Daily Comment (July 31, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with several reports touching on China’s economy and foreign relations. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a modest acceleration in eurozone economic growth and news of an important bankruptcy in the U.S. trucking industry.

China: Financial data provider Preqin reported that China-focused venture capital funds raised just $2.7 billion in the second quarter, down 54.2% from the first quarter. Separately, a Beijing think tank on Friday said total investments in China’s internet sector during the second quarter were down 69.8% from the same period one year earlier. The figures illustrate how global investors, especially those from the U.S., are channeling capital away from China in response to its slowing economic growth, increased government interference in the economy, dire demographics, and increasing geopolitical tensions with the West.

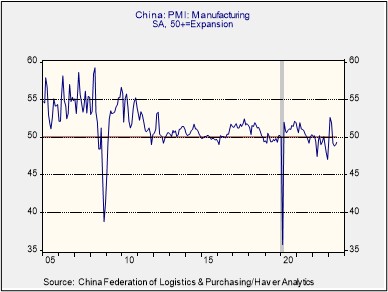

- Separately, the official July purchasing managers index for manufacturing rose slightly to 49.3, beating expectations that it would remain at its June reading of 49.0. Nevertheless, the July reading marks the fourth straight month in which the index was below the level of 50 that points to expanding activity.

- The July nonmanufacturing index fell to 51.5 from 53.2 in June, suggesting that growth in that sector is now at its weakest all year.

China-United States: U.S. military, intelligence, and national security officials now believe the Chinese malware discovered in May within the telecommunications systems on Guam was only the tip of the iceberg. The officials now believe Chinese hackers have inserted well-hidden malware in networks controlling power grids, communications systems, and water supplies that feed military bases in the U.S. and around the world, with the goal of disrupting or slowing U.S. military deployments and resupply operations in a future conflict. If activated, the malware would probably also disrupt civilian communications and economic activity.

- The reports say U.S. officials have been working to hunt down and eradicate the malware, although it isn’t clear how successful they’ve been.

- Even though Western business elites continue to resist “de-risking” or “de-coupling” with China, based largely on their own economic interests, we still think increased Chinese military threats will prompt Western leaders to clamp down further on trade, investment, technology, and personnel flows with the China/Russia bloc over time, raising risks for investors with exposure to China or to companies that are highly dependent on China.

United States-Australia: Over the weekend, the U.S. and Australia struck a deal in which Australian manufacturers, in partnership with U.S. defense firms, will produce missiles and potentially other ammunition for the U.S. military beginning in 2025. The officials also agreed on a further expansion of U.S. military rotations through Australia to help build a bulwark against Chinese geopolitical aggressiveness in the region.

- Among the Western allies, the large U.S. defense industry still has the bulk of the arms production capability. All the same, replenishing equipment and ammunition sent to Ukraine to help it in its defense against Russia’s invasion and rebuilding the U.S. military to deal with the Chinese threat have stretched the weapon makers’ capacity.

- S. defense budgets are rising, but we see increasing evidence that the country will need to rely on innovative new schemes to increase its stockpile of weapons and ammunition in the near term. Relying more on allied producers is clearly one part of that.

- We’ve been arguing that re-industrialization is already becoming apparent in the U.S., and that an increased defense effort will feed into it. We therefore think U.S. industrial stocks are poised for good growth, as are U.S. defense stocks in particular. If the U.S. continues to buy more weapons and other material from allied countries, despite the obvious supply-chain security risks, it suggests there could also be good opportunities in foreign industrials and defense industry stocks.

United States-Japan-South Korea: The White House announced that President Biden will host Japanese Prime Minister Kishida and South Korean President Yoon for a trilateral summit at Camp David on August 18. The meeting will focus on further steps to increase the three nations’ security against the growing threats from North Korea and the rest of the China/Russia bloc in the Indo-Pacific region. The announcement came just as new reports suggest Russia has been buying North Korean missiles and using them in its invasion against Ukraine.

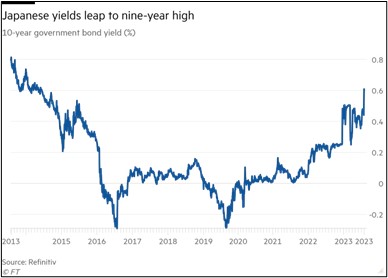

Japan: As global investors continue to digest last week’s move by the Bank of Japan to loosen its yield curve control and allow longer-term bond yields to rise, the yield on 10-year government bonds today rose to a nine-year high of 0.607% before falling back to 0.590% after the BOJ announced unscheduled purchases of 300 billion JPY in five- to 10-year government bonds. Higher bond yields are expected to draw funds back to Japan, driving up the JPY, and the currency so far today is up 0.7% to 142.10 per dollar.

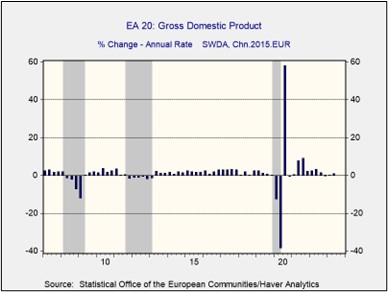

Eurozone: New data today shows second-quarter gross domestic product grew at an annualized rate of 1.1%, still very weak but better than the tiny 0.1% growth rate in the first quarter and a modest decline in the fourth quarter of 2022. The region’s economy continues to struggle with weakening exports to China, high interest rates, and high price inflation.

Chile: On Friday, the central bank slashed its benchmark short-term interest rate by 100 basis points to 10.25%, citing reduced inflation pressure and prospects for weaker economic growth in developed countries. Some major Latin American central banks were among the first to hike interest rates in the current global cycle, helping support their currencies. Responding to the Friday rate cut, the Chilean peso (CLP) so far this morning has weakened 0.9%, trading at 834.77 per dollar.

Niger: Responding to last week’s coup, the Economic Community of West African States warned that if the coup leaders don’t restore Niger’s democratically-elected government to power within one week, the bloc will launch military action to do so. The statement follows calls by the U.S. and France for President Mohamed Bazoum to be restored to power. The coup leaders have rejected those calls, portending a likely period of instability ahead.

U.S. Labor Market: Over the weekend, debt-ridden trucking firm Yellow (YELL, $0.7069) said it has shut down operations and will file for bankruptcy. The move will throw as many as 30,000 employees out of work, including 22,000 members of the Teamsters union. The firm clearly had its own issues, so its failure doesn’t necessarily say anything about the health of the overall economy or the recession that we still think is likely to arrive in the coming months. All the same, the failure may help to soften the labor market slightly.

U.S. Commercial Real Estate Market: Blackstone Real Estate Income Trust, a unit of Blackstone (BX, $105.05) that is also known as BREIT, has reportedly sold some $10 billion in assets since last autumn, allowing it to return $8 billion to investors and raise cash for new investments related to artificial intelligence, such as data centers. The move marks a big turnaround from last autumn, when BREIT’s decision to limit withdrawals helped spark fears of commercial real estate calamity.