Author: Rebekah Stovall

Daily Comment (July 17, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity markets are modestly higher after a choppy week. The EU budget summit is underway. Relations between the U.S. and China continue to deteriorate. The new Asset Allocation Weekly is published below; the accompanying podcast and chartbook will be available on Monday. Here are the details:

Foreign news:

- The EU budget summit is underway; here’s a way to follow along. The biggest issue at the meeting is the pandemic rescue plan that includes a mutualized Eurobond. This meeting is historic; if the leaders agree to a mutualized debt scheme, it would make the EUR an attractive alternative reserve currency. If the leaders fail completely, it may signal the end of the Eurozone. We may not get a deal this weekend, but if the leaders agree to continue talks, all won’t be lost. Given that Chancellor Merkel is endorsing the rescue plan, there is a good chance we see passage at some point. As we discussed in a recent WGR, a mutualized bond issued by the EU would likely be bearish for the dollar.

China news:

- High ranking U.S. officials have been making speeches denouncing China. AG Barr is the most recent member to give a talk on this issue. He accused Hollywood and Tech of collaborating with China in his remarks. He also expressed concerns that businesses could be used by Beijing to undermine the U.S. policy crackdown. This is a legitimate concern. Chairman Xi will likely try to offer preferential treatment to U.S. firms in return for informal lobbying efforts to foster a more friendly policy regime.

- The U.S. is increasing pressure on China across a number of fronts. There have been notable trade actions and an increase in freedom of navigation operations in the South China Sea. The administration is considering travel bans on CPC members. This would be a significant action; there are over 90 MM members of the CPC. The U.S. is considering banning TikTok (the owner, ByteDance, is not publicly traded) due to security concerns.

- Although China’s GDP showed a strong recovery, worries that the growth was driven by investment remain. Evidence that policy easing may be fostering yet another property boom could lead to a deterioration of credit quality. China’s financial authorities have used financial repression for years, keeping deposit rates at low levels to create pools of cheap financing for investment. Households are seeking higher returns on investment and there is an underlying belief that policymakers won’t allow residential property prices to fall (sound familiar?). The key question that follows is “who will pay for the bailout, if it comes”? The recent rise in foreign buying of Chinese sovereigns provides one potential clue.

- After a sharp rally, Chinese equities are taking a sudden hit.

COVID-19: The number of reported cases is 13,830,933 with 590,608 deaths and 7,735,623 recoveries. In the U.S., there are 3,576,430 confirmed cases with 135,205 deaths and 1,090,645 recoveries. For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases across nations using similar scaling metrics. Only seven states have a reproduction ratio under one, which means that the virus is expanding at an increasing rate. However, there was some good news in the data; Arizona, which has been hard hit recently, saw its R0 fall under 1.

Virology:

- The S., U.K., and Canada report that Russians are attempting to hack vaccine and anti-viral researchers in an attempt to steal their research. As expected, the Kremlin has denied the claims.

- “…some animals are more equal than others…”; this famous quote from Animal Farm seems to describe the current testing regime.

- It is looking less likely that school districts will be able to fully open this fall. Instead, a mix of online and in school regimes is more likely. The long-term impact on education is uncertain, but the likely outcome is a slower pace of learning.

- A bit of good news, as doctors deal with more COVID-19 patients, they are learning more about the disease and are developing treatment protocols that are improving hospitalization outcomes. These include less use of ventilators and a greater deployment of high concentration oxygen, various treatments to reduce the symptoms of the disease and simple changes, like laying patients on their stomachs.

Market and Economy news:

- The 30-year mortgage rate has dipped under 3.00%, a record low. Housing data has been strong recently and there is evidence of a move to the suburbs. That could put urban housing at risk.

- Food banks have seen high demand during the pandemic. Now they are dealing with logistics challenges as food supplies are increasing after facing disruptions.

Asset Allocation Weekly (July 17, 2020)

by Asset Allocation Committee | PDF

One of the burning issues about the current path of policy is its inflationary impact. In other words, will the massive increase in fiscal spending and the Fed’s balance sheet lead to higher price levels? To discuss this issue, we return to the equation of exchange:

M x V = P x Q

The money supply times velocity is equal to the price level times goods and services produced. This equation is an identity; simply put, it will always be true. But, the direction of causality of the variables comes from theory. Classical economists and their philosophic progeny, monetarists, argued that V and Q were fixed, so changes in price levels were due to changes in money supply. Keynesians and their most recent variation, modern monetary theorists, argue that Q can be below its capacity and V is variable, so increases in M may not necessarily lead to higher price levels but could result in a decline in V or a rise in Q. Essentially, the Keynesians and their modern versions argue that if Q is below capacity, increasing M can boost the economy without triggering inflation.

