomic reasons has increased by only 2.96% in the same period. Hence, the increase in underemployment may not be explained by workers choosing to work part-time for personal reasons, such as caring for children or elderly relatives.

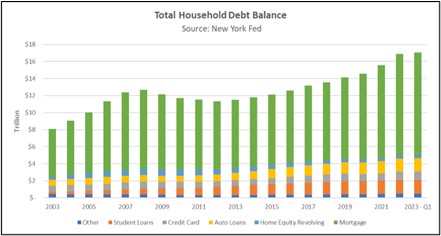

The rise in the number of workers resorting to part-time work might be indicative of households facing financial hardships. Despite the Federal Reserve’s attempt to tighten monetary policy to curb the level of debt accumulation, household liabilities have reached new heights. According to the most recent quarterly report on household debt and credit from the Federal Reserve Bank of New York, consumer debt has surged to reach a 20-year high. This suggests that borrowers are relying on costlier forms of debt to cover their everyday expenses.

An abundance of job openings could possibly be concealing the growing financial distress. In the aftermath of the pandemic, there was a sizable drop in the labor force as many older workers retired, which left a gap in the labor force. In May, there were nearly 4 million more job openings than there were workers available to fill them. However, this surplus of available job opportunities was not evenly distributed as many of the new openings have come from industries that offer below-average wages. According to the Bureau of Labor Statistics, sectors like leisure and hospitality and retail trade collectively accounted for a quarter of the job openings in May. So, just because jobs are being created does not mean financial conditions are improving.

Looking beyond job openings, it becomes evident that firms are actively seeking ways to reduce their overhead costs. Some firms have begun cutting work hours, while others are considering layoffs. A report released by Challenger, Gray & Christmas, a global outplacement and business and executive coaching firm, found that businesses issued 458,209 warning notices for job cuts in the first six months of 2023. This is a 244% increase from the 133,211 cuts reported during the same period in the previous year. These cuts have primarily targeted the technology and financial sectors, suggesting that the increase in part-time work may be related to workers facing challenges in their job searches and potentially settling for lower-level positions until they can secure more suitable employment.

While the sudden acceleration in the rate of workers taking on part-time work for economic reasons is indeed troubling, it is crucial not to draw too strong of conclusions. Examining other indicators of labor underutilization reveals that even when factoring in part-time workers, the job market remains resilient. Additionally, while debt-to-income and debt-service ratios have risen from their pandemic lows, they are still well below the levels seen prior to the Great Financial Crisis.

However, it is important to pay attention to deviations from historical norms, such as the unprecedented change in the rate of people taking on part-time work. These divergences can provide insights into future shifts within the business cycle. As the data continues to offer mixed signals about the health of the U.S. economy, we will continue to broaden our approach and remain attentive for possible signs of trouble or improvement.

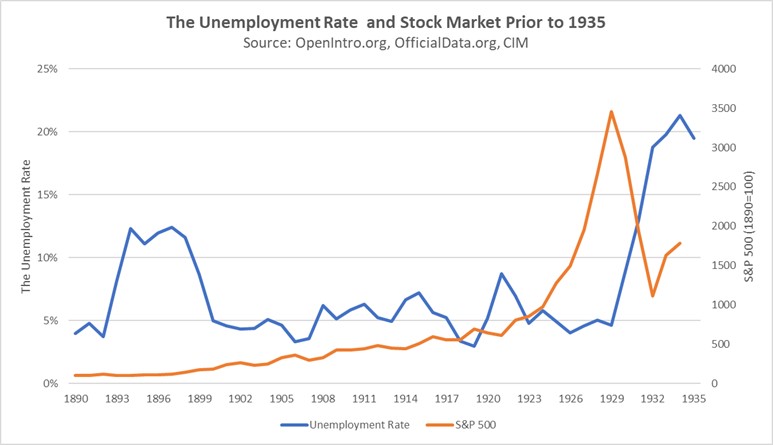

History shows us that investors who become overly confident that a recession has been successfully avoided are often tempted to take unwarranted risks that can ultimately harm their portfolios. As John Kenneth Galbraith’s book, The Great Crash, 1929, reminds us, identifying an impending recession is not always straightforward even for experts. In the book, he describes how the Harvard Economic Society went from being mildly bearish in early 1929 to bullish by the summer:

“By wisdom or good luck, the Society in early 1929 was mildly bearish.

Its forecasters had happened to decide that a recession (though assuredly

not a depression) was overdue. Week by week they foretold a slight setback

in business. When, by the summer of 1929, the setback had not appeared, at

least in any very visible form, the Society gave up and confessed error.

Business, it decided, might be good after all.”

The events leading up to Black Thursday on October 24, 1929, demonstrated how even an apparently strong economy, characterized by low unemployment and a thriving stock market, can still be susceptible to an unforeseen downturn.

While we are not currently predicting a major recession, we are cautious about ruling out the possibility of an economic downturn altogether. The significant increase in part-time workers due to economic reasons is one example of potential vulnerabilities within the labor market. Additionally, the mounting debt burden of households and rising borrowing costs could foreshadow challenges ahead. In light of these uncertainties, we advise investors to approach recent strong and positive economic data with cautious optimism. While the current indicators may appear promising, it is essential to remain vigilant and recognize that the future remains uncertain.