Author: Amanda Ahne

Asset Allocation Bi-Weekly – Activist vs. Accommodative Treasury Issuance (August 26, 2024)

by the Asset Allocation Committee | PDF

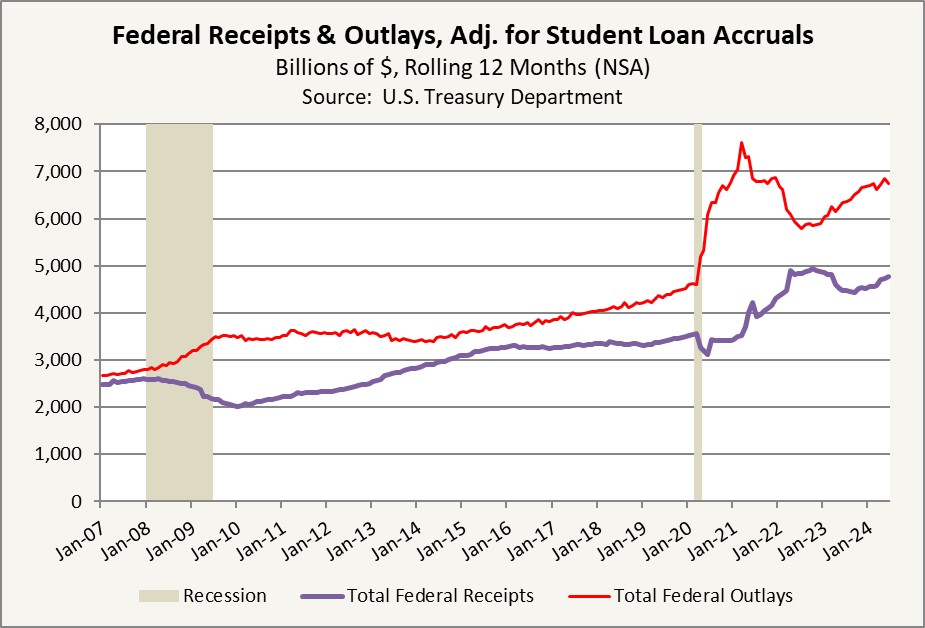

The Federal Reserve and the US Treasury are independent government agencies with the shared objective of economic prosperity. While the Treasury manages government finances and executes fiscal policy, the Fed focuses on monetary policy as it aims to maintain price stability and full employment. Despite the Fed and the Treasury having distinct roles, there is an ongoing debate over whether they should coordinate their policies or whether it’s appropriate for one to work at cross-purposes with the other, particularly in the context of the big US budget deficit and growing debt load.

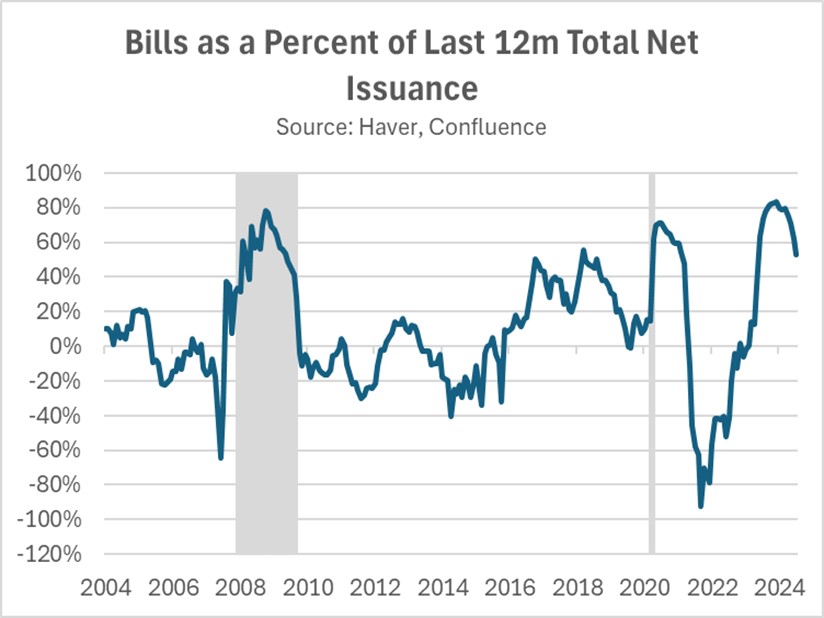

A recent report has accused the Treasury of intentionally shifting its debt issuance strategy to favor shorter-term bills over longer-term notes to the detriment of the country. Economists Nouriel Roubini and Stephen Miran, both Treasury veterans, contend in their paper, “ATI: Activist Treasury Issuance and the Tug-of-War Over Monetary Policy,” that this strategy is a deliberate attempt to counteract the Fed’s tightening measures and artificially stimulate the economy.

The Roubini and Miran paper argues that the Treasury’s strategy effectively amounts to a covert form of quantitative easing (QE). When the Fed employs QE to stimulate the economy, it purchases long-term bonds, thereby suppressing interest rates. The Treasury can achieve a similar outcome by shifting toward shorter-term debt issuance. By reducing the supply of longer-term bonds, the Treasury can indirectly push up their prices and lower their yields, effectively loosening financial conditions.

Roubini and Miran contend that the Treasury’s shift toward more bill issuance has counteracted the Fed’s effort to tighten monetary policy, contributing to the robust economic growth and elevated inflation seen in Q1 2024. According to Roubini and Miran, Treasury bills serve as a near-cash asset, enabling financial institutions, institutional investors, and corporations to secure loans by using them as collateral. In essence, the issuance of new Treasury bills can amplify the money supply through the money multiplier effect, which increases market liquidity.

While they acknowledge the typical shift toward shorter-term Treasury issuance in economic downturns, Roubini and Miran argue that the current pronounced bias for bills over notes is exceptional and may be politically motivated. By prioritizing bill issuance, the Treasury may have sought to avert a surge in long-term interest rates typically associated with bond sales. This strategy is credited with contributing to a decline in 10-year yields, which, in turn, has fueled risk appetites and inflated stock valuations in the lead-up to the election.

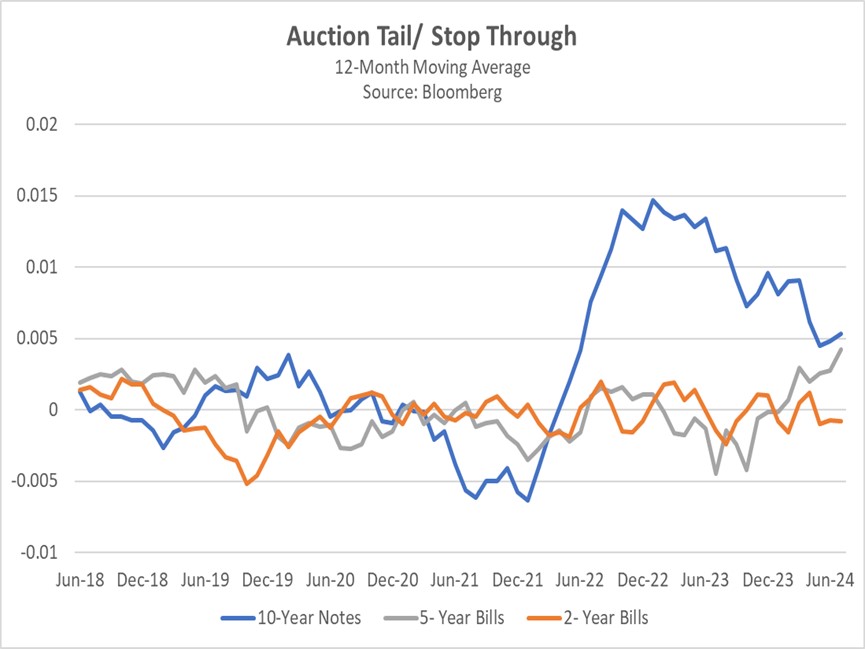

However, an alternative explanation for the Treasury’s issuance reallocation lies in the market’s response to rising interest rates. When the Fed initiated rate hikes in 2022, demand for longer-term bonds weakened due to increased interest rate risk. Conversely, demand for shorter-term Treasury bills surged, primarily driven by money market funds and institutional investors seeking higher yields on short-term assets. This market dynamic is reflected in the results of Treasury auctions, with 10-year bonds consistently undersubscribed and two-year bills frequently oversubscribed.