The problem with both of the major theories is that there is a psychological element to the equation that tends to be downplayed. The problem for the Classical construct is that even at full employment (Q) rising M might simply lead to falling V. Complacency about future inflation or fears about the future growth path of the economy might lead households and businesses to simply hold larger cash balances. Confounding the Keynesians is the potential outcome where P rises even with Q below capacity when M is increased if economic actors fear future inflation. In fact, higher price levels can result even without a rise in M if V rises. The most extreme case of this condition is hyperinflation, where V rises rapidly as households and businesses rush to convert cash to real goods that will hold their value.

Therefore, determining if there is an inflation problem from current policy is tricky because there is a psychological element that is difficult to estimate. It is easy to measure money supply, output or price levels, but the psychology of velocity is hard to measure and potentially prone to sudden shifts.

Reframing the question can simplify this problem. If a household receives a notable sum of money, let’s say, $10,000, what does it do with it? If the householder fears future price increases, it would make sense to use that money to buy inventory. In other words, they may take part of it to buy food, perhaps consumer durables, art, gold, or other items that might hold their value. On the other hand, if there is little fear of future inflation, the household may be content to simply hold the cash as savings or place it in other financial assets.

One way to answer this question is to compare the money supply to gold prices. If some money supply, say, M2, rises faster than gold, it would suggest that economic actors are not afraid of future inflation. A rising ratio of M2/gold would be a positive signal for financial assets; on the other hand, a falling ratio would likely be bearish. Now, it is possible that a contracting money supply could distort the measure. The monthly change in M2 since 1959 has only been negative 4.4% of the time. Over that same time frame, it has never been negative on a yearly change basis.

Anyone familiar with financial market history can note that equity markets tend to outperform when this ratio rises, but equities tend to suffer when the ratio declines. The ratio captures that when the supply of money is rising relative to gold (the proxy for real assets), economic actors tend to put this excess liquidity into financial assets. A declining ratio suggests a preference for real assets.

In general, the ratio has been mostly steady for the past four years. Despite a rally in gold, the ratio hasn’t declined. Put another way, we haven’t seen households and firms show significant inflation fears despite a massive increase in liquidity. Gold prices have been mostly rising with M2 but not accelerating faster than the money supply. And so, in a portfolio, gold has been acting as a diversification asset without unduly hampering performance. As the Fed has boosted liquidity, funds have been going into both stocks and gold at a pace where neither has signaled a particular bias. If inflation fears escalate, we would expect this ratio to decline and equity markets to show signs of weakness. But, for now, easy monetary policy is supportive for both gold and equities.

Daily Comment (July 16, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! Global equity markets are lower this morning. Chinese stocks fell hard overnight but have been very strong recently. China’s GDP data came in stronger than forecast; we may be seeing a bit of “buy rumor, sell fact” behavior in Chinese equities. Retail sales in the U.S. came in better than forecast; we cover the data below. The ECB met this morning, and there was no change in policy. The EU suffered a blow yesterday in its attempt to tame the U.S. tech sector. There is much to discuss on the policy front. We update the pandemic news. The Weekly Energy Update is available. Here are the details:

China news:

- China’s Q2 GDP roared back, rising 59.7% on a quarterly annualized basis, up 3.2% from last year. What is most remarkable about the bounce is that the level of GDP exceeds Q4 2019 by CNY 80MM. Of course, this stunning recovery was engineered through the usual policy path—a massive rise in debt and forced investment. Michael Pettis, one of our favorite China analysts, has always argued that China can have any GDP level it wants; it’s just a matter of how much debt and uneconomic investment it is willing to make. At the same time, cross-country comparisons will look like China has fully recovered from the COVID-19 event and will be used for the full benefit by Chairman Xi to promote China’s economic model as superior to Western democracy.

