by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are closely watching the Republican budget bill, as the likelihood of extended tax cuts grows. In sports news, Alex Ovechkin made history by scoring 30 goals in a season for the 19th consecutive year, setting a new NHL record. Today’s commentary will delve into the sharp decline in consumer confidence, provide an update on the ambitious efforts by House Republicans to pass a new budget, and highlight other market-moving developments. As always, it will also include a roundup of key international and domestic data releases.

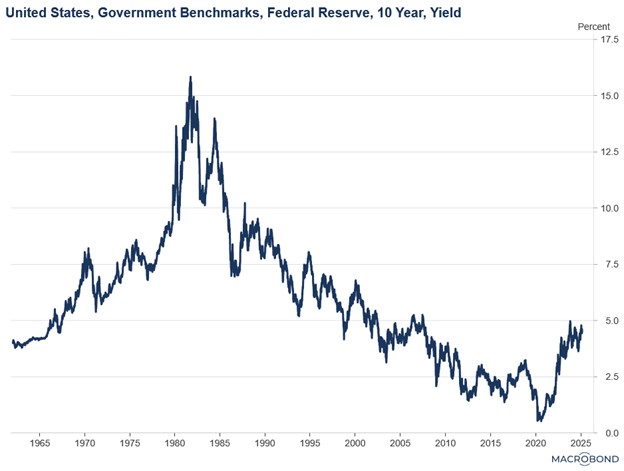

Consumer Sentiment Dips: A sharper-than-anticipated decline in the Conference Board’s Consumer Confidence Index has heightened concerns that the economy may be on the brink of a slowdown. The S&P 500 plunged below 6,000, and the 10-year Treasury yield dropped below 4.30%, as investors sought refuge in bonds.

- The February Consumer Confidence Index dropped sharply from 105.3 to 98.3, marking its largest decline since August 2021. The significant downturn in overall sentiment was primarily driven by growing concerns about the future, as the Expectations Index plunged 9.3 points to 72.9, falling below the critical recession threshold of 80 for the first time since June 2024. Additionally, consumer assessment of the current economic situation also weakened, with the Present Situation Index declining by 3.4 points to 136.5.

- The decline in sentiment was driven mostly by inflation fears. Rising egg prices and the perceived threat of tariffs are key contributors. The Conference Board survey revealed widespread unease about tariff impacts, with both businesses and households expressing heightened concern. Alarmingly, 12-month inflation expectations surged from 5.2% to 6.0%, signaling a growing belief in renewed inflationary pressures.

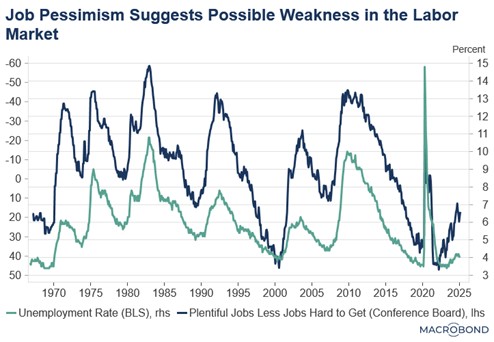

- Beyond inflation, respondents voiced growing unease about the labor market, particularly in light of recent federal government layoffs. The proportion of respondents saying jobs were “plentiful” dropped from 33.9% to 33.4%, while those reporting jobs as “hard to get” climbed from 14.5% to 16.3%. As a result, the net labor market reading, which measures the difference between “plentiful” and “hard to get” responses, narrowed to 17.1, the lowest level observed since October 2024.

- We believe the recent decline in confidence may partly reflect the initial shock effect of the Trump administration’s policies, particularly around tariffs and layoffs. As markets and consumers adjust to these changes, the negative sentiment could begin to ease in the coming months. However, continued monitoring of economic indicators will be essential to gauge whether this is a temporary dip or the start of a more sustained decline.

The Big Beautiful Bill: House Republicans successfully passed a budget blueprint on Tuesday that paves the way for extending the Trump tax cuts and raising the debt ceiling but is contingent on cuts to the social safety net. However, significant hurdles remain before the proposal can become law. Concerns over its impact on the deficit, coupled with potential revisions in the Senate, pose challenges to its passage.

- The bill passed by a razor-thin margin, 217-215, after last-minute presidential lobbying swayed several moderates. It now heads to the Senate, where it faces further amendments. Republicans aim to use budget reconciliation to extend the tax cuts with a simple majority once the bill is finalized.

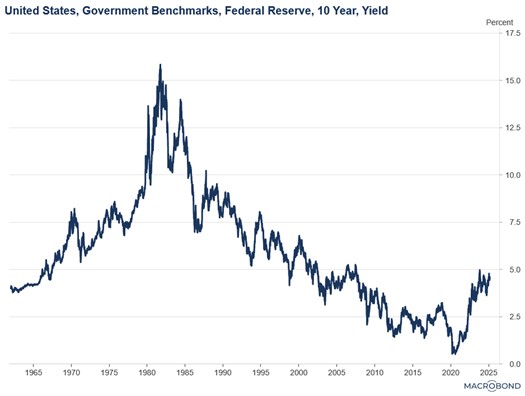

- The overall cost of the bill continues to be a significant concern for the incoming administration, which aims to reduce the deficit as a strategy to lower long-term interest rates. According to estimates from the nonpartisan Committee for a Responsible Federal Budget, the new measure would add $2.8 trillion to the deficit by 2034. While this figure is substantial, it represents a notable reduction from the pre-election estimate of $7.5 trillion.

