by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that the Russian intelligence services are trying to take advantage of the job buyouts currently being offered to employees of the US intelligence community. The situation highlights the risk that the personnel turnover could affect the US’s ability to counter rival countries such as China and Russia. We next review several other international and US developments with the potential to affect the financial markets today, including Chinese preparations to target US tech firms to retaliate for the Trump administration’s tariffs and the administration’s preparations for a range of new tariffs this week.

Russia-United States: Just days after the Trump administration extended its job buyout offer to workers at the Central Intelligence Agency and other US intelligence organizations, Russia’s Foreign Intelligence Service, the main successor to the KGB, released a video parodying the chaos in the US government and inviting US intelligence professionals to sell their secrets to Russia. The offer highlights the potential threat to US national security from the administration’s aggressive effort to push workers out of the government.

- On a related note, the new leaders at the CIA last week used an unclassified email to respond to a White House request for the names of all employees hired over the last two years. The request from the White House appears to be a part of the administration’s effort to shrink the federal workforce and root out any employees at odds with its goals.

- Virtually all unclassified communications with the White House are monitored by the Chinese, Russians, and other US adversaries. For the newly hired employees, the CIA only sent first names and first initial of their last names, but the Chinese and Russians will be able to triangulate that information with other data in their possession and identify the vast majority of the new workers.

- Since the CIA in recent years has rapidly ramped up its intelligence effort against China, many of the compromised workers were probably China-focused. They will now almost certainly be targeted by the Chinese intelligence services. Some will be targeted merely for surveillance; others will be pressured to become double agents. The incident will almost certainly undermine US national security versus China in the coming years.

- Of course, China and Russia also continue to aggressively court US officials outside the intelligence community. For example, a former senior advisor to the Federal Reserve was recently arrested for selling confidential US financial information to Chinese intelligence. China could have used the information to manipulate US markets.

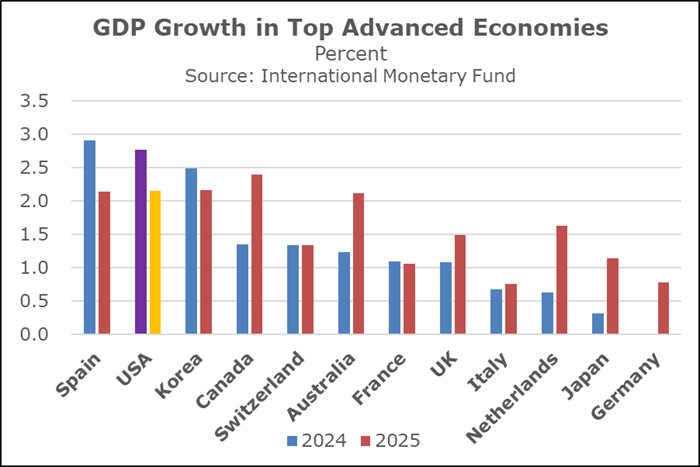

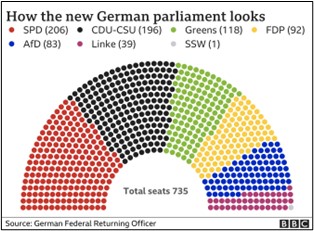

Germany: Friedrich Merz, the center-right CDU party’s nominee for chancellor in this month’s election and the current leader in polls, said last night that he is open to easing Germany’s strict “debt brake” limits on fiscal deficits to help pay for a higher defense budget. However, he insisted that easing the debt brake would only come after all possible cuts in the government’s nonmilitary spending and strong efforts to boost the country’s economic growth. The prospect of eased fiscal rules would likely be positive for the German economy and stocks.

France: Ahead of his “AI Action Summit” in Paris this week, President Macron has announced 109 billion EUR ($112 billion) in new artificial-intelligence investments in the coming years, most of which will be carried out by private companies. The total apparently includes the 50-billion EUR ($51.5 billion) investment in new data centers that the United Arab Emirates announced last week. The French total is smaller than the Trump administration’s $500-billion “Stargate” AI plan, but it is big enough to show that Europe may finally be ramping up its effort as it tries to catch up with the US and China.