Moreover, the Treasury’s issuance strategy may not be as counterproductive as Roubini and Miran imply, since the sale of bills has mitigated the need for extraordinary Fed intervention in the economy. Prior to the change, the banking sector faced severe liquidity challenges following the collapse of Silicon Valley Bank in 2023 due to heavy investments in low-yielding, long-duration bonds. As interest rates rose, bond values fell and hindered banks’ ability to use them as collateral to meet short-term cash needs. In response, the Fed established new lending facilities, which helped address the immediate crisis but hampered its balance sheet reduction efforts.

By significantly increasing bill issuance, the Treasury provided the banking system with high-quality collateral, therefore mitigating the risk of a liquidity crunch within the repo market. This buffer has made it easier for the Fed to maintain its policy tightening without hurting the financial system. As interest rates begin to decline, the urgency of this allocation strategy will lessen, leading to a gradual reduction in Treasury bill issuance as a share of total issuance.

Contrary to Roubini and Miran’s assertion, the Treasury’s allocation strategy has actually seemed to support the Fed’s objectives. It has enabled the Fed to prolong quantitative tightening and maintain higher interest rates for an extended period and has increased the likelihood of a soft landing. However, this cooperative stance could potentially embolden the Fed to adopt a more gradual easing path, which would benefit short to intermediate bond yields.

Daily Comment (August 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is still anxiously awaiting clues on the Federal Reserve’s next move. In sports news, Hideki Matsuyama continued his impressive run at the BMW Championship with a remarkable 73-yard putt for his third consecutive birdie. Today’s Comment will discuss our views on interest rate expectations and long-term bond rates, the persistent threat that unions pose to controlling inflation, and our early impressions of the two leading presidential candidates. As always, our report includes an overview of domestic and international news.

After the Fed Cuts: While investors eagerly await Powell’s speech for hints about the Federal Reserve’s September moves, we contend that monetary policy’s sway over the market is waning.

- Before his speech, several Federal Reserve officials have been working to temper market expectations. On Thursday, Boston Fed President Susan Collins and Philadelphia Fed President Patrick Harker both indicated a willingness to consider rate cuts at the Fed’s upcoming meeting but advocated for a cautious approach. However, there is noticeable hesitation about easing policy. Kansas City Fed President Jeffrey Schmid expressed that he would like to see more data before endorsing a rate cut, a sentiment shared by Fed Governor Michelle Bowman.

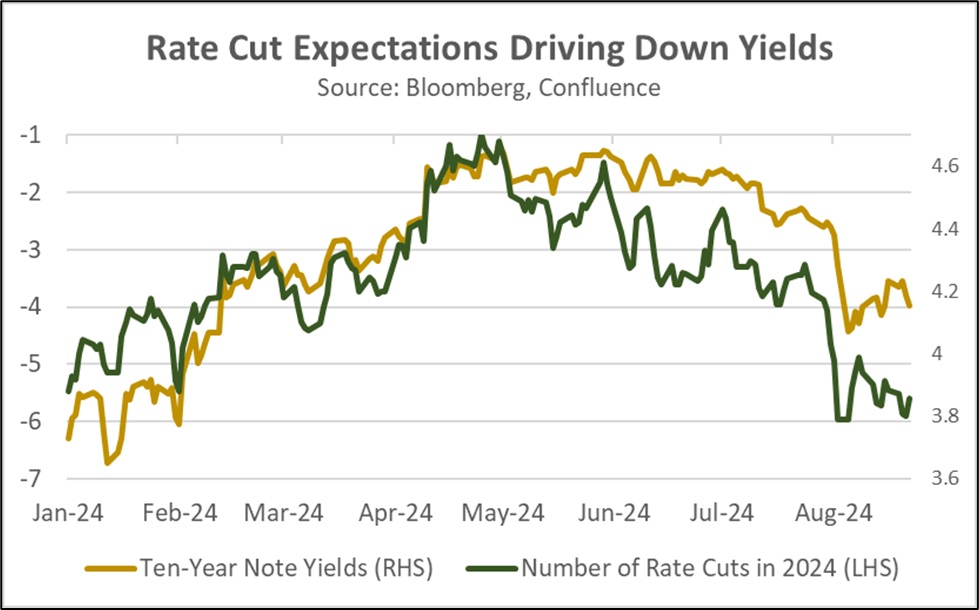

- Historically, Fed expectations have been a strong predictor of long-term interest rates. However, this year, the correlation between these two factors has become less pronounced. This divergence is likely attributable to concerns that the Fed may not be as aggressive in cutting rates as it has been in past cycles. The FOMC’s latest economic projections indicate that members anticipate the long-run rate to reach 2.8%, which is above the 20-year average by 100 basis points. This suggests that the market may be looking past the first rate cut.

- While the market may be looking to Powell’s Jackson Hole speech for signals of a potential 50 basis point rate cut at the September FOMC meeting, we believe such a move is unlikely. Even if we are mistaken, we would expect the effect on long-term rates to be minimal because the market has likely already priced in most of the expected rate cuts for the coming year, leaving little room for further declines. Consequently, other factors such as the widening fiscal deficit, aging demographics, and economic growth are more likely to influence long-term rates in the coming months.

Supply Chain Mayhem: The threat of disruptions to shipments has increased as Canadian railway workers continue their strike and US East and Gulf Coast port workers consider similar actions.

- North American supply chains will likely cope with twin strikes. In Canada, the government has intervened in the ongoing rail strike. The labor board has been ordered to end the shutdown that has halted freight traffic for the past two days. Two railway unions went on strike following failed contract negotiations with Canadian National Railway and Canadian Pacific Kansas City regarding railway schedules, safety, and time management. Meanwhile, US port workers are also threatening a strike in October. Negotiations have stalled over the use of automation for processing trucks without human labor.

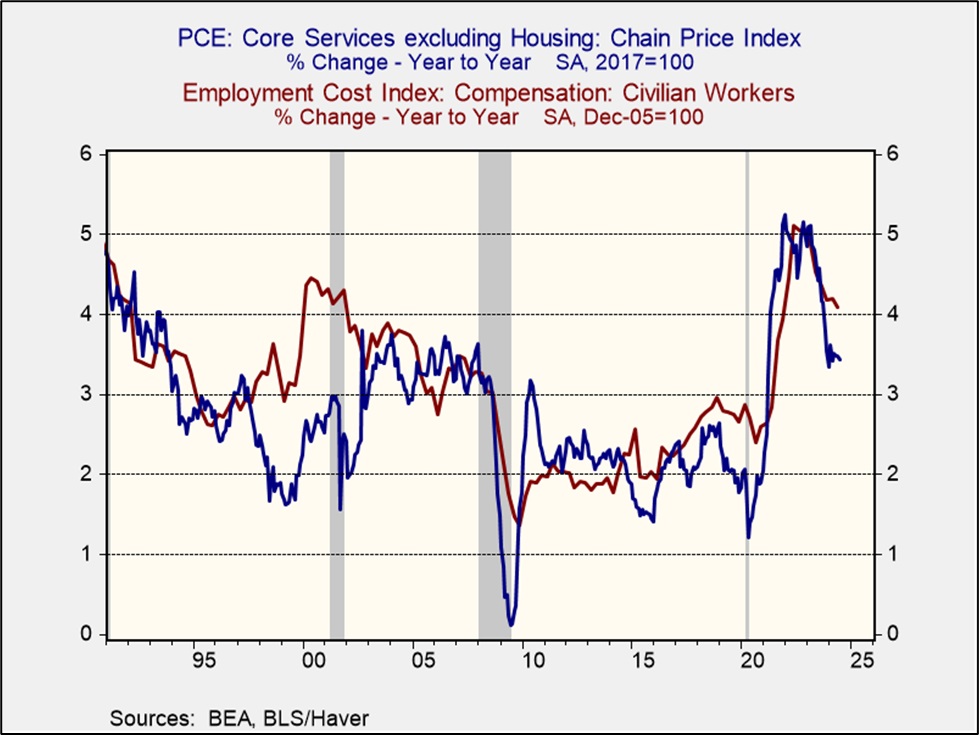

- The threat of strikes arrives at a politically charged moment. Since the pandemic, unions have experienced a resurgence, with the percentage of US workers belonging to unions reaching its highest point since the mid-1960s. The shift in sentiment has occurred as union leaders have been able to leverage a shortage of labor supply to demand higher wages for workers. Over the past four years, worker compensation has risen at the fastest pace since the early 2000s, though recent data suggests a slowdown.

