Daily Comment (January 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with an observation from a high-profile investment manager about renewable energy as one element of energy security. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including a surprise fall in the eurozone’s unemployment rate and further indications that the Federal Reserve is pivoting toward looser monetary policy (although still probably not as fast as many investors think).

Global Energy Market: In a short interview carried by the Wall Street Journal yesterday, a managing partner at infrastructure investor Brookfield Asset Management (BAM, $38.84) argued that last year’s slump in many renewable energy stocks was “very overdone” and that investment and capacity growth in renewable energy continues to surprise on the upside. Importantly, the manager tied the outlook for renewables not only to a desire for clean energy and growing opposition to fossil fuels but also as a source of secure, domestic energy.

- The comment came from Jehangir Vevaina, a managing partner in Brookfield’s renewable power and transition group. Vevaina touches on a theme we’re seeing more often these days: With geopolitical tensions raising the risk of disruptions in global energy flows, one advantage of solar, wind, hydroelectric, and other renewables is that they can provide secure, domestically produced energy.

- Clearly, the current push for “Green Technology” has become very politicized and polarizing. The green technology push will likely lead to lots of malinvestment and underinvestment in fossil fuels. On the other hand, looking at renewables as one way to improve energy security suggests that the industry could still have a bright future even if today’s environmentally driven push for renewables comes to an end.

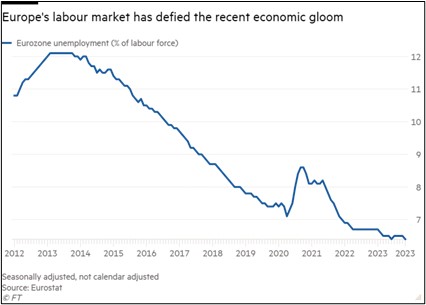

Eurozone: The November unemployment rate fell to a seasonally adjusted 6.4%, beating expectations that it would remain at October’s rate of 6.5%. With the decline in joblessness in November, the region’s unemployment rate is now once again at a record low, despite a recent slowdown in economic activity due to high interest rates and other factors. In turn, the continued strong demand for labor and rising wages could encourage the European Central Bank to keep interest rates high for longer than investors expect.

France: President Macron has named his recently appointed 34-year-old, charismatic education minister, Gabriel Attal, to be his new prime minister following the resignation of Élisabeth Borne on Monday. The popular Attal will be France’s youngest-ever prime minister, suggesting Macron was looking for a dramatic nominee who could breathe new life into his administration. Nevertheless, Macron’s lack of a majority in parliament means he will still struggle to push his agenda forward.

Russia: According to British intelligence, the Kremlin has re-established the Stalinist counterintelligence organization known as SMERSH, an acronym for “death to spies.” Made famous in Ian Fleming’s James Bond spy novels, the unit aims to root out traitors and spies within the Russian government. Coming hot on the heels of increased counterintelligence efforts in China, the move may be a reaction to increased human intelligence successes by Western services that have unsettled President Putin and General Secretary Xi.

Israel-Hamas Conflict: In separate incidents yesterday, the Israeli military killed a senior figure of the Iran-backed Hezbollah militant group in southern Lebanon and another top Hamas commander in Syria. The increasingly brazen Israeli assassinations outside of the conflict zone in the Gaza Strip are keeping alive the risk that the war will broaden regionally.

China: The China Passenger Car Association today said the number of Chinese-made autos that were exported abroad rose to a record 5.26 million in 2023, putting China on track to be the world’s top vehicle exporter. When Japan, the previous top exporter, reports its data in the coming weeks, it is expected to have sold less than 4.50 million vehicles abroad.

- China’s surging auto exports reflect both its strong competitiveness in electric vehicles and its surging sales to Russia after that country was sanctioned by the West for its invasion of Ukraine.

- Since China’s rising auto exports will threaten domestic carmakers around the world, they are likely to spur further protectionist policies, especially in Europe. In turn, efforts to hold back the Chinese export tide will likely further exacerbate today’s tensions between China and the members of the U.S.-led geopolitical bloc.

