Author: Rebekah Stovall

Asset Allocation Bi-Weekly – #82 “The Inflation Surprise” (Posted 8/22/22)

Daily Comment (August 17, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, including the latest on how the conflict is driving up global energy prices. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including news that consumer price inflation in the U.K. has now reached 10.1%, its highest level in more than 40 years.

Russia-Ukraine: Russian forces continue to make small, incremental territorial gains in Ukraine’s eastern Donbas region, while seeking to reinforce the territories they occupy around the southern city of Kherson, all while launching missile and artillery strikes against other parts of Ukraine. Meanwhile, the Ukrainians continue to gradually ramp up their counteroffensive to retake Kherson, which includes attacking Russian logistical nodes in Crimea with Western-supplied long range artillery and/or sabotage operations.

- Separately, the U.S. Agency for International Development announced it will spend more than $68 million to purchase and ship Ukrainian grain for the UN’s World Food Program. The grain will be used as aid for poorer countries around the world that are struggling with disrupted food supplies and spreading hunger. Ukraine has also been ramping up its grain shipments to other customers under the recent Russia-Turkey-Ukraine safe-passage deal.

- On the energy front, Europe’s intense heatwave is exacerbating its evolving energy crisis, as the Continent gobbles up energy for air conditioning.

- Futures for natural gas at a trading hub in the Netherlands, the benchmark in northwest Europe, rose 3.2% yesterday to an all-timer record of €233.56 a megawatt-hour, and they’ve risen another 6.0% so far this morning.

- Sky-high energy prices are now starting to force the closure of European mining and manufacturing operations, which will further weigh on the Continent’s economic activity and financial markets.

- Although it is less recognized in the press, China is also undergoing a painful heatwave and drought. As in Europe, the resulting drop in hydroelectric output has forced the government to ration electricity in the southwestern province of Sichuan, shutting down some industrial activity, including lithium output.

Germany: Officials in Berlin have confirmed that the government will temporarily postpone the planned year-end closure of the country’s last three nuclear power plants in order to deal with Russia’s cut-off of natural gas supplies, although the decision will likely need to be ratified by the German parliament. The decision confirms how desperate Europe’s energy supply situation could get this winter, even if U.S. investors haven’t fully recognized the risks.

United Kingdom: The July consumer price index was up a whopping 10.1% from the same month one year earlier, accelerating from the 9.4% gain in the year to June and marking the U.K.’s highest inflation rate in more than 40 years. To make matters worse, inflation is likely to accelerate further if energy price caps are lifted as planned in October.

- The high inflation rate is likely to pile more pressure on the Bank of England to keep hiking interest rates. In response, British government bonds have sold off modestly so far this morning, driving the yield on the benchmark 10-year Gilt to 2.242%.

- The inflation numbers could also lead to more generous consumer assistance offerings from the two Conservative Party candidates set to replace Boris Johnson as party leader and prime minister, Foreign Minister Liz Truss and Former Chancellor Rishi Sunak. Although polls suggest Truss remains in the lead, she has taken some heat for offering stingier responses to the cost-of-living crisis.

China: More than a dozen Chinese ministries and departments have released a joint policy statement aimed at boosting fertility and childbearing in order to arrest China’s collapsing birthrate and impending population decline. China’s declining workforce and population aging are key reasons we expect the country’s overall economic growth to keep moderating in the future.

Kenya: As we warned in our Comment yesterday, opposition leader Raila Odinga has rejected the official count in last week’s presidential election that showed him losing to Deputy President William Ruto. Odinga has indicated he will fight the results in court, likely setting up weeks or months of political uncertainty in the key African country.

Global Supply Chains: Even though global shipping rates have started to retreat, it appears that port congestion, dockworker strikes, and other challenges are still disrupting exports and imports in many countries. The continuing supply disruptions are likely to keep inflation from falling back as soon as it otherwise would. In turn, that will likely keep the world’s major central banks in rate-hiking mode, potentially prompting a pullback in risk assets.

U.S. Fiscal Policy: Yesterday, President Biden signed his Inflation Reduction Act into law, which will hike corporate taxes and increase funding to the IRS in order to rein in the federal budget deficit and fund some additional spending in areas such as healthcare and climate stabilization.