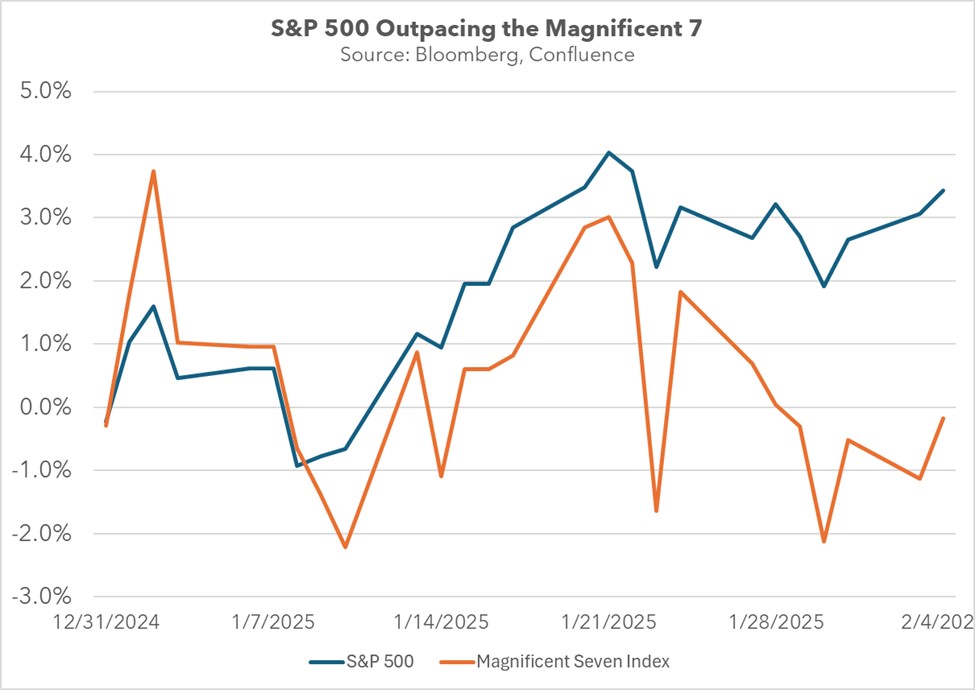

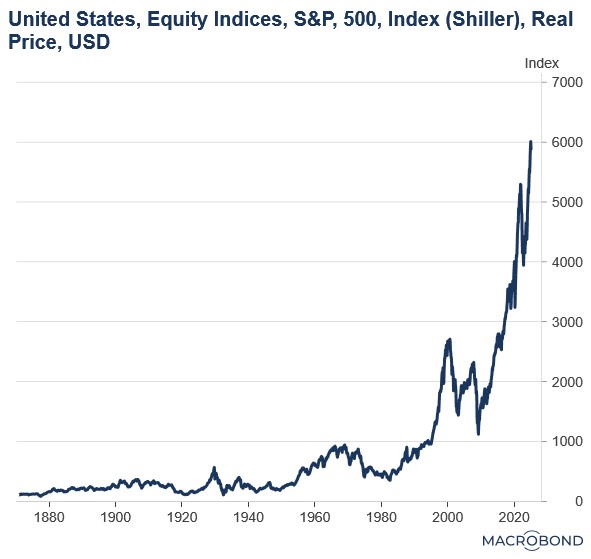

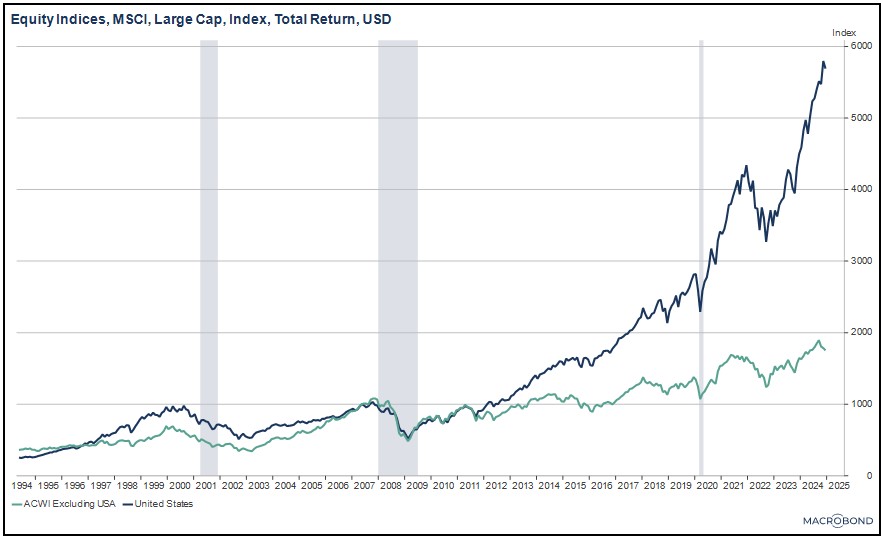

China: In another sign of how rapidly China is building on its success with artificial intelligence, Chinese firms such as Lenovo are already deploying the low-cost DeepSeek AI model into products such as personal computers, robots, and electric vehicles. The development will likely feed into concerns that AI companies in the US are now lagging, which, if true, could weigh on their stock valuations.

China-United States: According to the Wall Street Journal today, Chinese officials are compiling a list of US technology firms that they could target with antitrust probes and other measures to retaliate for the Trump administration’s tariffs and other policies opposed by Beijing. Besides Nvidia and Google, which are already being investigated, the report says the Chinese are preparing to target Apple, Broadcom, Synopsys, and others.

- China’s strategy apparently aims to leverage President Trump’s political reliance on Silicon Valley technology executives, who have become perhaps the most important members of Trump’s governing coalition.

- If Beijing does clamp down on more US tech firms, a key question is whether the tech leaders around Trump could convince him to reverse his tariffs and soften his approach to protect their interests.

- The extent to which Trump’s “tech bros” can influence him will likely help determine how exposed US tech firms — and their stocks — are to Chinese pressure.