- China continues to face sporadic bank runs. Although China established a system of deposit insurance in 2015, it only covers deposits up to CNY 500K ($70,400). In addition, there is deep suspicion that Chinese banks are suffering from loan losses and depositors fear they could be at risk if a bank fails. Finally, social media has been the platform for spreading rumors about bank instability, causing runs even against sound banks.

Foreign news:

- The EU suffered a stunning defeat yesterday when its second highest court overturned its order for Apple (APPL 390.90) to pay €14.3B in back taxes. The EU has been trying to push for harmonization of tax rates across member nations, undermining low tax regimes such as Ireland’s. The court indicated that Ireland didn’t violate any laws because its taxing doesn’t specifically give Apple a tax break. The decision was seen as a rebuke to Margrethe Vestager, who has campaigned against U.S. tech firms on anti-trust grounds.

- The U.S. will remove a sanctions exemption related to the Nord 2 gas pipeline. This controversial pipeline will deliver Russian natural gas directly to Germany, bypassing Ukraine and Poland in the process. The U.S. worries the pipeline will make Germany overly dependent on Russian natural gas and deprive transit nations the usual fees they gather for hosting pipelines. The decision to build the pipeline has always been contentious, especially after Russia’s annexation of Crimea and its interference in eastern Ukraine.

- EU leaders are meeting on Friday through the weekend to determine if a support package and the decision to fund the Eurobond will be approved. The “frugal four,” Sweden, Austria, Netherlands and Denmark, are all expressing opposition; at a minimum, they want conditions on the grants and loans. Chancellor Merkel has thrown her support behind the measure and will meet with Greek officials before the meetings.

- There are longstanding tensions between Azerbaijan and Armenia, mainly over the disputed region of Nagorno-Karabakh (for background, see our WGR). Azerbaijan forces destroyed an Armenian military facility on the border between the two nations yesterday. Armenia is said to have killed an Azerbaijani general. Usually, Russia eventually brokers some sort of arrangement to bring an end to overt hostilities, but if it refuses to act, conditions could deteriorate further and may support oil prices.

Policy news:

- As several fiscal programs are set to expire, congressional leaders are laying their markers for what follows. Congress took aggressive steps earlier this year to offset the impact of the pandemic and the actions did prevent a deeper decline in growth. Now, leaders are trying to figure out what they should do going forward, with an eye on using the crisis to promote their longer-term policy goals. We do expect additional support, but also would not expect an agreement until the 11th hour.

- A couple of points on Fed policy:

- There has been some consternation among the financial media over a decline in the Fed’s balance sheet.

Worries surrounding this decline are misplaced. The reason the balance sheet is contracting isn’t because the Fed is tightening support. It’s declining because market participants aren’t using available facilities because they aren’t needed. In other words, knowing the Fed is backstopping markets is keeping financial markets well behaved. It is worth noting that a number of facilities do have expiration dates for the end of Q3. We expect these deadlines to be extended, but even if they are not, if market participants expect the Fed to maintain low levels of financial stress then the need for actual facilities is unnecessary. Simply put, the fact that the Fed has signaled it will provide support will tend to preclude the actual need to do so because the markets will act as if the support is in place.

- As Fed officials work through a post-mortem of the crisis, the non-bank financial system is, again, seen as the fount of the overall system’s weakness. In other words, the “shadow” banking system remains vulnerable to runs and remains a source of financial instability. The Fed said its aggressive expansion of policy support was due to funding problems in the shadow system. At the same time, the non-bank system can’t really be closed because the banks won’t make loans to many areas of the economy due to the inability to scale the lending.

- U.S. sanctions on Hong Kong are putting global financial banks in a difficult position; essentially, it will be impossible to satisfy both Chinese and U.S. regulations. Of course, these large institutions will try to figure out what they can do to maintain operations in both jurisdictions, but it will be an additional complication.

- The USMCA included labor regulations designed to reduce Mexico’s edge in lower labor costs. Japanese auto firms are examining the laws and are trying to determine if remaining in Mexico or moving production to the U.S. makes sense in light of the changes.

COVID-19: The number of reported cases is 13,538,763 with 584,922 deaths and 7,600,418 recoveries. In the U.S., there are 3,499,394 confirmed cases with 135,205 deaths and 1,075,882 recoveries. For those who like to keep score at home, the FT has created a nifty interactive chart that allows one to compare cases across nations using similar scaling metrics. Axios has updated its state map.

