by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with energy industry warnings about insufficient oil supplies in the coming years, which is consistent with our positive outlook for commodity prices once the economy gets past the impending recession. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including an overview of Federal Reserve Chair Powell’s testimony before the Senate Banking Committee yesterday. Powell continues his semi-annual testimony today at 10:00 AM EST before the House Financial Services Committee.

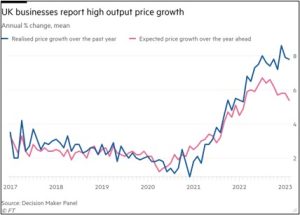

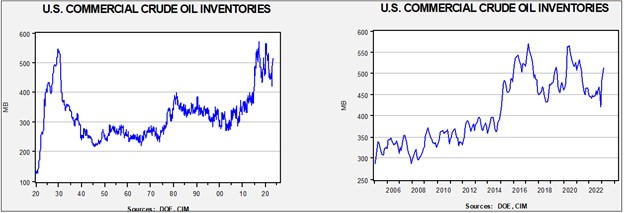

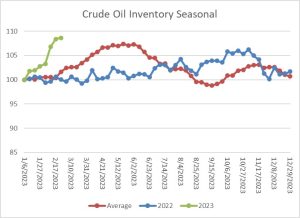

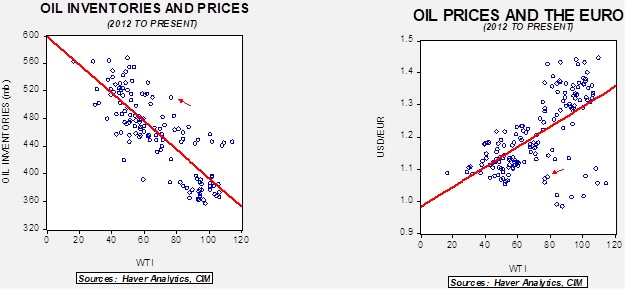

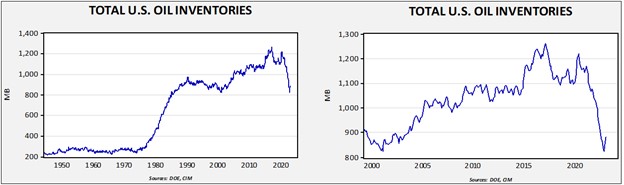

Global Oil Supplies: Energy industry leaders attending the annual CERAWeek conference in Houston have been warning that rising exploration and production costs and investor pressure to return cash to shareholders will crimp the growth of future shale oil supplies, leading to higher oil prices in the future. The assessment is consistent with our view that commodities, in general, and mineral fuels, in particular, are likely entering a period of elevated prices and good returns due to geopolitical frictions, deglobalization, and insufficient investment.

Russia-Ukraine War: After U.S. and German media reports suggested that a “pro-Ukrainian” group was responsible for last September’s bombing of the Nord Stream 1 and 2 natural gas pipelines under the Baltic Sea, a top Ukrainian official denied that his government had any involvement in the attack. Nevertheless, German officials today detailed some aspects of their investigation that seem to point in the same direction as the media reports.

- All the same, the media reports do sound plausible, given that the pipelines running from Russia to Western Europe were key to building Europe’s dependence on Russian energy. Putting the pipelines out of commission has helped accelerate the Continent’s rapid shift away from Russian energy sources and arguably helped buttress Western Europe’s ability to support Ukraine in its defense against Russia’s invasion. The bombings were, therefore, certainly in Ukraine’s interest.

- An important question remaining is whether Ukrainian special forces or intelligence operatives had the expertise and equipment needed to carry out the attacks without being detected. A further question would be whether they had any help from the U.S. or other countries.

Georgia: Mass protests and rioting have broken out in the capital of Tbilisi after the government’s proposed “foreign agent” law passed its first reading in parliament. The draft law is modelled on Russian President Putin’s restrictive regime for media and non-governmental organizations. For example, it would deem any Georgian media organization or NGO receiving more than 20% of its funding from foreign sources as a “foreign agent” and would subject it to undefined “monitoring.” The controversy will further sour relations between Georgia and the EU, making it more difficult for Georgia to eventually become a member of the bloc.

United Kingdom: Prime Minister Sunak has unveiled a proposed new law that would significantly toughen the U.K.’s approach to illegal migration into the country. The legislation would impose a legal duty on the home secretary to remove irregular migrants to a “safe” third country or to their country of origin. It would also bar any migrant deemed to have entered the U.K. illegally from ever claiming asylum in the future. Although British officials insist the legislation would be consistent with international law, the fact that it contravenes European standards means it could worsen U.K.-EU tensions again, despite Sunak’s apparent success in renegotiating the Brexit treaty’s Northern Ireland Protocol.

