Daily Comment (December 7, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning, on this 81st anniversary of the surprise attack on Pearl Harbor. Only a few surviving servicemen will visit this site today, a reflection of the aging of the WWII generation. A 17-year-old serviceman in 1941 would be 98 today. In the markets it is another rather quiet morning. Earlier this morning, U.S. equity futures and oil were lower but have turned higher in the past hour while the dollar is mixed.

In today’s Comment, our coverage begins with China news. International news comes next, and our update on the war in Ukraine follows. Coverage of economic and market news is next in line, and we close with a roundup of U.S. news.

China News: China is moving rapidly to ease COVID restrictions and there is some evidence of a thaw in U.S./China tech relations.

- So far, there has been no national announcement of an end to Zero-COVID policies, but we are seeing a rapid dismantling of the restrictions. Here are some of the changes:

- The Beijing Capital Airport has dropped its negative test requirement to enter terminals. If this becomes adopted broadly, it should dramatically ease air travel in China.

- Instead of sending infected patients to quarantine centers, those afflicted can now convalesce at home. Unfortunately, because there have been no national guidelines issued, local government reactions have been varied. Some podcasts we monitor on China report that local officials sometimes weld rebar on doors to ensure that those with the virus don’t venture out. In other areas, citizens are self-policing.

- Testing requirements are ending in most areas.

- An important element of the adjustment to policy is expanded vaccinations. A key worry is the low level of immunizations found among the elderly, who are especially vulnerable to COVID. China is facing strong resistance to vaccination among its older population.

- This opening brings risks with some models suggesting up to one million deaths could result. But with rising social unrest and a soft economy, Beijing likely feels it has little option but to ease restrictions. As we noted yesterday, the narrative around the Omicron variant is that it isn’t as deadly as earlier strains. Although there is some data to support that idea, it is also true that in the West, by the time Omicron was circulating, vaccinations and widespread infections were already in place and resistance was therefore elevated. In China, with fewer vaccinations and infections, the fast-spreading variant could be a problem.

- A surge in infections could not just overburden the health system, it could expose health workers to the virus.

- The recent actions to thwart China’s efforts to acquire advanced semiconductor chips and the tools to build them is leading to some adjustments. Corporate America is generally opposing the turn against China and their lobbying efforts are leading Congress to ease restrictions. On China’s side, Beijing is allowing U.S. officials to enforce export controls to ensure that chips don’t end up in the hands of the military. We don’t think these measures will change the trajectory of policy, but it does show how hard it is to enforce economic restrictions on a country like China, who is deeply enmeshed in the global economy.

- Another sign of the thaw are moves by Chinese regulators to allow real estate firms to service foreign debt. Throughout the real estate crisis, China has focused on domestic interests, mostly allowing foreigners to bear the brunt of the adjustment. However, it appears that Chinese officials have concluded that harming foreign investors may weaken their economy in the long run.

- TikTok continues to be a problem for U.S. security officials. The government remains worried that China will use the platform not only to collect data but to execute influence operations.

International News: Germany uncovers a right-wing coup plot, and Argentina’s vice-president has been found guilty of fraud.

- Twenty-five people were arrested from three countries on suspicion of a coup to overthrow the German government. Among those detained is a former AfD lawmaker, and a member of Germany’s special forces. It isn’t obvious if the plot was gaining traction or close to operational capacity. Some members did contact Russian intelligence, but there isn’t any evidence that the Russians were involved. Germany has a neo-Nazi undercurrent that resurfaces on occasion. During the 1970s, left-wing groups associated with communist factions, such as the Baader-Meinhof Gang, were prevalent. None, so far, have seriously threatened the government.

- Cristina Fernández de Kirchner, the current vice-president, a former president, and the wife of a late president, was convicted of fraud by an Argentine court. She was sentenced to six-years in prison and barred from public office for steering public works funding to a family associate while she was president and first lady. In the short run, nothing will change. She will appeal her conviction and during the appeal process, she will remain in office. Her term ends next December, so it is likely she will leave office without the case being resolved. The Kirchners are polarizing figures in Argentina; though, if the conviction sticks, it may mean the end of her family’s influence in the country.

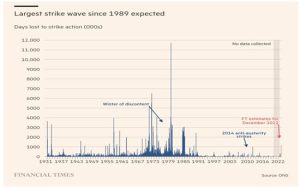

- The U.K. is facing a wave of labor discontent. PM Sunak is considering anti-strike legislation to stem the tide.

War in Ukraine: More on the Ukraine strikes inside Russia, and Hungary blocks aid.

- The recent drone attacks (apparently on three airfields) carried out by Ukraine have put the U.S. in a delicate position. Washington does not want to see this war escalate, and thus, isn’t supportive of these attacks. However, it is also aware that Russia has been attacking Ukrainian infrastructure, so it can’t really tell Kyiv not to attack Russia proper. One goal of Ukraine was to force Russia to expend resources to defend these airfields. That goal has apparently been met.

- The EU and Hungary have been at loggerheads over a number of issues, including immigration and social policy. In response, the EU has blocked funds to Hungary, and this decision led Hungary to veto aid to Ukraine. The EU is looking for ways to circumvent the veto.

- Although there have been steady calls for peace talks, the head of NATO suggests conditions for those talks are “not there now.”

Markets, Economics and Policy: Lumber futures rise, and supply chain issues slow arms sales.

- Lumber prices soared during the pandemic, as there was a lift in housing and remodeling. However, the rally failed as time passed, and prices slid. Although prices remain well below pandemic highs, prices jumped to their daily futures limit on reports that Canfor (CFPZF, $17.20) has cut mill output due to the falling demand.

- Arms demand is elevated due to the war in Ukraine and the general rebuilding of defense. However, supply chain issues and rising costs have cut sales over the past few months.

U.S. News: Part of North Carolina remains without power, and the Georgia Senate seat remains with Democrats.

- Utilities are struggling to fix the sabotaged substations in North Carolina. It is still uncertain who was behind the attacks, but the event highlights the need for redundancies. It would be prohibitively expensive to defend all infrastructure, but holding inventory of critical parts would likely speed recovery. Of course, inventory costs money and reduces efficiency.

- Raphael Warnock (D-GA) won a new six-year term by defeating Hershel Walker. This gives the Democrats a 51-49 advantage in the Senate.

- Rackspace Technology (RXT, $3.95) reported a massive ransomware attack. The company hosts emails and cloud computing, mostly for business.