Virology:

-

- We continue to closely watch the path of vaccine development; Bloomberg has a profile of Sarah Gilbert, who is spearheading Oxford’s program. Although we are heartened by the rapid developments on the vaccine front, there remain worries that the level of immunity may be limited.

- Meanwhile, Chinese firms are using their employees as testing subjects for their vaccine candidates.

Market and Economy news:

- Yesterday’s Beige Book suggested the economy is improving, but at a very gradual pace.

- As of July 13, 87.6% of apartment households paid some amount of rent.

Weekly Energy Update (July 16, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

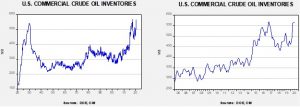

Here is an updated crude oil price chart. The oil market has stabilized at higher levels after April’s historic collapse.

Crude oil inventories reversed last week’s unexpected rise, with stockpiles falling 7.5 mb compared to forecasts of a 1.8 mb draw. The SPR added 0.1 mb this week.

In the details, U.S. crude oil production was unchanged at 11.0 mbpd. Exports rose 0.2 mbpd, while imports declined 1.8 mbpd. Refining activity rose 0.6%, near expectations.

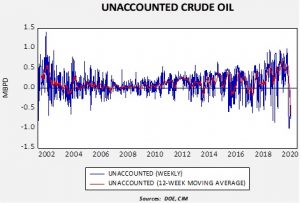

High negative readings continue for unaccounted-for crude oil, although they are higher than what we saw a few weeks ago.

Unaccounted-for crude oil is a balancing item in the weekly energy balance sheet. To make the data balance, this line item is a plug figure, but that doesn’t mean it doesn’t matter. This week’s number is -768 kbpd. This is a large number and suggests the DOE is still struggling to figure out what accounts for the missing barrels. We suspect much of it is caused by the DOE overestimating production.

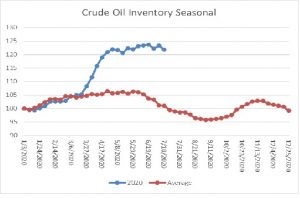

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s data showed a decline in crude oil stockpiles. We are well into the seasonal draw for crude oil. By this time of the summer, we have usually seen a 5% decline in commercial storage. The fact that inventories are mostly steady is a bearish factor.

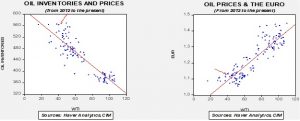

Based on our oil inventory/price model, fair value is $30.14; using the euro/price model, fair value is $53.25. The combined model, a broader analysis of the oil price, generates a fair value of $40.42. We are starting to see a wide divergence between the EUR and oil inventory models. The weakness we are seeing in the dollar, which we believe may have “legs,” is bullish for crude oil and may overcome the bearish oil inventory overhang.

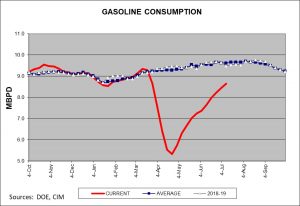

Gasoline consumption remains below average, but the recovery is unmistakable.

The oil and gas industry is facing a disinvestment movement from college and university endowments, driven by student activism. In general, such movements tend to gain momentum when the cost of the action is low. Current low oil prices make activism toward disinvestment relatively costless. This action could become difficult to sustain if oil prices (and gasoline prices) rise in the future.

In light of last spring’s oil price collapse, the CFTC is getting involved in commodity ETPs. The commodity regulator is pushing for greater disclosure of activity. The ETPs were widely blamed for the negative prices for WTI (see the chart above) seen in April.

The recent rise in VAT in Saudi Arabia is calling into question the kingdom’s social contract. For years, the House of Saud offered Saudi citizens a deal—the government would provide a deep safety net in return for not having a direct voice in how citizens are governed. In essence, the Saudis created a rentier state that was funded from oil revenues. In an attempt to diversify the economy in a period of low oil prices, CP Salman has moved to raise taxes to restore some of the lost revenue. What remains to be seen is if common Saudis will tolerate “taxation without representation.”