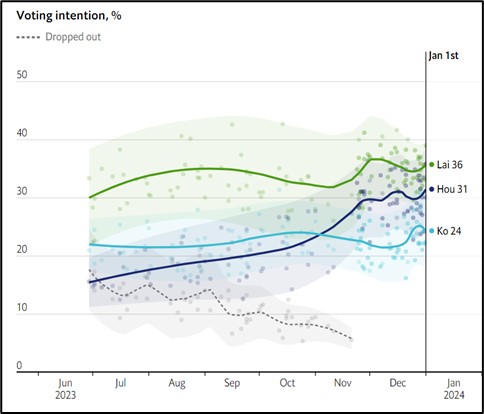

China-Taiwan: Just days before the presidential election on Saturday, independence-leaning frontrunner Lai Ching-te of the ruling Democratic Progressive Party has accused China of trying to undermine his campaign. According to Lai, Beijing has used the full gamut of interference tactics, from propaganda and military intimidation to “cognitive warfare” and fake news to scare voters into casting their ballot for his opponents, especially the China-friendly Kuomintang Party’s Hou Yu-ih.

- A victory by Lai could immediately raise tensions between China and Taiwan, potentially drawing in the U.S., Japan, and other Taiwan supporters.

- This portends rocky trading in the world’s financial markets early next week, assuming the current opinion polls are accurate (see the latest chart by the Economist below).

(Source: The Economist)

(Source: The Economist)

China-Argentina: The Chinese government yesterday said it would cut import tariffs or extend tariff reductions on 143 different products from Argentina, ranging from dried sweetcorn to infant formula and plywood. The move is being seen as an effort to curry favor with Argentina’s new, radical libertarian president, Javier Milei, who has vowed to shift his country’s orientation back to the U.S. and away from China.

- Our objective, quantitative methodology for predicting which geopolitical bloc a country will end up in currently places Argentina in the “Leaning China” camp, based in large part on Argentina’s strong commodity exports to China.

- Nevertheless, we think the U.S. and China will actively work to draw “Leaning” countries closer and away from their rival. With Milei threatening to reorient Argentina toward the U.S., it’s no surprise that Beijing has taken steps to curry favor with Milei.

- Going forward, many countries, especially those in the “Leaning” blocs, will likely be in a position to play the U.S. and China off against each other. To the extent that they can garner concessions from either of the big powers, those countries could see improved economic prospects and better stock returns.

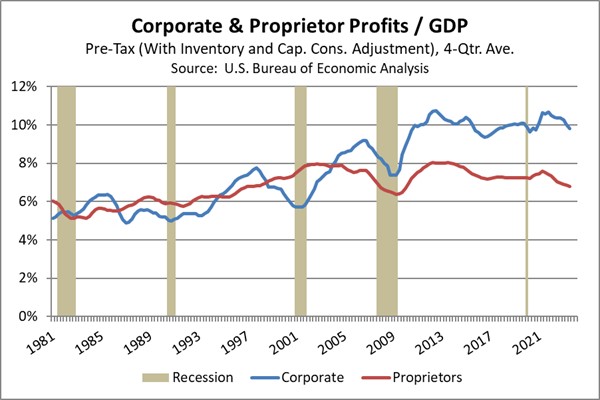

U.S. Economic Growth: New analysis cautions that the recent strong financial results at big companies may not be indicative of the overall corporate sector. Indeed, the analysis notes that while big firms’ earnings before interest, taxes, depreciation, and amortization (EBITDA) soared 18% from 2019 to the end of 2022, “middle market” companies with annual revenues between $100 million and $750 million saw their EBITDA fall 24% in the same period. That’s important because middle market companies account for a huge chunk of the U.S. economy and workforce.

- A range of other measures also reflect big advantages for big firms and tough challenges for smaller ones. For example, the advantages to size also show up in disparate EBITDA margins and differing trajectories for corporate profits versus sole proprietorships (see chart below).

- The tougher challenges for smaller firms could eventually prompt them to cool hiring, cap wage rates, and reduce investment, leading to stronger headwinds for the economy and financial markets.

U.S. Monetary Policy: In a further sign that the Fed has pivoted toward loosening monetary policy relatively soon, Dallas FRB President Logan in recent days delivered a speech calling for the Fed to slow its quantitative tightening program. We still think bond investors have gotten ahead of themselves in expecting sharply looser policy in the very near term, and we still think there is a risk that bond yields will rebound at least temporarily in the coming weeks and months. Nevertheless, the signs are starting to point more strongly to looser policy later in 2024.