U.S. Drought: For the first time ever, the Bureau of Reclamation has declared a Tier 2 water shortage for the Colorado River basin in seven southwestern states and Mexico. In addition, the Bureau has ordered those entities to cut their water use by a total of 721,000 acre-feet (each acre-foot is about the amount that a family of four uses in one year). The resulting water use restrictions will likely be a drag on agricultural and industrial activity in the region over the coming months.

Bi-Weekly Geopolitical Podcast – #15 “The End of the World is Just the Beginning: A Book Review” (Posted 8/15/22)

Bi-Weekly Geopolitical Report – The End of the World is Just the Beginning: A Book Review (August 15, 2022)

by Bill O’Grady | PDF

Soon after founding Confluence Investment Management, we formulated a position that the U.S. was in the early stages of ending its hegemonic role. We postulated that this event would have a profound effect on the domestic and global economy, and, consequently, financial markets. In traveling around the country discussing this idea, we[1] were often asked, “When are you going to write a book about this?” It seemed like something we should do, although finding time while meeting a tight publication schedule and trying to run a business made it challenging. When Mark and I discussed the idea of a book, we wanted it to cover the material in an accessible manner.

And then the idea died…because Peter Zeihan beat us to it. His 2014 book The Accidental Superpower hit all the themes we wanted to cover and did so in a manner that we probably couldn’t improve upon. Zeihan has worked for the State Department and other think tanks. I saw his work with Stratfor when he was with that private intelligence firm, and he now runs his own consulting firm, Zeihan on Geopolitics. He frequently sends out short videos on various topics; you can join his mailing list here. Since The Accidental Superpower, he has written three books, the most recent of which was published in July and is the topic of this week’s report.

In this report, we will review Zeihan’s new book, The End of the World is Just the Beginning, briefly discussing its content, the major insights, and the overall strengths and weaknesses of his argument. We will conclude with market ramifications.

[1] Mark Keller (Confluence CEO/CIO) and me.

Don’t miss the accompanying Geopolitical Podcast, available on our website and most podcast platforms: Apple | Spotify | Google

Daily Comment (August 15, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, where the disposition of forces has changed relatively little in recent days. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, most notably a bevy of disappointing economic news from China and a surprise interest-rate cut from the country’s central bank.

Russia-Ukraine: Russian invasion forces continue to make only incremental territory gains in Ukraine’s eastern Donbas region, while reinforcing their troops occupying the southern region around Kherson. The latest reports highlight that those reinforcement efforts have left the Russians with a hodgepodge of forces from different military districts and of different capabilities, which would likely make them hard to manage and relatively ineffective.

- Ukrainian forces continue to destroy the bridges linking Kherson with the rest of the territory occupied by the Russians, which will make it even harder for the Russians to defend the territory against Ukrainian counteroffensives.

- Meanwhile, global leaders are becoming increasingly alarmed about the fighting around the Zaporizhzhia nuclear power plant in eastern Ukraine. One concern is that the fighting could damage the reactors and cause a nuclear disaster. Another concern is that the Russians are reportedly siphoning off electricity from the plant and sending it to Russia.

- On the energy front, the leaders of Spain and Portugal said they support German Chancellor Scholz’s call last week for a north-south natural gas pipeline that would run from Portugal via Spain and France to Central Europe.

- According to Spanish Ecological Transition Minister Teresa Ribera, the Spanish portion of the pipeline could be finished in eight or nine months.

- The next major approval would have to come from France.

China: After a wide range of data today showed China’s post-pandemic economic recovery stumbled in July, the People’s Bank of China announced a surprise interest-rate cut. However, the cut in the medium-term interest rate was just 0.1%, to 2.75%, perhaps signaling the central bank’s reluctance to ease policy more aggressively after it recently warned about inflation pressures.

- Among the weak data points, July industrial production was up just 3.8% year-over-year, well short of the expected rise of 4.5%. July retail sales were up 2.7% on the year, compared with an anticipated rise of 5.0%. A key index of new home prices was down 1.7% year-over-year, after being down 1.3% in the prior month.

- The broadly weak economic data and tepid interest-rate cuts suggest China’s economy will offer little support to global economic activity this year. This news coupled with high inflation around the globe, aggressive interest-rate hikes by many key central banks, and the impact of the Russia-Ukraine war, suggests the U.S. economy and financial markets are likely to face headwinds in the coming months.

