Weekly Energy Update (December 8, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices continue to come under pressure on worries over economic growth.

(Source: Barchart.com)

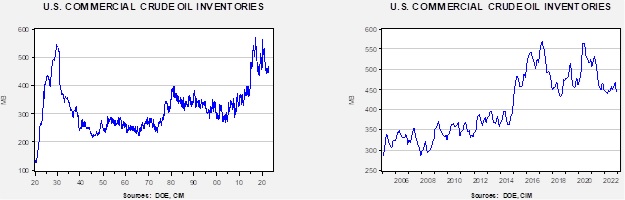

Crude oil inventories fell 5.2 mb compared to a 3.9 mb draw forecast. The SPR declined 2.1 mb, meaning the net draw was 7.3 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.2 mbpd. Exports fell 1.5 mbpd, while imports were unchanged. Refining activity rose 0.3% to 95.5% of capacity.

(Sources: DOE, CIM)

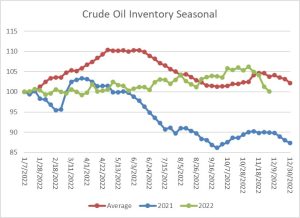

The above chart shows the seasonal pattern for crude oil inventories. As the chart shows, we are past the seasonal trough in inventories and heading toward the secondary peak which occurs in early Q4. SPR sales have distorted the usual seasonal pattern in this data. This week’s draw takes inventories further below the seasonal average, though perhaps the most important takeaway is that the usual seasonal pattern in inventory is breaking down.

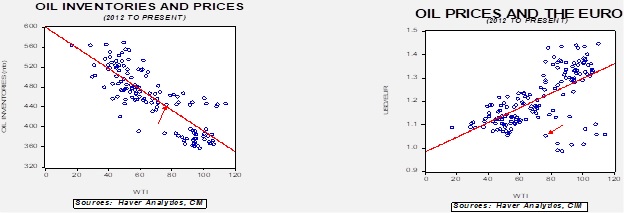

Shortly after the war started, we stopped reporting on our basic oil model that uses commercial inventory and the EUR for independent variables. We have updated that model, which puts fair value at $73.60 per barrel. We are currently trading near fair value for the first time since the war began.

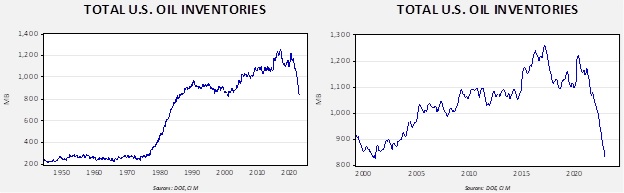

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $106.07.

The Cap: At long last, the EU has finally agreed on a price cap plan for Russian oil, pending Poland’s approval tomorrow. The cap price is $60 per barrel, and since the current Urals price is around that level, it’s possible that not much will change. The price was below what the Eastern Europeans were pushing for—Poland wanted a $30 price. The U.S., however, was afraid that a price that low, which would effectively ban Russian oil exports, would trigger a major price rally and harm the world (and U.S.) economy. The current price won’t really stop Russian exports if Russia wants to sell the oil. Russia’s initial reaction is to refuse to sell oil to nations using the price cap. We also note that, effective last Monday, the EU and U.K. will stop seaborne oil imports from Russia, which will have a more material impact on the oil markets. The most likely market reaction is volatility. The initial reaction to the cap and the OPEC+ decision was a sharp rise in oil prices, but that reaction faded earlier this week.

- It’s important to remember that this isn’t so much a price cap as a plan to restrict Russian oil shipments by denying this oil access to European and U.S. shipping and insurance. Without access to insurance and shipping finance, port and canal operators either won’t handle the cargo or will demand higher processing rates.

- There are reports that Russia has been amassing tankers in order to avoid sanctions. Although these vessels may ease some of the pressure on global oil supplies, they will probably not be enough to prevent shortages.

- The initial reaction to the cap is a bit as we expected; although it may not stop shipments, it is causing disruption. A large number of tankers are said to be awaiting passage through the Bosporus Strait as Turkish officials check paperwork.

- Once the EU signs off, the G-7 and Australia will be the next bodies to approve the measure.

