Weekly Energy Update (December 1, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

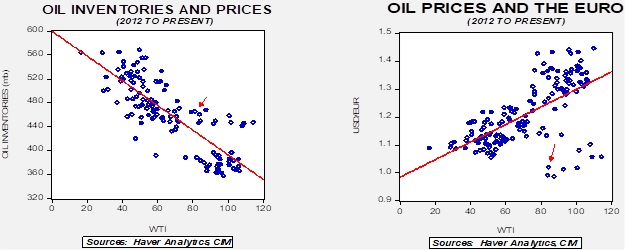

Crude oil prices have been falling on fears of weaker Chinese demand due to COVID issues. We note that the futures market structure has moved into contango, where the deferred contracts trade at a premium to the spot. This is a bearish market structure.

(Source: Barchart.com)

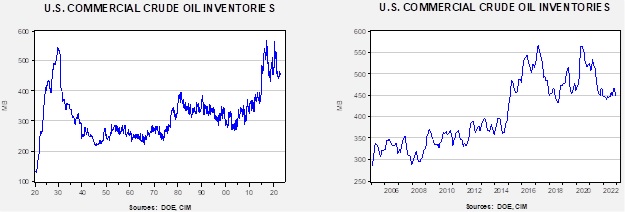

Crude oil inventories fell 12.6 mb compared to a 3.1 mb draw forecast. The SPR declined 1.4 mb, meaning the net draw was 14.0 mb.

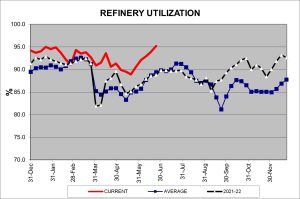

In the details, U.S. crude oil production was steady at 12.1 mbpd. Exports rose 0.7 mbpd, while imports fell 1.0 mbpd. Refining activity rose 1.3% to 95.2% of capacity.

(Sources: DOE, CIM)

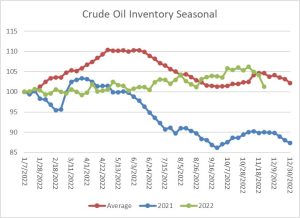

The above chart shows the seasonal pattern for crude oil inventories. As the chart shows, we are past the seasonal trough in inventories and heading toward the secondary peak which occurs later this month. SPR sales have distorted the usual seasonal pattern in this data. This week’s large draw takes inventories below the seasonal average, though perhaps the most important takeaway is that the usual seasonal pattern in inventory is breaking down.

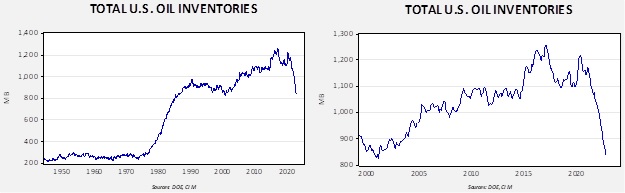

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $108.94.

Refinery runs are elevated as refiners take advantage of favorable crack spreads.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

Market News:

- This is a major week for global oil markets. On December 5, the EU is expected to implement its sanctions on Russian oil exports, specifically targeting the insurance and financing infrastructure of the oil trade. Tied to these sanctions is U.S. support for a price cap. The goal of the EU sanctions is to cut Russian oil from world markets and undermine Russia’s ability to conduct the war in Ukraine. The goal of the price cap is to allow some level of Russian oil flows but at reduced prices. So far, Moscow says it won’t sell oil under the price cap system. In addition, the EU hasn’t been able to decide on a price since more hawkish nations want a low price, while others, who are less hawkish, want something closer to the market price.