View PDF

Daily Comment (July 15, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Financial markets are responding to important progress in developing a coronavirus vaccine today. You can almost hear “Happy Days Are Here Again” being played in the back of our minds, though it’s important to remember that plenty of economic and financial damage can still arise before widespread vaccinations are possible. We review all the key news below:

COVID-19: Official data show confirmed cases have risen to 13,349,649 worldwide, with 579,335 deaths and 7,430,243 recoveries. In the United States, confirmed cases rose to 3,431,744, with 136,468 deaths and 1,049,098 recoveries. Here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Moderna, Inc. (MRNA, 75.04) reported that its coronavirus vaccine performed well in its Phase II trial, producing the targeted antibody response in all 45 people studied and proving to be well tolerated. Importantly, the immune response also appeared to last at least two months. The vaccine will now enter a Phase III trial consisting of about 30,000 people starting in late July, with final results expected around the end of the year.

- Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, hailed the results as “really quite good news.”

- Coupled with the other vaccines currently moving through trials, the initial success of the Moderna injection could help rekindle optimism regarding control of the disease, despite the discouraging resurgence of infections in the South and West. As reflected in the market action so far today, the improving prospect of a vaccine should be bullish for global equities and other risk assets, but negative for bonds and precious metals.

- Despite the improving prospects for a future vaccine, the current surge of infections continues in multiple states around the country, and in several large developing countries abroad. Here in the U.S., the rise in infections is boosting absenteeism at large employers, leading to production shutdowns and signaling a potential new supply shock for some industries. On the demand side of the economy, emerging data shows the U.S. recovery to date has been driven mostly by higher-income consumers with stable jobs who have been taking advantage of the rising financial markets to buy homes, cars, and other big-ticket items. All the same, at least one low-cost item has seen a sustained surge in demand: canned tuna fish.

- Following Britain’s decision yesterday to require face masks in retail stores, the French government said it will require mask-wearing in enclosed public spaces within the next few weeks because of a recent slight uptick in infection rates.

- Central Asian countries that had boasted of their early success fighting the pandemic, including Kazakhstan and Uzbekistan, have reintroduced lockdowns in response to a new surge in coronavirus cases that threatens their economies.

U.S. Policy Response

- Despite the good news on vaccine research, Fed Governor Lael Brainard said difficulty suppressing the new coronavirus will pose substantial risks for the U.S. economy, including a possible double dip in economic activity. She also warned that the nation faces a long, slow recovery even if those hazards are avoided. On a brighter note, that’s likely to be a positive for the markets; however, she also underlined Fed Chair Powell’s call for continued monetary and fiscal accommodation.

Foreign Policy Response

- In Japan, a government effort to support the tourism industry will kick off next week by providing $10 billion in subsidies for urbanites to visit the countryside, despite concerns that doing so will help spread the virus.

United States: Presumptive Democratic presidential candidate Joe Biden released his proposed plan to combat climate change. Under the plan, the government would spend some $2 trillion over the course of a decade to eliminate carbon emissions from the power grid, put Americans into electric vehicles and zero-emissions mass transit, and rebuild roads, bridges, and other infrastructure. The plan would devote spending to minority communities and bolster rules to support unions, which the Biden campaign frames as a way to ensure benefits go first to poor and working-class people and to communities hurt the most by pollution.

European Union-United States: In another blow to the European Commission’s effort to exact more tax revenue from big, U.S. multinationals, an EU appeals court quashed a commission order for Apple (AAPL, 388.23) to pay back €14.3 billion in taxes to Ireland. According to the court, the commission failed to prove that Ireland had provided Apple with an illegal discretionary tax deal that gave it a competitive advantage. That echoed the reasoning behind a similar decision last year that spared Starbucks (SBUX, 72.73) from having to pay back taxes. Taken together, the decisions suggest EU competition czar Margrethe Vestager may be facing a prohibitively high hurdle in her effort to crack down on low-tax regimes in the EU.

European Union: As national leaders continue to negotiate over the European Commission’s proposed €750 billion coronavirus recovery plan, including the proposal to finance it with mutualized EU debt, the horse trading has kicked into high gear. For example, in a meeting yesterday between Portuguese Prime Minister Costa and Hungarian Prime Minister Orbán, Costa said matters concerning “liberty and the rule of law” shouldn’t be a part of the EU’s negotiations. In other words, to make sure Hungary doesn’t veto the program and to ensure Portugal gets its share, Costa doesn’t want to press Orbán on his controversial social and judicial policies.