- To ensure Poland’s participation, the EU will review the price cap every two months beginning in January.

- In anticipation of the cap and the EU embargo, Asian buyers have been purchasing Russian crude oil and Russia has been boosting production. Now that the deal is in place, we may actually see a slowdown in Russian purchases.

- OPEC+ met over the weekend and left production targets unchanged. There had been talk of both increases and cuts to targets, but in the end, the cartel decided to adopt a “wait and see” approach.

- Here are the key items to watch for in the coming weeks:

- Russia really can’t afford to cut production significantly. If Russia shuts in wells, it will likely lead to a near-permanent loss of productive capacity. If the cap had been set much lower, below $40, for example, it might have led to supply loss. This cap probably won’t do much to change overall supply.

- Russia is facing increasing budget pressures, and the cap won’t help those.

- The price cap will, however, change supply patterns. Russia will need to sell more oil to non-EU and non-G-7 nations. Although this is doable, it will be more costly and could cause short-term disruptions.

- OPEC+ worries that the price cap could evolve into a buyer’s cartel. That may lead to more hostile actions from the oil producers.

- Daniel Yergin warns that the price cap may mark a new era where oil is no longer a global commodity.

Market News:

- The White House is seeking to halt SPR sales in the coming years. Congress has tended to use the SPR as a sort of budget “piggy bank” to allow for funding of various projects. Thus, various sales have already been authorized for future years. However, with the SPR being drained by the sales completed due to the war in Ukraine, the administration now wants to halt those future sales. So far, we are not seeing any programs put in place to refill the reserve, but this action does suggest growing concern about the sales.

- Recent data suggests that U.S. drilling activity remains lackluster. Due to regulatory and investment constraints, the U.S. oil and gas industry thus far has not reacted strongly to high oil prices. We expect that to continue.

- The fertilizer market has been a major concern since the Russian invasion of Ukraine. Both nations are major producers of fertilizers and feedstock for the product. The UN says that it is near a deal that would allow Russia to export ammonia via a Ukrainian pipeline. Ammonia is a key element for the economy and resuming this supply is important. We note that fertilizer prices have been falling recently as markets adjusted to high prices, and the UN news will likely support further price declines.

- One of our firm’s positions is that the unwinding of U.S. hegemony will lead to supply disruptions and trigger hoarding. Confirming this assertion is an announcement that Japan is building a strategic reserve for natural gas. Japan gets nearly all of its natural gas from LNG and has faced higher prices as European demand for LNG has soared due to the war.

- India is planning to boost natural gas imports in order to meet summer power demand.

- High prices and weak economic activity have reduced EU natural gas demand.

- If China continues to ease COVID restrictions, oil prices should benefit.

- Saudi Arabia announced it has discovered two new natural gas fields.

- A 2019 study by the NBER showed that lower heating costs prevent winter deaths. The study suggested that the shale gas revolution likely saved 11k lives in the U.S. If the study is correct, high heating prices may lead to higher mortality rates in Europe this winter.

- Ethanol blending has hit new records.

- Mild temps are bearish for natural gas prices. Meanwhile, U.S. LNG projects are being funded rapidly, although there are concerns that the industry won’t be able to find enough gas to match these projects.

- Glencore (GLNCY, $13.31) is planning to accelerate coal mine closures. The closures have little to do with profitability but are instead being done to meet emissions targets. The IEA is forecasting that renewables will overtake coal by 2025.

- Russia and China have completed a pipeline to Shanghai.

- New England authorities are warning that if the weather is unusually cold, rolling blackouts might occur. Some of the problem is tied to the Jones Act.

Geopolitical News:

- Although OPEC+ has remained on the sidelines for now, weak oil prices may prompt the cartel to cut targets in the near future.

- Iran announced that it has disbanded its morality police and may ease hijab regulations in light of continued protests. However, state media raised doubts about the veracity of these pronouncements, and the government has not officially given notice that the group has been disbanded.

- The U.S. Navy has seized an Iranian fishing trawler that was shipping war materials to Yemen.

- Iran is facing a general strike as protests continue. Twitter evidence suggests that strike participation is high. At least 300 Iranians have died in the protests. The government continues its policy of executing protesters.

- Western intelligence agencies report an increase in Iranian assassination and kidnapping plots.

