Daily Comment (January 8, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a discussion of how the Houthi threat to shipping in the Red Sea is disrupting global supply chains and threatening to push up inflation again. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a cut in Saudi Arabia’s oil export price and a budget agreement in the U.S. Congress that could avert another partial government shutdown or the need for another stopgap funding measure when the current one starts to run out later this month.

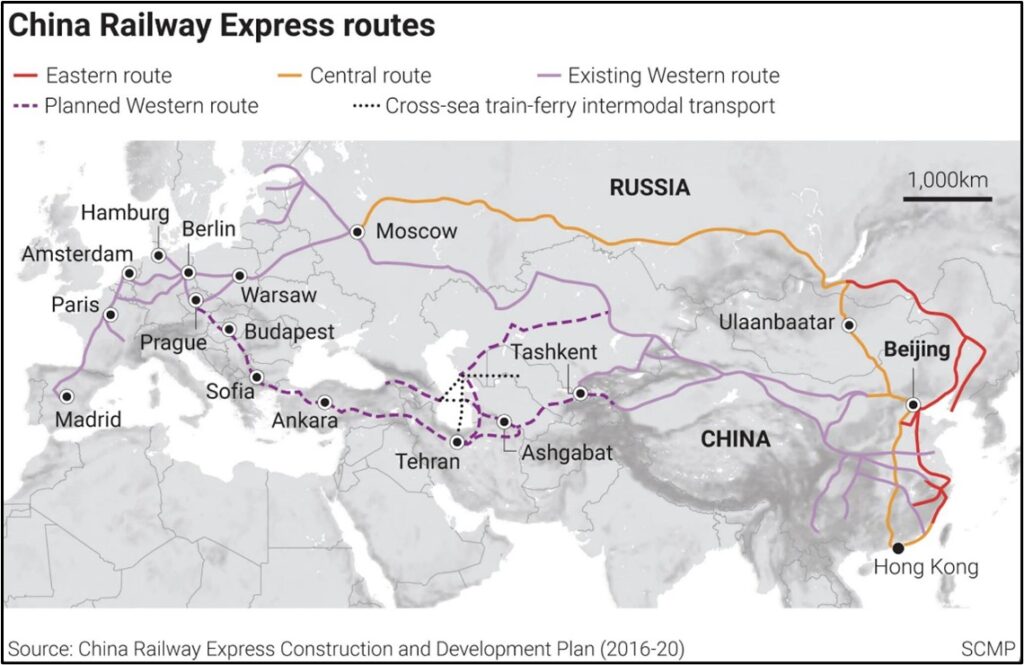

Global Supply Chains: As Houthi rebels in Yemen continue to attack commercial shipping in the Red Sea, shippers are increasingly worried that China won’t have enough shipping containers for its future exports. When firms carrying goods from China to Europe divert their ships away from the Red Sea and Suez Canal to the longer route around the Cape of Good Hope or shift to the overland China-Europe rail route (see map below), the delivery delay of up to two weeks means the return of half-empty containers to China will also be delayed.

- Any shortage of containers could stymie Chinese exports, further weighing on the country’s economic growth. Separately, Chinese electric vehicle makers are struggling to send their EVs to Europe because of an unrelated shortage of car-carrying ships.

- A surge of aggressively priced Chinese exports has been a key reason for the recent decline in consumer price inflation in the U.S. and the rest of the developed countries. Constricted Chinese exports and rising container leasing rates would therefore threaten to boost developed-country inflation again, complicating the major central banks’ calculus on when they could start cutting interest rates.

Global Oil Market: Today, Saudi Arabia cut the official selling price for its February oil exports. The cut reflects both rising U.S. oil production and slowing global energy demand because of factors such as China’s weak economic growth and high interest rates in many countries.

- We continue to believe that the outlook for oil is bullish over the longer term, but prices are likely to remain under pressure in the short term as global economic growth slows.

- In response to the Saudi price cut, oil prices have fallen approximately 3.3% so far this morning, with Brent currently trading at $76.19 per barrel.

