Daily Comment (July 27, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a summary of the Federal Open Market Committee’s policy rate decision and our views on the path of rates going forward. Next, we provide an overview of the European Central Bank’s monetary policy decision. Finally, we give an update on the war in Ukraine.

Close to the Vest: The Federal Reserve has kept its options open on future rate hikes after lifting rates to a 22-year high but has explicitly ruled out any cuts in 2023.

- The Federal Open Market Committee (FOMC) raised its policy target range by 25 basis points to 5.25%-5.50%. In a press conference following the decision, Chair Jerome Powell said that the committee would take a data-dependent approach to future rate hikes. While the committee welcomed the recent progress in declining price pressures, Chair Powell noted that he did not believe inflation would return to its target of 2% until 2025. Last month, the overall Consumer Price Index (CPI) rose 3.0% from the previous year, while core CPI rose 4.8%.

- Markets were relatively muted following the Federal Reserve’s policy decision on Wednesday, as traders were unsure of the central bank’s future plans. The S&P 500 closed down 0.02%, while the yield on 10-year Treasuries declined by a mere 3 bps. Chair Powell’s reluctance to commit to further rate hikes weighed on the dollar, as it reaffirmed investors’ belief that the European Central Bank (ECB) and Bank of England may be more aggressive in tightening monetary policy over the next few meetings. As a result, the U.S. Dollar Index (DXY) ended the day down 0.32%.

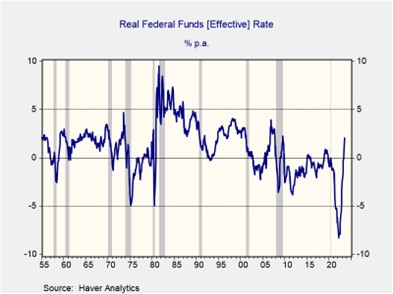

- The Fed’s rate-hiking cycle is nearing its end. The committee has already pushed rates into restrictive territory, and it is unlikely that every member will be able to tolerate further increases in 2024. Real interest rates, which measure the interest rate after inflation has been removed, are currently at their highest level since the end of the financial crisis. According to former Richmond Fed President Jeff Lacker, a real fed funds rate between 2% and 4% is needed to bring inflation down to the Fed’s 2% target. The real fed funds rate was around 2.1% before the July FOMC meeting, which suggests that the interest rates may already be sufficiently high.

No Surprises: Similar to its American counterpart, the European Central Bank has stated that it will keep its options open when deciding further rate hikes.

- The ECB’s governing council voted to increase its benchmark interest rates for the ninth consecutive time, by 25 basis points. It has raised interest rates by 425 basis points since last July, as it seeks to bring inflation under control. The hikes have come even as the eurozone economy is showing signs of slowing, with growth expected to be around 1% in 2023. During her press conference, ECB President Christine Lagarde insisted that the bank is still dedicated to achieving its mandate of price stability, while acknowledging that the committee will be data dependent going forward.

- The European Central Bank faces a difficult balancing act as it tries to raise interest rates to combat inflation without tipping the eurozone into recession. The region narrowly avoided a technical recession in the previous quarter, and there are signs that tightening credit conditions are already having an impact on consumption. According to the ECB bank lending survey, demand for loans by firms and households slowed in the second quarter of 2023. Additionally, manufacturing activity has stagnated showing no signs of improving, and the energy outlook continues to look uncertain. El Niño weather conditions are expected to bring more extreme weather events as well as lower temperatures in the winter months, which should hurt household budgets.

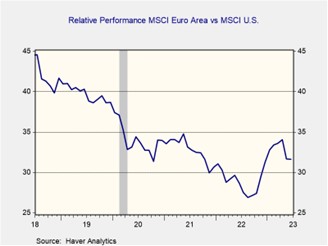

- As the chart above shows, there has clearly been a shift in sentiment regarding European assets. Expectations of slower economic growth and higher inflation in the eurozone have contributed to the outperformance of U.S. equities relative to European assets. Given the uncertainty regarding the state of the global economy as well as the possibility of a weaker dollar, it is still unclear whether this trend will continue throughout the year. The current environment shows that international equities still offer relative value, especially given that the recent rally in large-cap assets has pushed stock valuations to near-cycle highs.

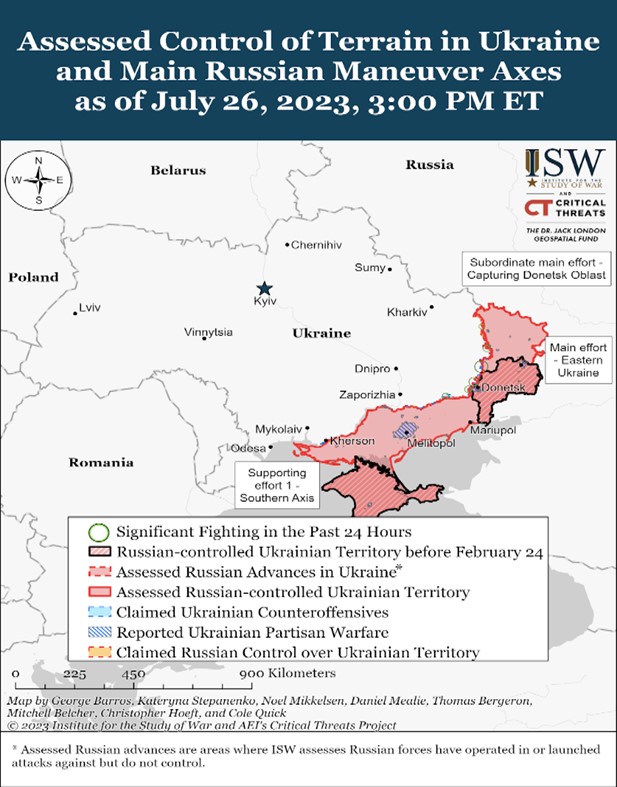

Next Stage: Ukraine forces are switching tactics, while Moscow is doubling down on its war efforts.

- Ukraine is in the midst of its much-vaunted counter-offensive, but so far it has not been as successful as officials had hoped. The group has already lost almost a fifth of the NATO kit provided to help the operation. The Ukrainian forces have made much needed changes to improve military efficiency, such as focusing on attacking using heavy artillery fire instead of crossing Russian minefields. However, it is still too soon to tell whether these changes will be enough to break through enemy lines. Western officials are closely watching the situation, and they may decide to send more weapons to Ukraine to help its war effort.

- Meanwhile, Moscow is still looking for new recruits as it seeks to protect its hard-fought gains. The government has introduced a bill that would raise the age of conscription eligibility from 27 to 30. This change, which would not take effect until January 2024, could potentially increase the pool of conscripts by more than 2 million. Russian President Vladimir Putin’s push for more recruits is a sign that he is not ready to give up the war in Ukraine, and it also highlights the growing manpower challenges that Russia is facing.

- All signs point to a protracted war in Ukraine, as both sides battle for leverage. Despite a few setbacks, Kyiv has shown that it is capable of winning this war with the continued support of Western allies. Moscow, on the other hand, has shown that it is willing to continue sacrificing its own people in the hopes of wearing down its opponent. It is likely that it will take an outside power, such as China or the West, to bring this war to an end. As a result, the conflict will continue to present a risk to commodity prices.