Daily Comment (August 2, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a discussion of Fitch’s decision to cut the U.S. government’s bond rating to one notch below its highest score. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including news of possible new U.S. restrictions on Chinese semiconductors and rising global food prices as Russia attacks Ukraine’s grain-export facilities.

U.S. Treasury Market: After market close yesterday, Fitch Ratings cut its assessment of U.S. Treasury bonds to AA+, down from its top rating of AAA. Fitch attributed the downgrade to growing U.S. fiscal deficits, high debt, and political dysfunction. The Fitch downgrade is the first such action by a ratings firm since a similar move by Standard & Poor’s in 2011.

- At this point, it appears the downgrade has not produced any considerable disruptions in the Treasury market. We have not been able to identify any major Treasury holder that would be forced to sell the obligations because of the downgrade. Other analysts and observers that we track also seem to be taking a relatively sanguine view of Fitch’s actions. Indeed, so far this morning, Treasury prices are up across almost the entire yield curve, pushing yields lower. The yield on the benchmark 10-year note has fallen slightly to 4.014%.

- Nevertheless, having two of the three major bond assessment firms rating the U.S. government below their top rating has the potential to erode faith in Treasury obligations over time, potentially driving up yields in the future. More immediately, the rating cut has undermined sentiment toward risk assets today, and major stock market indices are modestly lower.

United States-China: U.S. officials are growing concerned that China is rapidly ramping up its production of less-advanced, highly commoditized semiconductors in order to dump them on the world market and put competitors in the U.S.-led bloc out of business, as it has done with solar panels and other industries. That would put China in control of the important market (even though the semiconductors at issue are relatively less advanced, they are still critical to a wide range of industries).

- The Chinese move could be retaliation for the Biden administration’s draconian crackdown on selling advanced semiconductor technology to China last October.

- U.S. officials are reportedly starting to consider moves to block the Chinese threat, but no measures are imminent.

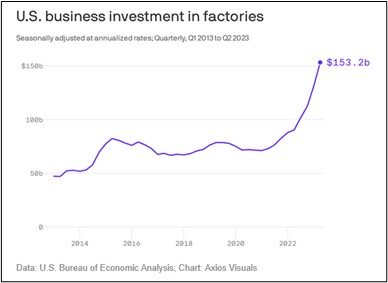

U.S. Industrial Sector: Consistent with our recent analyses, incoming data points to continued strong investment in new factory construction. Data out yesterday showed that nonresidential construction (which would include manufacturing facilities) rose 17% in the second quarter from the previous three months. According to last week’s report on gross domestic product, second-quarter business investment in “manufacturing structures,” aka factories, was up nearly 70% from the same period one year earlier.

Russia-Ukraine War: Russia launched another salvo of missile and drone strikes against Ukrainian port facilities and grain storage infrastructure last night, partially reversing the decline in key grain prices over the last week or so. Nearby wheat futures are trading up 1.1% to $6.5925 per bushel so far this morning, while corn futures are up 0.5% to $5.0925 per bushel.

- Just as important, we note that the facilities Russia struck last night are on the Danube River, just across from NATO-member Romania. On top of that, the Polish government yesterday said military helicopters from Russian ally Belarus violated its airspace, forcing Poland to rush more of its armed forces to the border.

- The Russian attacks on Ukraine’s grain facilities are raising the prospects for accidental damage to Romanian territory, which would threaten to bring NATO forces directly into the conflict.

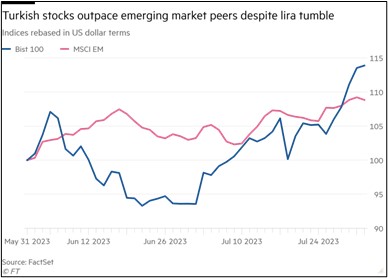

Turkey: Now that President Erdoğan has won re-election and is shifting his economic policy in a more orthodox direction, foreign purchases of Turkish stocks have rebounded and helped push the country’s stock market indices higher. Adding fuel to the fire, the policy change has pushed the lira (TRY) sharply lower, adding to inflation pressures and pushing more Turks into the market. With strong buying from both foreign and domestic investors, the benchmark BIST 100 stock price index is up 46% since the end of May in TRY terms, and 14% in USD terms.

India: Ethnic and religious violence has been surging in India in the run-up to next year’s elections, in which Prime Minister Modi and his Hindu-nationalist Bharatiya Janata Party will be trying to retain power. In the latest incident, Hindu-Muslim clashes broke out on Monday near a key business district on the outskirts of New Delhi. The growing violence threatens to undermine investors’ recent focus on India as they pivot away from China because of its slowing economic growth, state interference in the economy, and tensions with the West.