Emerging Market Debt: In a new report, Fitch Ratings warns that higher global temperatures, rising sea levels, and increased flooding could lead to lower credit ratings for developing countries in the Asia-Pacific region that don’t adapt. The only country that Fitch identifies as safe is Singapore. The report warns that most other countries in Asia and South Asia will have trouble finding the resources to mitigate the risks.

Japan: Prosecutors have made their first arrests in the illegal political fundraising scandal that’s been dogging the administration of Prime Minister Kishida. Those arrested included Yoshitaka Ikeda of the ruling Liberal Democratic Party and one of his aides. Kishida announced that the party has expelled Ikeda, but the scandal nevertheless continues to weigh on the prime minister’s approval ratings and threatens his political power.

China: Now that Chinese home prices are no longer providing the strong investment returns that they used to, younger Chinese consumers are reportedly investing more in gold jewelry. Because of their enormous populations, India and China are already the world’s top consumers of gold jewelry. If Chinese demand accelerates further, it could conceivably give a further boost to global gold prices, just as recent purchasing by key central banks has done.

United Kingdom-China: The Chinese Ministry of State Security has accused the British secret intelligence service MI6 of recruiting a private-sector consultant from a third country to repeatedly enter the country, collect information, and try to recruit sources of information. The Chinese government has already cracked down on other Western data and due diligence firms, leading to some arrests. The new accusation is likely to further scare off Western professionals and prompt more Western companies to reconsider doing business in China.

United States-China: The top Republican and Democrat on the House Select Committee on the Chinese Communist Party have released a letter they sent to President Biden urging him to take stronger action to stem China’s growing dominance in the global market for older, less-advanced semiconductors, rather than just constraining China’s access to the most advanced chips, as the administration has already done. The lawmakers warn that the U.S. economy is becoming too dependent on workhorse chips from China.

- As we’ve discussed in the past, the worsening U.S.-China rivalry is driving a continued fracturing in global supply chains. Government and business leaders are likely to keep driving to cut dependence on critical, high-value goods from China, although many less important, low-value products are likely to continue being sourced from that country.

- The widening scope of the restrictions will continue to be a risk for companies that rely on Chinese inputs or sell to China.

U.S. Military: On Friday, the Pentagon announced that Defense Secretary Austin had been hospitalized in intensive care since New Year’s Day to deal with complications from an unspecified elective surgery. However, the incident created a scandal when it emerged that President Biden wasn’t informed about Austin’s hospitalization for three days, and that key members of Congress weren’t informed for four days.

- Deputy Defense Secretary Kathleen Hicks reportedly took on Austin’s duties while he was incapacitated, but only via secure communication links from her temporary location in Puerto Rico, rather than returning to Washington.

- The scandal is likely to raise pressure on Austin and lead to increased calls for his replacement. In any case, the scandal has the potential to disrupt the U.S. military’s on-going restructuring and adjustments to meet the rising challenge from China.

U.S. Fiscal Policy: Congressional leaders reached a deal yesterday on overall budget spending for the current fiscal year, potentially averting another partial government shutdown or stopgap spending bill when the current stopgap bill starts to run out later this month. The challenge now will be for Congress to pass the many individual appropriation bills that will turn the budget into law. Republican conservatives in particular are expected to oppose the spending total and demand riders that implement their preferred conservative policies.

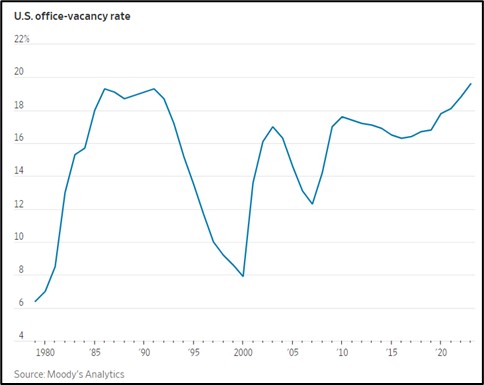

U.S. Commercial Real Estate Market: New data shows that a record 19.6% of office space in major markets was unleased in the fourth quarter, up from 18.8% one year earlier and slightly above the previous record of 19.3% in 1986 and 1991. The high vacancies reflect both previous overbuilding and the pandemic-inspired “work from home” movement. In any case, high vacancies coupled with high interest rates means the office sector remains an economic risk.