- There are reports that the clerical leadership of Iran is considering ending the presidential system and replacing it with a parliamentary system. Since the conservatives dominate the legislature, this change would expand clerical control.

- The Kingdom of Saudi Arabia’s (KSA) support of OPEC+ production cuts caught the White House off guard, leading the U.S. to issue threats against the kingdom. Though, so far, no appreciable consequences have developed. In fact, the KSA is preparing for a state visit from General Secretary Xi, in a reminder that the Saudis are hedging their relations.

- Last week, we noted that the Biden administration granted Crown Prince Salman immunity. This week, a court dismissed a suit against him over the Khashoggi murder due to that decision.

- We are monitoring the recent sabotage of power substations in North Carolina. Although domestic terrorism isn’t unusual in the U.S., most of the time, the terrorists attack government buildings or other areas of high visibility. Attacking infrastructure would be a new development that could raise fears and trigger hoarding behavior. So far, no group has been tied to the attack, but reports suggest that whoever did it was knowledgeable about substations.

- As the U.S. eases sanctions on Venezuela, further progress depends on reforms by the Maduro administration. We harbor serious doubts such changes are likely. Meanwhile, U.S. refiners are lining up to purchase Venezuelan crude oil.

- Turkey and Greece have been enemies for years. Fears that Turkey will disrupt oil shipments through the Bosporus Strait are leading Greece and Bulgaria to discuss an oil pipeline. Interestingly enough, Russia would be expected to be the primary supplier of oil to this pipeline. Building it suggests that Greece expects the current supply restrictions to be lifted.

- Slovenia is looking to build a pipeline to handle Algerian gas.

Alternative Energy/Policy News:

- Last week, French President Macron visited the White House. As expected, he complained about the Inflation Reduction Act’s provisions that only grant subsidies for EV batteries made in the U.S. As we noted last week, this act is signaling a new American industrial policy that is designed to industrialize the U.S., almost certainly at the expense of our trading partners. The U.S. has shrewdly “encouraged” the EU to implement its own subsidies, likely relying on the fact that Germany will skew any program to benefit itself at the expense of other EU members, which will tend to weaken support for any program. France is trying to work with Berlin to establish a united front. In addition, a subsidy program that would actually rival that of the U.S. will likely upset Washington, which continues to defend Europe and is the primary contributor of arms to the war in Ukraine.

- Japan is also upset by the Inflation Reduction Act but is making its protests quietly.

- The U.S. action is designed to create a battery supply that is free from China. Europe seems to be leaning toward Chinese domination.

- The Commerce Department confirmed what is widely known: China has been re-exporting solar panels to third nations in order to evade U.S. sanctions. The U.S. believes that China is using incarcerated labor to build these panels and bars their importation to the U.S. As a consequence, the U.S. will impose new tariffs on Chinese solar panel imports. The issue for the U.S. is that without China’s solar panels, costs to U.S. installers will rise significantly and will likely slow adoption.

- China has overbuilt the solar supply chain, which may pressure prices in the coming months.

- General Motors (GM, $38.85) announced that it is investing in order to expand a Tennessee EV battery plant. Rising prices are threatening EV sales and profitability.

- Environmentalism sometimes works at cross purposes. An endangered toad is blocking a proposed geothermal plant in Nevada.

- Tesla (TSLA, $181.31) has started to deliver its semi rigs.

- BP (BP, $35.00) is increasing its commitment to hydrogen.

- The EPA is considering new regulations on a refinery byproduct called alkylate. By adding it to gasoline, it improves octane and lowers volatility. It comes from either hydrofluoric acid or sulfuric acid. As they sound, both are potentially harmful chemicals, and the EPA has been pressing the industry to use less difficult chemicals. Because both are potentially hazardous, refineries usually select one or the other to generate in the refining process and use for formulating gasoline. The industry fears that if the EPA comes down on one side or the other, it could further reduce U.S. refining capacity.

- Although EVs continue to dominate the non-internal combustion engine vehicle space, Toyota (TM, $141.76) is continuing to develop hydrogen vehicles as an alternative.

- Microsoft (MSFT, $244.73) is developing a process to use limestone to capture carbon dioxide.

- Biotech firms are injecting bacteria into spent oil wells to create hydrogen.