United States-China: President Trump on Friday signed an order delaying the application of US tariffs on Chinese imports considered “de minimis,” i.e., valued under $800. The delay will be welcomed by China, but it does not constitute a softening of the Trump administration’s general trade policies toward the country. Rather, the delay is strictly to allow the Commerce Department time to develop the procedures and systems needed to apply tariffs to such small shipments.

United States-Japan: Fresh off his summit with President Trump in Washington, Japanese Prime Minister Ishiba yesterday said Trump didn’t press him to either raise Japan’s defense spending or cut its auto exports to the US.

- Under previous US pressure, the Japanese government already plans to double its military budget to 2% of gross domestic product.

- By declaring his satisfaction with that effort instead of demanding Tokyo reach the defense burden of 5% that he wants for the US’s allies in Europe, and by avoiding any sharp demands on trade, Trump may be signaling that he will prioritize the US-Japan relationship.

- If so, it would mean that Japan’s political and economic landscape will be spared the disruptions Trump is imposing on other key countries. A relatively hands-off policy by Trump would likely be positive for Japan’s economy and stock market.

US Trade Policy: President Trump over the weekend said he would announce tariffs on additional countries on Tuesday or Wednesday of this week. According to Trump, the “reciprocal” tariffs in this batch will aim to match the tariffs that the targeted countries have imposed on US products. Possible targets for the new tariffs include the European Union, India, Vietnam, and Brazil.

- Trump also announced that he will impose 25% tariffs on steel and aluminum imports.

- The announcements suggest that the administration may keep rolling out new tariff plans for some time. If so, the continued uncertainty could start to weigh more heavily on global stock markets.

