by Bill O’Grady, Kaisa Stucke, and Thomas Wash

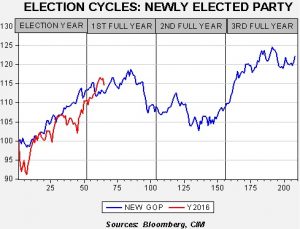

[Posted: 9:30 AM EDT] Global equity markets are in retreat this morning as bond yields fall and the dollar declines. What we are seeing is the reversal of the “Trump trade” that came out of the election. The Trump trade was to buy equities (especially financials), sell bonds and buy the dollar. Thus, concerns about the future path of policy are leading to a retreat on these positions.

As it become obvious on Friday that the AHCA was not going to pass, Speaker Ryan decided not to hold a vote on the bill. We did see some weakness in equities; overall, the decline looked to be well contained. However, over the weekend, sentiment deteriorated and concerns rose that the whole Trump agenda may be imperiled. This is how that current analysis stands:

The GOP faces major divisions that Trump will struggle to manage. As we have documented over the past two years, populists on both the left and right wings have become increasingly unhappy with how the center-left and center-right establishment have been managing the country. The insurgent campaigns of Sen. Sanders and the victory of Donald Trump revealed those divisions, and the AHCA revealed the divisions within the GOP. We found it notable how the president initially blamed the Democrats after the AHCA failed but shifted his focus to the right wing of the GOP later in the weekend, including the Club for Growth, Heritage, etc. It’s worth remembering that Trump is a populist; the GOP establishment and much of the hard right are not.

Those divisions exist for tax reform as well. The Freedom Caucus usually want policy to be revenue neutral and tend to be deficit hawks. We note that Rep. Mark Meadows (R-NC) did suggest over the weekend that tax cuts don’t have to be “fully offset,” suggesting there may be some room to maneuver. However, it’s unclear how much room exists. A simple cut in rates may get through Congress on just GOP votes but only in the reconciliation process, meaning the cuts will sunset in 10 years. Such cuts won’t have as much effect because businesses won’t know if the reductions will stand and thus will be reluctant to make long-term investments based on them. Expansive tax reform may be more difficult than the health care bill, so it could mean a very simple tax cut and little else. And, the border adjustment tax is probably dead as well.

Trump is reaching out to Democrats. If that was the plan, he should have led with infrastructure. That would have created goodwill in a policy area where Democrats are inclined to help. Trump could have used that goodwill to gain support for other policies. Trump is facing a similar problem that Speaker Boehner faced; some legislation may require isolating the Freedom Caucus and joining with moderate Democrats to pass things. Unfortunately, in the current partisan political environment, those moderates may be terrified to vote for anything GOP-led for fear of being hit with a primary challenge from the left. Thus, by leading with the AHCA and trying to bring down what the Democrats see as one of their major achievements, it will be difficult to get any bipartisan cooperation.

The AHCA’s failure will make tax reform harder in other ways. Speaker Ryan wanted to lead with health care because the AHCA would have would have eliminated the taxes that the ACA levied. By reducing the amount of revenue coming into the government from the ACA, the baseline would have been reduced, making the impact of tax cuts appear less onerous. In addition, the spending cuts shown by the CBO would have freed up revenue for tax reductions. Thus, the scope of tax reform may be reduced.

The debt ceiling may become a crisis. The continuing resolution funding the government expires on April 28. We have been expecting it to be extended, with the real “crunch” coming in autumn. However, the failure of the AHCA suddenly complicates this issue. The Freedom Caucus will likely insist that any new resolution end funding for Planned Parenthood. There is no way the Senate will vote for such a resolution even if the House goes along with the Freedom Caucus on this issue. The other way this moves forward is the “Boehner option” of pulling Democrats into a coalition to fund the government. However, they will have their own demands and will undermine the speaker. The president will be unsympathetic; his argument will be that the Freedom Caucus had the chance to defund Planned Parenthood with the AHCA and their failure to pass that bill means that Planned Parenthood will continue to receive money from the government.

The big picture is that political coalitions are shifting. A two-party system is really one of enforced coalitions. In other words, political parties tend to have groups within them that are not necessarily compatible but grudgingly work together for political purposes. Every so often, however, these coalitions can’t hold and new ones are formed. For example, we noted last week that the head of the AFL-CIO was worried that the anti-trade group within the Trump administration is losing influence. It’s a bit shocking when “anti-trade” and “GOP” are united; however, it should be noted that the GOP was the party of tariffs before WWII. We are not sure how various groups will realign in the coming years but we feel confident that it will occur. Investors should be careful in that the GOP may evolve into the party of the working class and the enemy of capital. It’s worth remembering that Andrew Jackson was a Democrat; Trump recently laid a wreath at his tomb.

In other news, there were widespread protests in Russia over the weekend and Russian security forces arrested Alexei Navalny, an opposition figure. The protests rose over reports that PM Medvedev took over $1.0 bn in bribes but also seemed to reflect opposition to Putin’s reign. The protests occurred despite official bans. Unlike earlier protests, they occurred across the country, along the Black Sea coast and as far east as Vladivostok. Putin is usually able to quash these uprisings but the fact that this one came out of nowhere will likely rattle the Kremlin.

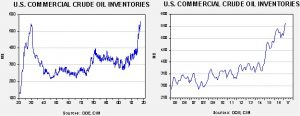

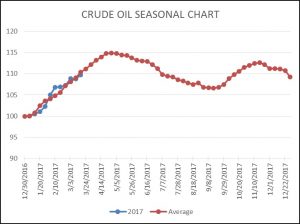

OPEC is talking about extending its production cuts and Saudi Arabia is clearly wanting to boost prices by cutting its own output. The Kingdom noted its output cuts are nearly double what it had promised. However, non-OPEC cuts have been disappointing as Russia has mostly failed to reduce output. Anyone surprised by Russia’s lack of compliance has no sense of history; Russia is notorious for not meeting such promises. Saudi Arabia should have known these promises were unlikely to be fulfilled, which has likely led it to reduce output beyond its quota cuts. We believe the Saudis are engaging in “window dressing” in front of its Saudi Aramco IPO next year and thus will take aggressive steps to keep prices supported. However, there are limits to how much the kingdom can cut output and maintain revenue in a falling price environment.

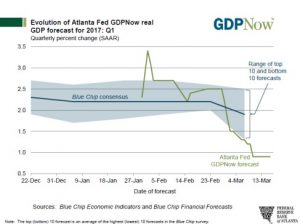

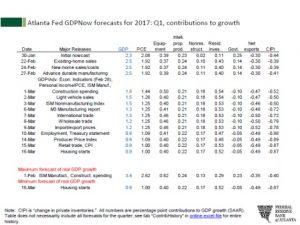

So, where does all this lead us? After the election, all the groups supporting President Trump were projecting their best outcomes on his presidency. Reality is starting to set in. It’s fair to say he won’t get everything done; no president ever does. However, worries on even the most basic legislation (like tax reform) are bearish for equities. How bearish? We note that the economy is still doing ok and there appears to be ample cash on the sidelines. Thus, the worst case scenario is probably a pullback toward the 2200 area for the S&P 500. We will have more on this tomorrow.