Daily Comment (January 12, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! U.S. equities appear subdued ahead of the weekend, while Inter Miami’s new game plan is clear — feed Messi! Today’s Comment kicks off with an analysis of the potential risks of Western allies’ joint action against Houthi rebels, followed by a deep dive into why traders remain confident in a March Fed rate cut. We also unpack the latest Japanese monetary policy decisions and bring you up to speed on key domestic and international data releases.

Broadening Conflict: The U.S. and U.K. launched joint airstrikes against Houthi rebels in Yemen, heightening tensions in the Middle East.

- The U.S. and U.K. launched joint airstrikes against Houthi rebel targets in Yemen, responding to their recent attacks on commercial ships in the Red Sea. They were joined by Australia, Bahrain, Canada, and the Netherlands in this operation. The coalition used precision-guided missiles to hit more than 60 targets in 16 locations in Yemen. This coordinated effort comes days after the U.S. and its allies warned Houthi rebels that continued attacks on vessels would lead to a military response. The coordinated offensive raises the likelihood of a broader conflict in the Middle East. In response to the attack, the Houthis have vowed to retaliate.

- Fighting in the region is likely to lead to volatility in oil prices. The International Association of Independent Tank Owners, a trade group representing 70% of globally traded petrochemicals, has advised its members to stay away from the highly contested Bab-el-Mandab strait. The warning comes a day after Iran seized a ship with Iraqi crude that was headed for Turkey in the Gulf of Oman. Uncertainty regarding how the next few days will play out has led to a surge in oil prices, which have risen 4% over the past two days as traders price in the potential for supply disruptions. Despite the uncertainty, oil prices remain below the previous year’s levels.

- Red Sea tensions underscore the U.S.’s critical role in safeguarding economic stability through ensuring free passage in key shipping lanes. Though oil prices have been affected, swift containment of the situation should prevent long-term trade disruptions. Yet, a wider conflict which escalates military action could trigger a more sustained price shock and heighten recessionary risks, potentially sparking financial market panic due to geopolitical uncertainty. Although we remain optimistic that this will not turn into an all-out war in the Middle East, we acknowledge that risks remain elevated.

Traders Unconvinced: Market bets of rate cuts surprisingly increased even after hotter-than-expected inflation data and a reiterated commitment from Fed officials to maintaining restrictive policy.

- Central bank officials pushed back on speculation of March rate cuts but stopped short of ruling them out entirely. Hawk Loretta Mester, president of the Cleveland Fed, insisted it’s too early for such a move. However, she pointed out that December’s inflation uptick doesn’t mean that progress has stalled. Meanwhile, both Richmond and Chicago Fed Presidents Thomas Barkin and Austan Goolsbee, refused to rule out a March rate cut, adding to the uncertainty. The lack of clarity from Fed officials prompted markets to boost their March pivot prediction by five percentage points, raising the expectation of a rate cut next spring to 70%.

- Mixed economic data fuels uncertainty around the Fed’s March policy stance. December inflation hit 3.4%, exceeding both forecasts and November’s reading, raising concerns about a potentiation return of price pressures. Conversely, a surprisingly strong December job market, which added 216,000 positions, suggests ongoing economic momentum. While headline figures mask nuanced trends, like a downward shift in monthly inflation and a steady increase in the number of unemployed workers throughout the year, the Fed’s muted reaction indicates they’re prioritizing different factors or possible embracing ambiguity. With conflicting signals and hidden depths, predicting their next move is like peering into a foggy crystal ball — a gamble fraught with uncertainty.

- Pent-up anticipation of a Fed pivot to easier policy has fueled risk appetite, with traders betting on six aggressive rate cuts this year. While this expectation reflects the perceived historical tendency of the Fed to cut rates faster than it raises them, we believe the actual easing cycle will be later and shallower than the market anticipates. If policymakers prove less dovish, the recent bond rally could face a sharp reversal. Nevertheless, even in that scenario, fixed-income securities should fare better than last year. The upcoming FOMC meeting will likely serve as the key turning point, testing market expectations and setting the tone for the year ahead.

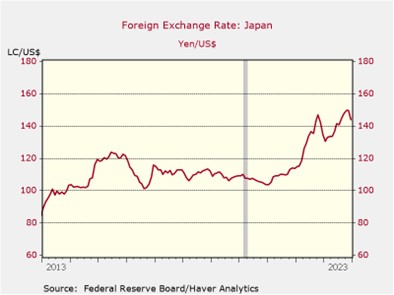

What’s Next for BOJ? The Nikkei 225 continues to rally in 2024 as investors grow concerned that the Bank of Japan won’t be able to shift away from its aggressive monetary easing.

- The strength of Japan’s benchmark stock index comes amid signs that nominal wage growth slowed sharply in the final months of 2023. The annual change in nominal wage growth slowed to 0.2% in November, down considerably from the previous month’s rise of 1.5%. The slowdown raises concerns that BOJ Governor Ueda will see it as a sign of weak inflationary pressures, and will delay his planned pivot away from aggressive monetary easing. The wage slowdown points to firms’ continued reluctance to increase labor earnings, likely due to concerns about hurting profit margins if they cannot readily pass on the costs to consumers.

- While optimism has fueled a surge in popularity for Japanese equities since 2023, concerns linger about the sustainability of the rally. The Nikkei’s RSI climbed above the overbought threshold of 70, suggesting a potential loss of momentum in the coming months. Price pressures also provide a headwind. November’s CPI data showed a welcome decline in annual inflation to 2.5%, down from 3.2% in October. However, government forecasts predict inflation will struggle to fall below that threshold throughout 2024, exceeding the central bank’s 2% target.

- Many economists and market analysts anticipate that the Bank of Japan will eventually pivot away from its ultra-accommodative policy, but the timing largely hinges on the outcome of the annual wage negotiations in March, known as Shunto. If labor unions secure significant wage increases, the central bank may feel compelled to finally raise interest rates or adjust its yield curve control policy, potentially leading to a stronger yen (JPY). This may hurt Japanese businesses due to higher borrowing costs and a less competitive currency, but we suspect the fallout could spread into global financial markets due to the preponderance of yen carry trades that are outstanding.

Other news: Taiwan’s presidential elections take place this weekend, and China has issued another strong warning against any moves towards formal independence, raising concerns about a potential increase in regional tensions.