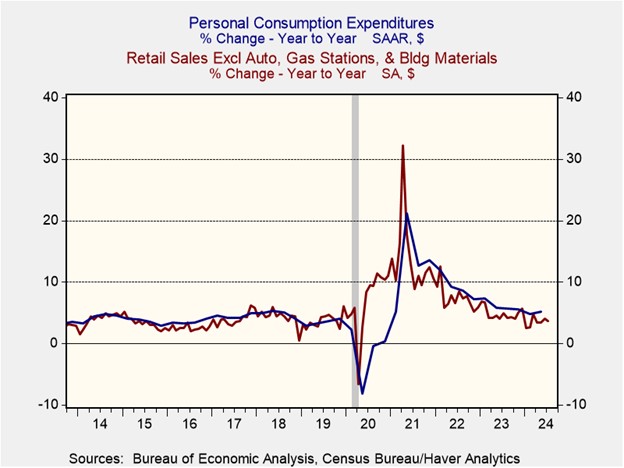

- Unit labor costs are arguably the most reliable indicators of long-term inflation. As marginal production costs rise, firms are more likely to pass these costs on to consumers. Consequently, the resurgence of labor unions could hinder the Federal Reserve’s efforts to achieve its 2% inflation target. As the chart above demonstrates, worker compensation has been a primary driver of core PCE services, a key inflation metric closely watched by the Fed. While rising productivity has thus far helped offset increased wage bills, a reversal of this trend could significantly complicate inflation control efforts.

First Impressions: With the major parties having officially selected their presidential nominees, it’s time to summarize their key ideas.

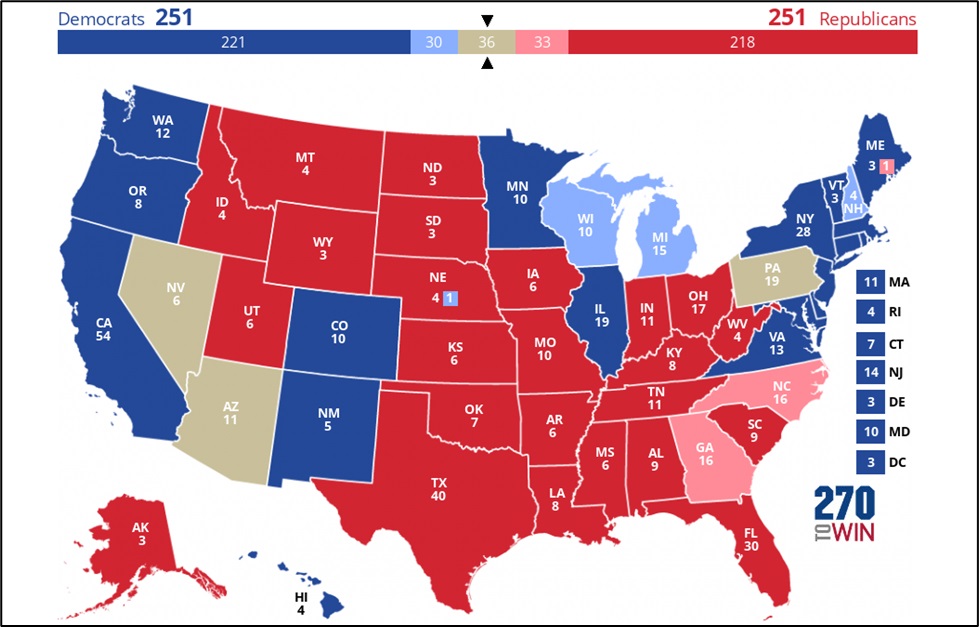

- The Republican presidential candidate, Donald Trump, a supply-sider with a populist edge, advocates for expanding domestic production through deregulation and incentives to bring manufacturing back to the US. He has pledged to lower taxes and eliminate restrictions on energy production. In contrast, the Democratic nominee, Kamala Harris, a traditional Keynesian, supports using subsidies and regulation to achieve her policy goals. She has endorsed price controls on medication, rent, and food and has proposed grants for first-time homebuyers.

- While the president plays a key role, the primary arena for policy battles is Congress. In recent decades, rising partisanship has hindered both parties’ ability to pass legislation as groups have become increasingly focused on obstructing the other rather than passing laws. A prime example of this is the reliance on continuing resolutions, which avoid government shutdowns but fail to address the deficit. Although controlling both houses of Congress increases the chances of passing legislation, it has also made it easier for fringe groups to derail the process.

- The betting odds indicate a closely contested election. On PredictIt, Kamala Harris holds a slight lead of 55% to 48%, while Polymarket shows Donald Trump ahead at 51% to 47%. However, bettors are leaning toward a split in Congress. Polymarket suggests a 72% chance that Republicans will regain the Senate, while Democrats have a 62% chance of regaining the House. With plenty of time before Election Day, these odds are subject to change. That said, if they hold, both candidates will face challenges in fulfilling their campaign pledges.

In Other News: Hamas rejected the latest ceasefire agreement over demand to have troops in Gaza. The rejection is a reminder of how hard it will be for the two sides to end the conflict within a short time. An oil tanker was attacked in the Red Sea, another indication of the threat that geopolitical tensions pose to supply chains. Separately, RFK Jr. is widely expected to step down from presidential contention and is rumored to be endorsing President Trump in exchange for a potential role in his administration, possibly as the head of the National Institutes of Health or as Spy Chief.

Daily Comment (August 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The stock market is currently grappling with the potential for interest rate cuts, fueled by the recent downward revisions to BLS payroll data and dovish commentary from Federal Reserve officials. In sports news, Cincinnati Reds first baseman and 2010 NL MVP Joey Votto has announced his retirement at the age of 40. Today’s Comment delves into the recent Federal Reserve meeting minutes, explores the escalating tensions between the West and China in the race for clean energy dominance, offers a comprehensive update on Mexico, and discusses the increase in US concern about China’s nuclear capabilities. As always, our report concludes with a concise overview of key domestic and international data releases.

Doves Take the Wheel: Expectation of a rate cut in September appear locked in after it was revealed that some policymakers were willing to cut in July.

- The Federal Open Market Committee (FOMC) released the minutes from its July 30-31 meeting, which highlighted the growing shift in Fed officials’ focus away from its inflation mandate and toward employment. Nonfarm payroll data and the unemployment rate have exhibited signs of increasing and raised red flags for the committee. Additionally, FOMC members expressed optimism that inflation is likely to continue its downward trend. Despite a unanimous vote to maintain interest rates, several members expressed an openness to supporting a decision to cut interest rates by 25 basis points.