- The consensus is that the price cap won’t work because, generally speaking, a consumer can’t usually dictate what the price of a product will be. As consumers, we may decide not to buy at a given price, but we can’t go to the seller and simply set the price. After all, if we could do that, it would literally be a “free world”! However, if a buyer has market power, then they can influence the price that sellers can get for their product. OPEC+ is worried that the price cap mechanism will be turned on them, and that the cap could evolve into a “buyer’s cartel.” That is a risk, but we doubt that will occur. In this specific case, however, Russia is deeply vulnerable to the sanctions and cap. Why? Russia is dependent on foreign tankers and especially foreign insurance and financing to move oil. Russian ports can’t handle the largest crude carriers and the supply of smaller vessels is tight. Also, despite its best efforts, Russia has not been able to duplicate the existing insurance and financing system for oil sales, which reduces the number of tankers available to carry Russian oil. That doesn’t mean there are not rogue carriers, but they are not big enough to matter much.

- The U.S. wants the cap because it fears that the EU plan will result in a spike in oil prices. It wants to keep Russian oil flowing but reduce the revenue Russia receives. If Russia holds to the policy that it won’t honor the price cap, it could easily find itself in a situation where it is forced to close in production, and once shut in, that production may be lost indefinitely. If that occurs, oil prices could jump.

- It should be noted that Russia is finding fewer takers of its oil, and the Urals benchmark price has fallen to around $52 per barrel. So, even without a cap, the expectations of one seem to be having an impact.

- Although OPEC+ was making noises about cutting production in the face of weak prices, it looks like the cartel is more likely to maintain current production targets.

- Tensions within the ruling coalition have led Norway to delay any new oil and gas leases until 2025, a blow to European energy supplies.

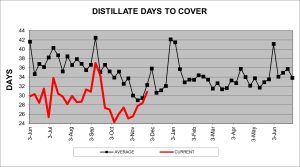

- As diesel prices soar, the “magic” of markets is starting to work. Consumption is easing, and refining operations are increasing, causing inventories to lift.

(Sources: DOE, CIM)

- However, this good news may still not be enough for New England to escape high prices and shortages.

- Europeans have been complaining that the U.S. is profiting from the war in Ukraine[1] by pointing at the massive price differential between U.S. and EU gas prices. However, it turns out the profiteers are European. Most LNG sold by the U.S. is based on the Henry Hub price, the benchmark for the CME futures contract. Currently, that’s set at 115% plus $3.00 of the benchmark price. However, the actual price in Europe is far higher; for example, a $6.00 per MMBTU price at the Henry Hub translates to a €32.59 MWH price. European utilities are buying at that price and reselling the gas at nearly €119 MWH.

- As global demand weakens and supply chains begin to improve, freight rates are falling rapidly, but that isn’t the case with oil tanker rates. High demand and the scramble to secure transportation before EU sanctions on Russian oil are in place are sending rates to record levels.

- Japan is warning that global LNG supplies are sold out “for years,” but what they mean is that most LNG is sold on long-term contracts. That’s how the infrastructure for LNG is usually financed — a project aligns buyers on long-term contracts at a set price to pay for the build-out of the project and then sends the gas to the buyers regardless of the spot price. Japanese buyers report that there are no long-term contracts available before 2026, meaning that the “marginal molecule” is being sold at spot rates.

- Europe’s LNG import capacity is expected to expand by 33% by the end of 2024.

- Germany and Qatar have agreed to a 15-year supply deal for LNG.

- There is growing evidence that the Middle East has reached oil capacity limits and shale oil production has not reacted to high oil prices as it has in the past. However, one bright spot for additional barrels is coming from deep-water offshore projects such as Brazil and Guyana.

- Western Canada is seeing a jump in natural gas production and could become a significant supplier of LNG to the Asia-Pacific region.

- Despite having what appears to be ample generating capacity, China suffers from regular blackouts. The reasons are complicated but involve the lack of market pricing and regional distrust, which then leads to excess capacity construction.

Geopolitical News:

- As the U.S. moves to bolster global oil supplies, it is making deals with previous pariah states in order to increase output. The Biden administration is lifting some sanctions on the Maduro regime in Venezuela in a bid to boost production. Venezuela’s production is important to the U.S. because most of it is heavy crude oil which is better suited for U.S. refineries. However, in the short run, production will likely only rise modestly, around 0.3 mbpd. Venezuela underinvested in the oil industry during the Chavez years, and it will take years of investment just to return to earlier production levels.