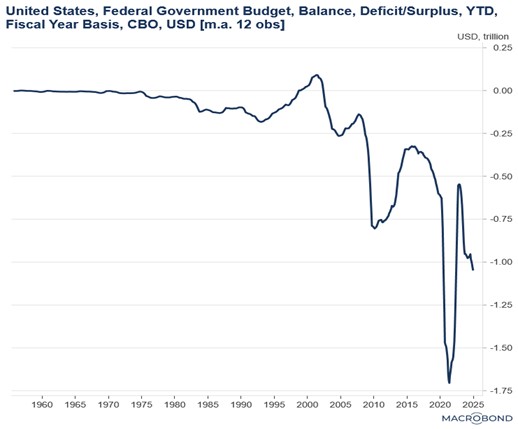

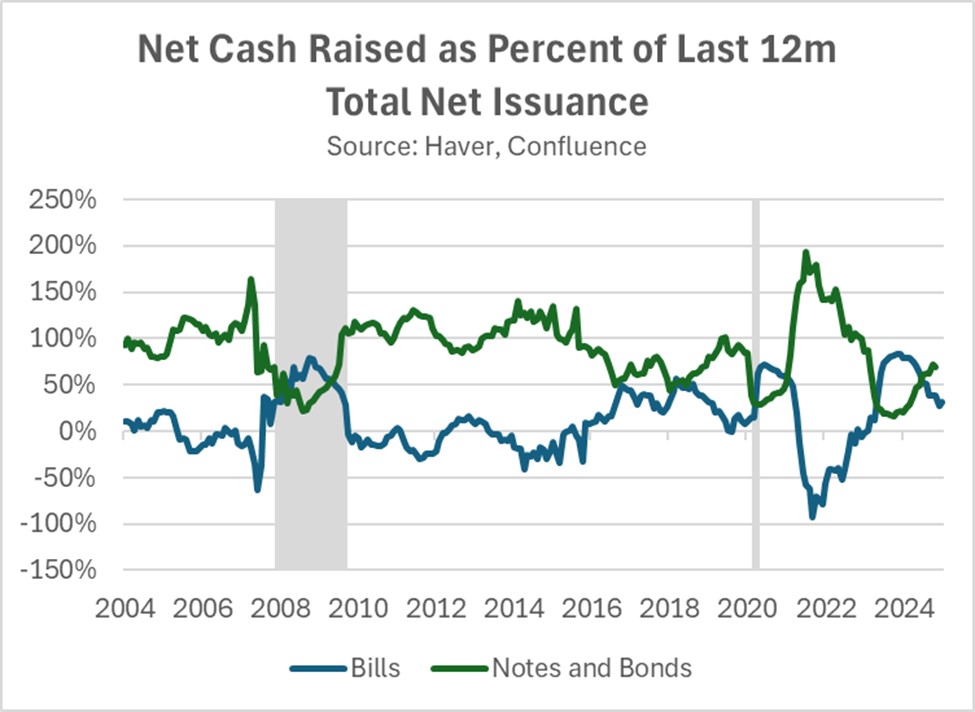

US Fiscal Policy: In an interview aired during the Super Bowl’s pregame show yesterday, President Trump said he would soon ask Elon Musk and his Department of Government Efficiency to investigate wasteful and fraudulent spending at the Department of Education and then at the Department of Defense. The statement suggests that those two departments will be the next to face dramatic cutbacks potentially affecting thousands of workers and contractors.

- According to Trump, the Musk effort will find and end “hundreds of billions” of dollars of waste and fraud at the Defense Department. Of course, Musk has already frozen a lot of other government outlays, but because the defense budget is so big and affects the country so broadly, sizable spending cuts there could disrupt and slow economic activity in a much more noticeable way, not to mention that it could also reduce the military’s ability to respond to a national security threat.

- More broadly, government spending is an important source of demand for the economy, so if Musk is able to cut outlays enough, the sudden fiscal contraction could potentially produce a recession and weigh on the financial markets, at least temporarily.