- While the recent triggering of the Sahm Rule has fueled expectations for a substantial interest rate cut at the Fed’s upcoming meeting, we maintain a cautious outlook. Although the rule (which measures the three-month moving average of the unemployment rate against its 12-month minimum) has surpassed its recession threshold of 0.5%, the spike could be transitory. The early July passage of Hurricane Beryl through the southern states likely contributed to a temporary surge in job losses.

- The Federal Reserve’s decision on interest rate cuts will likely be influenced by the August employment and Consumer Price Index (CPI) reports. While the July Personal Consumption Expenditure (PCE) data may offer some insights, its impact is expected to be relatively minor. If these figures continue to support the notion of a cooling labor market and inflation, the Fed is likely to implement a 25-bps rate cut in September. A larger, more substantial cut would likely only be considered if there is another unexpected surge in the unemployment rate.

The Great Split: While it appears that demand for EVs have waned, the geopolitical war over dominance in the space has started to heat up.

- The West is actively working to prevent China from dominating the clean energy sector. Next month, the EU plans to impose tariffs as high as 36% on Chinese-made electric vehicles, including Tesla, due to unfair competition concerns. This move is intended to protect its struggling industrial sector by preventing China from dumping its artificially cheap plug-in vehicles in Europe. The production of electric vehicles in the West has faced challenges due to limited consumer demand. Recently, Ford scrapped plans to build a fully electric SUV.

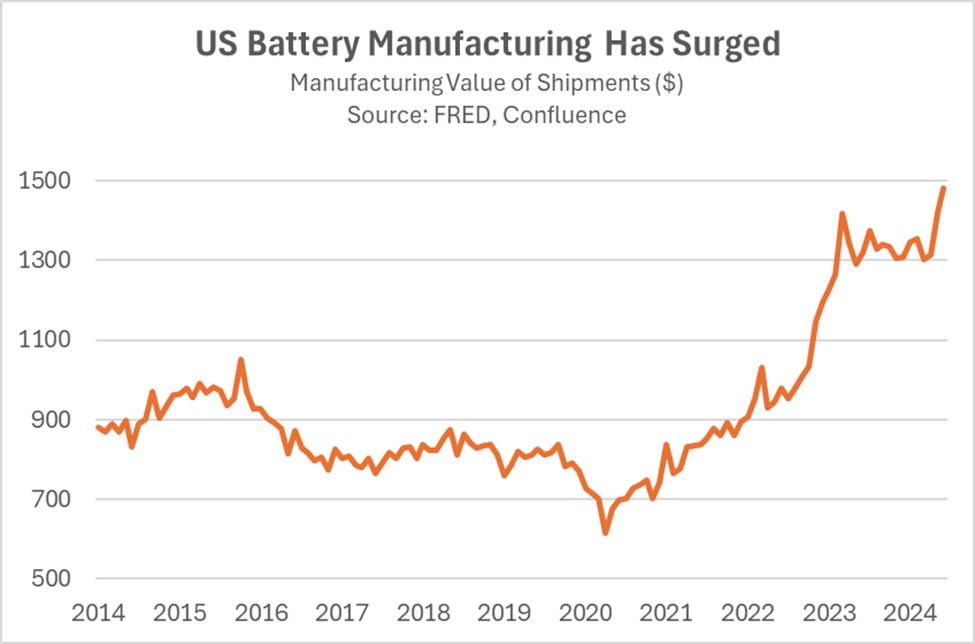

- Despite weak demand, the West has continued efforts to bridge the technological gap with China. Earlier this week, the Department of Defense approved a $20 million grant to fund a cobalt sulfate refinery in Canada, a mineral that is a critical precursor for battery production. Meanwhile, the EU secured a deal with Serbia to allow lithium mining last month. These moves align with both regions’ plans to expand their renewable energy capacity. US battery production is expected to increase from 257 to 1000 gigawatts hours over the next decade, while Europe aims to become battery cell self-sufficient by 2026.

- The battle for clean energy dominance is likely to intensify over the coming years. The Inflation Reduction Act, designed to incentivize clean energy projects, has strategically targeted Republican districts to counter conservative efforts to undermine its goals. Meanwhile, Europe’s ability to wean itself off imported fossil fuels from hostile powers like Russia hinges on the successful development of its renewable energy resources. While China will likely dominate the space for now, we expect the West to push through plans for renewable energy despite the political headwinds.

The New Mexico: Growing concerns surround the country’s direction as Claudia Sheinbaum prepares to become president.

- Mexican judicial officials staged a strike on Wednesday in protest of controversial reforms aimed at overhauling the country’s court system. The proposed system would elect judges, including those in the high court, through popular vote. This initiative, championed by outgoing President Andrés Manuel López Obrador (AMLO), is intended to combat corruption and impunity within the judiciary. However, it has been widely criticized as a tactic to replace judges who oppose his agenda with those who will support it. The push has led to concerns about the lacking balance of powers within the government.

- The push to reform the country’s judicial system could further tarnish Mexico’s reputation as a nearshoring hub for companies seeking proximity to the US supply chain. During the AMLO presidency, the judiciary served as a valuable check on the president’s overreach. For instance, earlier this year, the Supreme Court struck down a law that would have favored state-owned power companies over private ones. The proposed reforms could pave the way for more policies that would increase the costs of doing business in Mexico for foreign investors.

- With AMLO’s Morena party securing a supermajority, a sweeping overhaul of the judicial system appears inevitable. The market has already reacted, leading to a sharp sell-off in the country’s currency, with the Mexican peso (MXN) dropping 10% against the dollar since the election. Meanwhile, Mexican equities have also suffered. This trend could shift after the US election if the next American president pushes for changes to the USMCA. As a result, we believe the situation in Mexico remains fluid.

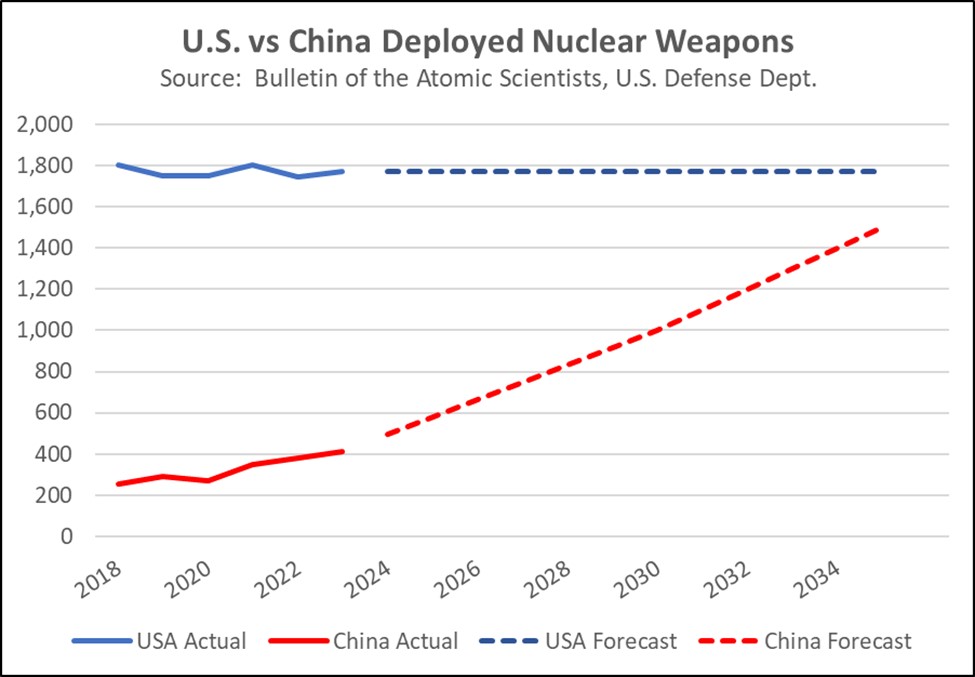

United States-China-Russia: According to the New York Times, President Biden in March approved a highly classified nuclear strategic plan, the “Nuclear Employment Guidance,” that prioritizes China ahead of Russia for the first time. It also directs preparation for a coordinated joint nuclear attack from China, Russia, and North Korea. The new plan is consistent with fears that China’s nuclear arsenal will match or exceed the deployed US arsenal within 10 years.