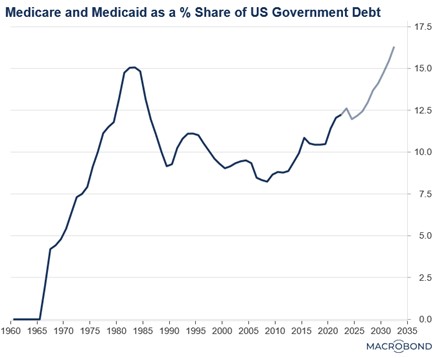

- Most of the projected savings appear to stem from cuts to the social safety net. The budget directs the House Energy and Commerce Committee to identify $880 billion in spending reductions, raising concerns that lawmakers may target Medicaid as a primary area for cuts. Furthermore, the Agriculture Committee has been tasked with reducing $230 billion from food aid programs, specifically the Supplemental Nutrition Assistance Program (SNAP).

- Although the budget resolution offers a nonbinding framework, the combination of tax cuts and a lower-than-anticipated deficit may bolster investor confidence, signaling that the incoming administration is more fiscally disciplined than initially expected. Should lawmakers successfully enact these measures, the resulting stimulus could provide a moderate lift to equities.

Ukraine Agrees to Deal: Officials in Kyiv indicated that Ukraine is prepared to sign an agreement with the US, exchanging access to critical minerals for security assurances. The deal was finalized after Washington withdrew its initial demand for $500 billion worth of mineral resources. However, the agreement does not include any formal, written security guarantees, leaving the specifics of US support unclear.

- The new agreement stipulates that Ukraine will contribute 50% of the proceeds from the “future monetization” of state-owned mineral resources. These funds will also be allocated for investments within Ukraine. However, the agreement excludes mineral resources that directly contribute to the Ukrainian government’s budget, ensuring that the country’s gas and oil companies remain unaffected by the arrangement.

- Ukraine is a resource-rich nation, boasting critical minerals essential for defense technology and electric vehicle production, such as titanium, rare earth elements, cobalt, lithium, and graphite. Access to these resources provides the US with a strong incentive to ensure Ukraine is treated fairly during peace negotiations with Russia.

- The minerals deal will continue to be negotiated by both sides as they work to resolve any disagreements over the specifics of the arrangement. Once finalized, it will require approval from the Ukrainian Parliament before it can take effect. The US, however, does not intend to pursue a formal treaty, as that would necessitate a two-thirds Senate vote, making it politically challenging to achieve.

Joint European Bonds: There is increasing speculation that the EU may turn to the bond market to finance a significant increase in defense spending. This move reflects the region’s growing recognition that it can no longer depend solely on the US for its security.

- This sentiment stems from recent discussions among European leaders regarding the need to enhance the region’s military capabilities. The group of countries is expected to convene on March 6 to develop a bloc-wide defense package, estimated to cost around 500 billion EUR ($524 billion), with the potential for additional funding.

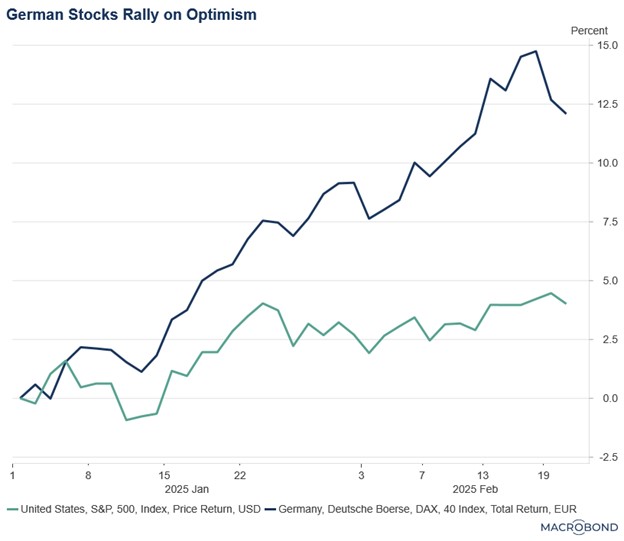

- Additionally, several countries are already planning to increase their defense expenditures. On Tuesday, Irish Finance Minister Paschal Donohoe advocated for higher defense spending at the national level. Meanwhile, in Germany, the likely ruling conservative CDU/CSU party is drafting a bill to approve a 200 billion EUR ($210 billion) special fund for defense spending.

- The decision by European countries to increase defense spending is expected to provide a boost to regional equities, as heightened investment in the sector could stimulate corporate earnings for defense firms. However, this fiscal expansion is also likely to exert upward pressure on bond yields, as governments continue to grapple with the challenge of curbing expenditures in the aftermath of the pandemic.