China: At the Chinese government’s big “two sessions” meetings yesterday, President Xi presented a major bureaucratic reorganization aimed at solidifying the Communist Party’s control over the agencies of state power and accelerating the country’s technological and financial development. Among other initiatives, the plan would:

- Cut the government’s workforce by 5% across the board;

- Shift some responsibilities of the Ministry of Science and Technology to other agencies in order to make the ministry more focused on spurring scientific and technological innovation;

- Establish a national data bureau to regulate the control and use of information, which is expected to be the lifeblood of China’s evolving artificial-intelligence driven economy;

- Consolidate the existing banking and insurance regulatory bodies into a new State Administration for Financial Supervision and Administration which would also absorb some functions from other agencies, such as the central bank’s oversight powers over financial holding companies and the securities regulator’s investor protection duties;

- Resurrect the Communist Party’s Central Financial Work Commission to oversee the government’s financial regulation effort and ensure it conforms to Party priorities.

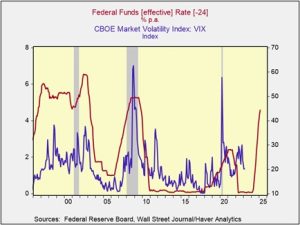

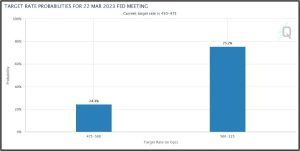

U.S. Monetary Policy: In the first day of his semi-annual testimony before Congress, Fed Chair Powell told the Senate Banking Committee yesterday that since recent data on demand, employment, and inflation had come in hotter than expected, monetary officials would likely hike interest rates further than previously anticipated. Even more concerning for the financial markets, Powell said that “If the totality of the [upcoming] data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

- In other words, Powell was signaling that the policymakers could return to hiking rates at an aggressive pace of 50 basis points per policy meeting, as they had been doing over much of the last year before slowing the pace to 25 bps at the last meeting.

- Investors quickly repriced a range of financial assets to reflect the more aggressive policy tightening. The target-rate probability tool from CME Group (CME, $182.22) quickly shifted to show that investors now see about a 75% chance that the Fed will hike its benchmark fed funds rate by 50 bps at its March 21-22 meeting, versus just a 31% chance prior to Powell’s testimony (see chart below). Equities sold off sharply in response.

- The renewed signals of even tighter monetary policy appear to be worrying officials at the White House. Asked about the Fed’s plans yesterday, a top official insisted that the Biden administration wouldn’t try to interfere with the monetary policymakers but suggested they take a longer look at the data before hiking rates more aggressively.

U.S. Industrial Policy: Illustrating the impact of the green-technology subsidies provided in last year’s Inflation Reduction Act (IRA), Volkswagen AG (VWAGY, $18.81) stated that it will prioritize its plan to build an electric-vehicle battery plant somewhere in North America. According to Volkswagen, the company should expect to receive more than $10 billion in incentives from the IRA and other U.S. laws over the lifetime of the plant. In contrast, the company said it will put a similar battery plant planned for eastern Europe on hold until the EU clarifies what support it is willing to provide.

- The news will likely exacerbate EU leaders’ irritation over the IRA subsidies, which they fear will draw billions of dollars of investment toward the U.S. and away from Europe.

- On the other hand, U.S. officials have encouraged the EU to adopt similar industrial policies to support its manufacturing base, and the competitive threat from the U.S. will probably convince the EU to do just that in the future.

U.S. Antitrust Regulation: The Justice Department filed a lawsuit yesterday to block the proposed merger between JetBlue Airways (JBLU, $8.16) and Spirit Airlines (SAVE, $17.13) on grounds that the linkup would stifle competition and boost airfares for travelers. The two companies vowed to fight the lawsuit. Nevertheless, the Justice Department’s action illustrates the Biden administration’s stepped-up antitrust regulations.

U.S. Labor Market: An analysis of recent employment data shows that more women than men have gained jobs over the last four months, pushing the female share of nonfarm payrolls to 49.8%. As recently as 2019, women represented more than half of all nonfarm payrolls, but that changed with the COVID-19 pandemic, when women lost 12 million jobs and men only lost 10 million. The surge of women coming back into the labor force could help unshackle the economy and could potentially hold down excessive wage increases.