by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Financial markets are a bit calmer this morning. Equities are rebounding and Treasury yields are rising. The EUR is also higher. Here is what we are watching:

Italy: The populist coalition is trying to revive talks to form a government, perhaps coming up with a less controversial slate of ministers. However, disputes between the Five-Star Movement and the League have developed as they both try to jockey for power. Meanwhile, Carlo Conttarelli has been assigned the task of putting together a government by Italy’s president and has made little progress on that front. It looks like the most likely outcome is a new vote, which will occur in late July at the earliest but more likely by mid-September.

The EU has also weighed in on the turmoil. Germany’s EU commissioner, Günther Oettinger, indicated that the financial markets would show Italian voters they should reject populist parties.[1] He faced harsh criticism from the president of the EU council, Donald Tusk, but the general feeling is that his comments were not incorrect, but rude. And, this statement coming from a German, the nation being blamed for the woes of southern Europe, didn’t help matters.

This is what we are seeing in the political trends. The populist coalition could have been saved but the League seems to want new elections. Polls suggest its support is growing and the leadership of the party seems to believe new elections would designate it as the senior partner in a coalition with Five-Star. The establishment in Italy wants to make the next election a full-blown referendum on the Eurozone, betting that Italian voters, though unhappy with the fiscal restrictions of the Eurozone, will not support exiting the single currency for fear of the high costs involved with moving from the euro to a new currency. It looks like the most probable outcome is (a) new elections, but (b) no party will be able to build a working coalition, and thus (c) more muddling through.

When one forecasts anything, there is the short run (now to three years roughly) and the long run (the eventual outcome). In reality, the long run is really nothing more than an envelope of short runs that eventually travel toward the most likely equilibrium. The Eurozone has a structural problem. Successful currency blocs (such as the U.S.) have:

- Common political and, more importantly, fiscal transfer systems which allow for some degree of equality across regions;

- High labor and product mobility;

- Jointly held debt.

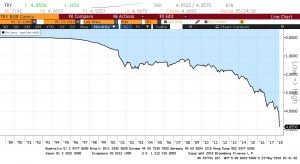

Or, in simple terms, states and regions in a currency bloc have limited sovereignty. In the U.S., for example, states have some sovereignty but not complete power; they don’t print their own money. For the Eurozone to really work, European nations have to give up sovereignty to the EU. Absent of some unifying war, there is little chance that these nations will willingly give up enough sovereignty for the Eurozone to work. Here is a milestone that would show the Eurozone will work—when Germans are willing to underwrite a Eurobond that allows Greece to issue debt that is guaranteed by the whole Eurozone (read: Germany). It could happen…but it’s not likely. In other words, Europeans can have the Eurozone and the single currency at the cost of reduced sovereignty or keep the current level of sovereignty but give up the single currency. They can’t have both. Every Eurozone crisis could be the “one”; however, conditions are probably not quite dire enough to push Italy to vote to exit the Eurozone, which would be expressed by voting in a massive coalition of populists.

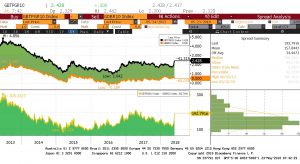

Trade:The Trump administration has moved to put tariffs on $50 bn in Chinese imports, just a few days after it appeared a truce was in place. We will be watching to see if North Korea suddenly turns hostile again. The U.S. has also decided to impose greater limits on Chinese visas, perhaps in a bid to reduce China’s ability to send students to the U.S. to study and boost China’s tech prowess.[2] Commerce Secretary Ross is scheduled to meet with Chinese officials this weekend. The new tariff announcement could scuttle these talks. On June 1, the temporary postponement of steel and aluminum tariffs on numerous American allies expires; it isn’t clear if they will be postponed further or not. If they are not, look for retaliation. The trade drama continues but the direction is steadily moving toward a change in the trade relationship with the world.

[1] https://www.ft.com/content/8edfb128-631f-11e8-90c2-9563a0613e56

[2] https://apnews.com/amp/82a98fecee074bfb83731760bfbce515?__twitter_impression=true