Japan: In its latest policy decision, the Bank of Japan kept its monetary policy unchanged. The central bank held its benchmark overnight interest rate at -0.1%, kept 10-year bond yields capped at “around” 0.0%, and held its purchases of equity ETFs steady at a pace of ¥12 trillion per year. The decision came even as the institution revised down its economic growth forecasts and warned of further downside risks. GDP in the year to March 2021 is now expected to decline 4.7%. Consumer prices are expected to fall 0.5%.

Saudi Arabia: Despite the challenges caused by the coronavirus, low oil prices and the government’s effort to gradually wean the economy off oil, Riyadh has gone ahead with a tripling of its value-added tax this month. The move hiked the VAT to 15% from 5% previously.

Shining a Light on Indexes: How to Help Investors Better Achieve Their Goals (July 2020)

A Report from the Value Equities Investment Committee | PDF

“What is the appropriate benchmark for your strategy?”

This is a question frequently posed to an investment manager. Before this question can be answered, it is necessary to gain a solid understanding of the strategy by examining the manager’s investment philosophy and how it is applied in the investment process, and, more specifically, how it is expected to perform throughout a full business cycle.

At Confluence Investment Management, our investment philosophy for the domestic value equity strategies was adopted in mid-1994 at our predecessor firm and continues to be implemented more than 25 years later. The approach is focused on understanding and valuing individual businesses with the emphasis on owning competitively advantaged businesses at attractive prices. It is a fundamental approach that views risk as losing money, or more precisely, the probability of a permanent loss of capital. Today, it is the foundation for all six of our domestic value equity strategies.

It is an approach borne from the belief that as investment managers we manage risk, not returns. Returns are the byproduct of an investment process and how well it is deployed. Our philosophy and process are centered around individual businesses with the intent of owning a collection of superior entities in a concentrated manner and then allowing them to compound over long periods.

Our energy has never been focused on managing to a benchmark or index as it is not additive to the investment process. Furthermore, we do not view tracking error as a measure of risk. Quite the contrary, active investors should welcome tracking error as it is the only way to outperform an index. This is not to say that we are not mindful of the indexes; we are, and it is perfectly reasonable to compare us to an index. But it is equally important to understand how an index is constructed to better understand the applications and limitations when using that index as a benchmark to measure an investment manager.

Daily Comment (July 14, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Our latest Confluence of Ideas podcast episode is now available, titled “The 2020 Election: Part 2.” In our “2020 Geopolitical Outlook,” we named the 2020 U.S. election as a key event. Our recent five-part Weekly Geopolitical Report series examined this issue in more detail. This is the second of three podcast episodes that will look at the 2020 election. In this episode, we discuss the issue of inequality and the rise of populism, the impact of social media, and the current problems of extreme partisanship and political legitimacy.

As usual in recent weeks, the financial markets today reflect a tug-of-war between coronavirus optimism, and renewed outbreaks and lockdowns in a growing list of countries, states and localities. As described below, the renewed outbreaks and lockdowns seem to be winning of late, helping reverse an initial uptrend in the stock market yesterday. Just as important, we also review several indications that relations are continuing to worsen between China and the Western democracies, which is a further threat to global risk assets.

COVID-19: Official data show confirmed cases have risen to 13,127,030 worldwide, with 573,664 deaths and 7,280,515 recoveries. In the United States, confirmed cases rose to 3,364,704, with 135,615 deaths and 1,031,939 recoveries. Here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

Virology

- Responding to the recent surge of infections in California, state officials ordered an immediate lockdown on indoor activities at restaurants, bars, museums, zoos and movie theaters. In addition, the main school districts in Los Angeles and San Diego said they would start the school year solely online. Separately, Oregon Governor Kate Brown ordered a ban on most indoor social gatherings of more than 10 people, and said the state would require people to wear masks outside when they can’t properly social distance.

- Coupled with renewed lockdowns in other areas, these measures underscore the risk of renewed economic damage from the resurgence in infections in the South and West. Even though this round of infections has mostly affected the younger, healthier victims that typically handle the disease better, intensive-care capacity is already being stretched to the limit in some areas and the first hints of a resurgence in deaths is already visible.

- If those trends continue, more state and local governments are likely to reimpose their lockdowns to protect the most vulnerable – a move that would probably lead to another retreat in equity prices.