- One major impact so far this morning: commodity prices have fallen dramatically, with Brent crude oil down 5.2% to $93.06 and copper down 3.0% to $3.5555.

China-Taiwan-United States: Following House Speaker Pelosi’s controversial visit to Taiwan earlier this month, a bipartisan group of Congressmen landed on the island yesterday, prompting another round of protests and threatening military exercises by Beijing. Like Pelosi, the legislators said they were visiting Taiwan to express support for its democracy and to demonstrate their right to visit the island.

- Indeed, these Congressional visits could be seen as political “freedom of operation sailings” or FONOPS, similar to those the U.S. Navy makes throughout the waters around China to assert the right of foreign ships to sail in international waters.

- The Congressional visits, like their naval counterparts, help to push back against Beijing’s geopolitical aggressiveness in the Indo-Pacific region, but they also raise U.S.-China tensions and increase political risks for cross-border investors.

United States-Iran: U.S. Secretary of State Blinken has explicitly linked Iran to the attempted murder last week of irreverent novelist Salman Rushdie. Specifically, Blinken called out Iranian institutions for inciting violence against Rushdie for generations and then gloating over the news of his stabbing last week. The statement illustrates how the stabbing has become yet another source of tension between the U.S. and Iran.

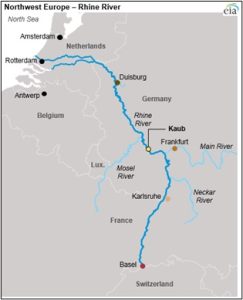

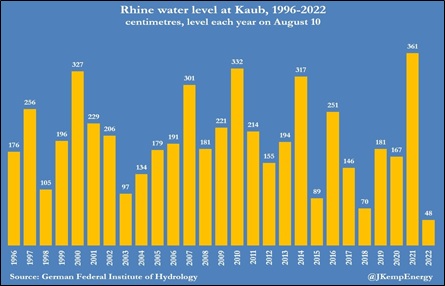

European Drought: As Europe’s historic drought worsens, the depth of the Rhine River between Wiesbaden and Koblenz fell to just 40 cm on Friday. At that depth, most barges can only carry a fraction of their capacity, meaning companies needing to send coal, chemicals, or components upstream from Rotterdam and Antwerp will have to use much more expensive truck and rail systems.

United Kingdom-Leadership Race: In the race to succeed Boris Johnson as Conservative Party leader and prime minister, polling over the weekend showed Foreign Minister Liz Truss’s lead over Former Chancellor Rishi Sunak has narrowed to 22%. However, other reports say as many as 8 in 10 party members have already sent in their ballots, which likely works in Truss’s favor because her lead hadn’t begun to narrow until recently.

United Kingdom-COVID: The Medicines and Healthcare Products Regulatory Authority has approved a COVID-19 vaccine from Moderna (MRNA, $171.18) that is specifically targeted to the highly transmissible Omicron variant. The move makes the U.K. the first country in the world to approve an Omicron-specific vaccine and likely sets up an autumn vaccination drive for it.

U.S. Fiscal Policy: On Friday, the House passed President Biden’s “Inflation Reduction Act,” which includes higher taxes on corporations and increased funding for the IRS to raise funds for deficit reduction, as well as providing new funding for healthcare, climate-stabilization, and sustainable agriculture policies. As we’ve noted previously, passage of the bill may marginally improve the Democrats’ prospects in the mid-term elections in November, but we still expect the Republicans to take control of at least the House.

Daily Comment (August 12, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning. Today’s Comment starts with a discussion of tensions in Asia and how they could impact global supply chains. Next, we review the ongoing energy crisis in Europe and its effects on the global economy. Finally, we conclude with our thoughts on improving relations between Russia and Iran and what this development could mean for the West.

Asia: The continent is rife with political risk as countries are becoming more contentious and less predictable.

- China could escalate tensions over Taiwan after Xi is officially granted an unprecedented third term. Before Pelosi visited the self-governing island, Chinese President Xi Jinping assured President Biden that China was not willing to go to war over the trip; this reluctance was likely related to Beijing wanting to maintain stability as the country prepares for the National Party Congress in the fall. The government is under a lot of pressure due to dissatisfaction with its Zero-COVID Policy and the property market meltdown. Therefore, China does not want to risk angering its people as the country seeks to present itself as a bastion of wealth and economic growth to the rest of the world. After Xi is reappointed as president, analysts expect he could become more hostile to countries that challenge China’s authority.