- As we noted in our last report, relations with Iran are rapidly deteriorating. Although the Biden administration had hoped to return to the JCPOA and perhaps improve relations, the election of a hardline government in Iran, recent protests, and Iran’s support of Russia in the war in Ukraine have clearly scotched any chance of normalization.

- The U.S. is amping up secondary sanctions on Asian companies that are purchasing Iranian oil and products.

- New sanctions are being placed on Iranian officials involved in protest suppression.

- Another Islamic Revolutionary Guard Corps member has been assassinated in Isfahan, a city in central Iran. No group has taken responsibility.

- Iran has sentenced four people to death for spying.

- Turkey has been working all sides in Europe and the Middle East. It has become a center for Russian capital flight and has acquired investment, reserves, and credit lines from the Gulf nations. And now, it appears to be cooperating with Iran on sending Iranian dissidents to Tehran.

- Recently, OPEC+ roiled oil markets by suggesting it might boost production, only to later deny the reports. Coincident to these rumors are reports that the U.S. will shield Saudi Crown Prince Salman from lawsuits related to the brutal killing of Jamal Khashoggi. It should be noted that such protections are common for heads of state with the reason being that if the U.S. subjected foreign rulers to lawsuits, other nations could do the same to American presidents. Nevertheless, the timing did not look good.

- The EU is expanding its monitoring and protection of undersea pipelines and other infrastructure.

- In an unorthodox move, Ghana says it will buy oil products with gold. The country is facing a foreign reserve crunch, with only enough liquid reserves to cover three months of imports. Ghana holds about $400 million of gold reserves, which have doubled over the past six years. Although such reports often trigger all sorts of fears that the dollar is losing its reserve currency status, in reality, this decision seems to reflect something quite different. Ghana lacks dollars and is selling off its gold in order to protect those reserves.

- Many emerging economies are suffering from shortages caused by debt crises. The inability to buy energy is leading to blackouts.

- The U.K. has decided to buy out China’s investment in a nuclear power plant.

- As we noted recently, refracking is lifting U.S. output.

Alternative Energy/Policy News:

- Although the world will still be using fossil fuels well into this century, other sources of energy are steadily emerging that will displace oil and gas in various areas. One area we monitor is geothermal energy, which uses the heat from the earth’s interior to generate steam or electricity. Quaise Energy, a privately held company, is working on deep drilling methods that, if successful, could provide nearly limitless clean energy.

- Another area we monitor is geoengineering. In general, it is a series of techniques designed to directly cool the planet. This report is a primer on the concepts and potential pitfalls from such programs.

- The major oil-exporting nations are fighting climate change policies to slow the loss of demand for oil and gas.

- The Inflation Reduction Act has restrictions on subsidies for purchasing EVs, specifically, requiring 100% U.S. content on batteries. The EU is furious with this provision. Europe is facing deindustrialization, as high energy costs are making manufacturing untenable, and the U.S.’s action is accelerating that process. U.S. automakers are trying to soften the requirements due to the lack of U.S. battery production capacity, and foreign nations are trying to create loopholes,[2] but it should be noted that (a) this bill can’t really be amended easily, and (b) the goal of the policy is the reindustrialization of America, something that both populist and progressives support.

- Lithium processing is heavily dependent on China, but Australia is rapidly expanding its refining capacity.

- This report offers an update on the global EV market.

- The EV market in the U.S. is facing a serious lack of charging stations.

- Nissan (NSANY, $7.07) was once dominant in the EV market as its Leaf model was one of the early EVs, although it later tended to “stand still” while others have passed it. The company now intends to release an SUV EV next year and is also working on a solid-state battery, which would have a longer range and faster recharging times.

- The U.S. is facing a shortage of solar panels. China is a major producer of the panels, and fears that incarcerated labor may be fabricating the product have led to shipments either being held in port or diverted to Europe.

[1] Among other general complaints.

[2] In fact, French President Macron is visiting the U.S. this week and subsidies are expected to be discussed.