by Thomas Wash | PDF

The business cycle has a major impact on financial markets; recessions usually accompany bear markets in equities. The intention of this report is to keep our readers apprised of the potential for recession, updated on a monthly basis. Although it isn’t the final word on our views about recession, it is part of our process in signaling the potential for a downturn.

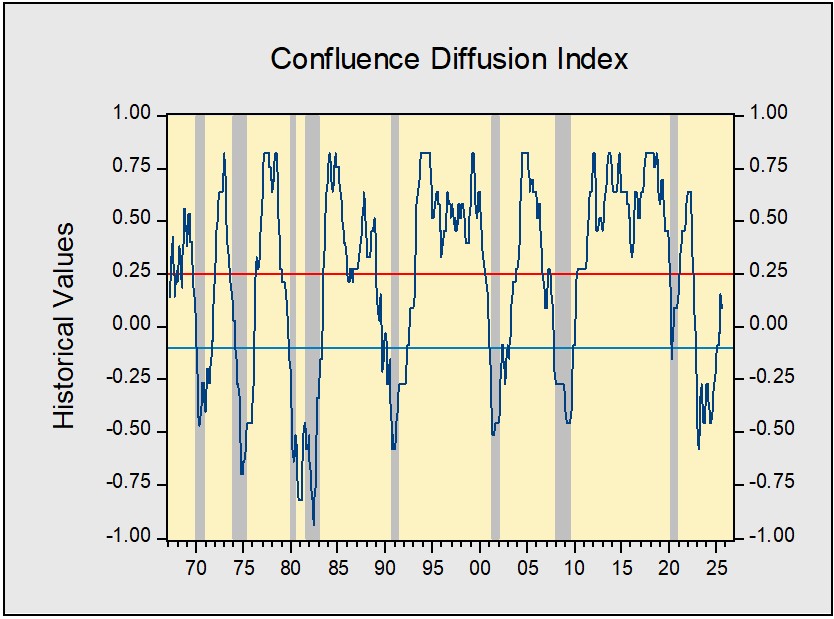

The US economy continued to expand in August, though warning signs are starting to appear. Our proprietary Confluence Diffusion Index remained out of contraction territory for the seventh straight month. Three indicators slipped back into contraction, raising the total number of warning signals to five out of 11. Despite these concerns, both stock and bond markets were bolstered by optimism regarding a potential shift in monetary policy. Signals from the “real economy” remain mixed, with business spending holding up, while households and firms continue to express concerns about the impact of tariffs. The labor market showed a notable slowdown, with firms hiring fewer workers, indicating a weakening in labor demand.

Financial Markets

Investors broadened their focus beyond the Information Technology sector. This shift is supported by growing optimism about the wider economy, driven by strong corporate earnings. Leading the performance charge were the Health Care and Materials sectors. In the bond market, yields have begun to fall as recent economic data suggests the Federal Reserve will prioritize maximum employment over price stability. This change in sentiment is largely due to evidence that the hiring slowdown was more significant than initially estimated, while inflation, though still elevated, has remained roughly in line with expectations.

Goods Production & Sentiment

August’s economic data presented a mixed picture. While new orders continued to show signs of strength, the housing market painted a different story. Housing starts fell last month, in an indication that homebuilders remain hesitant to begin new projects due to ongoing uncertainty in the market. At the consumer level, households expressed growing apprehension about the labor market and persistent concerns over rising prices. Conversely, the business outlook, while still subdued, showed signs of improvement as deliveries have picked up, driven by firms actively rebuilding their inventories.

Labor Market

The US labor market showed further signs of deterioration in August, with hiring slowing to a critical level. For the first time since the pandemic, the number of payrolls has dipped into “contraction” territory, a clear signal that labor demand has weakened. While the unemployment rate remains low, it did tick up slightly from the previous month. Nevertheless, initial jobless claims have remained relatively subdued, suggesting that firms are still reluctant to lay off workers. The shift toward a “low-hiring, low-firing” labor market is a notable trend.

Outlook & Risks

The economy may have lost some of its momentum, but it remains in a good state. The possibility of easier monetary policy and continued investment in AI should provide a lift. We believe the markets will continue to focus on monetary policy and corporate earnings as investors seek reassurance that the economy is not being negatively impacted by tariffs. Consequently, we are cautiously optimistic about risk assets, given the strong underlying fundamentals, but we are waiting for confirmation that this growth is sustainable for the medium term.

The Confluence Diffusion Index for September, which provides a composite view of the economy based on 11 benchmarks, remains in expansionary territory according to August data. The index’s value fell from +0.1515 in July to +0.0909 in August, but it is still well above the recovery signal threshold of −0.1000. This shows that while the economy continues to expand, the breadth of that expansion is narrowing. This is further evidenced by the fact that five of the 11 benchmarks are now in contraction, an increase from just two last month.

- Job growth concerns led to a flattening of the yield curve.

- Consumer sentiment is being weighed down by job uncertainty.

- The labor market appears to be in a phase of “low hiring and low firing.”

The chart above shows the Confluence Diffusion Index. It uses a three-month moving average of 11 leading indicators to track the state of the business cycle. The red line signals when the business cycle is headed toward a contraction, while the blue line signals when the business cycle is in recovery. The diffusion index currently provides about six months of lead time for a contraction and five months of lead time for recovery. Continue reading for an in-depth understanding of how the indicators are performing. At the end of the report, the Glossary of Charts describes each chart and its measures. In addition, a chart title listed in red indicates that the index is signaling recession.