- Taiwan rejected China’s claim of a “one country, two systems” model for the region. Beijing has used this model to dictate the relationship of areas such as Hong Kong and Macau. It allows territories to accept China’s sovereignty claim in exchange for greater autonomy.

- North Korean Leader Kim Jong-un might have suffered from COVID during the recent outbreak. The news of his illness is a rare admission from a country that generally likes to keep information secret about its leaders’ health. It is unclear whether the report is accurate or why the government made it public. However, if Kim Jong-un were to die, it could lead to instability in a country that has nuclear weapons.

- South Korea and China are clashing over plans to install a weapons defense system. The disagreement is over the Terminal High Altitude Area Defense (THAAD) system that the U.S. delivered in 2016. China insists THAAD has the potential to spy on its own systems.

The Korean peninsula is a region with risks that are hard to forecast. North Korea’s privacy makes it difficult to gauge political risk within the country. Meanwhile, China’s power projection may hurt countries looking to counter its influence. For example, Beijing could look to limit trade relations as retaliation for countries not doing what it wishes. Additionally, the Taiwan situation will likely escalate. Because many firms have manufacturing operations set up in Asia, tensions on the continent could complicate supply chains. This outcome could hurt firm profits and add to global inflationary pressures.

Europe: The energy crisis in Europe is adding to the continent’s economic woes and will severely impact firms and households as they head into winter.

- European countries are looking to avoid a potential energy crisis by integrating energy channels. For example, German Chancellor Olaf Scholz has backed a proposal that would link the pipelines of Spain and Portugal to the rest of Europe. Although construction of the pipeline will not be finished in time to prevent an energy crisis by this winter, it does suggest that European countries are looking to reduce their dependence on Russia.

- In the U.K., rising energy costs will take center stage as the prime minister battle heats up. Former British Finance Minister Rishi Sunak has plans to cut 200 pounds from household energy bills by reducing the value-added tax. Energy prices will triple this year; thus, consumers will likely welcome any financial assistance. He also has plans to offset the loss of revenue by levying a windfall tax on energy profits. However, his opponent, Liz Truss, has rejected the notion of implementing a windfall tax. Sunak remains an underdog in the prime minister contest; however, his windfall tax plan is very popular among Brits.

- Declining water levels in the Rhine will likely add to Europe’s economic woes. The Rhine River is a crucial trade route for the Netherlands, Germany, and Switzerland. The lack of rainfall and severely hot temperatures threaten to render the rivers impassable for ships. The waterway is expected to dip below the threshold needed for navigation over the weekend, and the problem could extend for months. The lack of maritime trade along the river will make it harder for firms to receive needed supplies such as oil, grains, and chemicals.

Governments in the West are coming under growing pressure to combat rising energy costs to appease their constituents. The lack of infrastructure, Russian energy, and maritime shipping capacity will make it harder to contain energy prices. Even if lawmakers offer financial assistance to households, it is unlikely to be enough to offset the surge in household costs. As a result, Europe will likely fall into recession sometime in the fall of this year.

Russia-Iran: Russia and Iran have strengthened ties to help each other circumvent Western sanctions.

- Russia, Iran, and India are close to opening a new trade route. The new shipping method will allow Russia to transport its resources to India without relying solely on Western waterways such as the Suez Canal, the Mediterranean, and the Bosporus. The route allows for the sanction-proof transport of goods and could benefit other countries in Central Asia and the Caucasus. Hence, Russia and Iran are learning to live with the sanctions.

- Additionally, the two sides have strengthened their military ties. Tehran has provided weapons to Russia and helped Moscow conduct cyberattacks on Ukraine. Meanwhile, the Kremlin has allowed Iran to use Russian satellites to gather intel on the U.S. and its adversaries in the Middle East. The two sides have also teamed up to help Armenia protect itself from its rival, Azerbaijan. The integration suggests the countries might coordinate some of their foreign policy as they look to counter other alliances in the West and the Middle East.