- The rapid growth in China’s strategic nuclear arsenal will likely reinforce the US’s emerging bipartisan support for nuclear modernization and rising defense budgets.

- More broadly, it will probably also contribute to further tensions between the Chinese bloc and the West.

Daily Comment (August 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is awaiting more guidance from Fed officials as it looks for a better understanding of the path of policy rates. In sports news, Jets QB Aaron Rodgers is being pushed to his limits in training camp as he prepares for a grueling comeback attempt after an injury ended his previous season. Today’s Comment will explore the reasons behind the market’s recent broadening, analyze the implications of payroll revisions for the Fed’s upcoming rate decision, and examine why investors are growing nervous about central bank independence in Brazil. As always, our report will include a comprehensive roundup of key international and domestic data releases.

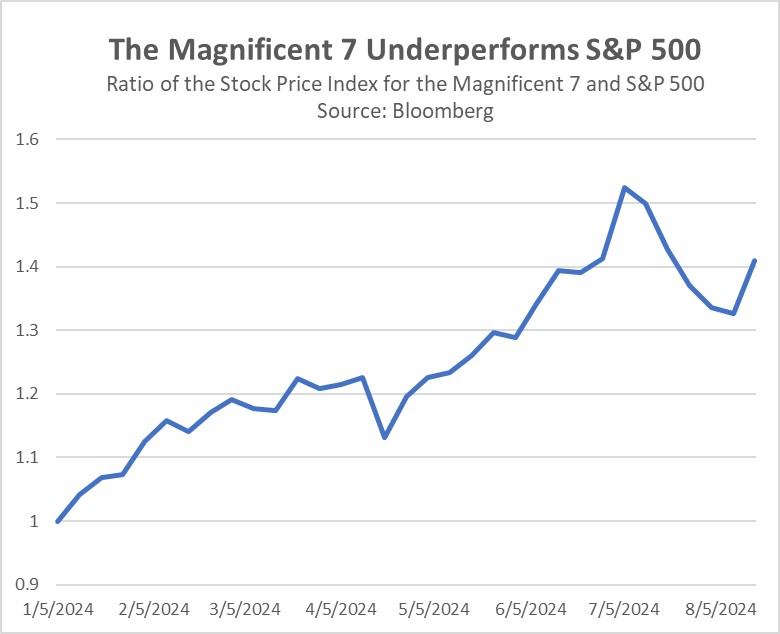

The Great Rebalancing: While mega-cap companies struggle to recover from the July sell-off, smaller firms are leading the market rally.

- The S&P 500 is poised for a new high this week as market uncertainty stemming from Fed rate cuts and recession worry diminishes. This surge seems to reflect strong second-quarter 2024 earnings. Over 80% of companies surpassed earnings expectations, with the overall index outperforming estimates by 13.6% compared to the anticipated 8.3%. A strong guidance also played a role as companies were relatively upbeat about future growth despite growing concerns of a looming economic slowdown.

- Surprisingly, this market rally has not been driven by the tech giants that typically dominate the S&P 500. While the Magnificent 7 Index, which once led the S&P 500’s gains, is now 8% below its early July peak, the overall S&P 500 has remained relatively unchanged during the same period. In contrast, the S&P 500 Equal Weight Index, which eliminates market cap bias, has reached an all-time high. Although the mega-tech companies have regained some ground, there are signs of a potential shift in market leadership.

- This shift in market leadership is likely to be gradual and uncertain over the next few months. The upcoming election, unclear monetary policy, and economic strength will likely weigh heavily on investor sentiment. As a result, investors may be reluctant to abandon their previous winning trades in the Magnificent 7, especially given their strong performance over the past two years. This will be particularly true if Nvidia reports another strong earnings result next week. However, we are increasingly confident that the dominance of tech stocks may be nearing its end.

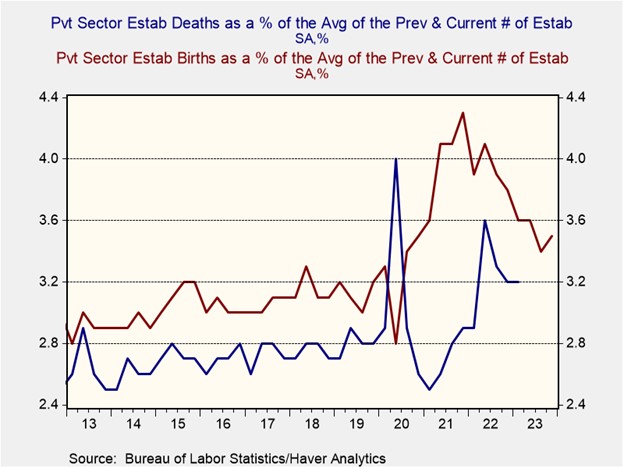

Gloomy Payrolls: Bureau of Labor Statistics (BLS) revisions are expected to show that the economy added less jobs than originally estimated, which is likely to place additional pressure on the Fed.

- Market expectations suggest that benchmark revisions will unveil a significant overestimation of job growth in the prior report, ranging from 400,000 to 600,000 positions. These revisions arrive amid growing criticism that the Federal Reserve may have neglected its maximum employment mandate in its singular focus on taming inflation. While the anticipated downward adjustment to job numbers is unlikely to reshape the overall economic outlook, it could exacerbate worries about a more rapid labor market cooldown than policymakers realized in its previous rate decision meetings.

- The pandemic likely contributed to the BLS’s difficulty in accurately determining the number of job openings in recent years. Government stimulus and increased free time encouraged many people to start their own businesses, complicating the Fed’s efforts to track hiring trends. Additionally, many of these new companies struggled to stay open in the years following the pandemic, making it challenging to assess their impact on the job market. This likely caused delays in the BLS’s data collection, forcing surveyors to rely on educated guesses while awaiting more accurate information.

- The revisions could influence how the Fed adjusts policy rates. A larger-than-expected drop might push the central bank to take a more aggressive stance to safeguard the labor market. On the other hand, a milder revision could encourage caution, with officials gradually easing policy restrictions to prevent inflation from reaccelerating. Additionally, the upcoming jobs data will be pivotal in shaping the Fed’s September decisions. While we expect the Fed to limit rate cuts to 25 bps, a surprise rise in unemployment above 4.5% could prompt stronger measures to prevent further labor market deterioration.

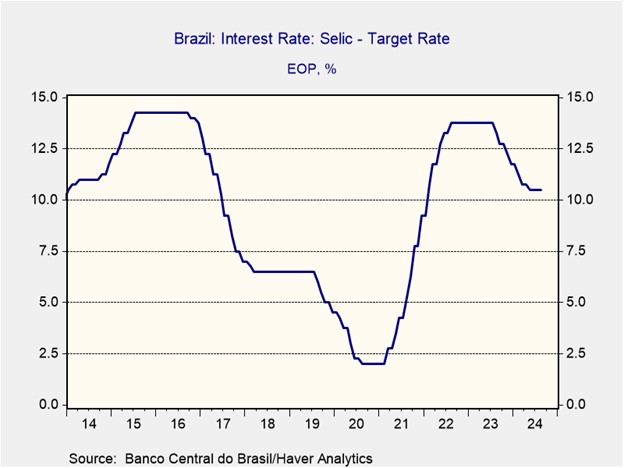

Brazil: While the central bank has mentioned that it will not hesitate to raise interest rates to control inflation, it appears that Brazilian President Lula da Silva has other plans.

- On Tuesday, Brazil’s central bank chief, Roberto Campos Neto, appeared to downplay the possibility of raising interest rates in a newspaper interview. Specifically, he stated that he was not committed to raising interest rates and remained optimistic about inflation falling below the country’s 3% target. His comments led to a sharp decline in the Brazilian real (BRL), as investors interpreted them as signaling a lack of urgency from policymakers to address rising inflation, which had increased from 3.7% in April to 4.5% in July.

