by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an analysis of the White House’s discussions on Greenland and their implications for NATO’s future. We then transition to other developments, including a breakdown of the latest Fed Beige Book and the de-escalation of tensions between the US and Iran. Additionally, we provide a brief overview of the recent decline in silver prices. The report also includes a roundup of essential domestic and international data.

Greenland Talks: Tensions between the United States and its NATO allies have escalated as the White House continues to pursue the acquisition of Greenland. On Thursday, foreign ministers from Denmark and Greenland met with US officials to discuss Arctic security concerns. While the meeting established a formal dialogue, significant disagreements remain. In a sign of sharply deteriorating relations following the visit, NATO deployed its navy to the waters surrounding Greenland.

- The primary disagreement centers on the US rationale for the takeover. The White House claims the move would enhance security for all NATO allies; however, the logic is questionable. While ownership might slightly improve the US’s ability to counter Russian and Chinese threats, the 1951 defense treaty already provides the US with the necessary access to defend the region.

- A more plausible explanation for the US action is a deep-seated distrust of multilateral organizations, particularly NATO. The White House has long criticized the alliance over chronic underinvestment in defense by member states and clear deficits in military readiness for a major conflict. Consequently, US leadership doubts that these allies would fulfill their treaty obligations to defend the United States in the event of an attack.

- Under this view, the US may perceive Greenland as a de facto protectorate, despite it being under Danish sovereignty and the NATO security umbrella. This perception has likely fostered a sense of entitlement toward the territory and its strategic assets, particularly its vast reserves of rare earth elements.

- In short, the US push to acquire Greenland may signal a broader departure from the traditional framework of alliance building toward a foreign policy defined by territorial and resource accumulation. Consequently, this move represents a more assertive — and perhaps unilateral — America than the world has encountered in recent decades.

- The fracturing of relationships with European allies represents a pivotal shift in foreign policy, perhaps signaling a transition from a benevolent to a malevolent hegemon, which we’ve written on in the past. This adjustment suggests a future where the US prioritizes resource security over diplomatic alliances, a move likely to drive a surge in the demand for industrial commodities over the coming years.

Beige Book: The Federal Reserve’s latest summary of regional economic conditions shows a slight rebound in sentiment following a period of pessimism from respondents. According to the Beige Book, a majority of districts reported that growth has accelerated from “slight” to “moderate,” while the remaining regions saw no change and one noted a marginal decline. This upswing in sentiment, emerging in the wake of the government shutdown, may signal a shift in momentum after a year characterized by persistent uncertainty.

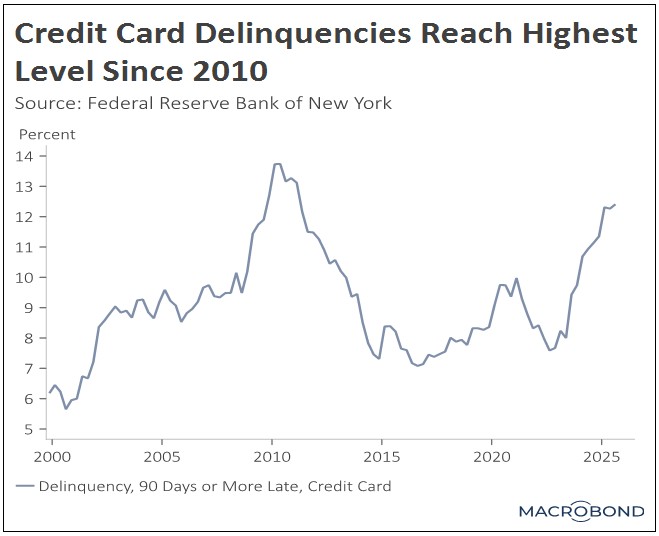

- The improvement in economic activity appears to be driven by increased consumer spending. Much of this surge followed the end of the government shutdown, with the holiday season providing additional momentum. However, the rise in purchases appears largely concentrated among high-income households, while low-income households continue to show signs of growing price sensitivity.

- Improved sentiment has also translated into a more stable employment outlook. Most districts reported that employment levels remained unchanged from the previous period, an improvement over November’s survey, which had indicated that employment was in decline. Contributing factors include firms’ strategic shifts from aggressively limiting headcount to now prioritizing the use of temporary workers and AI implementation.

- Despite an overall positive report, price pressures remain a focal point of concern. A majority of districts reported moderate cost increases, largely attributed to ongoing tariff anxieties. As pre-tariff inventories are exhausted, an increasing number of firms have expressed a willingness to pass these costs through to the consumer. Conversely, sectors such as retail remain hesitant, fearing a pullback from price-sensitive customers.

- The rise in optimism appears to be part of a broader trend, as firms begin to look beyond immediate tariff concerns to focus on future growth. Provided there are no material changes to regulation or fiscal policy, this change should bolster the prospects for a stronger economy. While it is too soon to recommend an increase in risk tolerance, these conditions could significantly enhance the investment climate, provided this sentiment persists.

Iran Strike Avoided: Tensions between Iran and the US have slightly eased following pledges from Tehran to halt protester executions. On Wednesday, the White House signaled it would withhold planned military strikes in response to these assurances, a move that coincided with the reopening of Iranian airspace. This cautious de-escalation comes as the Iranian regime continues its crackdown on domestic protests now entering their third week. While this easement has calmed global markets and lowered commodity prices, the risk of renewed conflict remains significant.

Data Center Consumption: PJM Interconnection, the largest US grid operator, has lowered its 2027 peak power demand forecast from 164 to 160 gigawatts. This revision serves as a reality check for the “AI boom,” as PJM cited a lack of firm construction commitments or electrical service agreements for many projected data centers. The new outlook is likely to pressure energy companies whose valuations have rallied on near-term AI energy demand.

Silver Prices Decline: The White House has deferred the imposition of new tariffs on silver, a move expected to alleviate immediate price pressures on the metal. This decision follows a November directive to study silver’s national security implications under Section 232. While the president has not ruled out future duties, he has signaled a shift toward protecting domestic producers through price floors rather than broad-based tariffs. This pivot has already begun to cool “bubble” concerns that had previously sent silver prices to record highs.