- Lastly, Russia and Iran are working vigorously to create a system that can be used as an alternative to SWIFT. They have agreed to allow trade using their respective currencies and are looking to expand the payment system to include currencies such as the Turkish lira and Indian rupee. The alternative payment system is paving the way for dollar-free trade for countries not aligned with the West and is an example of the ongoing trend toward deglobalization.

The increased economic and military cooperation between Russia and Iran is an example of countries starting to form blocs based on their financial and geopolitical interests. Given their volatile relationships with countries in the West and the Middle East, their rivals may decide to boost their military capabilities. Thus, strengthening relations between Russia and Iran should benefit defense industries.

Daily Comment (August 11, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment is divided into two main sections, starting with reactions from the market and the Fed to the latest CPI data. We include our thoughts on whether the Fed will pivot and why we are not convinced that inflation has plateaued. Next, we review international news focusing on stories that highlight rising geopolitical risks, namely, the latest developments in Ukraine, Taiwan, and Iran.

The Fed Speaks: Stocks rallied and the dollar weakened on Wednesday after the latest CPI report showed that inflation decelerated for the first time since February 2021.

- Regional Fed Presidents Neel Kashkari and Charles Evans cautioned investors not to assume that the latest CPI report will change the central bank’s policy path toward higher interest rates. Chicago Fed President Evans welcomed the news about the slowdown in price increases but added that the FOMC’s job is not finished. Minneapolis Fed President Kashkari further added that the Fed is far from declaring victory. The comments suggest that central bank officials view the market’s reaction as premature.

- Although both officials downplayed the possibility of a Fed pivot, neither changed his end-of-year target rate. For example, Evans maintained that the central bank should raise rates to around the median year-end projection in the Fed dot plots that was released in June. Meanwhile, Kashkari, who has the highest year-end fed funds target forecast, revealed that his end-of-year projection for the policy rate has not changed. Thus, it would seem Fed officials are not placing much weight on the July CPI report.

- It is too soon to tell whether inflation has indeed hit a turning point. Much of the decline in the CPI index was due to a drop in historically volatile energy prices. Meanwhile, relatively stable shelter prices, which comprise a third of the index, continue to rise well above their long-run averages. Thus, the market could be cruising toward a bruising if it gets too confident in a Fed pause or pivot. The next FOMC meeting will be September 20-21, 2022. At this time, central bank members will have the August CPI numbers, which will play a bigger role in whether the Fed decides to change course on its policy path.

- Declining fuel prices suggest that the August report may show further decelerating inflation. This month, gasoline prices fell below $4/gallon for the first time since March.

Despite the market’s reaction over the last few days, an economic downturn will not necessarily force the Federal Reserve to end its tightening. The central bank’s mandate is to maintain price stability and prevent rising unemployment. It might want to encourage growth, but it is not under any obligation to do so. Thus, the Fed will likely be open to raising rates as long as the labor market remains strong and inflation remains high. An aggressive Fed determined to bring inflation back to its 2% target and markets brewing with confidence create a fertile environment for a Fed surprise. Thus, investors should be cautious to place too much emphasis on one report.

International Risks: Rising geopolitical tensions suggest that investing abroad may remain difficult.

- The Russia-Ukraine war shows no signs of abatement. Ukraine forces are set to launch a counter-offensive to retake regions lost to Russia. Ukrainian President Volodymyr Zelensky has built up troops around the city of Kherson in preparation for a battle, while also leaving troops to fight in contested areas of the Donbas region. The war will likely be extended if Ukraine successfully regains the lost territory or can force a strategic retreat. A protracted conflict in Ukraine will make investing in Europe challenging as firms struggle to receive much-needed energy supplies. Thus, the possibility of a recession in Europe is elevated.

- The war will make it harder to reverse burdensome sanctions on Russia. The EU import ban on Russian coal will take effect on Thursday. Meanwhile, the International Energy Association (IEA) has projected that Russian oil output could fall by 20% by the start of next year due to the EU import ban. As a result, Russia’s lack of export capacity and production will likely keep commodity prices elevated going into next year.