- The Central Bank of Brazil, while officially independent since 2021, has struggled to maintain its autonomy amidst political pressure to adopt more expansionary monetary policies. This pressure has been particularly evident in calls for lower interest rates to stimulate economic growth from the Brazilian president. Last week, Lula attempted to deflect criticism of his involvement in monetary policy decisions by asserting that the next central bank head he appoints will need to demonstrate courage when deciding to lower or hike interest rates.

- In the coming weeks, Lula is widely expected to choose Gabriel Galipolo as his pick to take over the central bank. The central bank faces internal tension as Galipolo, set to take full control in 2025, has views more closely aligned with Lula’s economic team. While Galipolo has also pushed for rate hikes, there are concerns about his loyalty. That said, the leadership announcement could spark division within the central bank and could complicate efforts to shift policy in any one direction. As a result, the September meeting will be a crucial indicator of the bank’s future direction.

In Other News: A federal judge has halted the Biden administration’s attempt to ban noncompete clauses, underscoring the challenges that presidents face in advancing their agendas within a highly partisan government. Meanwhile, China has countered the EU’s crackdown on EV imports by launching an investigation into European dairy products, further highlighting the escalating trade tensions between China and the West. Ford is scrapping plans for a fully electric SUV due to cost concerns, in another sign that the EV market is starting to cool.

Daily Comment (August 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a potentially groundbreaking deal in which a Canadian firm is seeking to buy the Japanese company that owns the 7-Eleven chain of convenience stores. If successful, the deal would be the biggest-ever foreign takeover of a Japanese firm. We next review several other international and US developments with the potential to affect the financial markets today, including an interest-rate cut by Sweden’s central bank and a proposal by Vice President Harris to hike the US’s maximum corporate income-tax rate to 28%.

Japan: Seven & i Holdings, the Japanese firm that owns 7-Eleven, has announced it is considering a friendly takeover offer from Canadian retailer Alimentation Couche-Tard, which has a controlling stake in the Circle-K chain. Any deal would face US antitrust scrutiny, of course. Nonetheless, if a transaction is concluded, it would be the biggest-ever foreign takeover of a Japanese company.

- If a deal can be concluded, it would also signal that Japan has made further progress in dismantling its prior protective, inflexible business culture and regulatory approach.

- To date, the progress on that front has already helped make Japan a darling of stock investors in recent years. If the proposed Seven & i deal is successful, it could unlock even more value in Japanese stocks.

Australia: The minutes of the Reserve Bank of Australia’s latest policy meeting, which were released today, showed that the central bank has ruled out any interest-rate cuts in the near term due to continued price pressures. With the Bank of Japan starting to hike rates and the RBA holding them steady, that makes the two Asia-Pacific central banks the most important holdouts against the broader trend toward rate cuts in major developed economies.

China: The Shanghai and Shenzhen stock markets yesterday said they have cut the amount of data they will provide on foreign inflows into onshore shares, apparently to reduce the influence of foreign capital flows on the domestic markets. The move, which was likely made under pressure from Beijing, is another example of government intrusion into China’s private markets, which we think is one reason for China’s recent slowdown in economic growth.

Israel-Hamas Conflict: Hamas and Palestinian Islamic Jihad said they were responsible for an attempted suicide bombing in Tel Aviv yesterday. The bomb detonated early, killing the attacker and slightly injuring just one bystander. Nevertheless, as Israel continues pummeling Gaza to destroy its Hamas-led government, the attack may signal that the Palestinians are shifting tactics back to the frequent suicide bombings that rocked Israel in the early 2000s. If successful, such tactics could leave Israel with prolonged security issues, even if Hamas is routed in Gaza.

Sweden: Citing “somewhat” weaker economic growth and roughly on-target consumer price inflation, the Riksbank today cut its benchmark short-term interest rate by 25 basis points to 3.50%. The central bank also signaled it will probably cut rates two or three more times before the end of the year if the inflation outlook doesn’t worsen again. The move reflects the broad trend toward lower interest rates in key economies around the world (excluding Japan and Australia, as mentioned above).

Canada: Ahead of a railroad strike that could be launched as soon as Thursday, global shipping giant A. P. Moller-Maersk said it will stop taking orders for Canada-bound cargoes that would have to be transferred to rail transport. More broadly, the threatened strike could significantly disrupt the operations of companies across North America, given how intertwined the US and Canadian economies are.

US Tax Policy: As the Democratic Party opened its national convention in Chicago yesterday, Vice President Harris’s campaign office said she now endorses hiking the maximum corporate income tax rate to 28% from today’s 21%. The proposal sharpens the contrast between Harris and Republican nominee Donald Trump, who has proposed cutting the rate to 15%.

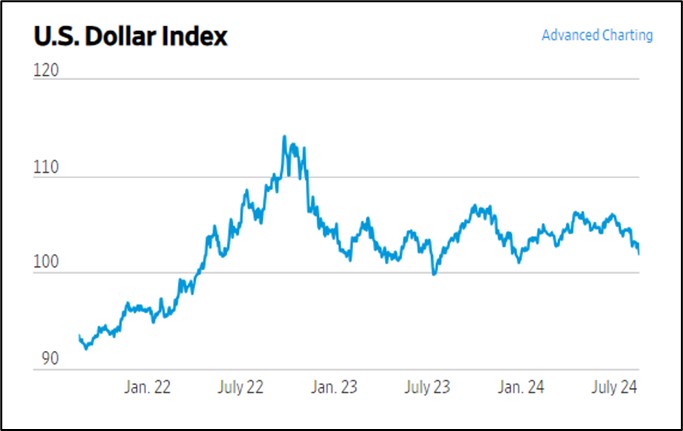

US Dollar: The greenback weakened against a key basket of currencies again today, leaving the widely followed US Dollar Index down 4.1% from its most recent high in May and basically right where it was at the start of the year.

- The index is still historically high after the dollar’s long bull market that began more than a decade ago, but it has been stuck in a range between about 106 and 100 since the beginning of 2023.

- If the prospect of falling US interest rates now pushes the index below 100, it could potentially signal a longer-term downtrend for the greenback.

- Any potential bear market in the greenback would likely be positive for international stocks going forward.

Bi-Weekly Geopolitical Report – The Recent Iranian Election: Results & Implications (August 19, 2024)

by Daniel Ortwerth, CFA | PDF

The Iranian political landscape experienced a major earthquake on May 19, when the country’s president, Ebrahim Raisi, died in a helicopter crash on his return from a visit to neighboring Azerbaijan. Consequently, in June and July, Iran conducted a two-round presidential election with a surprising result. In a country ruled by a highly conservative theocracy, whose political system has become increasingly dominated by its most hardline, right-wing parties, a reformist (i.e., moderate) candidate came out on top. How did this happen, and what does it mean for the rest of the world? Will it inspire changes in Iranian domestic politics or foreign policy? How will it affect the United States, and what does it mean for investors? Since Iran tends to be a disruptive force in the world, these and other questions need our attention.

This report begins with a review of three key challenges currently facing Iran: regional and global opposition to Iran’s long-term geopolitical strategy, deepening economic woes, and an upsurge in societal unrest. We continue with an explanation of the role of the president in the Iranian political structure and a brief introduction to the winner of the election, reformist Masoud Pezeshkian. We conclude with an explanation of why we do not expect this change of leadership to shift Iran’s geopolitical strategy, even if it does usher in adjustments to how it approaches its key challenges. As always, we conclude with implications for investors.

Note: There will be no accompanying podcast for this report.

