by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with an update on today’s markets where some asset values are rebounding from their sell-offs late last week, while others have remained weak. We next review several other international and US developments with the potential to affect the financial markets, including a positive statement about Iran from President Trump, which has weighed on global oil prices so far today, and the latest on what is likely to be a very short federal government shutdown over continued budget squabbles.

Global Financial Markets: So far this morning, prices for precious metals and other safe haven assets appear to be stabilizing or even rebounding from their sharp declines late last week, even as prices for risk assets including equities and industrial metals continue to weaken. As of this writing, prices for gold, silver, platinum, and palladium are all at least 0.7% higher, while bitcoin prices are up 1.2%. However, major US stock indexes are down as much as 1.5%.

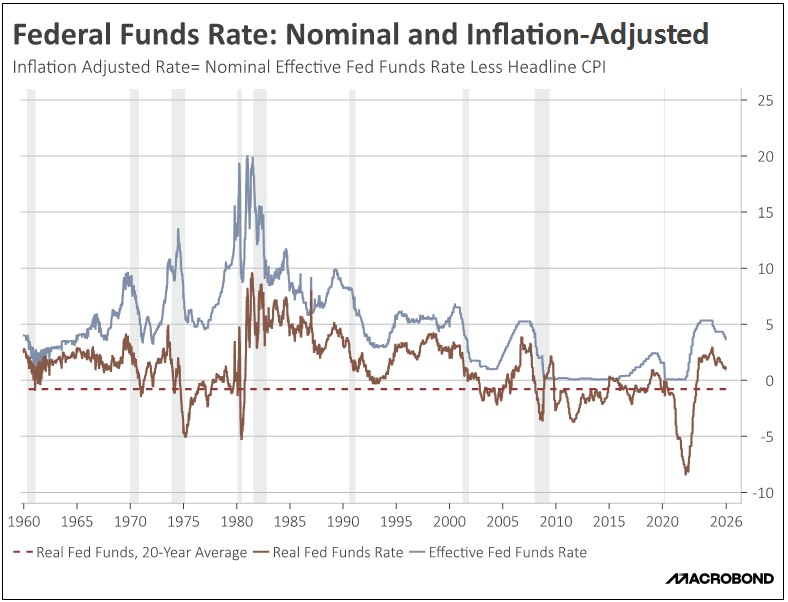

- We see two main catalysts for last week’s sell-offs: President Trump’s appointment of Kevin Warsh, who has a hawkish reputation, to be the new head of the Federal Reserve, and concerning data in the latest earnings reports of two key technology companies.

- The differentiated market action today suggests that investors remain concerned about volatility and economic challenges if US monetary policy ends up being less dovish than previously expected and if companies misallocate capital amid the boom in artificial intelligence. The rebound suggests they may now be regaining their interest in traditional safe-haven assets despite the risk of relatively high interest rates going forward.

United States-Iran: In an interview Saturday night, President Trump said he thinks the Iranian government is negotiating “seriously” about its nuclear program as the US continues to build up its military assets in the Middle East for a potential strike against Tehran. The president’s statement has raised hopes that a strike won’t be carried out and that US sanctions against Iran’s oil could eventually be lifted. That prospect has pushed global oil prices down some 4.8% so far this morning, with Brent currently trading at about $66.08 per barrel.

- Separately, the Financial Times today carries a story saying that several major European oil companies — including Shell, BP, TotalEnergies, Eni, and Equinor — are expected to slow their stock buybacks by 10% to 25% when they release their 2025 earnings reports later this month.

- The expected action reportedly reflects the firms’ continued struggle to deal with excess oil supplies and low oil prices. Naturally, reduced stock buybacks will likely be a headwind for the companies’ stock values going forward.

US Fiscal Policy: Senators on Friday passed a deal stripping the funds for the Department of Homeland Security from a broader bill financing the rest of the federal government through the end of the fiscal year on September 30. Under the deal, DHS will be funded at last year’s level for two weeks to allow more negotiations for its budget. The bill still needs to be passed by the House early this week, so technically, we’re in a partial government shutdown. However, it is likely to be resolved soon, with little if any impact on the economy or financial markets.

China: The official purchasing managers’ index for manufacturing fell to 49.3 in January, short of expectations and down from 50.1 in December. The non-manufacturing PMI fell to 49.4 from 50.2. Like most major PMIs, China’s is designed so that readings over 50.0 point to expanding activity. The data therefore suggests the Chinese economy is contracting again, largely due to weak demand among domestic consumers and businesses.

- Weak domestic demand will likely give firms even more incentive to boost exports, potentially creating new trade frictions with the US and European countries.

- In any case, China’s weak domestic demand is probably weighing on current economic activity in many countries and could become more of a headwind for Chinese stocks.

India: Announcing the government’s proposed budget for the 2026-2027 fiscal year at the weekend, Finance Minister Nirmala Sitharaman said India will boost its capital investment in cutting-edge manufacturing by 9% to shield the country from increased protectionism in global trade flows. The proposal illustrates how the US’s new, protectionist trade policies and changed approach to foreign affairs have prompted many countries to adopt more stimulative economic policies — policies that could further boost the prospects for foreign stocks going forward.

Japan: According to new data from the Health Ministry, there were 2.57 million foreigners working in Japan at the end of October, up 11.7% from the previous year and enough to mark the 13th straight record high. While the surge in foreign workers has helped firms deal with Japan’s shrinking domestic workforce, it also helps explain the electoral success of conservative, anti-immigrant politicians and growing demands for new restrictions.

South Korea: In an initial estimate, January exports totaled $65.85 billion, up 34% from the same month one year earlier. That marks a significant acceleration from the annual growth of just 13% in the year to December. The strong increase in January represented both a higher number of working days and surging semiconductors exports. South Korean exports are seen as a bellwether for global and US economic activity. The data therefore suggests the economy has entered 2026 with plenty of momentum, which probably bodes well for global stock markets.

European Union: In a speech today, former European Central Bank President Mario Draghi again urged EU countries to form a federation with deeper integration in areas such as defense, industrial policy, and foreign relations. According to Draghi, such a federation may be needed to keep the EU from disintegrating under pressure from the US and China.

- While there is little prospect of such a major change in the near term, we think Draghi’s statement does reflect the Europeans’ growing realization that they need to make major economic and political changes to regain competitiveness and influence.

- To the extent that those changes are implemented, they could prompt better economic growth or otherwise be positive for investors.