- Tensions between the U.S. and China have boiled over for now, but the dispute over Taiwan could still lead to conflict. On Wednesday, China ended its military drills near Taiwan. Officials from Beijing vowed to regularly send patrols across the U.S.-drawn median line in the Taiwan Strait. Additionally, China withdrew its promise never to send troops to Taiwan in the event of a takeover. As this current crisis subsides, both sides will attempt to position themselves with more leverage in subsequent disputes over the island. Accordingly, the decoupling between the U.S. and China will likely accelerate over the next few months as firms come to terms with this new reality.

- As an example of this decoupling, Apple (AAPL, $169.24) has looked to expand its manufacturing operations into Vietnam. Meanwhile, Foxconn (2354, NT$50.60), a major Apple supplier, is building its production capacity in India. In the short term, firms will try to divest away from China by building capacity in nearby areas in Asia due to their familiarity with many of the countries in the region. Over time, however, the lack of stability and political uncertainty in small Asian countries may force forms to shift operations near the U.S. or possibly into Europe. This shift will be costly and potentially inflationary in the short and medium terms as firms will have to price in additional risks to the supply chains.

- The Biden administration’s hope of securing a nuclear deal with Iran hit another roadblock. Former Secretary of State Mike Pompeo and former National Security Advisor John Bolton were targeted for assassination by affiliates of Iran’s Islamic Revolutionary Guard Corps. Iran has also provided military training for Russian troops fighting in Ukraine. The Biden administration would like to secure a deal with Iran to prevent conflict in the Middle East. In the past, Israel has mentioned that it will not stand idly by while Iran develops its nuclear capacity. Thus, the likelihood of a potential conflict between Iran and Israel is elevated.

The recent slate of international news reinforces our view that global equities remain risky. A more hostile world will likely exacerbate supply chain issues and potentially slow the production of commodities. This outcome should be beneficial to energy-related assets. Additionally, as countries build up their military capabilities, industries related to aerospace and defense should also benefit.

Weekly Energy Update (August 11, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Prices have broken support but appear to be basing around $88 per barrel.

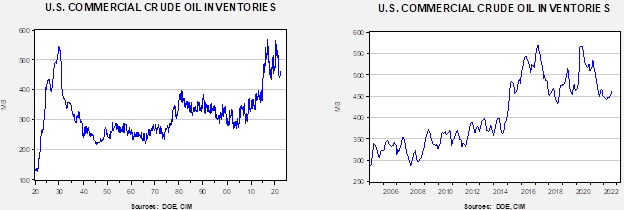

Crude oil inventories rose 5.5 mb compared to a 1.0 mb draw forecast. The SPR declined 5.3 mb, meaning the net build was 0.2 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.2 mbpd. Exports fell 1.4 mb, while imports declined 1.2 mbpd. Refining activity jumped 2.3% to 94.3% of capacity.

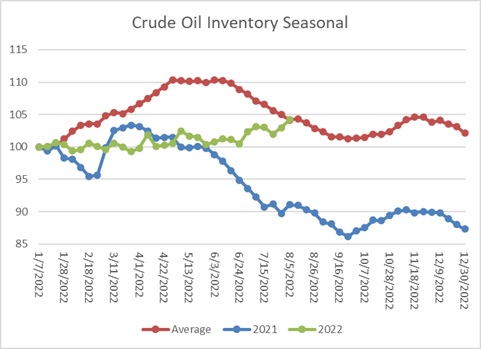

The above chart shows the seasonal pattern for crude oil inventories. Clearly, this year is deviating from the normal path of commercial inventory levels. The fact that we are not seeing the usual seasonal decline is a bearish factor for oil prices.

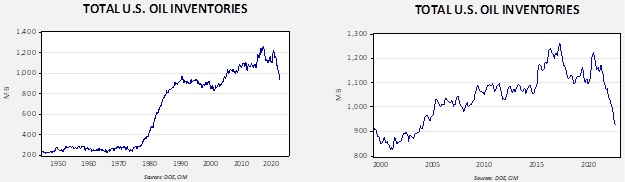

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2004. Using total stocks since 2015, fair value is $102.55.