Daily Comment (August 19, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some notes on Vice President Harris’s big economic speech on Friday, which appears to have fallen rather flat. (We also note that the Democratic Party opens its national convention in Chicago today.) We next review several other international and US developments with the potential to affect the financial markets today, including another move by China to weaponize its rare-earth mineral resources and a new statement by a Federal Reserve policymaker pointing to only cautious interest-rate cuts starting in September.

US Economic Policy: In a speech on Friday laying out her economic agenda if she were to win the presidency, Vice President Harris proposed several populist measures aimed at cutting taxes and reducing living costs for working-class families. As with her proposal the previous week to make tips to service and hospitality workers tax-exempt, some of her proposals echoed the populist goals of the Republican ticket. As we’ve noted before, it appears the two sides are in a potentially expensive bidding war for working-class voters.

- Harris’s proposals include re-instating the expanded child tax credit from the pandemic era, but she would raise it to $6,000 until the child’s first birthday. That echoes a recent proposal by Sen. JD Vance, the Republican’s vice presidential candidate, to hike the child tax credit to $5,000.

- To help bring down housing costs, Harris proposed tax incentives and subsidies aimed at encouraging homebuilders to construct more affordable homes. She laid out a goal of having three million new housing units built by the end of her term.

- Harris also proposed a series of regulatory actions to bring down prices, including moves to stop alleged “price gouging” by companies and negotiating lower prices for more drugs bought by the Medicare and Medicaid programs.

- In energy policy, Harris has adopted an ambiguous approach, even though she has stepped back from the idea of banning hydraulic fracturing to search for oil and gas on federal lands, which she had proposed in her 2019 run for president as she made a play for the progressive wing of the Democratic Party.

- Finally, in international trade policy, Harris criticized former President Trump’s proposal for massive tariffs of 60% against imports from China and across-the-board tariffs of 10% or more on imports from other countries, saying those moves would raise prices for US consumers.

- Of course, even if Harris is elected, her ability to pass these economic ideas would largely depend on whether the Democrats or the Republicans control Congress. Nevertheless, the overall populist tenor of the two parties’ proposals is consistent with our expectation that the US budget deficit, consumer price inflation, and interest rates will be higher in the coming years than over the last couple of decades.

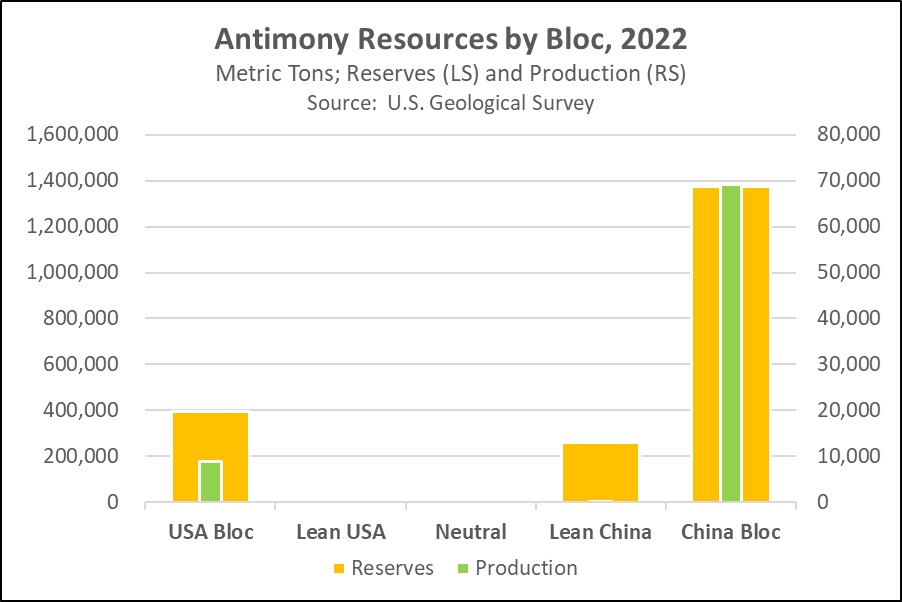

China-United States: The government last week said it will impose export controls on rare antimony metals, ores, and oxides, as well as equipment for processing superhard materials, starting September 15. Since antimony is critical to producing many advanced technologies, including armor-piercing ammunition, the new restrictions are being seen as retaliation for the recent US moves to block Chinese imports and investments and restrict China’s access to advanced US technologies.

- Given that the world continues to fracture into relatively separate geopolitical and economic blocs, a key question is whether China’s action will seriously crimp US access to antimony. As shown in the chart below, most of the world’s antimony reserves and output are in China’s bloc, meaning Beijing’s new measures could have a serious impact on the US and its allies.

- In our analysis of global fracturing, we have long expected the China bloc to weaponize its extensive commodity holdings to retaliate for the US’s recent trade, investment, and technology barriers. Besides antimony, Beijing and Russia (its junior partner) have already clamped down on natural gas and rare earths exports. Going forward, we believe the resulting risk to supplies will tend to boost commodity prices generally.

China-Philippines: According to Manila, Chinese coast guard ships rammed at least two Philippine coast guard vessels this morning near a disputed shoal in the South China Sea. The incidents caused significant damage to the Philippine vessels, but they apparently caused no injuries. Nevertheless, as we’ve noted before, the new tensions around Sabina Shoal show there is still some risk of a conflict developing between China and the Philippines, despite a deal the two countries recently struck to ease tensions around a separate shoal in the area.

- The tensions between Beijing and Manila are especially dangerous because of the US-Philippine mutual defense treaty. In the event of a Chinese attack on the Philippines or Philippine vessels, the US could be obligated to come to Manila’s defense.

- The Philippine government has said that a key red line would be if aggressive Chinese action killed a Philippine citizen.

Thailand: King Maha Vajiralongkorn yesterday endorsed Paetongtarn Shinawatra as Thailand’s new prime minister, following her election by parliament last week. Paetongtarn is now the third member of the billionaire Shinawatra family to lead Thailand. Her elevation follows yet another power play by the country’s conservative monarchists and their allies on the top court, which recently banned a key reformist party and forced out the previous prime minister. The incident shows that political instability remains an investment risk in Thailand.

Germany-Ukraine-Russia: Finance Minister Lindner, a member of the fiscally conservative Free Democrats Party, has reportedly sent a letter to the German ministries of foreign affairs and defense saying he won’t approve any new requests to send military aid to Ukraine unless new funding is identified to pay for it. Lindner was reportedly urged to write the letter by Chancellor Scholz, the leader of the center-left Social Democratic Party (SPD) who has been pressured by pacifists in his party to reduce involvement in the Russia-Ukraine war.

- To date, Germany has been the second-biggest donor of military aid to Ukraine, after the US. Any cut-off of German aid could have a significant impact on Kyiv’s ability to keep fending off the invading Russians.

- Lindner’s letter brings to light the fractious nature of Germany’s ruling three-party coalition. In contrast with the Free Democrats and SPD, the Greens have been more supportive of Ukraine and the need to boost defense spending. Panning Lindner’s letter, a Green lawmaker quipped, “One has the impression that it is about sacrificing peace and freedom, but remaining debt-free.”

- More broadly, we continue to believe that growing tensions between the China/Russia geopolitical bloc and the US bloc will keep driving defense budgets higher over time. Being closer to the Russian threat and not facing the toxic budget politics of the US, the Europeans have made much progress in that direction, giving European defense stocks a big boost. However, the news of Lindner’s letter has driven those stocks sharply lower so far today.

United Kingdom: Now that Prime Minister Starmer’s new government has offered generous pay hikes to striking doctors and train drivers, unions representing other healthcare and transport workers are reportedly considering going on strike to see what they can get. If the new strikes and pay hikes materialize, it would put further pressure on the UK’s big budget deficit and may tempt Starmer’s government to call for even bigger tax hikes than expected.

