by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EST] The overnight news was less active than the weekend but there’s still a lot going on. Here’s what we are watching:

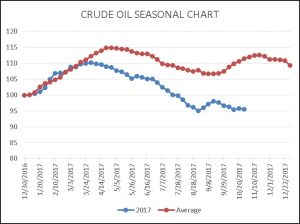

Saudi Arabia: We see two items of note this morning. First, the king has ordered banks to freeze the accounts of numerous Saudi nationals who are not formally under arrest. We suspect this was done for two reasons. First, the purge may be widening and the king wants to remove the capabilities of these people from leaving the country. Second, it may be designed to prevent capital flight. Although the people affected by the account freeze may not be involved in corruption, fears of political instability will lead people with assets to try to secure them outside the country.[1] The drain can adversely affect local financial markets, so freezing the accounts prevents them or their money from fleeing. Second, Saudi Arabia has accused Iran of an “act of war”[2] after a missile was launched from Yemen into Riyadh. War would raise tensions and increase the odds of a supply disruption. Oil prices jumped yesterday and are modestly lower this morning. The kingdom also accused Lebanon of declaring war on Saudi Arabia due to the actions of Hezbollah. Tensions in the region are clearly rising. We note that in a series of tweets the president praised King Salman and his son for their actions.

Trump in South Korea: President Trump has left Japan for Seoul today. In a speech, he struck a conciliatory tone with North Korea, imploring its leader to “make a deal.” The president noted that there has been “a lot of progress” in negotiations with the Hermit Kingdom.[3] He also noted that the U.S. has three carrier strike groups in the region and unexpectedly informed his audience that a nuclear-powered submarine is also in theater, which may have been a surprise to his guests. The president has consistently downplayed the likelihood of a negotiated settlement to the North Korean situation, but these comments raise hopes that a diplomatic solution is possible.

Trump goes to China next: President Trump will meet with President and General Secretary Xi later this week. We expect that China will offer a series of inconsequential trade concessions that will allow President Trump to gain a “win.” Whether the president sees through the ruse will be the focus of our attention.

The return of Wang: Comments from former graft-buster Wang Qishan suggested that there are “plots to grab power” in China,[4] and vigilance against corruption is critical. Wang recently stepped down from the Standing Committee of the Politburo due to age but there are rumors he may be selected for vice president,[5] a state office rather than a CPC office. Wang is one of Xi’s most trusted associates so finding a place for him makes sense.

China’s debt ploy: It is no secret that leverage in China is excessive. PBOC Governor Zhou Xiaochuan has been ranting on this problem for the past few months. Bloomberg[6] reports that under Chinese law firms can swap debt for “perpetuals,” which appear to be similar to the old British consuls, which were bonds that paid interest but were never amortized nor returned principal. By making this swap, firms can count perpetuals as equity and not debt, “instantly” reducing leverage. Of course, they still must service at least the interest, which tends to be a bit higher for perpetuals. Interestingly enough, Zhou has apparently discovered this tactic and has begun to criticize it as masking the degree of leverage in the Chinese financial system.

Quarles to speak: As noted below, Governor Quarles will talk today at The Clearing House’s annual conference in New York. This looks like the first public speech since he was sworn in yesterday as governor and vice chair for supervision. We will be looking to see if he gives any hint on policy.

[1] This is one of the attractive features of cryptocurrencies—they facilitate capital flight.

[2] https://www.ft.com/content/eaf5b226-c38f-11e7-a1d2-6786f39ef675 (paywall)

[3] https://www.washingtonpost.com/news/post-politics/wp/2017/11/07/trump-arrives-in-seoul-tours-camp-humphreys-military-base-on-eve-of-north-korea-speech/?utm_term=.096975fcf465

[4] http://www.reuters.com/article/us-china-corruption/chinas-former-top-graft-buster-warns-of-plots-to-seize-power-idUSKBN1D70HR

[5] https://www.axios.com/potential-next-act-for-trusted-xi-adviser-2505606876.html

[6] https://www.bloomberg.com/news/articles/2017-11-06/china-s-firms-have-found-a-way-to-cut-debt-at-least-on-paper