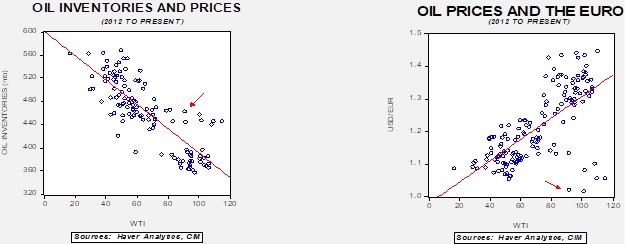

With so many crosscurrents in the oil markets, we are beginning to see some degree of normalization. The inventory/EUR model suggests oil prices should be around $64 per barrel, so we are seeing about $24 of risk premium in the market.

Market news:

- Oil prices rose this week as Russia halted shipments to central Europe over a dispute on payments. According to reports, Russia cut throughput after sanctions prevented Russia from accepting transit fees. However, the market failed to hold gains as a workaround was created.

- In last week’s report, we noted that OPEC+ increased production targets by 0.1 mbpd, a remarkably small adjustment. This had to be a disappointment for the White House. But beyond this news reveals a more troubling problem—the cartel may be near maximum output. For most of my career, we spoke of OPEC production “quotas” that were routinely violated. The usual excess production would tend to quell prices and, occasionally, lead the KSA to enforce discipline by flooding the market with oil. We now are in a world where we have production “targets” that are not met. The reason for the small increase appears to be less of a snub to President Biden and more because the producers just don’t have the capacity. Now, that doesn’t mean that they have no more oil to tap, but using that capacity would mean there is no additional buffer if something happens this winter. In any case, the price weakness we are seeing now is mostly a function of weakening demand.

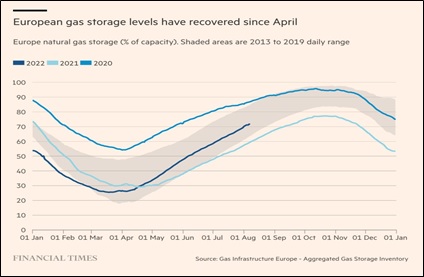

- Meanwhile, in Europe, countries are trying to figure out how to reduce demand to shore up inventories of natural gas without relying solely on price to ration demand. Such schemes have some usefulness, but there is a clear incentive to “free ride” the conservation of others. For example, Greek authorities are pressing for citizens to maintain an air conditioning temperature of 80o, but actually doing that is hard. So far, a weakening EU economy coupled with these measures is allowing inventories to accumulate, but at much higher costs. The other action we are seeing is fuel switching, which has mixed value. Still, research from the IMF suggests that with better coordination, the EU could offset some of the supply issues with better distribution.

- Although we have doubts that such demand “scolding” will work, EU storage levels are about normal.

- The negative effect on fertilizer and chemical plant operations in Europe could be significant if natural gas supplies remain constrained.

- After cutting off flows of natural gas to Latvia, supplies returned; it is not obvious why Russia restarted flows.

- Freeport LNG will resume partial operations in October. Although that is good news for Europe, it may result in higher U.S. natural gas prices. Various outages at gasification facilities have been very costly for natural gas firms.

- Reports suggest that Russian oil prices are starting to rise, which signals some degree of normalization of trade flows. Although bans on Russian oil in some markets will remain in place, nations open to buying Russian oil, namely, China and India, are likely creating a trading infrastructure to facilitate these sales.

- As Asia and Europe scramble to secure natural gas supplies, buyers are finding themselves competing for the same cargos. Meanwhile, as the U.K. steps up its LNG regasification, it is confronting a situation where some of the gas is tainted; if not rectified, this contamination could harm gas pipelines to the continent

- In Asia, a strike at an Australian LNG facility will delay maintenance and may reduce available supplies.

- As we noted last week, Rhine River water levels are declining due to unusually warm weather and the lack of rain. As levels decline, freight costs rise as ships can only be partially loaded.

- Factories in Bangladesh are planning for “holidays” to reduce energy demand.

- Gulf of Mexico oil production has been flat for the past two years. Most projects are longer term in nature and the investing environment is such that oil companies are being cautious, wanting to avoid stranded assets. In addition, production in the region is always at risk to tropical storm activity. That said, there are some projects coming on line which could lift production from this area in the coming months. Still, given where prices are, oil production has shown little growth, mostly because of capital discipline.

- The ESG movement has pressed financial firms to cut lending and investment to fossil fuels. As backlash has developed, banks and other financial firms are finding themselves caught between competing political trends.

- A Cuban tank farm caught fire after a lightening strike.