US Monetary Policy: In an interview with the Financial Times, San Francisco FRB President Daly said recent economic data has given her more confidence that inflation is coming under control, but she said the Fed should still be “prudent” and cut interest rates only gradually to make sure price pressures don’t increase again. Coming just days before the Fed opens its annual Jackson Hole monetary policy conference, the statement helps confirm that investors had gotten ahead of themselves in recent weeks as they began to expect an aggressive rate cut in September.

US Art Market: New reporting shows auction prices for paintings and other artworks have plunged over the last year, especially for the output of young, up-and-coming artists. The values of some celebrated paintings have plunged as much as 90% from their peak. Even though the art market was at a record high just a few years ago, prices are now dropping in response to higher interest rates and moderating economic growth.

Daily Comment (August 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good Morning! Investors are reacting to the strong economic data released on Thursday. In sports news, New York Yankee Aaron Judge became the player to hit 300 home runs the fastest in MLB history. Today’s Comment will delve into the market’s newfound optimism surrounding positive economic data, examine the factors driving gold’s strong performance this year, and provide a comprehensive overview of global monetary policy. As always, the report will include a summary of key domestic and international economic indicators.

September Take Off? While a rate cut at next month’s FOMC meeting appears likely, a strong economy has dampened expectations of a mega cut.

- More members of the Federal Reserve are backing a September rate cut. St. Louis Fed President Alberto Musalem reinforced this view on Thursday, endorsing a modest rate reduction as recent data suggests the economy is regaining balance. This marks a significant shift from his June stance, where he argued that rate cuts were appropriate only after several quarters, not months, of solid data. Musalem now aligns with Federal Reserve officials like Chicago and Atlanta Fed presidents Austan Goolsbee and Raphael Bostic, who also support a rate cut at the upcoming meeting.

- Strong retail sales and Walmart’s upbeat outlook eased concerns that consumer demand was slowing. In July, retail sales surged at their fastest pace since January 2023, according to the Commerce Department. While the rebound in auto purchases following a crippling software attack on dealerships contributed significantly to the overall sales surge, broad-based spending growth was evident across most retail sectors. Walmart reinforced this positive trend by reporting increased spending, particularly among high-income households looking for bargains, and subsequently upgraded its company outlook for earnings.

- As September nears, market attention will likely transition from the question of whether the Fed will pivot to the timing and pace of rate cuts. A sustained period of robust economic data will probably induce a gradual approach to monetary easing from the Fed, which will be aimed at preventing a resurgence of inflation and the need for policy tightening. Conversely, signs of economic weakness, particularly a rising unemployment rate, could prompt a more aggressive easing cycle.

Gold Bulls Are Back! Bullion prices have soared to record levels as investors seek refuge in the commodity amid escalating geopolitical tensions and currency debasement.

- Gold has outperformed the S&P 500 year-to-date, surging 20.3% compared to the index’s 16.8% gain. While Chinese gold purchases contributed to the metal’s early-year rally, the recent price surge has been fueled by a broader range of factors. Soaring geopolitical tensions, exemplified by the assassination of leaders associated with the war in Gaza and Ukraine’s incursion into Russia, have intensified safe-haven demand for gold. Moreover, concerns over currency debasement, driven by nations grappling with high debt loads and potential interest rate cuts, have fueled substantial gold purchases.

- Gold has increasingly supplanted 10-year Treasury notes as the preferred safe-haven asset. This decoupling intensified in 2022 as government spending soared and the Federal Reserve rapidly tightened monetary policy. The correlation between the two assets has weakened from a strong 88% to a more modest 75% over the past two years, primarily driven by an oversupply of Treasury bonds relative to demand. While redirecting Treasury issuance towards shorter maturities has mitigated some imbalances, the fundamental relationship between gold and 10-year Treasurys appears to be broken.

- We anticipate the negative correlation between gold and Treasury yields to persist due to escalating geopolitical tensions and the diminishing appeal of US dollar-denominated assets. As the global order fractures, a declining pool of interest rate insensitive Treasury buyers will likely contribute to higher and more volatile interest rates. While potential Treasury and emergency Federal Reserve interventions could temper extreme rate spikes, we anticipate a new interest rate environment over the next few years with persistently higher levels compared to the pre-pandemic era.

Global Rate Cut Angst: There is growing concern that central banks may not be able to continue cutting rates following setbacks in inflation.

- Central banks are adopting a more cautious tone despite a wave of policy pivots this year. Brazil, one of the first major economies to cut rates, is now considering a reversal due to a worsening inflation outlook. Meanwhile, an unexpected surge in German wages has prompted calls for the European Central Bank to exercise caution before implementing another rate cut next month. In contrast, recent market turbulence has led the Bank of Japan to reconsider its tightening plans to prevent further volatility.

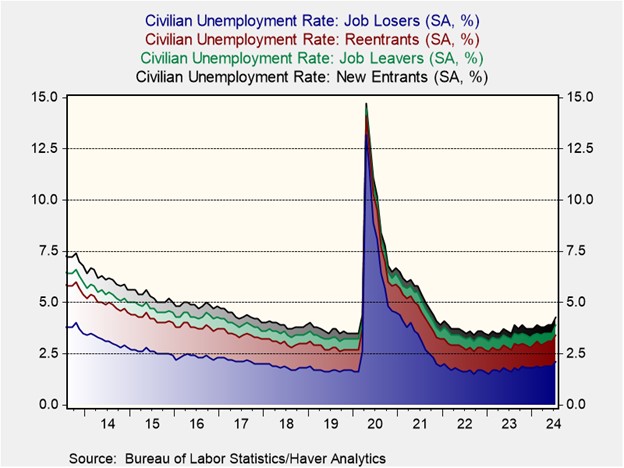

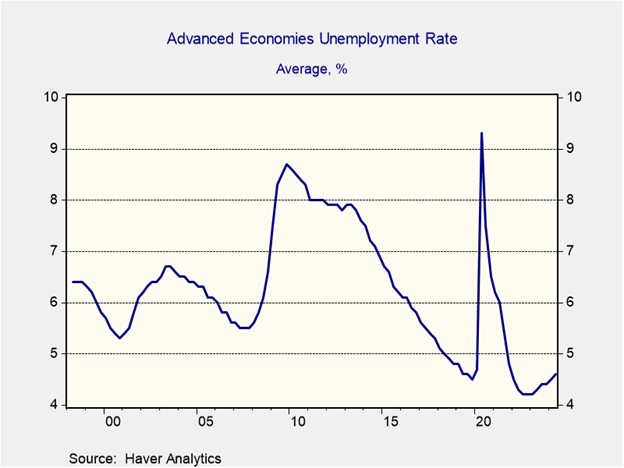

- Central banks face a complex landscape as they navigate persistent global labor shortages and the US dollar’s strength. While service sector inflation has eased, tight labor markets continue to fuel wage pressures. As the chart below shows, the unemployment rates remain notably below pre-pandemic levels. Moreover, exchange rate volatility has been a major problem, especially for countries dependent on dollar-denominated imports. The Bank of Japan’s surprise rate hike last month, partly attributed to yen weakness, underscores the challenges posed by currency fluctuations.

- As the global economy transitions towards policy normalization, investors should anticipate a more gradual process compared to previous cycles. Central banks are navigating an unprecedented post-pandemic landscape characterized by heightened geopolitical tensions and reduced global interconnectedness. These complexities will challenge policymakers to maintain consistent policy rate paths in either direction. Barring a catastrophic event, policy normalization is likely to proceed, albeit at a slower pace and in a more restrictive manner than the market currently anticipates.

In Other News: The Nigerian government claims diplomatic immunity after a French court ordered the seizure of three of its jets in a dispute with a Chinese company. The case is a test of tolerance for multilateralism in an increasingly fractured world. Democratic presidential candidate Kamala Harris has announced a plan to give first-time home buyers a $25,000 home tax credit. Saudi Arabia’s holdings of US Treasurys rose to the highest level in history, which is another sign that the demand for Treasurys is still there for foreigners looking to play both sides of the US-China rivalry.