- Compounding the negative news from the U.S., the Walt Disney Company (DIS, 116.22) said it is reclosing its Hong Kong Disneyland theme park, just a month after it reopened, because of a resurgence of infections in the city. The closure comes as Hong Kong officials said all activities such as large social gatherings, dining in at restaurants and going to the gym would be temporarily suspended.

- The British government said face masks will be required for anyone entering retail stores in England beginning on July 24, on top of the existing requirement to wear a mask on public transport. Cabinet Office Minister Michael Gove had said on Sunday that masks should not be made mandatory, but the government overruled him on grounds that “there is growing evidence that wearing a face covering in an enclosed space helps protect individuals and those around them from coronavirus.” The decision brings England in line with Scotland, Germany, Italy and several other European countries and locales.

- In South Africa, a sharp resurgence of coronavirus cases has forced the government to reimpose its lockdowns, including a ban on alcohol sales and a curfew.

- Economic reports from Europe and Asia today show continued deep economic scarring from the virus lockdowns (see data below), including an annualized drop of 41.2% in Singapore’s second quarter GDP.

- If you’re looking for more evidence that some things will never be the same after the virus crisis, recent polling shows that a large percentage of Japanese commuters don’t want to go back to the office and submit themselves again to the nightmare known as Japanese public transport. The reporting highlights the risk that many office complexes around the world could end up being less utilized and less valuable going forward.

Foreign Policy Response

- Germany continues to show surprisingly strong support for the European Commission’s proposed €750 billion coronavirus recovery package, which is expected to include a large program of joint, mutualized EU debt. Chancellor Merkel yesterday insisted the package had to be “massive.” In fact, she insisted that, “Europe wants to stick together in this difficult time,” illustrating Germany’s fresh sense of leadership in the EU as the U.S. pulls back from its traditional role as global hegemon.

United States-China: In a major shift away from the previous U.S. policy of not taking sides in territorial disputes where it is not involved, Secretary of State Pompeo said the United States has formally rejected a range of Chinese territorial claims against its neighbors in the South China Sea. In his statement, Pompeo characterized the decision as an effort to uphold international law against what he called a “might makes right” campaign by China to coerce and intimidate its Southeast Asian neighbors into ceding their interests. Although it wasn’t immediately clear what the practical implications of the policy shift will be, there is a high risk that the move will exacerbate U.S.-China tensions in trade, technology, human rights and other areas. At the extreme, the move could also raise the risk of military confrontation with China at some point down the road, so it is a decided negative for equities and bears close watching.

China-United Kingdom: Buckling to U.S. pressure, the U.K. did an about-face and banned Chinese telecom giant Huawei (002502.SZ, 3.07) from the country’s 5G communications network. The company will be banned from supplying new equipment to Britain’s 5G networks from December 31, while existing Huawei equipment must be stripped from 5G networks by 2027. The move, which aims to prevent Huawei’s equipment from being used for Chinese spying or influence operations, illustrates the growing global pushback against China’s political, economic and technological rise. Not only does that pushback portend a potential conflict with China at some point in the future, but it also has the potential to crimp Chinese economic growth and the success of its firms as they attempt to expand overseas. As noted above, the pushback is therefore a growing risk for global risk assets.

China-Hong Kong-United Kingdom: The British government estimated about 200,000 residents of Hong Kong could apply for special “British National Overseas” passports and emigrate to the U.K. under Foreign Secretary Raab’s offer last month. That’s far below the 3,000,000 or so who are eligible for the passports, but even that level of emigration would likely anger Beijing and further strain relations between China and the West.

United States: A fire in port has caused major damage to the USS Bonhomme Richard, one of the Navy‘s few amphibious assault ships capable of conducting offensive operations like an aircraft carrier. According to officials, the damage is so severe that it may be impractical to repair. If the ship is lost, it would significantly reduce U.S. ability to project power around the world for an extended period.

European Union: The European Commission is reportedly planning to clamp down on the sweetheart tax deals that some smaller countries have offered to multinational firms. Crucially, unlike ordinary tax legislation in the EU, the initiative would only require the backing of a qualified majority of the EU’s 27 member states rather than unanimous support of all countries. That would limit any government’s ability to wield a veto, although the measure would also need approval from the European parliament.