Tag: GDP

Asset Allocation Bi-Weekly – The Economy That Won’t Die (June 16, 2025)

by Thomas Wash | PDF

The old Wall Street quip about economists having “predicted nine of the last five recessions” has never felt more painfully relevant. Since the pandemic era began, economists have sounded the recession alarm no fewer than three times: first when gross domestic product (GDP) shrank in early 2022, again during the Silicon Valley Bank crisis of 2023, and most recently when the Sahm Rule was triggered during the summer of 2024. Yet America’s economic engine keeps chugging along, leaving analysts scrambling to explain why the doom forecasts keep missing their mark.

The stock market’s reaction to President Trump’s tariff announcement followed this now-familiar pattern of panic and resilience. Initial headlines sparked a sell-off that briefly dragged the S&P 500 stock price index below 5,000 for the first time in months. But within weeks, the index came roaring back, erasing its year-to-date losses and flirting with bull market territory. This whipsaw action revealed an important truth: Investors are increasingly betting that the economy can absorb policy shocks that would have crippled previous expansions.

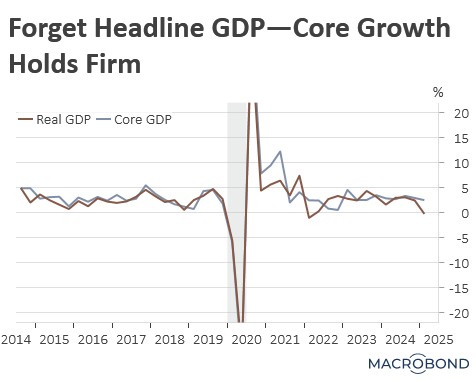

This underlying economic resilience, even in the face of apparent warning flags, highlights the importance of looking beyond superficial data. The solution may lie in what analysts call “core GDP,” which measures the final sales to private domestic purchasers. Where the headline GDP figure mixes volatile government spending and trade data with underlying demand, this refined metric instead focuses solely on how much US households and businesses are actually buying. This distinction proved critical in understanding the first quarter’s apparent contraction, which upon closer examination revealed more about temporary distortions than fundamental weakness.

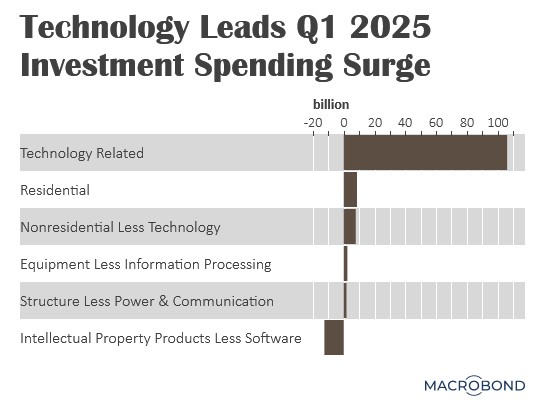

In the first quarter, a surge in imports caused by companies racing to beat the coming tariffs artificially depressed the GDP numbers, while simultaneous government spending cuts further skewed the picture. Meanwhile, the core GDP figure told a different story about the real economy. Consumer spending slowed and rotated from discretionary goods to consumer staples and services, but it didn’t contract. Most tellingly, business investment accelerated, particularly in technology sectors because of what appears to be an influx of AI-related capital expenditures.

This wave of AI investment has helped blunt the impact of tariff uncertainty in early 2025. Despite the positive momentum, a caveat remains. The economy’s and market’s reliance on technology investment seen in the first quarter may not be sustainable if trade restrictions lead to critical shortages. AI development, in particular, is vulnerable to the availability of essential mineral resources, such as rare earths, which could limit its expansion. Therefore, we believe the economy and market can continue to defy skeptics, provided trade relations are meticulously managed.

Looking ahead, we suspect that as long as the Trump administration continues to facilitate the expansion of AI firms, it will remain a positive driver of growth. For the broader economy, any indications that a trade war will not result in painful outcomes — such as elevated inflation and unemployment — should encourage increased consumer and business spending. We continue to believe that stocks and other risk assets can continue to recover, with prospects especially positive for quality assets. This assessment reflects both the prevailing uncertainty with a dash of hope for improvement after the July 9 tariff deadline.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Bi-Weekly Geopolitical Podcast – #56 “Rising US & Global Debt: A Perspective Check” (Posted 11/4/24)

Bi-Weekly Geopolitical Report – Rising US & Global Debt: A Perspective Check (November 4, 2024)

by Daniel Ortwerth, CFA | PDF

Concern has been rising across American society and throughout much of the world about the level of United States government debt. An increasing number of voices are sounding the alarm that the debt level is unsustainable, and crisis is on the way. Debates rage about how such a crisis will begin and when it will happen, but according to the alarmist view, the country will inevitably face financial catastrophe, with grave consequences for the security of the nation and the welfare of its citizens. Is this true? Are we really on a critical path, and is a catastrophic outcome inevitable? It is time to gather the facts and apply sound analysis to give ourselves a well-founded perspective.

This report uses standardized, internationally recognized data for 43 of the largest countries, from the beginning of the century to the present, to analyze US and global debt levels according to broadly accepted methods. It assesses the progression of debt levels across the period, between countries and country groups (i.e., developed and emerging) and between sectors of society (i.e., government and private). Our goal is to provide a fact-based sense of the situation and its trends. The report pays particular attention to the comparison between US and Chinese debt levels, since this plays a role in the geopolitical competition that has emerged. As always, we finish with implications for investors.