- Although the Biden administration hasn’t moved to restrict oil exports like President Nixon did in the 1970s, there is a risk that such policies might be considered again. However, given different grades of crude oil and their compatibility with the U.S. refining system, it is quite possible that the oil that isn’t exported would not be used domestically. This outcome would likely lower U.S. crude oil prices without lower product prices. In addition, such a ban would discourage U.S. production.

- High energy prices are translating into high food costs.

- China is producing oil and gas with ultra-deep drilling techniques.

Geopolitical news:

- According to reports, EU mediators negotiating between the U.S. and Iran have submitted their “final text.” Although Iran has returned to nuclear talks, the odds of success appear very low. For one thing, Tehran looks to be moving rapidly toward a nuclear weapon. For another, Tehran is trying to prevent the IAEA from investigating suspected weapons sites. We continue to expect that the talks will fail.

- Russia is launching a satellite for Iran to spy on the region.

- In Iraq, Muqtada al-Sadr is calling for new elections. Turmoil has been high in Iraq since al-Sadr’s supporters resigned from parliament.

- We have been reporting about high European temperatures this summer. One potential fallout is that hot weather could be contributing to geopolitical tensions in the Balkans.

Alternative energy/policy news:

- As the Inflation Reduction Act of 2022 careens toward passage, the climate change portions appear to be quite remarkable. Obviously, these projections are just that; it remains to be seen how this bill will work in practice. Nevertheless, it is notable that a political deal with a supporter of fossil fuels was open to signing off on such a measure.

- The bill does offer some political lessons. In a closely divided nation, carrots work better than sticks. This bill doesn’t have a carbon tax or items that will restrict demand; instead, there are subsidies and incentives.

- The parts of the bill that streamline permitting for pipelines is, in our opinion, a significant win for the oil and gas industry.

- One of the stranger elements of the bill is that to receive the EV tax credits, the supply chain has to exclude China. Since many of the EV elements come from China (batteries, some key metals in batteries, etc.), most EVs will be excluded. Although this rule does make sense, it also makes sense to buy your EV ASAP.

- As EVs become more popular, drawbacks are starting to emerge. First, EVs are expensive, even with generous subsidies. For widespread adoption, more affordable models will be required. Second, it will be difficult to source key inputs, such as lithium, nickel, and cobalt; there simply are not enough mines to meet the demand. Third, the charging infrastructure isn’t built out yet, and allocating the costs for that infrastructure will be partly absorbed by those not driving EVs.

- China’s CATL (300750, CNY, 505.65) intends to go ahead with its plans to build a battery facility in the U.S. With all the turmoil tied to Speaker Pelosi’s (D-CA) visit to Taiwan, there were doubts the investment would occur.

- Sanctions on imports from Xinjiang will likely reduce the availability of solar panels in the U.S.

- In some respects, hydrogen is the future of the energy industry and always will be. Hydrogen is not only ecologically friendly (using it in a fuel cell creates water as a byproduct), but it could conceivably use the existing filling station network and avoid the buildout of charging stations. Still, making hydrogen on a commercial scale has always been cost prohibitive. Fuel cells mostly use platinum, lifting costs as well. But, emerging research suggests that iron might be an acceptable catalyst, which could reduce costs significantly.

- Over the summer, we have been commenting on extreme temperatures and other weather events around the world. Iraq, for example, is reporting 120o temps this week. In the face of rising temperatures, cities are beginning to build and expand cooling centers to give people a place to cool off during the day. Drought conditions exist in 60% of the EU plus the U.K. The latter is bracing for another dangerous heat wave.

- The lack of rainfall is reducing Norway’s hydroelectricity supply; consequently, exports to the continent will be cut.

- U.S. power demand is set to make a new record this year.

- Thermal storage is increasingly becoming an alternative for absorbing excess electricity from wind and solar.

- One of the “dirty little secrets” of green energy is that it relies heavily on rare earths minerals. These tend to be mined in the developing world at terrible environmental costs.

- In a bid to clean up the plastics chain, investments in bioplastics are starting to ramp up.

- Although nuclear energy offers a path toward carbon-free energy, the U.S. is heavily dependent on Russia for uranium supplies.

- Solar and wind farms can take up space in farmlands. China is considering reducing such installations to ensure ample food supplies.